Roots’ RZTO technology delivers substantially increased yields

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Roots Sustainable Agricultural Technologies Limited (ASX:ROO) has reported very encouraging results on the effects of root zone heating of asparagus from a Proof of Concept (POC) trial undertaken at its research and development facility in Israel using the company’s proprietary Root Zone Temperature Optimisation (RZTO) technology.

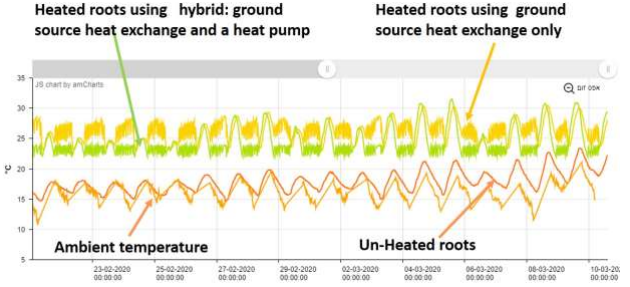

The asparagus fruits were heated in applying two levels, one plot being heated to around 22 degrees centigrade to 24 degrees centigrade using a hybrid system, a fusion of a ground source heat exchange (GSHE) and a heat pump, and the other heating to around 26 degrees centigrade to 28 degrees centigrade using GSHE only.

Results from 7 harvest cycles showed that asparagus heated at the root zone level using Roots’ RZTO GSHE solution showed a mean increase of yield by 90% of all marketable asparagus compared with the control plot.

While the hybrid GSH and heat pump system resulted in a 15% increase only compared with control group (possibly due to lower temperatures), the GSHE with only coils and circulation pump resulted in the impressive yield increase of 165%.

Management has drawn the conclusion that the higher roots zone temperature of the GSHE as seen below resulted in significant yield increase.

Commercialisation opportunities to target a US$20 billion industry

These results provide Roots with considerable validation of its RZTO technology and present a significant commercial opportunity.

RZTO technology optimises plant physiology for increased growth, productivity and quality by stabilising the plant’s root zone temperature year round.

Optimal root zone temperature is commonly known to be the most influential parameter besides water in a plant’s physiology.

Asparagus is a unique and high-end perennial crop, producing multiple crop harvests and a very long growing cycle of up to 15 years.

It is also susceptible to cold, and growth can be diminished due to cold stress, and as part of the study, the POC crop was heated between February 6, 2020 and April 4, 2020.

During that time, the number of marketable size fruits increased by 95% in the root zone heated crop.

Heated asparagus resulted in 46% more marketable yield over all fruit sizes compared with unheated asparagus.

This development provides a significant opportunity for ROO as the global market for fresh asparagus is valued at over US$20 billion.

The canned and frozen market segment for the plant is also expected to grow rapidly in coming years, and Roots will now begin aggressively marketing its RZTO technology to asparagus growers.

Environmental benefits

The RTZO system can reduce the incidence of using plastics that aren’t environmentally friendly to heat the plant during growth periods, and it is only required to be embedded into the soil every six to eight years, leaving the plant’s growing cycle uninterrupted.

RZTO is also the only technology that can economically heat crops in open fields, which is the most common growing method.

Discussing recent developments, Roots’ chairman and chief executive Boaz Wachtel said, “Results from this early study are very encouraging and further validate our RZTO technology and its applicability to a large number of commercial crops.

‘’Discussions with commercial asparagus growers are advancing favourably.

‘’Heating asparagus roots using the energy efficient and environmentally sustainable GSHE as compared with traditional heating system, opens new horizons for Roots.

“We continue to witness an increased interest in our RZTO solutions as more countries and producers tackle the issue of food security and increase local cultivation to decrease reliance on imports.

“Our new business pipeline is building favourably despite the slowdown in the sales cycle that COVID-19 has caused, and we look forward to delivering more updates on R&D and our commercial progress.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.