OKR receives important permit at large US uranium project

Over the last few weeks there’s been plenty of progress for our US uranium Investment Okapi Resources (ASX: OKR).

Today, OKR announced that it had received a Conditional Use Permit from the Board of County Commissioners in Fremont County, Colorado, USA.

This means OKR is almost ready to drill at its Tallahassee uranium project which is home to a large 49.8M lb resource - something which OKR is targeting in 2024.

Importantly, this Conditional Use Permit covers the areas of the project which is home to the higher grade portions of the resource.

OKR intends to progress towards the final piece of permitting business before drilling, which is a Notice of Intent to Conduct Prospecting Operations.

Having local stakeholders onboard during the permitting process has been a key focus for OKR and we see this permitting milestone as an endorsement of OKR’s work in Colorado.

It’s a good time for OKR to get ducks in a row to drill too.

After a decade-long dormant period - market sentiment towards uranium has improved quickly as the US aims to shore up its domestic uranium supply chain with a couple important pieces of legislation making their way through the machinery of US government.

Read our latest note on how OKR fits into the US uranium landscape here.

It’s possible that the appetite for US sourced uranium could be even stronger by the time that drilling happens as well.

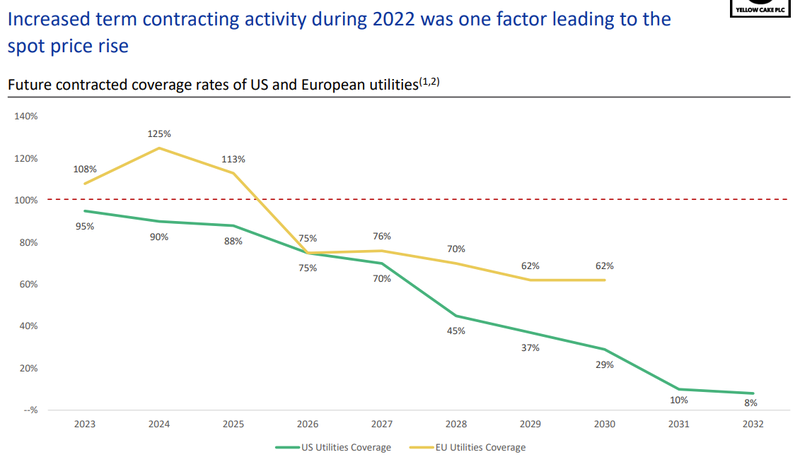

The uranium spot price has moved well ahead of a coverage rate “cliff” that accelerates from 2025 in the EU and 2028 for US utilities:

(Source)

Note the lower coverage rates that US utilities have relative to their EU counterparts.

This is part of the reason that Joseph Dominguez, who is president of a 21 reactor nuclear company, said in March before a US government committee that his company had enough inventory and contracts to meet the needs of its fleet of 21 reactors until 2028.

But that, “in the world of nuclear fuel, 2028 is tomorrow.”

We think this chart clearly shows that forward contracting of uranium supplies for Western nuclear companies is increasingly insecure and that with a rising spot price, this could rapidly drive capital flows to the uranium sector to the benefit of OKR.

Particularly in light of potential proposed US government incentives for domestic production and/or mandated domestic supply sourcing for US utilities.

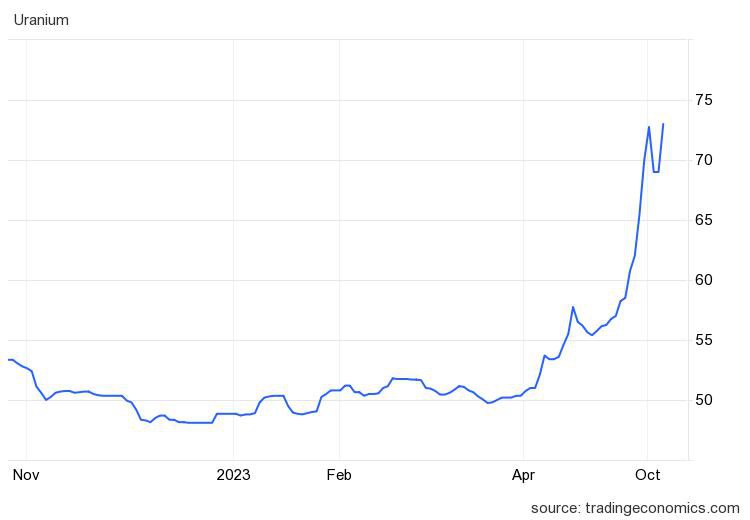

Meanwhile the spot price remains strong.

The uranium spot price has regained its upwards momentum moving to a 12 year high and hitting US$73/lb:

(Source)

Shades of the 2006-2007 bull run in the offing?

The pieces are certainly aligning - we will see.

OKR has also expanded its position at the Maybell project

OKR has a second more advanced project called Maybell, also in Colorado.

This is located in another historically producing uranium district - back when the US wasn’t almost entirely reliant on foreign imports, as it is now.

Here at Maybell, OKR has grown its land package at a project that produced 4.7Mlb U3O8 at an average grade of 1,300ppm U3O8 during the mid 50s and 60s.

We think that OKR’s Maybell project could prove valuable as more and more uranium projects in the US either come online or return to production with the spot price driving improved economics and capital flows.

The good news here is that OKR’s Maybell project has a company called BRS Engineering working to progress the project who have direct experience with Maybell back when it was still producing between 1975 and 1982.

The Maybell project went offline as the spot price declined during this period, but a rising spot price could reinvigorate the project’s potential with additional drilling.

Uranium from Maybell was also shipped to Wyoming for processing during this period, so we think BRS Engineering knows how to make the project work again now that the uranium spot price is up again.

OKR enrichment tech partner ramping up with extra staff

OKR has a 21.9% stake in Ubaryon, a private company working on uranium enrichment tech which has secured additional staff to accelerate its enrichment tech development, something which was announced in another October update from OKR.

The update noted that Ubaryon was investigating new applications of its tech in isotope separation and uranium waste management.

This is the wheelhouse that Silex Systems operates in, one of the major commodity-tech success stories on the ASX over the last few years.

OKR’s potential ability to emulate the success of Silex Systems in the enrichment space or improve on its process was a key part of why we Invested in OKR in the first place - back in February of this year when we launched our OKR Investment Memo.

Click here to read our first note on OKR

Click here to read our OKR Investment Memo

As a point of emphasis, Russia controls ~38% of the world’s enrichment capacity while China controls ~25%.

OKR noted in its October Ubaryon update that it was engaged with “strategic parties in the enrichment market”.

What’s next for OKR?

🔄 Drilling at Athabasca Basin

The world's highest grade uranium and ~20% of the world's uranium supply comes from the Athabasca Basin - and OKR has a number of targets to drill at its projects in this region. We’re looking for OKR to articulate when it plans to drill this project (conscious that advancing many projects across the US and Canada simultaneously can result in delays).

🔄 Drilling at most advanced project in Colorado (which has a JORC resource)

OKR previously said the company is planning for a 18,200m across 60 drill holes - we want to see OKR firm up a timeline for this drilling, once the final permitting approval is in place.

🔄 Drilling at second Colorado project (Maybell)

Today, OKR indicated it is planning for a 2024 drill program at this project.

🔄 Progress on enrichment tech

Scientific progress and regulatory approvals aren’t linear processes, but we are looking for one of the following three things to happen on the enrichment front:

🔲 Further validation and extend the enrichment performance (show how well it works)

🔲 Achieve continuous operation at bench scale (scale up process)

🔲 Regulatory approvals