US rushing to secure uranium supply - OKR drilling next quarter

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 2,633,352 OKR shares at the time of publishing this article. The Company has been engaged by OKR to share our commentary on the progress of our Investment in OKR over time.

The US needs uranium for its nuclear reactors in a hurry.

And lots of it.

The USA is rushing to secure domestic energy sources, and not rely on other countries such as Russia and China, specifically for uranium enrichment capabilities.

Alarmingly, the current situation is that US uranium production is non-existent.

And Russia and China control 63% of the world’s uranium enrichment capacity.

The USA is desperate to change this as a matter of national security.

The US government has recently introduced several bills and billions of dollars in funding to support its nuclear industry.

The goal is to secure uranium and uranium enrichment capability domestically.

There is already US$37.5BN of money directly targeted at the uranium and nuclear energy industries, with more in the pipeline.

One of these bills would start banning Russian uranium 90 days after its enactment.

Importers would need to apply for waivers showing a clear need to import Russian uranium.

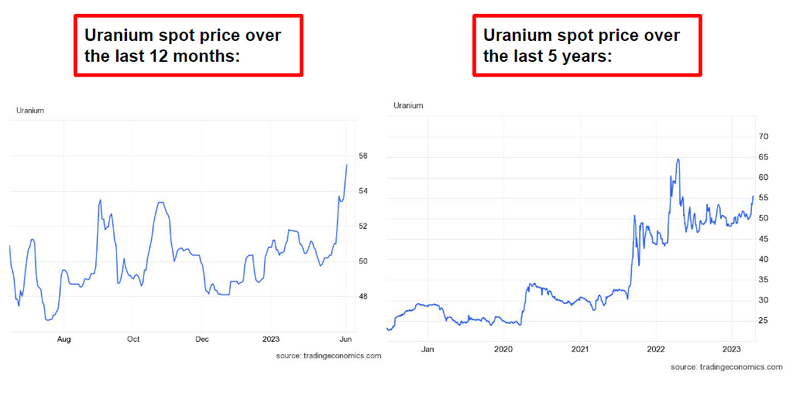

Perhaps reflecting this, the uranium spot price is currently holding at a level that hasn’t been seen in 12 years.

To gain exposure to the uranium thematic, earlier this year, we Invested in Okapi Resources (ASX: OKR).

We Invested in OKR at 15c back in February. It's now trading around 12c after what has been a pretty bad 6-12 months in the broader small cap markets, not helped by May & June weakness in the market.

OKR is currently capped at $21M, and held $2.6M in cash at the end of last quarter.

OKR has projects across four North American uranium districts, in addition to its 20% stake in a uranium enrichment technology company.

Uranium “enrichment” is basically applying an advanced process to raw uranium (that is mined out of the ground) to enhance the concentration of its key element enough to be used as the fuel in nuclear reactors.

OKR’s technology could make uranium enrichment more efficient, safer and cheaper than other enrichment technologies, and reduce reliance on China and Russia.

The other ASX ‘uranium enrichment’ stock has gone from a $35M to a $1BN market cap in recent years (Silex Systems, but this isn’t an indicator that OKR will do the same thing).

In addition to uranium enrichment technology, OKR has JORC stage uranium resources in the USA, and is about to explore for raw uranium supply in Canada.

Today OKR has announced newly identified uranium drill targets that they are planning to drill next quarter.

One of our key Investment themes for 2023 is critical materials in the USA - specifically for energy and resource independence in a rapidly de-globalising world.

OKR offers uranium enrichment technology combined with JORC-stage USA based uranium assets.

It's not often we see macro forces as powerful as this all coming together - meaning it’s a great time for OKR to go drilling.

Once mothballed uranium operations are switching on again and the uranium spot price is edging up rapidly.

Domestic or friendly uranium supply is now of strategic importance to the US.

Enter OKR.

OKR set to drill for uranium in the Athabasca Basin next quarter

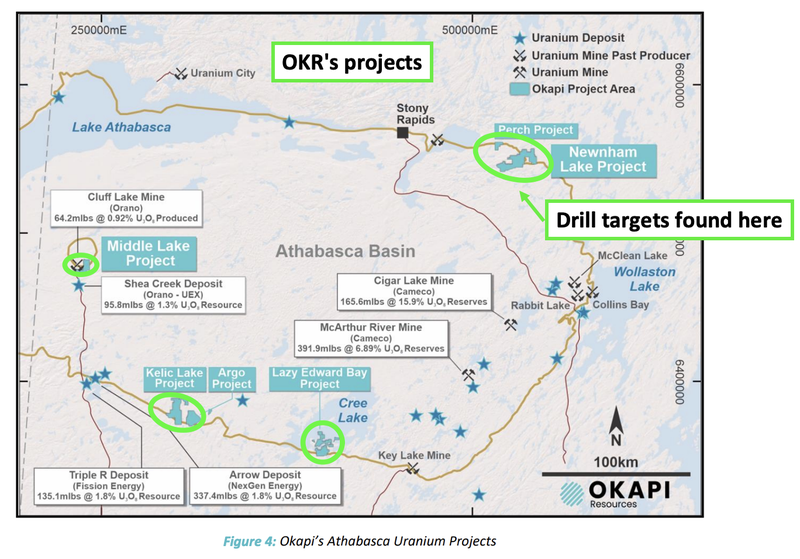

The world's highest grade uranium and ~20% of the world's uranium supply comes from the Athabasca Basin

OKR is planning on drilling here next quarter. Today OKR released its highest priority drill targets.

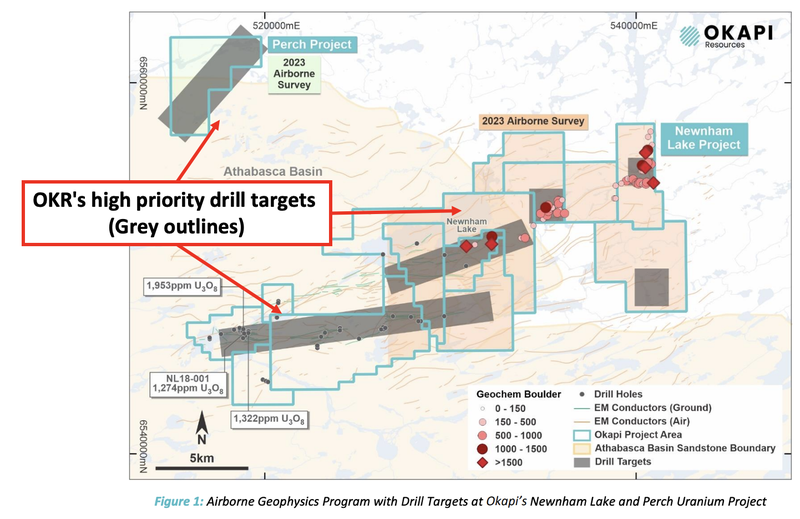

The drill targets come from a combination of airborne magnetic and airborne EM surveys indicating the most conductive spots.

OKR says these targets could be like other basement hosted deposits in the region like the valuable Triple R and Arrow deposits.

The Triple R deposit is owned by the TSX-listed CAD$460M (AU$509M) capped Fission Uranium Corp and is the region's largest high-grade deposit at shallow depth - 135mlbs @ 1.8% U3O8.

The Arrow deposit is a fair bit bigger 336mlbs @ 1.8% U3O8. Arrow is the largest development-stage uranium project in Canada right next door to Triple R, owned by the CAD$3BN (AU$3.3BN) capped Nexgen Energy.

To say nothing of US$14BN capped Canadian uranium giant Cameco’s Cigar Lake project which is the world's highest grade uranium mine, which also sits in the Athabasca Basin.

These types of uranium deposits give you a sense for the kind of targets the $24M capped OKR is going after in the region. However for OKR - it's only the very early stage of its exploration, and discovery success is no guarantee.

However, IF OKR can hit shallow high grade uranium in this upcoming drilling, it could form the basis for a re-rate.

Particularly if that drilling coincides with some major uranium macro tailwinds.

Previously OKR has flagged that it is planning a ~2500m, 10-15 hole program at its primary Athabasca Basin project, and is fully permitted to commence drilling.

That should be enough metres and holes to find out a lot more about the projects. Again we’re hoping the drilling proves that there’s more of the mineralisation that already exists on the projects.

Only one hole has ever been drilled at OKR’s project (in 2018) - and it returned 7.2m @ 0.03% U3O8 including 0.5m @ 0.127% U3O8.

We think that’s a promising place to start, so the goal for OKR is to follow this up and try and find the source of the uranium mineralisation at depth or along strike.

We specifically Invested in OKR for its North American uranium exposure, and this drilling program will give OKR a decent chance of making a uranium discovery at a time when the US uranium market is crying out for more supply.

We’re also Invested in OKR to see it advance its uranium enrichment technology - to get a full rundown of why this is so important to OKR’s strategy see our OKR Launch Note below:

Click here to see our OKR Launch Note

Today’s note however, is mainly focussed on OKR’s physical assets in the Athabasca Basin.

So while we wait on news from OKR’s stake in a potentially breakthrough uranium enrichment tech company, we see the potential delivery of high grade Athabasca Basin drilling results as OKR’s clearest near term catalyst.

As a reminder, our OKR Big Bet is as follows:

Our Big Bet:

“OKR re-rates to a +$250M market cap by achieving a major technological breakthrough with its uranium enrichment technology and/or is acquired at multiples of our Entry Price by a US focussed uranium major looking to gain access to its assets and technology”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our OKR Investment Memo.

More on OKR’s targets: North America’s most prolific uranium district

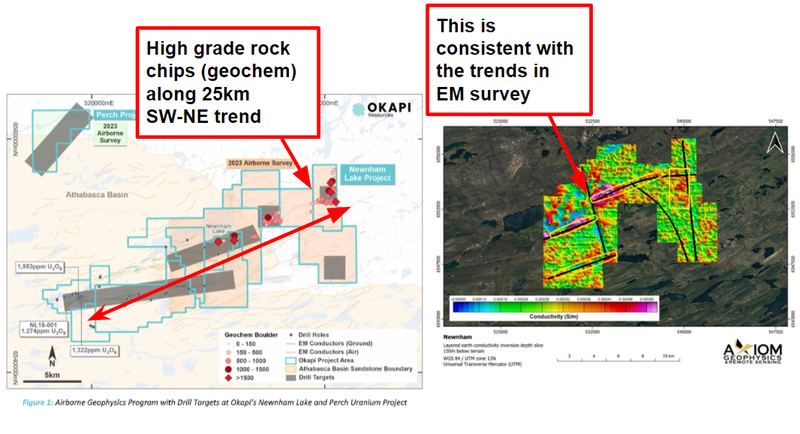

OKR seems to have quite a bit to work with here, in total ~25km of conductive trend.

Below you can see little red dots (high grade geochemistry results) matched up with trends from OKR’s brand new EM data:

We’re particularly interested in what can be found in that clustering of rock chip (geochem) results and EM results in the middle of the project.

OKR completed EM surveys over two projects here, and it remains to be seen if OKR will have a crack at both or just one.

This is vision from the survey earlier this year:

OKR plans to drill test the high priority targets in Q3.

Based on what we’re seeing in the uranium macro environment, that drilling (if successful) could become a big deal if recent events in the uranium space are anything to go by...

Macro heating up from OKR: US needs uranium, quickly

The US uranium macro theme is bubbling beneath the surface, but we think that if/when it goes mainstream it could be one of the biggest stories in commodities this year.

Things started ramping up in March when Joseph Dominguez, who is president of a 21 reactor nuclear company, said that his company had enough inventory and contracts to meet the needs of its fleet of 21 reactors until 2028.

But that, “in the world of nuclear fuel, 2028 is tomorrow.”

Cognisant of the brewing US domestic uranium supply crisis, there are now two bills/potential US laws making their way through the US Congress:

Bill #1: This legislation would start banning Russian uranium 90 days after its enactment. Importers would need to apply for waivers showing a clear need to import Russian uranium.

Bill #2: This law would establish a domestic nuclear fuel program with the purpose of onshoring nuclear fuel production to ensure a disruption in Russian uranium supply would not impact new reactor development or ongoing operations. It appropriates ~US$3.5BN to make this possible.

Together we see this legislation as the beginning of an inflection point for US uranium stocks - one that we hope will drive interest in OKR’s projects across both the US and Canada.

Remember, OKR has an existing JORC resource of 49.8Mlbs in Colorado, another project in Colorado as well as a project in Utah - in addition to the Athabasca Basin projects it will be drilling next quarter.

It’s a large portfolio to build value from and this spread of prime uranium real estate was part of what attracted us to Invest in OKR in the first place.

We’ve also recently noted the uranium spot price moving up sharply, threatening to break the US$60/lb mark:

Given OKR has pounds in the ground already, as the U spot price goes higher, OKR’s in ground value increases.

There are some interesting data points out of uranium producers too.

The following uranium companies have secured contracts with the US Government and/or restarted operations:

Exhibit A: US$1BN capped Energy Fuels sold 300,000 lbs. of uranium to the U.S. Department of Energy at $61.57/lb in January.

Exhibit B: CAD$380M capped Ur-Energy sold 100,000 lbs at $64.47/lb to the US Department of Energy AND restarted operations at its Lost Creek facility in May.

Exhibit C: US$1BN capped Uranium Energy Corp sold 300,000 lbs to the US Department of Energy at $59.50/lb in Q1 this year.

Exhibit D: Late last year US$14BN capped Canadian uranium giant Cameco produced the first pounds out of its restarted McArthur River/Key Lake projects in the Athabasca Basin.

We see this activity - particularly the sales of pounds to the US government well above prevailing spot prices at the time of sale - as indicative of an immense amount of pressure building up in the uranium supply chain in North America.

There’s geopolitical jockeying happening as well...

Noting that:

- China has 23 nuclear reactors under construction (equivalent to nearly half of its current operating fleet number)

- China’s Xi Jinping’s first trip out of China, post-lockdowns, was to Kazakhstan and he recently held talks with Kazakhstan’s president last month...

It’s no surprise that a headline about Kazakhstan’s state owned uranium producer Kazatomprom popped up in April:

So China clearly wants a piece of Kazakhstan’s supply... that would normally head to the US.

Sensing the opportunity, the finance world has moved to offer exposure to the theme and we’ve seen two new uranium exchange traded funds (ETFs) launch in the last few months:

ETF #1: The VanEck Uranium and Nuclear Technologies (NUCL) launched in February

ETF #2: Sprott Junior Uranium Miners ETF (URNJ) also launched in February

These funds package up a range of uranium stocks in a single basket, and we see the launch of these new ETFs as a sign that there is appetite in the market for uranium investments.

The ETFs also add liquidity to the uranium space, which we hope begins to trickle down to companies like our Investment, OKR.

Adding up the US legislation, the contracts above spot price, the geopolitical jockeying for supply and the new ETFs - it leads us to the conclusion that the uranium macro thematic could be about to seriously take off in the coming months.

Fertile ground for OKR’s projects to thrive in and we think now is an ideal time for OKR to start drilling.

Again, for a full rundown of why we Invested in OKR click the link below to see our OKR Launch Note:

Click here to see our OKR Launch Note

With a strong macro theme and a catalyst to come next quarter, below is what we expect OKR to accomplish going forward...

What’s next for OKR?

This is what we think the near-term newsflow for OKR will look like:

🔄 Drilling at Athabasca Basin

We expect OKR to drill its most promising projects in Canada in Q3 of this year.

🔄 Drilling at most advanced project in Colorado (which has a JORC resource)

A permit is in place for 18,200m across 60 drill holes - we want to see OKR firm up a timeline for this drilling.

🔄 Drilling at second Colorado project

At the Maybell project OKR has engaged a company called BRS Engineering to work over historical data - the company has direct experience at the Maybell Project when it was operating. We’d be looking for a drill program in H2 2023

🔄 Progress on enrichment tech

Scientific progress and regulatory approvals aren’t linear processes but we are looking for one of the following three things to happen on the enrichment front:

🔲 Further validation and extend the enrichment performance (show how well it works)

🔲 Achieve continuous operation at bench scale (scale up process)

🔲 Regulatory approvals

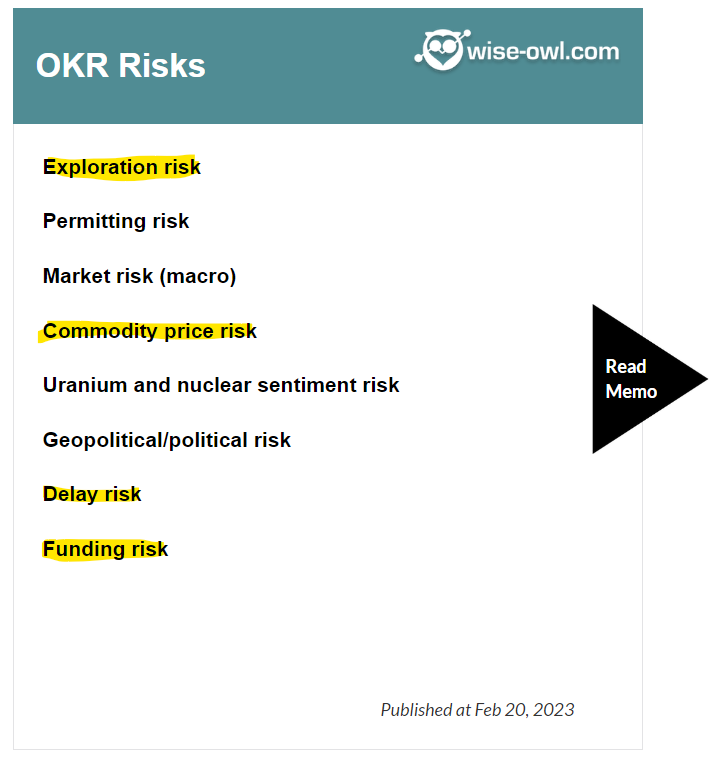

Risks

Below is an excerpt from the risks section of our OKR Investment Memo with the risks we are most focussed on at the moment (click the image below to read the full document):

Exploration risk - an ever present risk with any company that is drilling - there is no guarantee that OKR’s exploration will be successful. Assay results and intercepts can be uneconomic meaning the company might fail to find any valuable mineralisation.

Commodity price risk - the uranium spot price could fall and market sentiment towards uranium stocks like OKR could change.

Delay risk - if OKR fails to deliver the drilling on time and/or newsflow dries up, this could effect the OKR share price.

Funding risk - OKR had $2.6M cash at 31 March 2023. OKR may need to raise funds in order to advance its projects. Capital raises can weigh on share prices.

Our OKR Investment Memo:

Below is our OKR Investment Memo you can find a short, high level summary of our reasons for Investing.

In our OKR Investment Memo you’ll find:

- Key objectives for OKR in 2022

- Why we Invested in OKR

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.