OKR on the move as Uranium price hits highest in a decade

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,133,352 OKR shares and 500,000 OKR options at the time of publishing this article. The Company has been engaged by OKR to share our commentary on the progress of our Investment in OKR over time.

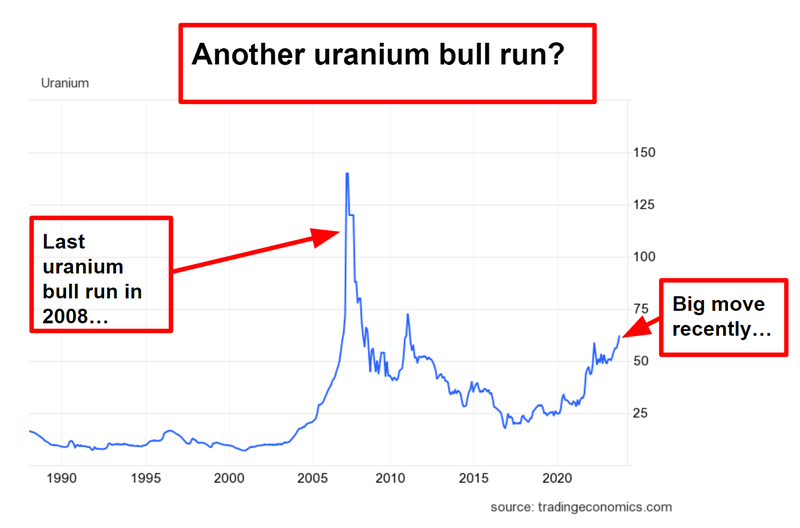

This week the uranium price surged to the highest it has been in over a decade.

Something big could be brewing in the uranium market.

In the last few days uranium stocks have been waking up from their slumber...

The performance of ASX uranium small caps are typically closely tied to the uranium price - if uranium price goes up, it usually brings small cap uranium companies with it.

...and we’re convinced that the epicentre of the action will be in North America.

We Invested in Okapi Resources (ASX: OKR) in February of this year for exposure to North American uranium AND OKR’s large stake in a uranium enrichment technology.

OKR is a uranium explorer and developer with projects across four uranium districts in Canada and the USA (including a 49.8m lb JORC uranium resource in Colorado).

OKR’s cornerstone stake in a uranium enrichment technology company uses a chemical process which could make uranium enrichment more efficient, safer and cheaper than other enrichment technologies.

One peer on the ASX in this space is Silex - a uranium enrichment company that owns 51% of its technology and is capped at $840M.

Yesterday, OKR opened at 9 cents and at one stage was trading as high as 12 cents, a ~33% gain in a matter of hours - on no news.

OKR is currently capped at $22M, recently raised $1.5M, which adds to the $1.4M in cash it held at June 30th.

We first Invested in OKR at 15c back in February this year, so it's good to see some life coming back into the stock.

Is this the start of a uranium renaissance?

Could it finally be the long awaited “uranium comeback” that has been talked about by die-hard uranium bulls for the last 15 years?

Alongside “silver bulls” and “gold bugs”, uranium bulls fall into the most high conviction and “interesting” commodity supporter groups.

Time will tell if this current uranium price surge has long term legs...

As we noted above, earlier in the week, we picked up on something strange on our watchlist.

Out of nowhere, our small cap uranium watchlist was solidly green - for what felt like the first time in ages.

We quickly went to check again on the uranium spot price chart and there it was...

A strong spike upwards in the uranium price to the highest its been in over a decade:

Uranium investors have been waiting a long time for another big move to play out, and we think the stars could be aligning for this to happen again.

Of course, anything can happen in markets, but what we are seeing could be the first signs of a structural supply deficit playing out and geopolitics is the fuel on the fire here.

We saw what happened when lithium started its run in 2021, existing small lithium stocks started running too, then suddenly there was a new lithium IPO every week.

It’s still early, but we are now watching the uranium price closely and hope that we see it continue its surge upwards.

Our Investment OKR has exposure to North American uranium across:

- JORC stage uranium projects inside the USA - 49.8m lb JORC uranium resource in Colorado.

- Exploration projects in the Athabasca basin, Canada - A region that is home to the world's highest grade uranium and ~20% of the world's uranium supply. Canada is politically friendly with the USA.

- 21.9% shareholding (largest holder) in uranium enrichment tech - the blue sky upside for the company.

The US needs uranium for its nuclear reactors in a hurry.

And lots of it.

The USA is rushing to secure domestic energy sources, and not rely on other countries such as Russia and China, specifically for uranium enrichment capabilities.

Alarmingly, the current situation is that US uranium production is non-existent.

And Russia and China control 63% of the world’s uranium enrichment capacity.

The USA is desperate to change this as a matter of national security.

The US government has recently introduced several bills and billions of dollars in funding to support its nuclear industry.

The goal is to secure uranium and uranium enrichment capability domestically.

There is already US$37.5BN of money directly targeted at the uranium and nuclear energy industries, with more in the pipeline.

One of these bills would start banning Russian uranium 90 days after its enactment.

Importers would need to apply for waivers showing a clear need to import Russian uranium.

Perhaps reflecting this, the uranium spot price is currently holding at a level that hasn’t been seen in 12 years.

To gain exposure to the uranium thematic, earlier this year, we Invested in OKR at 15c back in February, and more recently in the last placement at 6c.

OKR has projects across four North American uranium districts, in addition to its 21.9% stake in a uranium enrichment technology company.

Uranium “enrichment” is basically applying an advanced process to raw uranium (that is mined out of the ground) to enhance the concentration of its key element enough to be used as the fuel in nuclear reactors.

OKR’s technology could make uranium enrichment more efficient, safer and cheaper than other enrichment technologies, and reduce reliance on China and Russia.

The other ASX ‘uranium enrichment’ stock has gone from a $35M to as high as a $1BN market cap in recent years (Silex Systems, but this isn’t an indicator that OKR will do the same thing).

For a full rundown of why we Invested in OKR click the link below to see our OKR Launch Note:

Click here to see our OKR Launch Note

Our Big Bet:

“OKR re-rates to a +$250M market cap by achieving a major technological breakthrough with its uranium enrichment technology and/or is acquired at multiples of our Entry Price by a US focussed uranium major looking to gain access to its assets and technology”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our OKR Investment Memo.

Reminder: why did we Invest in OKR?

(from our original OKR launch note in February)

1) The US is completely dependent on foreign uranium and uranium enrichment. It’s making domestic uranium assets and enrichment a national priority

OKR has projects across four North American uranium districts, in addition to its 19.9% stake in an enrichment technology company. We think the combination of technology and assets will make OKR attractive to acquisitive uranium majors and governments as a target of funding.

2) The only other ASX uranium peer with enrichment technology is capped at $1BN with 51% ownership of its technology

Silex Systems is OKR’s only “uranium enrichment peer” on the ASX.

Silex has re-rated from a market cap of ~$35M to a ~$1BN in the space of two years on the back of US government initiatives, technical advancements and geopolitical factors.

Silex owns a 51% stake in an enrichment technology JV with Canadian uranium major Cameco (who holds the other 49%).

OKR is set to own 19.9% of its enrichment technology and is currently capped at ~ $25M.

If OKR is able to validate, scale up, and get regulatory approvals for its tech, we think it could follow a similar trajectory to Silex over time as the enrichment technology matures and is proven to work at scale.

3) OKR has a 49.8Mlbs uranium JORC resource in the USA - development potential

Located in Colorado, USA, OKR’s most advanced US uranium project has a JORC resource of 49.8Mlbs at a grade of 540ppm. Should future drilling be successful here, we think this project could move into a scoping study down the track.

4) Low EV relative to other uranium peers, and none have enrichment exposure

Following completion of OKR’s February 2023 capital raise ($5M) and subsequent payment for its stake in the enrichment technology ($3.1M), OKR will be trading on an Enterprise Value (EV) of ~$23M (assuming a 15c share price).

OKR currently has a total JORC resource base of 49.8Mlb. On a pure “pounds in the ground”/EV basis, this compares favourably with other ASX uranium peers such as Peninsula Energy (53.6Mlbs, ~$170M EV) and Alligator Energy (53Mlbs, ~$113M EV). While these two peers are more advanced in developing their assets, OKR is the only one with exposure to uranium enrichment.

5) Highly prospective uranium exploration ground in Canada’s largest uranium producing district

The Athabasca Basin in Canada is home to some of the worlds highest grade uranium projects and produces ~20% of the world’s uranium. We see drilling success in Canada as a significant source of upside if a major discovery is made here.

6) Strong Management and Board, with North America focus

We are impressed with Managing Director Andrew Ferrier’s background in private equity where he was focussed on managing US uranium assets and investments, as well as his degree in chemical engineering. We think this makes him well suited to understanding the significance of the enrichment technology, and how to get uranium deals done in the US.

OKR Chairman Brian Hill has 35 plus years experience, including a stint as Executive VP Operations at Newmont Mining Corporation (US$36BN market cap).

We also note the OKR management team’s significant US mining experience and in-country team - this is important for getting projects advanced as quickly as possible.

7) Tight, loyal register

With a relatively low number of shares on Issue, we think the capital structure of OKR is set up well for a re-rate if the company can deliver milestones and/or macro factors bring more market attention to uranium. We think OKR has been flying a little under the radar up until now and the story is going to get bigger in 2023.

8) Advanced stage company

OKR is not just an exploration company - as noted above, it has a JORC stage Uranium project and a stake in uranium Enrichment technology. This fits with our 2023 Investment theme of adding exposure to more later stage companies to our Portfolio, which could begin production sooner in the current commodities supercycle.

Uranium in the news - macro theme set for liftoff?

(Source)

(Source)

(Source)

(Source)

What has OKR done since we Invested?

Geophysics in Athabasca ✅

OKR announced that it has completed an airborne geophysics program in the Athabasca Basin in April, a precursor to a ~2500m, 10-15 hole program.

While this program has been delayed, we expect a drilling program to be a high priority for the company over the next two quarters during the Canadian winter.

Athabasca Basin is a region that is home to the world's highest grade uranium and ~20% of the world's uranium supply.

Increased stake in uranium enrichment technology partner ✅

In May, OKR moved from a 19.9% stake to a 21.9% stake in Ubaryon, its enrichment technology partner.

Permitting at Colorado JORC resource project ✅

OKR lodged a Conditional Use Permit (CUP) application covering two deposits at its most advanced US uranium project in Colorado.

If approved, this will effectively allow OKR to conduct drilling at the Colorado project on a rolling basis - 20 holes at a time.

Uranium tech partner permit renewed ✅

Australia's Nuclear Science and Technology Organisation (ANSTO) granted a 5-year permit renewal to Ubaryon, enabling advancement of its uranium enrichment tech.

Data review at Maybell project in Colorado ✅

A data review detailed potential high grade zones within thick lower grade zones, at the Maybell project which OKR intends to drill, pending a permit application.

What’s next for OKR?

🔄 Drilling at Athabasca Basin

We now expect OKR to drill its most promising projects in Canada some time in the next couple quarters despite OKR providing no guidance on the timeline for this drill.

🔄 Drilling at most advanced project in Colorado (which has a JORC resource)

A permit is in place for 18,200m across 60 drill holes - we want to see OKR firm up a timeline for this drilling.

🔄 Drilling at second Colorado project

At the Maybell project OKR has engaged a company called BRS Engineering to work over historical data - data which was announced today - the company has direct experience at the Maybell Project when it was operating. We’d be looking for a drill program timeline to be announced soon.

🔄 Progress on enrichment tech

Scientific progress and regulatory approvals aren’t linear processes but we are looking for one of the following three things to happen on the enrichment front:

🔲 Further validation and extend the enrichment performance (show how well it works)

🔲 Achieve continuous operation at bench scale (scale up process)

🔲 Regulatory approvals

Risks

What could go wrong?

Technology risk

It's possible that OKR’s stake in its technology partner doesn’t work out. OKR could fail to secure regulatory approvals, the technology could struggle to scale up, or the technology

partner fails to validate the efficiency improvements it brings at scale.

Intellectual property risk

Via its stake in its technology partner, OKR has its hands on a piece of a highly regulated, classified technology. The technology could be the subject of intellectual property theft.

Exploration risk

There is no guarantee that OKR’s upcoming drill programs in North America are successful and OKR fails to find economic uranium deposits.

Permitting risk

OKR needs to acquire permits to drill its projects and maintain its social license to operate. Not getting permits could prevent drilling and local stakeholders will need to be engaged if it seeks to develop a uranium mine in North America. These stakeholders might not approve of a uranium mine in their area.

Market risk (macro)

The broader market could sell down or crash, impacting the risk appetite of market participants and hurt the OKR share price.

Commodity price risk

The uranium price could fall, or fail to rise enough to make OKR’s US assets viable.

Uranium and nuclear sentiment risk

A large nuclear incident (such as Fukushima in the past) could make nuclear power unfavourable for a period, and set back the industry.

Geopolitical/political risk

Friction between the major powers could decrease, in turn impacting the urgency of US initiatives to secure domestic uranium supply and enrichment capacity. Alternatively, key legislation could fail to pass.

Delay risk

Both technology and drilling progress could be delayed and the market could sell down OKR on a lack of material newsflow.

Funding risk

As a small cap, OKR is reliant on capital markets to advance its projects. If some, any or all of the risks above materialise OKR could struggle to access capital.

Our OKR Investment Memo:

Click this link to see our OKR Investment Memo where you can find a short, high level summary of our reasons for Investing.

In our OKR Investment Memo you’ll find:

- Key objectives for OKR

- Why we Invested in OKR

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.