Yellow Cake Fever: Uranium's strong end to the year

Published 18-DEC-2023 09:17 A.M.

|

14 minute read

In the last two weeks the market has been busier than we have seen in a while...

Traditionally around early December the small cap market unofficially “closes” until late January.

Investors, management teams and the broking community all go on their holidays.

Seems like many stocks in our portfolio didn’t get the memo...

This year it's been company announcement after company announcement and back to back capital raises nearly every day, in what we expected to be a quiet mid-December.

Yes, there is usually a rush to release key announcements and/or raise cash before the Christmas shutdown.

But this year it has seemed a lot busier, and it has gone on longer than usual.

With capital raise pricing for ASX small caps well and truly in bear market territory we are using the opportunities to “average down” on many of the long term Investments across our Portfolio.

(“Averaging down” means adding to a position at a price lower than your entry price, bringing “down” your “average” entry price - broadly considered a risky move.)

We have been talking about this for a while as market sentiment has been low.

While the small cap markets are in a terrible state, share prices remain smashed and companies are forced to price capital raise terms aggressively to entice despondent and risk averse investors to part with their cash.

(We are seeing steep discounts plus attaching options, even 1 for 1 options.)

This is why over the last 12 months we have been trying to participate in most placements across our Portfolio (where we hold long term positions), to bring down our average entry price for when the market eventually makes a comeback (...c’mon 2024).

This strategy worked for us during the COVID crash back in 2020, albeit that was a much shorter market fall and rise, compared to the current small cap market horror show that just seems to be dragging on forever.

More patience is required this time around.

The difficult balance is making sure we have enough cash on hand as the placements come along while the market sentiment continues to be negative.

The balance is not deploying too much cash too quickly just in case things get worse, which means share prices go lower meaning deal terms for new investors need to get better.

(Remember when we thought the small cap market would bounce back starting in July? It did not. Deploying all cash in May/June would have been a mistake.)

This balance can be tricky when a lot of placements come along at once (like over recent weeks).

Over the last five weeks we have participated in the following placements:

- 88 Energy (ASX: 88E) 0.45 cent raise

- Elixir Energy (ASX: EXR) 8.5 cent raise

- Techgen Metals (ASX: TG1) 5.6 cent raise

- Pantera Minerals (ASX: PFE) 5 cent raise

- Noble Helium (ASX: NHE) 13 cent raise

We have also Invested in a couple of unlisted seed deals as well, we also put cash into the HVY Royalty agreement.

A couple of months ago we launched Next Cap Raise, which tries to get allocations in deals to share with s708 sophisticated investors.

If you are a 708 sophisticated investor and would like access to future deals, you can sign up here.

Due to Australian financial regulations these types of deals and placements are only available to s708 sophisticated investors (sorry! we don’t make the rules - so what exactly is an “s708 Investor” and why are certain deals not available to everyone?”).

With the market sentiment for risk assets starting to pick up globally and whispers of interest rate hikes being over, our hope is that sentiment returns to the small cap space in 2024.

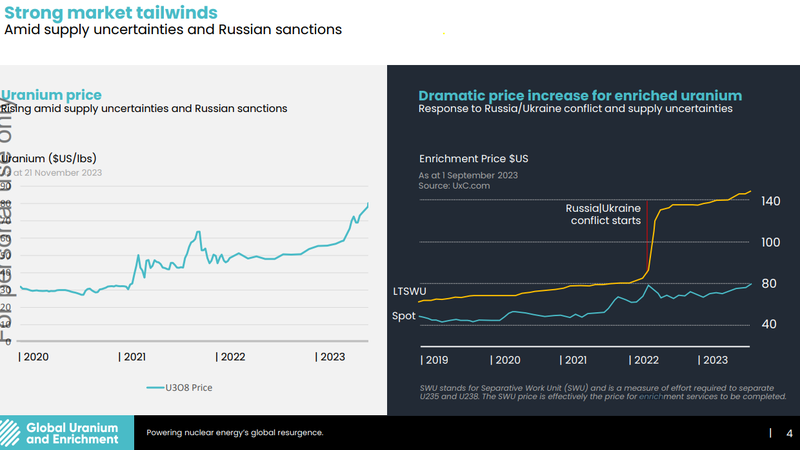

Uranium Macro continues to build...

Negative small cap market sentiment aside, there is one macro theme, more than any, that is having its time in the sun.

And that is uranium.

There are a few key events from this week that affect the uranium sector:

- Uranium spot price hits ~US$82 per lb.

- The US House of Representatives moves to ban Russian imported uranium

- 22 Countries pledge to “triple nuclear power by 2050” at COP28.

- The Australian Coalition pledges to remove the ban on uranium mining in Australia if elected

We will have a look at each of these in detail and give our take on the uranium sector going forward.

COP28 gets yellow cake fever as “Nuclear” is put on the clean energy agenda

This week marked the end of the annual global climate change summit “COP28”.

Although not a “game changer”, the deal that was ultimately signed acknowledged the need to “transition away” from ‘fossil fuel’.

This may seem obvious, but this rhetoric has eluded climate talks for decades - mainly because of lobbying by oil companies and petro-states.

And although “phase-out” or “phase-down” didn’t make the final text of the agreement - a “transition away from fossil fuels” was recognised.

As countries commit to transitioning to clean energy, they will need to find other reliable sources of base load power.

Like nuclear power.

At the summit there was a push from 22 nations declaring their ambitions to triple nuclear output by 2050.

These countries included the USA, UK, Canada, Japan, Korea, France and the Netherlands.

Interestingly these countries make up almost all of the world's existing nuclear power capacity.

If they decide to triple the size of their nuclear reactor fleets then demand for uranium could skyrocket...

China is also looking to “aggressively tie up uranium supply” amid a world wide rush to secure nuclear fuel.

(Source)

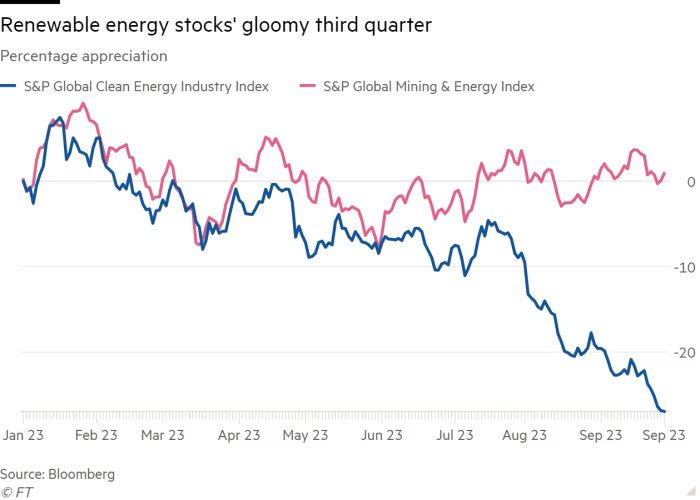

The past few months have been lean for traditional renewable energy, like wind and solar, as the sector confronts big headwinds like inflation (driving up input costs) and interest rates (driving up cost of capital).

(Source)

So, for countries to implement their commitments from COP28, to “transition away from fossil fuels”, nuclear energy will become a more and more attractive option.

No more is this relevant than in Australia.

Yesterday, the Australian market energy operator (AEMO) published a draft report that announced coal-fired power plants could drop off before replacements are ready (source).

Wind and solar is not being built fast enough, nor does it have the support from the local farming communities, to build the powerlines needed to wire up the grid.

The Australian opposition parties are turning to nuclear as a solution, with Tim O’brien, the energy spokesman for the Coalition backing the world’s nuclear pledge at COP28.

All of this shows that the demand for nuclear energy is growing, which directly impacts the demand for uranium... but what about the supply side of the equation?

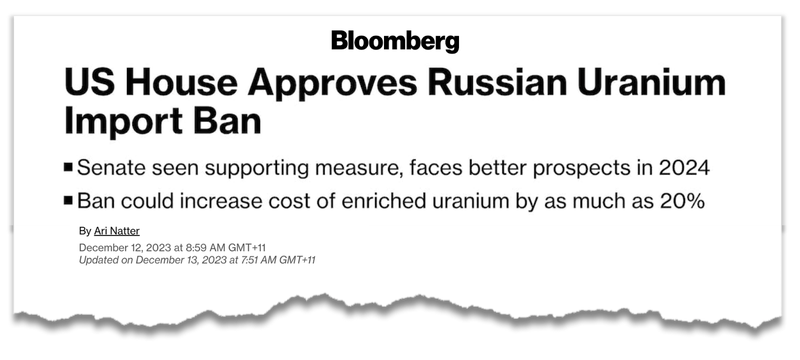

The US House of Reps passed a bill banning Russian Uranium

Earlier in the week the US House of Representatives approved legislation that would ban importations of enriched uranium from Russia.

The approval by the house of reps means the bill now heads to the US Senate for approval and given the topic is supported by both sides of politics it looks likely to be made into law...

(Source)

(Source)

Up until now, one of the only industries untouched by sanctions against Russia was the uranium industry - primarily because of how fragile supply chains were and how dependent on Russian supply the world is.

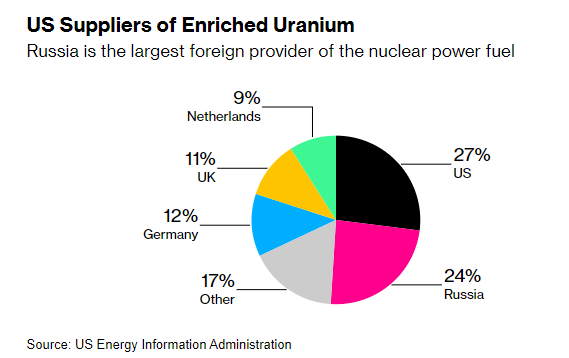

The US in particular is one of the most vulnerable to supply shocks with the world's biggest nuclear reactor fleet and close to no domestic uranium production.

For context - nuclear reactors produce ~20% of all US electricity.

The ban is especially important because the US energy grid is reliant on imports for ~95% of its uranium needs and Russia supplies ~24% of US enriched uranium demand.

It is also important because the Russians are the only ones that produce a commercially available supply of “special highly enriched reactor fuel known as Haleu that is needed for a new breed of advanced nuclear reactors”.

So it is no surprise the US utilities company Constellation Energy Generation signed a deal with ASX listed Silex to help develop enrichment technology inside the US.

Silex also recently received funding from the US government in the form of $5.1M from the defence trailblazer program in August this year.

Capped at ~$900M Silex is one of the darling uranium companies on the ASX, and we hope that its success will trickle down to the small cap end of the market where we like to make Investments.

With regards to the US ban on Russian uranium, our view is that this will put pressure on the short-medium term uranium supply.

And with supply down, we all know what happens when this is coupled with increased demand from COP28 targets....

Prices go up...

Uranium spot prices keep rising...

This week, uranium spot prices hit 15-year highs of ~US$82 per lb.

Prices have been moving higher and higher every week...

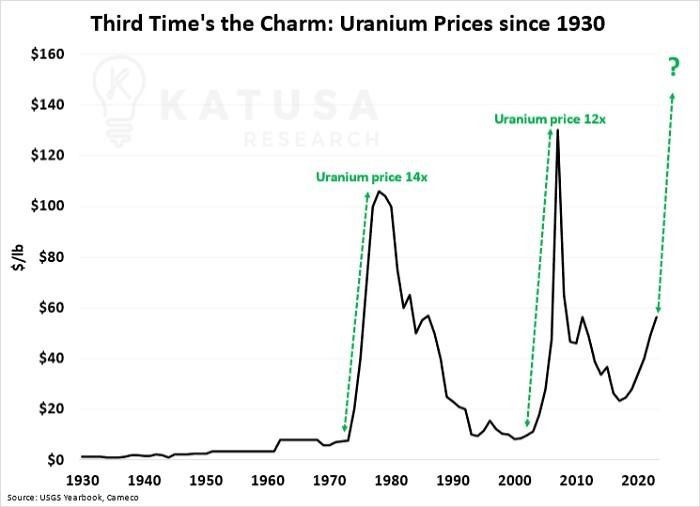

Anyone who has been around the markets for over a decade remembers the 2007-08 uranium run well...

Between 2004 and 2008, the uranium spot price more than quadrupled, hitting ~US$140/lb.

At the time, the macro theme for uranium was mainly based on energy security concerns and a rush to find alternatives to high carbon-emitting fossil fuels.

On the demand side, the theory was that nuclear power uptake would increase, and on the supply side, the theory was that supply wouldn't be able to keep up with that demand.

No matter the reason - during the 2007-08 run in the uranium price, companies, big or small, reached nosebleed levels.

Now, ~15 years later, we think the uranium macro fundamentals are as strong as they have ever been, supply chains are as fragile as we have seen them, and there is a chance we are at the very beginning of a third uranium price run.

Another pressure now that wasn't around back in the 1970s or in the late 2000s is the ban on Russian supply being approved by the US government.

Any commodity that sees ~25-50% of supply get taken out of a market is bound to experience supply deficits and see prices go to levels where new supply is encouraged to come to market...

Interestingly, the US Congressional Budget Office thinks that a ban on Russian uranium imports into the US could increase nuclear fuel costs by ~13% and enrichment spot prices could jump by ~20%.

Throw in the COP28 targets, and we think the impact could be a lot worse in the long run.

Interestingly, both spot uranium and spot enriched uranium prices started rallying after the Russia/Ukraine conflict started.

(Source)

Our view is that a ban on Russian imports would just bring about a second leg in price appreciation.

AND the spot price increasing will eventually mean the junior explorer/developers and those with exposure to enrichment will start to outperform.

Our Uranium Investments

There are a number of small cap companies that we have Invested in (the first two in 2023) to be leveraged to the uranium macro thematic:

Haranga Resources (ASX:HAR)

HAR is a junior explorer defining a uranium project in Senegal, Africa.

HAR owns 70% of its Saraya project, which has an existing JORC resource of 16m Lbs uranium.

HAR has a giant 1,650km2 uranium exploration land holding.

While Africa comes with risks, it is one of the rare places where massive new resources can be discovered and deliver multi-hundred million market caps uranium companies (like Paladin Energy, Lotus, Bannerman, Deep Yellow, Aura Energy).

HAR’s JORC resource only covers ONE of SEVEN uranium anomalies, and the company plans to undertake some extra drilling to expand its JORC resource.

This week the company announced that it had contracted an RC rig, with drilling to commence next week.

Read: HAR Investment Memo

Global Uranium and Enrichment (ASX:GUE)

GUE is a uranium explorer and developer with projects across four uranium districts in the USA & Canada.

GUE is also acquiring a cornerstone stake in a uranium enrichment technology company.

GUE's enrichment technology uses a chemical process which could make uranium enrichment more efficient, safer and cheaper than other enrichment technologies.

The only other ASX-listed company with uranium enrichment technology is ~$1BN capped Silex, who we spoke about earlier in this note.

What we want to see GUE achieve is to advance its uranium enrichment technology whilst drilling out at least two of its four projects in 2024.

Read: GUE Investment Memo

GTi Resources (ASX:GTR)

GTR is an exploration company targeting Uranium discoveries in Wyoming, USA & Utah, USA.

GTR’s Wyoming projects sit near ~9 central processing plants, with five fully permitted for production. GTR’s projects have the potential to be a part of a regional “hub and spoke” production model.

GTR has an existing JORC resource base of 7.37m lbs of uranium.

Ultimately we want to see GTR increase its total in-ground resource base through extensional drilling and then take one of its projects into the feasibility study stage.

Read: GTR Investment Memo

We think that as the uranium thematic picks up steam retail investors will be looking to small cap companies leveraged to the uranium thematic.

Although each of these companies are in the early stages of development, and there still are a lot of risks involved, this is where we are placing our uranium bets for 2024.

What we wrote about this week 🧬 🦉 🏹

Techgen Metals (ASX:TG1)

TG1 kicked off a busy week in our small cap portfolio by announcing two priority WA lithium drill targets... with a potential third one to come.

Read: 🎯 TG1 is getting closer to drilling its WA pegmatite field

Invictus Energy (ASX:IVZ)

Yesterday, IVZ announced drilling results from the Lower Angwin Target.

Net pay across two reservoirs is now a “conservative” 34.9m and likely to get bigger once the lab results come in.

The stock market didn’t react to this news as we would have hoped, and in this note we share our thoughts on the news.

Read: 🤔 IVZ declares second discovery

Global Uranium and Enrichment (ASX:GUE)

It was a big week for the uranium sector with the price hitting US$82 per lb, a 15-year high.

On top of that, the US senate passed a bill banning Russian uranium - whilst 22 countries pledged to “triple nuclear power by 2050” at COP28.

But it's not just about uranium for GUE, as the company also has some WA lithium that it “accidentally” found while exploring gold.

Read: 🔥🔥GUE now on two hot macro themes: Uranium and... WA lithium (accidently)

Haranga Resources (ASX:HAR)

Speaking of stocks poised to take advantage of the current uranium bull market, this week HAR gave some more information on its near-term drilling program.

The company announced that it has contracted an RC drill rig which will arrive on site next week.

HAR’s project already has a JORC resource of 16.1Mbs of uranium, and is hoping to develop this resource further with drilling.

Read: 🏹 HAR is Hunting for Uranium - 7 Big Targets, Drill Rig arriving next week

Pantera Minerals (ASX:PFE)

On Monday, PFE announced that it would acquire 100% of Daytona Lithium.

This gives it a 100% interest in a project that has over 10,000 acres of prospective leases in the Smackover Formation.

The Smackover Formation is the hottest area for lithium brine in North America, with Exxon Mobil, Alberamle and Standard Lithium all looking to stake their claims over the area.

Read: 🤝 PFE to own 100% over 10,000 acres in the Smackover Formation: USA’s new lithium hotspot

Global Oil & Gas (ASX:GLV)

Our 2023 Energy Pick of the Year GLV announced the appointment of Dr Alan Stein as a strategic advisor to the company.

The next 12-18 months for GLV is all about desktop studies, trawling through a mountain of seismic data to identify the best oil & gas drill targets.

This is why we think someone of Sein’s calibre and experience is crucial for the company at this early stage.

Read: ♟️GLV, Our 2023 Energy Pick of the Year, Gets Another Renowned Oil & Gas Expert

Quick Takes 🗣️

IVZ: Double Discovery Declared

LNR: LNR confirms outcropping pegmatite at its WA lithium project

GUE: GUE announces exploration target for US uranium project

EXR: EXR hits ~154m of net pay at its QLD gas project

TYX: TYX hits more spodumene bearing pegmatites

MEG: MEG permits soon? High grade US rare earths to drill

PFE: Pantera acquires 100% of Daytona Lithium

PUR: PUR’s lithium pilot plant to be switched on in Q1-2024?

ALA: Arovella presents new data

IVZ: IVZ hits Total Depth (TD) at its sidetrack well

WHK: WHK US$1.2M a year contract with "Top 5 Social Media Company"

GGE: GGE Flows Helium To Surface

Bite sized summaries of the latest mainstream news in battery metals, biotechs, uranium etc: The Future Money: https://future-money.co/

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.