GUE uranium drilling permits lodged in the USA

Our North American uranium Investment Global Uranium and Enrichment (ASX: GUE) just lodged drill permits for one of its four uranium projects in the US.

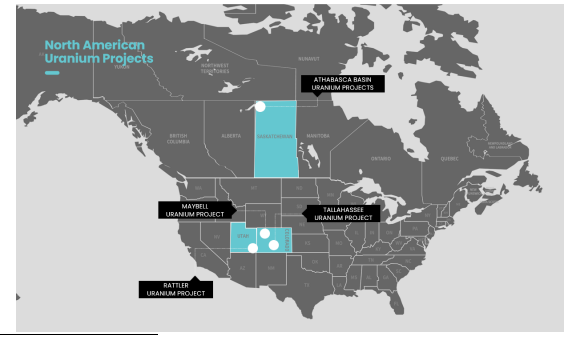

GUE has a portfolio of projects spread across North America:

- The Tallahassee project in the US - GUE’s most advanced asset with an existing JORC resource of ~49.8m lb of uranium.

- The Athabasca projects in Canada - Six different exploration assets in the Athabasca basin where some of the world’s highest-grade discoveries have been made/developed.

- The Rattler project in the US - Exploration project in Utah, ~85km away from the only operating conventional uranium processing plant in the USA.

- The Maybell project in the US - a previously operating mine that has produced ~5.3mlbs of uranium in the past. The project has an exploration target of ~4.3 to 13.3m lbs of uranium.

Today’s news was for GUE’s Maybell project.

GUE confirmed that drill permits had been lodged for a 40-hole (4,600m) drill program to test for extensions to the previously operating parts of its Maybell project.

The primary objective for the drill program will be to try and convert the exploration target into a maiden JORC resource for the project.

We touched on the exploration potential for the project in a previous Quick Take which you can see here: GUE announces exploration target for US uranium project

GUE expects to be drilling at Maybell in July, after its planned drill program at its more advanced Tallahassee uranium project.

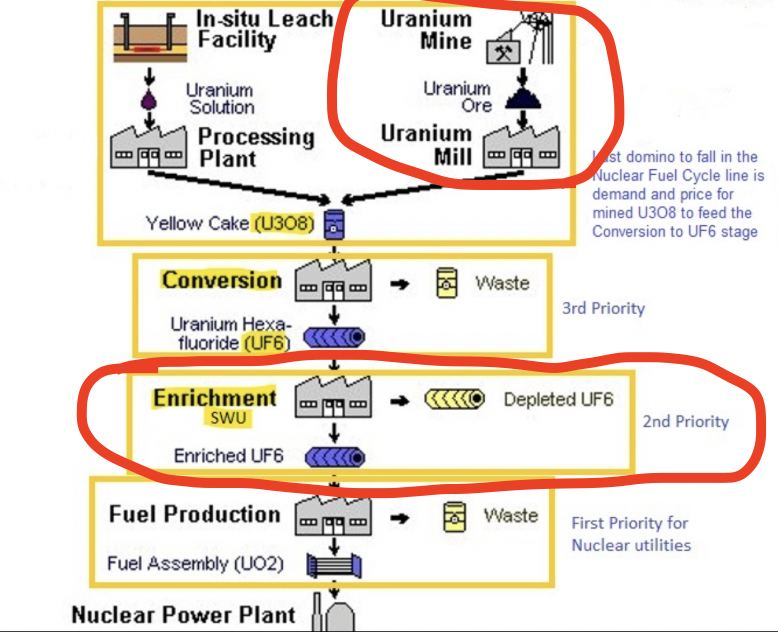

GUE also holds an Investment in a uranium enrichment technology

One of the key reasons we are Invested in GUE is because of its Investment in ‘Ubaryon’ - an Australian company developing uranium enrichment technology.

GUE is one of only two companies on the ASX with exposure to uranium enrichment - the other is Silex, which is capped at $1.2BN.

GUE is, therefore an Investment exposure for our portfolio across two parts of the uranium supply chain:

Why we are Invested in GUE:

Here is a quick summary of why we are Invested in GUE -

- The US is completely dependent on foreign uranium and uranium enrichment. It’s making domestic uranium assets and enrichment a national priority

- The only other ASX uranium peer with enrichment technology is capped at $1BN with 51% ownership of its technology

- OKR has a 49.8Mlbs uranium JORC resource in the USA - development potential

- Low EV relative to other uranium peers, and none have enrichment exposure

- Highly prospective uranium exploration ground in Canada’s largest uranium producing district

- Strong Management and Board, with North America focus

- Tight, loyal register

- Advanced stage company

To see the key reasons why in detail, check out our GUE Investement Memo here.

What’s next for GUE?

- Drilling at Tallahassee project (advanced stage JORC resource) 🔄

- Scoping Study at Tallahassee project 🔄