HAR is Hunting for Uranium - 7 Big Targets, Drill Rig arriving next week

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,410,000 HAR shares at the time of publishing this article. The Company has been engaged by HAR to share our commentary on the progress of our Investment in HAR over time.

The rig is arriving at site next week.

A new drill campaign for us to follow - this time on the hunt for uranium.

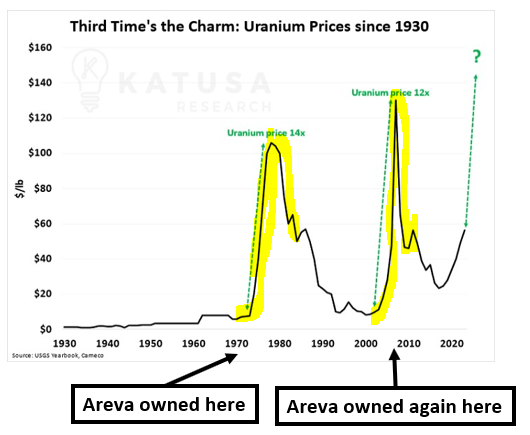

When the uranium price moves, it moves quickly.

In the 1970’s, within 3 years, the price went up 14x.

Between 2007-2009 it went up 12x.

The uranium price has been quickly rising over the last few months, and we think it could be on the cusp of having another big run.

IF the price does run, then we think the companies with tiny market caps in the exploration space stand to benefit the most.

That's why we are Invested in Haranga Resources (ASX:HAR).

HAR is a junior uranium explorer in Senegal, West Africa.

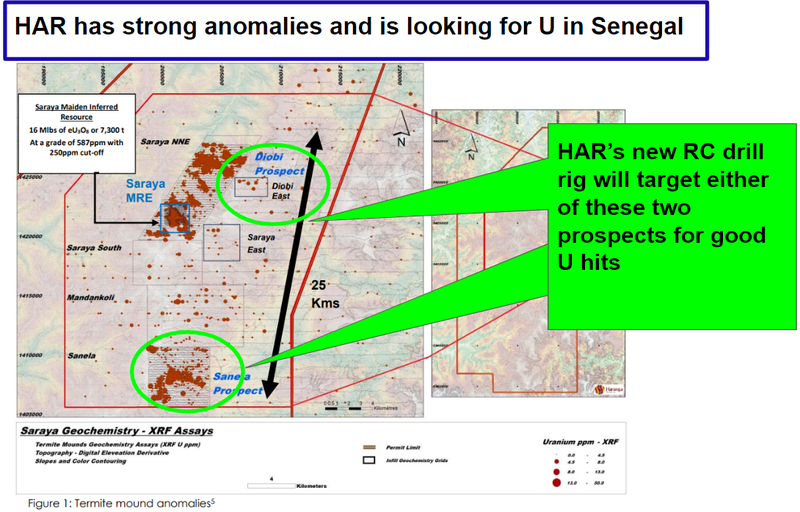

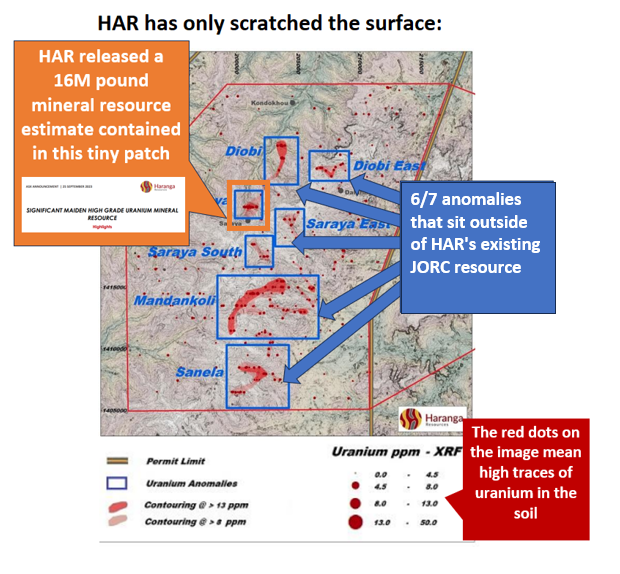

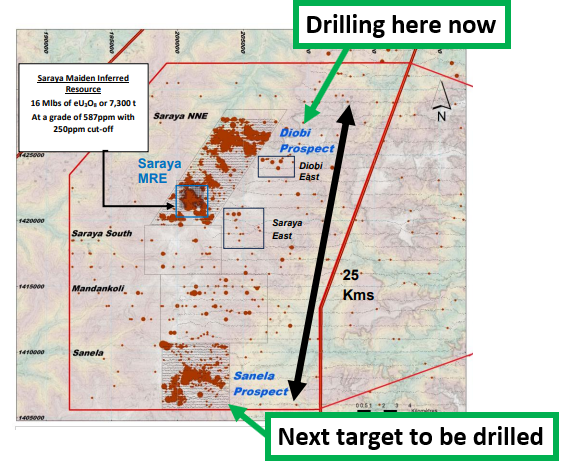

HAR’s project already has a JORC resource of 16.1Mlbs and its resource sits on a part of its project that is much smaller than the remaining undrilled uranium targets the project has.

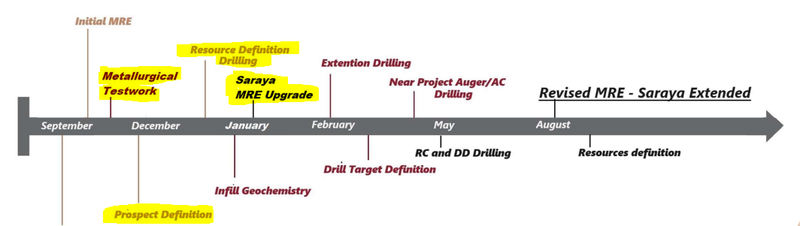

HAR is currently drilling to try and multiply that resource.

AND today HAR contracted an RC drill rig (that can drill deep holes) to be on site later this month...

HAR has done a lot of work over the last few months to prepare seven drill targets.

The upcoming RC drill holes are where the action will be.

Right now, HAR’s market cap is just $15M.

HAR ended the September quarter with ~$232k in cash and has since raised $2.86M at 11c per share which means HAR should have ~$3M in cash (before any cash burn during the December quarter).

Drilling is generally cheaper in West Africa than in other jurisdictions - which should help stretch the funds for longer.

Guiding proceedings will be highly experienced African uranium exploration and development expert, Peter Batten.

Peter was previously the Managing Director for Bannerman Resources where he put together the company’s Namibian projects and eventually defined a JORC resource of over 100m lbs of uranium.

During Peter’s time as MD, Bannerman Resources became the best performing stock on the ASX in 2006 - the share price went from 70c to $40 on his watch - so the fact he is on board as HAR’s Managing Director is a big part of our Investment thesis.

Our view is that once the project is drilled out further, HAR is in with a good chance of increasing its already large JORC uranium resource - which we hope in turn leads to a re-rate in the company’s market cap.

Right now, HAR is progressing its projects in three different ways:

- Drilling (currently underway) - 20,000m Auger (shallow) drill program at two of its seven drill targets. HAR also has a more powerful RC rig contracted and due to arrive on site later this month. For now HAR is focused on the Diobi and Sanela prospects.

- Sampling (target generation) - Termite mound sampling program is currently underway. The program is aiming to cover ~72% of the project area. Today HAR finished the first stage of this sampling program.

- Metwork results - HAR is also running metwork tests in the background. Metwork can make or break a project, so we will be looking out to see what comes from these tests.

Ultimately we want to see all of that work lead to the first (and hopefully not last) resource upgrade for HAR.

When U prices run so do juniors market caps

At the end of the day a big part of a company’s share price performance is a reflection of the overall market’s sentiment toward a particular sector.

The company fundamentals dictate where the company’s valuation goes in the long run BUT in the short term, sentiment matters a lot.

If the goal for a company is to define a large JORC resource and eventually get itself bought out/have its project developed, usually there is a point where growing the resource stops and project development works start.

That point is where the fundamentals have reached maturity stage and typically where an investor would expect the company to be valued the highest.

The reality is that company valuations can go for runs well ahead of any major catalysts.

Think of the dot com boom in the early 2000’s...

Companies like Amazon hit market caps in the billions of dollars and only really grew into those valuations a decade or so later.

The same thing happens for companies in the junior exploration space.

When a macro thematic heats up and the underlying commodity (in HAR’s case, uranium) starts to run, company share prices can start to get really frothy.

That was the type of trading we saw during the last uranium bull market (between 2006-2009).

It got so frothy that the same company HAR’s CEO Peter Batten ran - Bannerman Resources - was the best performing company on the ASX in 2006.

Bannerman’s share price went from ~70c to $40...

As a result, we think the time to be Invested is:

- When a company has a tiny market cap and is at the earliest stage of works where there is still a lot of work that can be done to add value to the project.

AND - when the macro thematic is just starting to heat up.

🎓 See why we think macro thematics drive share prices: Why do shares prices go up?

HAR’s location advantage - proximity to European markets

Earlier in the year, the Europeans started to strengthen ties with Senegal.

The meetings are an extension of the “Compact with Africa” initiative put together by the G20 that was announced by the German Chancellor Angela Merkel in 2017.

The whole purpose of the initiatives is to encourage Investment into African countries like Senegal.

The most recent was a €4BN pledge from the German’s for energy projects inside Africa.

(Source)

The German commitment comes ~5 months after the EU commission president Ursuula Von Der Leyen committed €2.5BN toward the “just energy transition partnership with Senegal”.

After that commitment was announced, she also mentioned that the EU would be “Teaming up with Senegal to accelerate investments in clean energy infrastructure”.

(Source)

At the moment, the big capital is being thrown at the most obvious renewable energy technologies like wind and solar - both of which are intermittent energy generators.

The reality is that a functioning energy grid can't operate without a stable source of baseload power.

Nuclear power offers that solution...

Across a range of metrics, we think nuclear power is the cleanest, cheapest and most efficient energy solution.

Unlike wind and solar, it can operate 24/7 and doesn't need to rely on things like the sun or wind to be able to generate electricity.

To be clear, we don't think nuclear replaces wind and solar - we think they work together with nuclear filling the gaps when the sun isn't shining and/or the wind isn't blowing.

For a large part of the last decade energy policies across the EU have been shifting away from nuclear BUT we are starting to see sentiment slowly change for the better.

Eventually, we think the EU will look to re-embrace nuclear just like it has done in the past.

For context - the French already have the world’s second largest nuclear reactor fleet & rely on nuclear power for ~70% of their electricity generation.

How does all of this relate to HAR?

Once the EU starts reinvesting back into its nuclear power fleet, it will need to look to secure uranium supply to feed those reactors.

We think that when that day comes, HAR would have had time to define a large uranium resource that could be of interest to the Europeans.

After all, the Europeans have had a history with HAR’s project in the past...

HAR’s project used to be owned by one of France’s biggest nuclear energy companies - Areva (recently renamed to Orano).

Areva was a French public multinational company involved in nuclear energy, including nuclear power plant design and construction, nuclear fuel supply, and nuclear services.

HAR’s project was owned by Areva TWICE in the past - both periods when the uranium price went parabolic.

There is a chance that as the EU-Africa partnerships get deeper, HAR works up the project to define a giant uranium resource, and the EU nuclear power sector gets stronger projects like HAR’s could become of interest.

We are hoping that when the EU needs to go out looking for uranium supply, HAR’s project will become of interest to them again...

Interest in HAR’s project from majors forms the basis for our Big Bet which is as follows:

Our long term HAR Big Bet:

“HAR re-rates to a +$100M market cap on significant resource growth and/or a transaction with a major player in the nuclear fuel supply chain”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our HAR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Haranga Resources

ASX:HAR

What’s next for HAR?

Drill results 🔄

HAR is currently running a ~20,000m Auger (shallow) drill program across two of its seven uranium targets, this is to help define the best place to place a deeper drill hole with the RC rig arriving on site next week.

HAR expects the current program to run through to March 2024 and results from the drilling to start being released to market progressively.

Sampling results 🔄

HAR is also running a tenement wide termite mound sampling program (we’ll explain what this is and how it works in a future note).

Today, HAR finished the first phase of this program and expects to be doing more work across the remainder of its project in 2024.

Assays from the first phase of sampling should start coming back in later this month.

The ultimate aim for the sampling work will be to find more drill targets.

Resource upgrade 🔲

After the results come back from the soil sampling/drilling, we want to see HAR increase its JORC uranium resource.

What are the risks?

Country Risk

While Senegal is generally one of the most stable countries in West Africa, the region where HAR’s project is located, is considered a high-risk region of the world.

Most recently in the region there was a coup in Niger (2023), which coups in Mali (2021) and Burkina Faso (2022) in recent years.

Political instability in the region could disrupt HAR’s ability to operate or commercialise its project.

Exploration risk

HAR is planning to drill exploration targets to grow its uranium resource.

Exploration activities may or may not return any uranium mineralisation or low-grade uranium resource that is uneconomic.

Commodity risk

In recent decades, governments have shunned uranium because of the issues related waste removal and accidents like Chernobyl and Fukushima.

If the adoption of nuclear power is slower than expected then it may impact the future demand for uranium.

Uranium price risk

Share prices of junior explorers like HAR are dependent on strong spot prices for the commodity they are exploring for.

The uranium price has started running at the moment but any retracements in spot prices could lead to capital withdrawing from the sector and a fall in share prices.

Funding risk

HAR is a junior explorer with no revenues to fund exploration and ongoing costs. This means the company is reliant on capital raises to fund exploration programs. Despite a recent capital raise, HAR will need to raise capital to continue its operations which may incur dilution to shareholders.

Market risk

If the broader market sells off, investors may shy away from high-risk investment opportunities like junior explorers. During market downturns, investors will look to pull capital away from the high risk investments. HAR is a junior explorer and may be impacted by these market wide sell offs.

Our HAR Investment Memo

In our HAR Investment Memo, you can find:

- HAR’s macro thematic

- Why we Invested in HAR

- Our HAR “Big Bet” - what we think the upside Investment case for HAR is

- The key objectives we want to see HAR achieve

- The key risks to our Investment thesis

- Our Investment Plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.