GUE announces exploration target for US uranium project

Our North American uranium Investment Global Uranium and Enrichment (ASX: GUE) just put out an exploration target for one of its US projects.

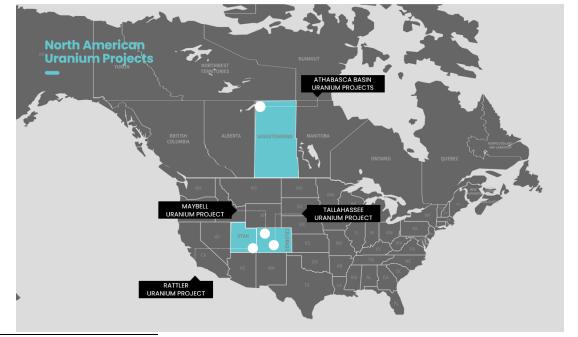

GUE has four different uranium projects across North America:

- The Tallahassee project in the US - GUE’s most advanced asset with an existing JORC resource of ~49.8m lb of uranium.

- The Athabasca projects in Canada - Six different exploration assets in the Athabasca basin where some of the world’s highest-grade discoveries have been made/developed.

- The Rattler project in the US - Exploration project in Utah, ~85km away from the only operating conventional uranium processing plant in the USA.

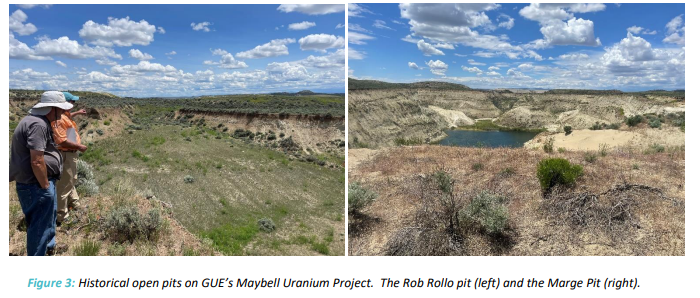

- The Maybell project in the US - a previously operating mine that has produced ~5.3mlbs of uranium in the past.

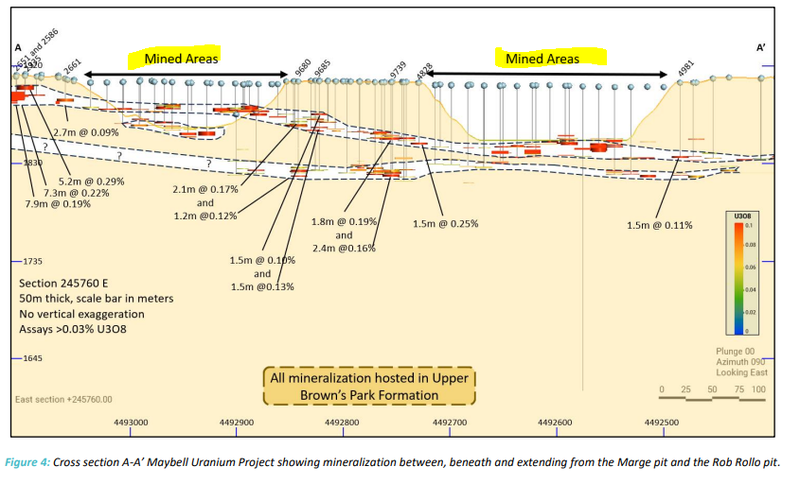

Today’s news came from its Maybell project with GUE announcing an exploration target for the project of ~4.3 to 13.3mlbs of uranium.

GUE’s Maybell project was previously a producing mine that stopped operating in the 1980’s primarily because uranium prices were too low.

The news today is GUE’s interpretation of where the company thinks it could find extensions to the old orebodies on the project.

The next steps for the project is to get exploration permitting done so that GUE can get on the ground and drill out the area’s it thinks could hold more uranium in them.

GUE expects to start the permitting process in Q1-2024.

GUE also holds an Investment in a uranium enrichment technology

One of the key reasons we are Invested in GUE is because of its Investment in ‘Ubaryon’ - an Australian company developing uranium enrichment technology.

Just a few days ago the US passed a bill banning uranium imports from Russia, which puts GUE’s uranium projects and its enrichment tech more in focus.

For context - the US relies on uranium imports from Khazakhstan and Russia for over 50% of its domestic needs.

In comparison, it produces next to nothing locally relative to demand.

(Source)

On top of that, the US is even more reliant on Russia for enriched uranium.

Russia is by far the world’s biggest producer of enriched uranium supply accounting for ~36% of global supply.

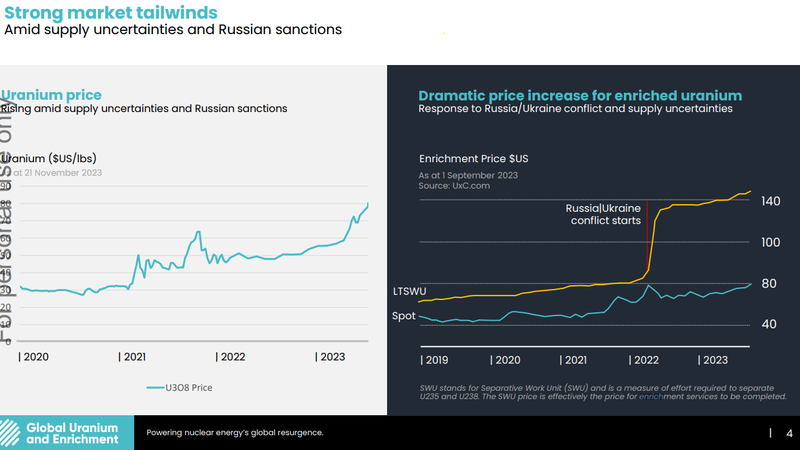

So the ban on Russian supply has implications not only on the spot price for uranium but also the price for enriched uranium.

Its not as widely reported but the price of enriched uranium actually went up by almost 100% after the Russia/Ukraine conflict started back in early 2022.

(Source)

Some of the key reasons we first Invested in GUE was for this dual exposure to both US-based uranium supply and the uranium enrichment market.

GUE, with its projects in the US and its Investment in enrichment technology, gives us exposure to both sides of the uranium market.