GUE now on two hot macro themes: Uranium and… WA lithium (accidently)

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,098,352 GUE shares and 500,000 GUE options at the time of publishing this article. The Company has been engaged by GUE to share our commentary on the progress of our Investment in GUE over time. GUE recently changed its stock code from OKR.

The macro planets are aligning for our Investment Global Uranium and Enrichment (ASX:GUE).

(The name and ticker code recently changed from Okapi Resources (ASX:OKR) to better reflect what the company does.)

GUE owns uranium exploration projects in the USA and Canada and a 21.9% interest in a uranium enrichment technology company called Ubaryon.

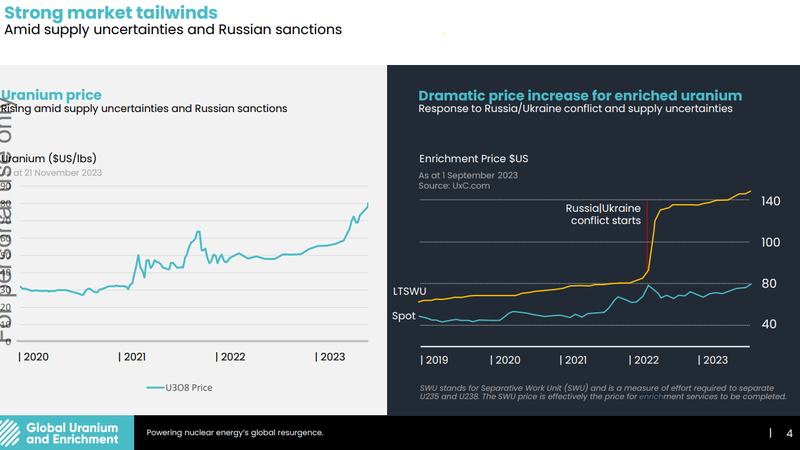

The uranium price keeps on rising - now at US$82 per lb (15 year highs).

This week the US house of reps approved a bill that would ban imports of enriched uranium from Russia.

Global leaders meeting at COP28 also signed a nuclear deal that is looking to triple nuclear power fleets by 2050.

And lithium projects in Western Australia continue their red hot run...

Wait, what?

What does the roaring WA lithium macro have to do with our uranium and enrichment tech Investment GUE?

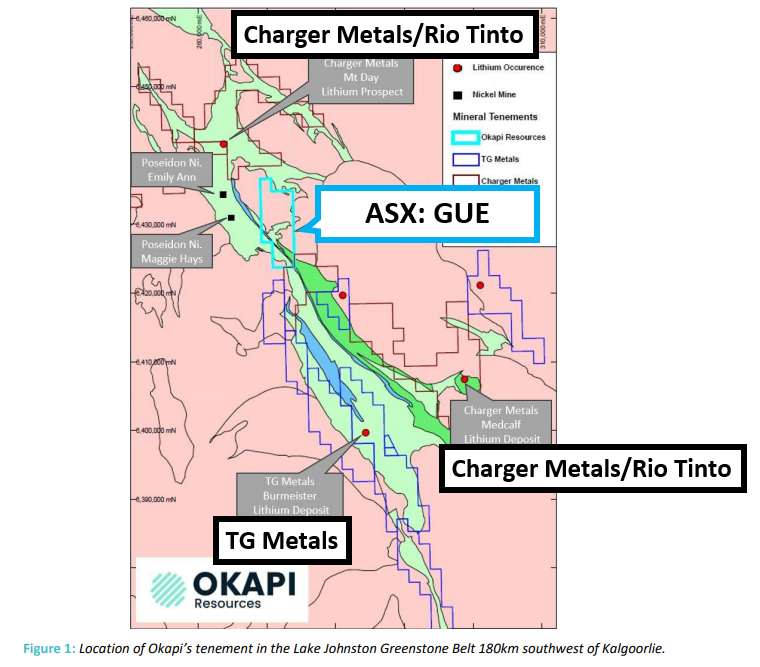

It turns out that in a past life GUE was exploring for gold in WA’s Lake Johnston region, and still owns exploration rights on some realestate that has suddenly become pretty interesting...

Especially after the TG Metals discovery that ran the stock by ~13x and Rio Tinto entering the region with a JV with Charger Metals.

So we were already pretty happy with GUE given that the uranium macro has been growing strongly...

And by sheer luck, it turns out they also have exposure to the other hot macro theme going around - WA lithium.

We are still primarily Invested in GUE for the uranium but we have come to learn that you can never discount a company’s “non-core” assets...

There have been plenty of occasions where a company’s non-core assets have turned around the fortunes of the entire company.

Everyone remembers the Mt Ida gold project being sold to Delta Lithium who then turned the project into a company making lithium discovery.

OR the Mount Holland gold project sold to Kidman Resources who did the same and only a few years later flipped the project for $776M.

Here is an update on what's been happening in uranium macro, what GUE has been up to and a little more on its suddenly interesting lithium tenements.

Global Uranium Enrichment

ASX:GUE

First on the uranium assets...

We started following GUE in early 2022 and then announced our Investment in the company in Feb 2023.

GUE gives us exposure to both raw uranium supply in North America AND enriched uranium through its 21.9% Investment in Australian enrichment technology company - Ubaryon.

GUE is one of two companies on the ASX with uranium enrichment exposure - the other is Silex which is capped at ~$1BN and owns 51% of its technology.

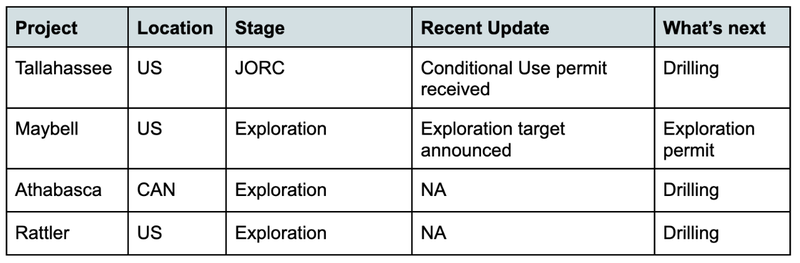

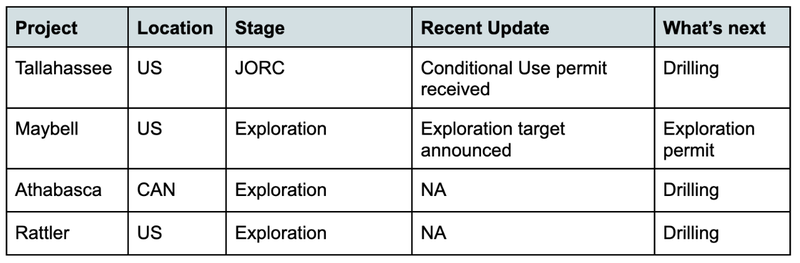

GUE also owns uranium exploration assets are spread across 4 different regions in North America:

- Tallahassee project in the US - GUE’s most advanced asset with an existing JORC resource of ~49.8m lb of uranium.

- Athabasca projects in Canada - Six different exploration assets in the Athabasca Basin where some of the world’s highest-grade discoveries have been made/developed.

- Rattler project in the US - Exploration project in Utah, ~85km away from the only operating conventional uranium processing plant in the USA.

- Maybell project in the US - a previously operating mine that has produced ~5.3mlbs of uranium in the past. Yesterday, GUE announced an exploration target for this project of ~4.3 to 13.3m lbs of uranium.

GUE is yet to update the market as to which project it wants to drill first, but the company is in a strong position given the macro tailwinds that are hitting the uranium sector.

A lot has happened in uranium since our last note on GUE, which was a few months back, and most of it happened this week...

The US Senate passed a bill banning Russian Uranium

Earlier in the week the US House of Representatives approved legislation that would ban importations of enriched uranium from Russia.

The approval by the house of reps means the bill now heads to the US Senate for approval and given the topic is supported by both sides of politics it looks likely to be made into law...

(Source)

(Source)

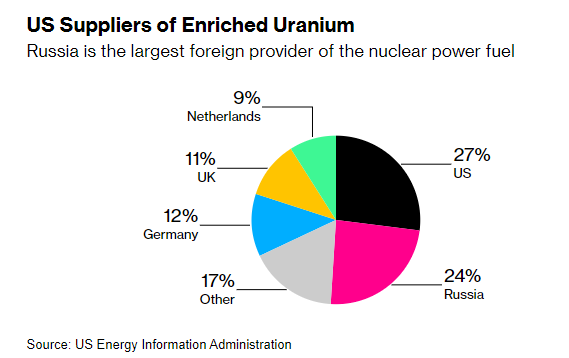

Up until now, one of the only industries untouched from a sanctions perspective was the uranium industry - primarily because of how fragile supply chains were and how dependent on Russian supply the world is.

The US in particular is one of the world's biggest uranium user and produces almost none of it domestically, making it most vulnerable to shocks in the uranium supply chain.

For context - the US has the world’s largest nuclear reactor fleet, which produces ~20% of the country's electricity.

Despite this, it relies on imports for ~95% of its uranium needs.

The ban is important because Russia supplies ~24% of all enriched uranium supply into the US and powers most of the US’s nuclear reactor fleet.

It is also important because the Russians are the only ones that produce commercially available supply of “special highly enriched reactor fuel known as Haleu that is needed for a new breed of advanced nuclear reactors”.

Right now the US is almost completely reliant on imports for the supply of mined uranium.

Our view is that when the ban on Russian imports becomes law, capital will rush into US based uranium projects like GUE’s.

(Source)

Nuclear was the talk of the town at this year's climate conference COP28

This week the annual global climate change summit “COP28” finished with a deal.

Although not a “game changer”, there was some meaningful progress that affects the global energy markets.

For the first time, leaders around the world recognised the need to “transition away” from ‘fossil fuel’.

This may seem obvious, but this rhetoric has eluded climate talks for decades.

And although “phase-out” or “phase-down” didn’t make the final text of the agreement - fossil fuels, as the root of the climate issue, was recognised from petrostates like the UAE and Saudi Arabia.

It will take time to implement the commitment to “transition away from fossil fuels”, and it is unclear whether it includes abatement or carbon capture technologies.

But as countries recognize the need to transition to clean energy, it is only inevitable that countries look for reliable sources of base load power.

Like nuclear energy.

At the summit there was a push from 22 nations declaring their ambitions to triple nuclear output by 2050.

These countries included the USA, UK, Canada, Japan, Korea, France and the Netherlands.

Where traditional forms of renewable energy (like wind and solar) are struggling to prove as economically viable (source), nuclear power is looking more likely to prevail.

Recently, the uranium spot price has been going up, and we suspect this is because of countries anticipating the demand for the commodity in the future and are looking to stockpile resources.

Uranium spot prices keep rising...

Uranium spot prices hit ~US$82 per lb this week.

Prices have been moving higher and higher every week...

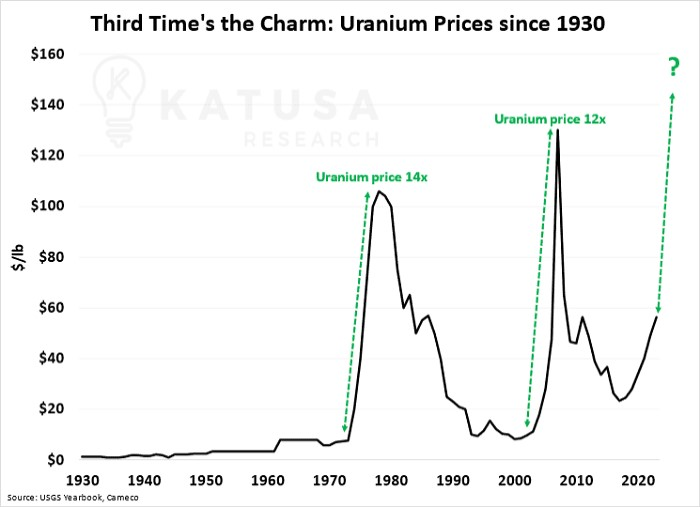

Anyone who has been around the markets for over a decade remembers the 2007-8 uranium run well...

Between 2004 and 2008, the uranium spot price more than quadrupled, hitting ~US$140/lb.

At the time, the macro theme for uranium was mainly based on energy security concerns and a rush to find alternatives to high carbon-emitting fossil fuels.

On the demand side, the theory was that nuclear power uptake would increase, and on the supply side, the theory was that supply wouldn't be able to keep up with that demand.

No matter the reason - during the 2007-08 run in the uranium price, companies, big or small, reached nosebleed levels.

Now, ~15 years later, we think the uranium macro fundamentals are as strong as they have ever been, supply chains are as fragile as we have seen them, and there is a chance we are at the very beginning of a 3rd uranium price run.

Another pressure now that wasn't around back in the 1970’s or in the late 2000’s is the ban on Russian supply being approved by the US government.

Any commodity that sees ~25-50% of supply get taken out of a market is bound to experience supply deficits and see prices go to levels where new supply is encouraged to come to market...

Interestingly, the US Congressional Budget Office thinks that a ban on Russian uranium imports into the US could increase nuclear fuel costs by ~13% and enrichment spot prices could jump by ~20%.

Both spot uranium and spot enriched uranium prices started rallying after the Russia/Ukraine conflict started, and so our view is that a ban on Russian imports would just bring about a 2nd leg in price appreciation.

From a macro perspective everything is just getting stronger for GUE...

What GUE has been up to:

GUE has four North American uranium projects:

GUE advanced permitting at its Tallahassee project ✅

GUE received a Conditional Use Permit (CUP) from the Board of County Commissioners in Fremont County, Colorado, USA.

The significance of the CUP is that it means GUE is a step closer to drilling out the Tallahassee project - something that GUE is looking to do in 2024.

We covered that news in a Quick Take here: OKR receives important permit at large US uranium project

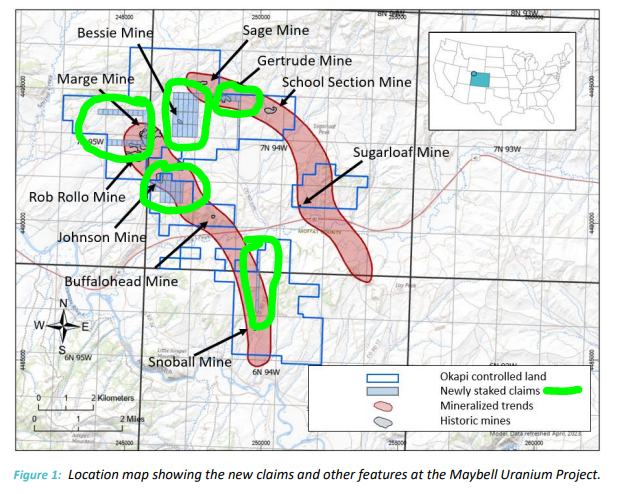

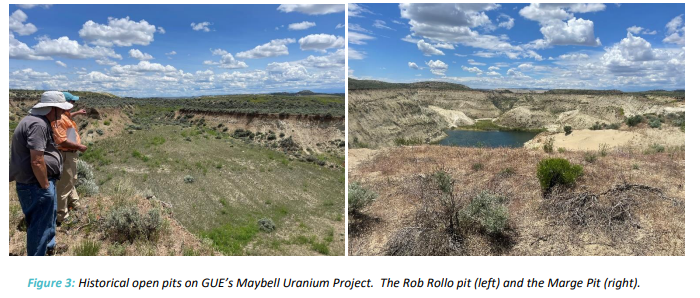

GUE expanded its project area at its Maybell uranium project ✅

GUE added ~69 claims, increasing the project area by ~384 hectares.

GUE now holds ~520 claims over a total project area covering ~4,145 hectares.

Check out the ASX announcement on that news here: GUE expands position at Maybell Uranium Project

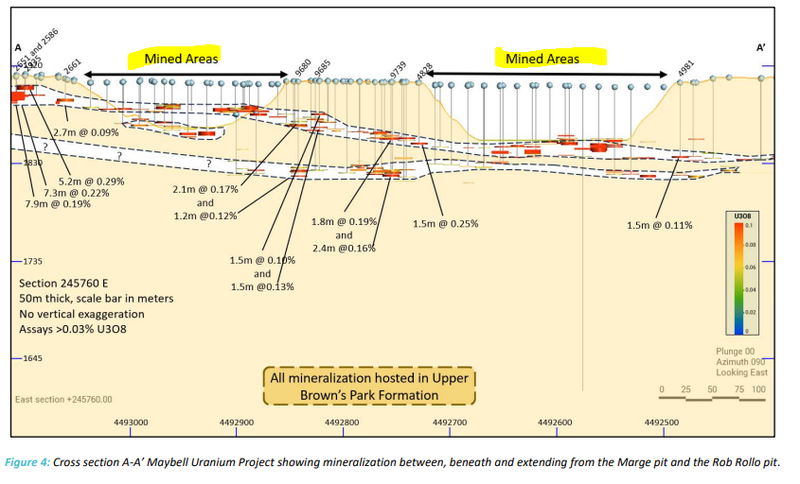

GUE put out an exploration target for its Maybell project ✅

Yesterday, GUE put out an exploration target for the project of ~4.3 to 13.3mlbs of uranium.

GUE’s Maybell project was previously a producing mine that stopped operating in the 1980’s primarily because uranium prices were too low.

The news yesterday is GUE’s interpretation of where the company thinks it could find extensions to the previously mined orebodies on the project.

The next step for the project is to get exploration permitting done so that GUE can get on the ground and drill out the areas it thinks could hold more uranium in them.

GUE expects to start the permitting process in Q1-2024.

We covered that news in a Quick Take here: GUE announces exploration target for US uranium project

GUE lithium sidebet...

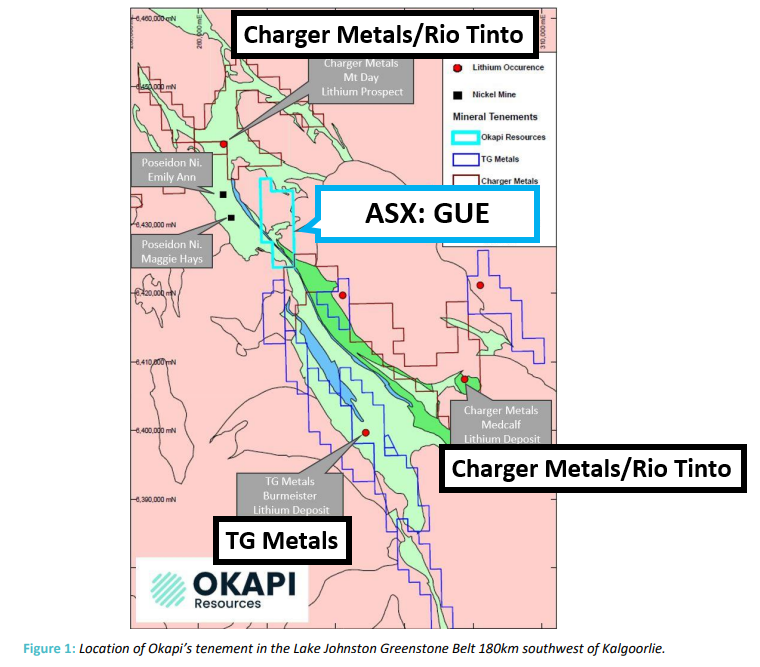

In early November, GUE also put out an announcement about a WA lithium project that sits in the company’s tenement portfolio.

The news came as a bit of a surprise given the ground had previously been sold and then returned to GUE.

Usually we don't place much emphasis on announcements about side projects for companies we are Invested in BUT this one was interesting because:

- GUE’s neighbour TG Metals made a discovery at its project nearby GUE’s and its share price re-rated by ~13x...

- TG Metals discovery was made after drilling under lithium soil anomalies - the same type of anomalies GUE announced.

- GUE’s project is also in the same region as the Rio Tinto deal with Charger Metals...

Below is some of GUE’s commentary on the project and a map showing where its project sits relative to TG Metals and Rio Tinto/Charger Metals.

It's still early days for the project but we will be watching to see if anything comes from the soil sampling/rock chip sampling GUE will be doing on the project soon.

All in all, the primary reason for our Investment in GUE is still related to its North American uranium projects & its investment in enrichment technology company Ubaryon. However we are also keeping an eye out for progress on the WA lithium front.

Progress across its uranium projects forms the basis for our GUE “Big Bet” which is as follows:

Our GUE “Big Bet” -

“GUE re-rates to a +$250M market cap by achieving a major technological breakthrough with its uranium enrichment technology and/or is acquired at multiples of our Entry Price by a US focussed uranium major looking to gain access to its assets and technology”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our GUE Investment Memo.

What’s next for GUE?

Drilling at its Tallahassee project 🔲

OKR is planning a 2024 drill program for the Tallahassee project which has an 49.8m lb JORC uranium resource.

The drill program will fill in the gaps for a scoping study that GUE plans to put together next year.

Drilling at Athabasca Basin 🔲

GUE has permits approved for a 5,000m drill program across two of its targets in the Athabasca Basin.

At this stage GUE hasn't given a timeline on when the drilling would start but there is potential for this program to start at any time given its permitting status.

Drilling at its Maybell uranium project 🔲

GUE is looking to run through the permitting process for a drill program on this project.

Drilling at its Rattler uranium project 🔲

GUE has a permit in place for ~100 RC holes on this project. Again the company hasn't given a timeline for when it might drill the project but it could happen at any time.

Progress on enrichment tech 🔄

Scientific progress and regulatory approvals aren’t linear processes but we are looking for one of the following three things to happen on the enrichment front:

- 🔲 Further validation and extend the enrichment performance (show how well it works)

- 🔲 Achieve continuous operation at bench scale (scale up process)

- 🔲 Regulatory approvals

What could go wrong?

The two key risks in the short term for GUE are “Exploration Risk” and “Funding Risk”.

GUE has multiple permits for drill programs across its portfolio and so can run multiple drill programs in 2024.

Like all exploration projects, it’s possible that none of these drill programs find economic uranium mineralisation.

In that case, GUE would have no return for its drill programs, and the market may sell off the company off the back of poor results.

The exploration programs also add to “Funding Risk” because it would mean capital is spent for no economic return.

GUE had $1.7M cash in the bank at 30 September 2023 and after spending more cash on drilling, would likely be in a position where it needs to raise more funds (likely at discounts) to its current share price at some stage

As a result, we think that over the next 3-6 months, the two risks are as mentioned above.

These are not the only risks to our GUE Investment Thesis, we listed more as part of our GUE Investment Memo here.

Our GUE Investment Memo:

Check out our GUE Investment Memo, where you can find a short, high level summary of our reasons for Investing.

In our GUE Investment Memo you’ll find:

- Our GUE “Big Bet” - the upside case for our Investment

- Key objectives for GUE

- Why we Invested in GUE

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.