Uranium Bull Market? GUE Aiming to Enrich

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,098,352 GUE shares and 500,000 GUE options at the time of publishing this article. The Company has been engaged by GUE to share our commentary on the progress of our Investment in GUE over time. GUE recently changed its stock code from OKR.

The uranium spot price hit US$104/lb last week - the highest price in 16 years.

The US has just released a tender for something called High Assay Low Enrichment Uranium (HALEU) which it expects to need for Small Modular Reactors.

HALEU is uranium fuel that is enriched up to 20%, compared with traditional uranium fuel used in today's reactors which usually sits at 5%.

In February of last year, we Invested in Global Uranium and Enrichment (ASX:GUE) which has BOTH uranium projects and an investment in a potentially breakthrough uranium enrichment technology.

When we first Invested in GUE in February 2023, the uranium spot price was sitting at ~US$47/lb.

We were very confident that a uranium bull market would eventually materialise - with a special emphasis on the US uranium market.

At the time GUE (then OKR) was capped at ~$27M.

GUE is still only capped at ~$31M after more than a year of positive uranium spot price action.

We think the market is sleeping on GUE, especially with the enrichment upside.

Over the course of 2023, GUE’s share price DECREASED ~50% - while the uranium spot price INCREASED 80%... we are hoping this disconnect changes in 2024.

This is what that looks like on the chart:

Meanwhile, Russia and China dominate the global uranium enrichment market with a combined ~63% of global capacity.

The US currently has no major enrichment capacity.

AND the US needs vast amounts of uranium.

The spot price surge and enrichment crunch has governments from Washington to Brussels worried:

After recent developments out of the US government, imports of Russian uranium to the US are on the cusp of being banned.

The US currently has virtually no domestic uranium production.

Something’s got to give.

Traditional major suppliers like Kazakhstan and Canada can barely keep up.

The world’s biggest uranium miner Kazatomprom, warned over the weekend of a production shortfall.

Turns out, the whole global uranium supply chain is at risk.

We think our Investment, GUE can deliver on two fronts for the US - uranium AND enrichment.

In November, GUE rebranded to “Global Uranium and Enrichment Ltd” from Okapi Resources, and has just won our award for the most accurate company name in our Portfolio.

GUE has uranium assets in the US and Canada AND also does enrichment technology - it does what it says on the tin.

At a high level, here’s what GUE has going for it:

- Significant JORC Resource, exploration upside - GUE has a pre-existing 49.8Mlbs uranium JORC resource in the USA which the company intends to drill out further soon.

This drilling could help lay the foundation for a scoping study and clear a pathway to development.

It also has projects across the US and Canada, bits of prime real estate which could be quickly brought up to speed in a uranium bull market where capital is easier to come by for uranium exploration.

- Breakthrough enrichment tech, with precedent for major re-rate - Silex Systems is GUE’s only “uranium enrichment peer” on the ASX.

Silex has re-rated from a market cap of ~$35M to a ~$1BN in the space of two years on the back of US government initiatives, technical advancements and geopolitical factors.

Silex has recently surged ~65% in the last 4 weeks.

Silex owns a 51% stake in an enrichment technology JV with Canadian uranium major Cameco (who holds the other 49%).

GUE owns 21.9% of its enrichment technology partner and is currently capped at ~$31M.

If GUE is able to validate, scale up, and get regulatory approvals for its tech, we think it could follow a similar trajectory to Silex over time as the enrichment technology matures and is proven to work at scale.

These two aspects of GUE form the basis for our Big Bet:

“GUE re-rates to a +$250M market cap by achieving a major technological breakthrough with its uranium enrichment technology and/or is acquired at multiples of our Entry Price by a US focussed uranium major looking to gain access to its assets and technology”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our GUE Investment Memo.

To read our February 2023 deep dive note launching our GUE Investment:

CLICK HERE TO READ OUR FIRST GUE (OKR) NOTE

Drawing from the note, below are the eight reasons we originally Invested in GUE back in February 2023, well before the current uranium bull market entered the frame:

Why we Invested (February 2023):

Note: Ticker code has been updated from the previous OKR to the current GUE in the text below.

(1) The US is completely dependent on foreign uranium and uranium enrichment. It’s making domestic uranium assets and enrichment a national priority

GUE has projects across four North American uranium districts, in addition to its 19.9% stake in an enrichment technology company. We think the combination of technology and assets will make GUE attractive to acquisitive uranium majors and governments as a target of funding.

(2) The only other ASX uranium peer with enrichment technology is capped at $1BN with 51% ownership of its technology

Silex Systems is GUE’s only “uranium enrichment peer” on the ASX.

Silex has re-rated from a market cap of ~$35M to a ~$1BN in the space of two years on the back of US government initiatives, technical advancements and geopolitical factors.

Silex owns a 51% stake in an enrichment technology JV with Canadian uranium major Cameco (who holds the other 49%).

GUE is set to own 19.9% of its enrichment technology and is currently capped at ~ $25M.

*** UPDATE: Since February 2023, GUE has increased its stake in its enrichment technology to 21.9%.

If GUE is able to validate, scale up, and get regulatory approvals for its tech, we think it could follow a similar trajectory to Silex over time as the enrichment technology matures and is proven to work at scale.

(3) GUE has a 49.8Mlbs uranium JORC resource in the USA - development potential

Located in Colorado, USA, GUE’s most advanced US uranium project has a JORC resource of 49.8Mlbs at a grade of 540ppm. Should future drilling be successful here, we think this project could move into a scoping study down the track.

(4) Low EV relative to other uranium peers, and none have enrichment exposure

*** UPDATE: GUE held $1.7M in cash at September 30th, and is currently capped at ~$31M. We are looking out for the December quarterly report to be released, which will have a more up to date cash balance. Today, the company also sold an 80% interest in a lithium ‘side-bet’ for $2.125M - $175k cash and the remainder in shares - more on this later.

Following completion of GUE’s February 2023 capital raise ($5M) and subsequent payment for its stake in the enrichment technology ($3.1M), GUE will be trading on an Enterprise Value (EV) of ~$23M (assuming a 15c share price).

GUE currently has a total JORC resource base of 49.8Mlb. On a pure “pounds in the ground”/EV basis, this compares favourably with other ASX uranium peers such as Peninsula Energy (53.6Mlbs, ~$170M EV) and Alligator Energy (53Mlbs, ~$113M EV). While these two peers are more advanced in developing their assets, GUE is the only one with exposure to uranium enrichment.

(5) Highly prospective uranium exploration ground in Canada’s largest uranium producing district

The Athabasca Basin in Canada is home to some of the worlds highest grade uranium projects and produces ~20% of the world’s uranium. We see drilling success in Canada as a significant source of upside if a major discovery is made here.

(6) Strong Management and Board, with North America focus

*** UPDATE: GUE has had a board change - Fabrizio Perilli is now the Non-Executive Chairman.

We are impressed with Managing Director Andrew Ferrier’s background in private equity where he was focussed on managing US uranium assets and investments, as well as his degree in chemical engineering. We think this makes him well suited to understanding the significance of the enrichment technology, and how to get uranium deals done in the US.

We also note the GUE management team’s significant US mining experience and in-country team - this is important for getting projects advanced as quickly as possible.

(7) Tight, loyal register

*** UPDATE: OK, maybe the commentary below was slightly premature, but it still stands for 2024.

With a relatively low number of shares on Issue, we think the capital structure of GUE is set up well for a re-rate if the company can deliver milestones and/or macro factors bring more market attention to uranium. We think GUE has been flying a little under the radar up until now and the story is going to get bigger in 2023.

(8) Advanced stage company

GUE is not just an exploration company - as noted above, it has a JORC stage Uranium project and a stake in uranium enrichment technology. This fits with our 2023 Investment theme of adding exposure to more later stage companies to our Portfolio, which could begin production sooner in the current commodities supercycle.

What is Uranium enrichment and why is GUE’s enrichment technology stake important?

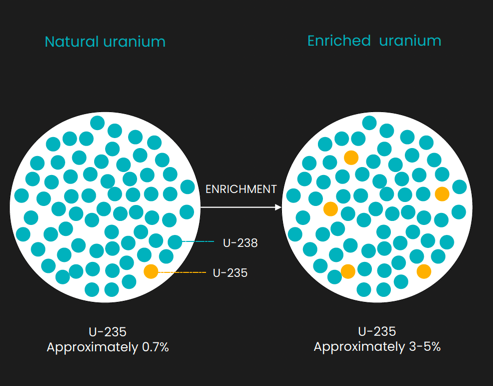

Before uranium can be used in nuclear reactors it needs to be “enriched” - an industrial process that brings natural uranium, which contains only 0.7% of U-235 (Uranium-235), to a uranium content of 3-5%.

Increasing the concentration of Uranium-235 is what makes uranium valuable in the nuclear reactor fuel cycle.

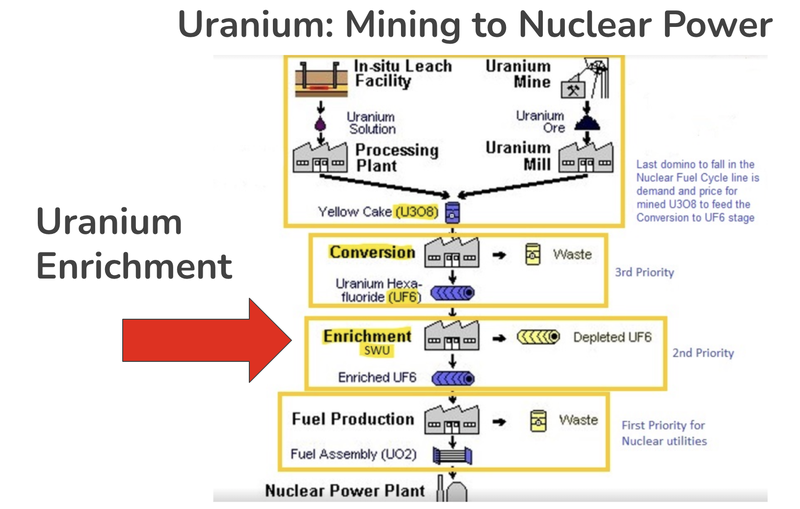

Enrichment is an important part of a multi-step process to take the raw material through to a form which can be used in nuclear reactors:

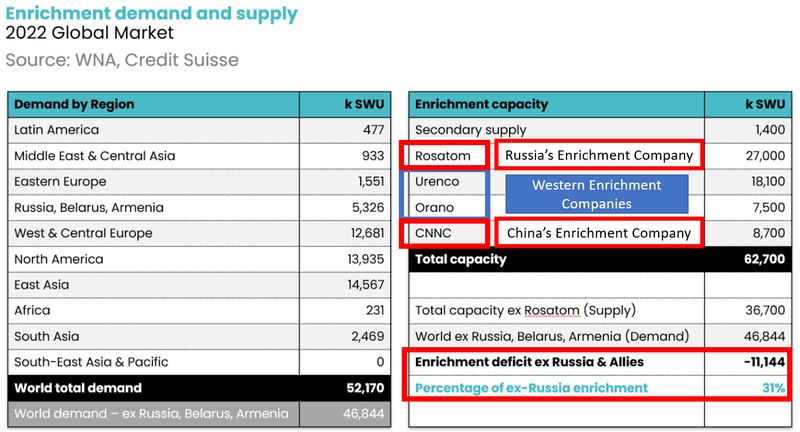

The uranium enrichment industry is controlled by four major companies. None of these companies are US based.

The biggest players in the enrichment space are based out of Russia who control ~38% of the market.

Below is a quick summary of the companies that have enrichment capacity in the world matched up against sources of demand:

Ultimately, Russia and China dominate the global uranium enrichment market with a combined 63% of global capacity - and there’s a big squeeze going on in the West for enrichment capacity.

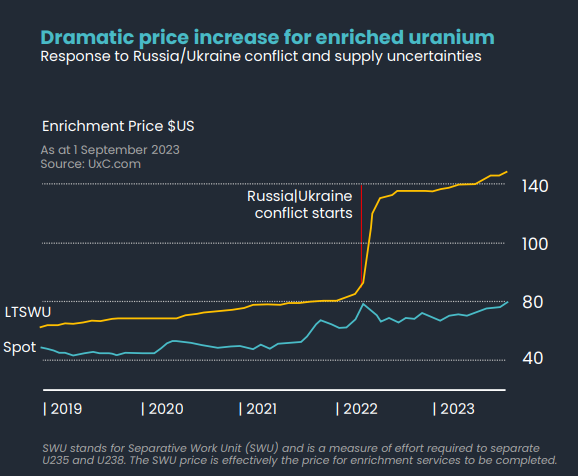

The enrichment capacity crunch could be exacerbated by new technology as well.

In addition to the standard level of enrichment - Small Modular Reactors would require a 19.5% threshold to be reached.

These reactors are part of the next generation of nuclear reactors - Bill Gates and Warren Buffer have put a large amount of money behind developing this technology and we expect these reactors to become more widespread in the future.

As a result, we see significant growth ahead for the $6BN enrichment market - which experienced a serious price crunch from the outset of the Russia/Ukraine war:

(Source)

Here’s where GUE comes in...

Once mined, uranium needs to be “enriched” before it can be used in nuclear power stations.

GUE’s uranium enrichment technology partner is developing a chemical process to make enrichment more efficient, safer and cheaper than other enrichment technologies.

Because it's a chemical process, there’s no need for lasers (like the process used by Silex) and OKR says there’s no significant heating, cooling or high pressures involved and the process can be built from readily available components.

What’s more, GUE says that the “enrichment factor is between 10 and 30 times higher than that of previous chemical enrichment technologies developed in France and Japan”.

All of that sounds potentially revolutionary - but it’s also a bit of a black box right now.

Meaning, we don’t know the specifics of how the technology works because it's classified.

We note that after the technology partner lodged a patent in 2018, the Australian Safeguards and Non-Proliferation Office and Defence Export controls now regulate all “technical disclosure”.

But we see this as an early sign of the technology's merits, because the Australian government is closely guarding it.

Ideally, GUE’s technology partner gets its technology to the US - so there may need to be regulatory accommodation for export.

As a result, regulatory developments will be key for GUE (see Objective #2 in our GUE Investment Memo).

What’s next for GUE?

🔄 Drilling at most advanced project in Colorado (which has a JORC resource)

GUE previously said the company is planning for a 18,200m across 60 drill holes - we want to see GUE firm up a timeline for this drilling for 2024.

At the end of last year GUE received a Conditional Use Permit (CUP) from the Board of County Commissioners in Fremont County, Colorado, USA.

The significance of the CUP is that it means GUE is a step closer to drilling out the Tallahassee project in 2024.

🔄 Drilling at second Colorado project (Maybell)

GUE indicated it is planning for a 2024 drill program at this project. Preparation of exploration permit applications is in progress and expected to be submitted in Q1 2024.

🔄 Drilling at Athabasca Basin

The world's highest grade uranium and ~20% of the world's uranium supply comes from the Athabasca Basin - and GUE has a number of targets to drill at its projects in this region. We’re looking for GUE to articulate when it plans to drill this project (conscious that advancing many projects across the US and Canada simultaneously can result in delays).

🔄 Progress on enrichment tech

Scientific progress and regulatory approvals aren’t linear processes, but we are looking for one of the following three things to happen on the enrichment front:

- 🔲 Further validation and extend the enrichment performance (show how well it works)

- 🔲 Achieve continuous operation at bench scale (scale up process)

- 🔲 Regulatory approvals

What could go wrong?

The two key risks in the short term for GUE are “Exploration Risk” and “Funding Risk”.

GUE has multiple permits for drill programs across its portfolio and so can run multiple drill programs in 2024.

Like all exploration projects, it’s possible that none of these drill programs find economic uranium mineralisation.

In that case, GUE would have no return for its drill programs, and the market may sell off the company off the back of poor results.

The exploration programs also add to “Funding Risk” because it would mean capital is spent for no economic return.

GUE had $1.7M cash in the bank at 30 September 2023 and after spending more cash on drilling, would likely be in a position where it needs to raise more funds (likely at discounts) to its current share price at some stage.

As a result, we think that over the next 3-6 months, the two risks are as mentioned above.

These are not the only risks to our GUE Investment Thesis, we listed more as part of our GUE Investment Memo here.

An update on GUE’s lithium project

Last month we highlighted GUE’s lithium “side-bet” project that it uncovered in November.

The WA-lithium project was next to TG Metals who had made a lithium discovery after drilling under some soil anomalies.

Click here to read our full commentary on the lithium side-bet: GUE now on two hot macro themes: Uranium and... WA lithium (accidently).

Today, GUE announced the sale of the project for $2.125M to ASX-listed Intra Energy Corporation (ASX:IEC).

GUE will be paid $175,000 cash upfront with the reminder paid in IEC shares.

GUE will still retain a 20% interest in the project with a 1% gross revenue royalty.

This sales comes at a good time for the company as the uranium macro theme heats up, and provides the company with more capital to focus on its uranium projects.

Given that the lithium project was a ‘side-bet’ for GUE, we think this is shrewd by the company to gain some value for the asset and focus on its portfolio of core uranium assets.

Our GUE Investment Memo

Click this link to see our GUE Investment Memo where you can find a short, high level summary of our reasons for Investing.

In our GUE Investment Memo you’ll find:

- Key objectives for GUE

- Why we Invested in GUE

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.