ROO Secures Italian Distributor with Multi-Million Dollar Sales Targets

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In October 2019, Roots Sustainable Agricultural Technologies Limited (ASX:ROO) entered the Italian market via a 12-month Letter of Intent (LOI) signed with leading Italian ag-tech producer and nursery Cairo & Doutcher.

Since then, the relationship has strengthened significantly giving Roots a firm foothold in the Italian agricultural market.

Today, Roots announced an exclusive sales agreement with Cairo & Doutcher.

This exclusive binding agreement commits Cairo & Doutcher to sell a minimum of five Root Zone Temperature Optimization (RZTO) systems during 2020. Further to that, over the course of the following three years, Cairo Doutcher have agreed to increase sales of the RZTO systems by 100% per year from €500,000 during 2021, to €1 million in 2022 and €2 million in 2023.

Putting that in an Australian context, Italy could be a lucrative market worth A$3.2 million annually in as little as three years’ time.

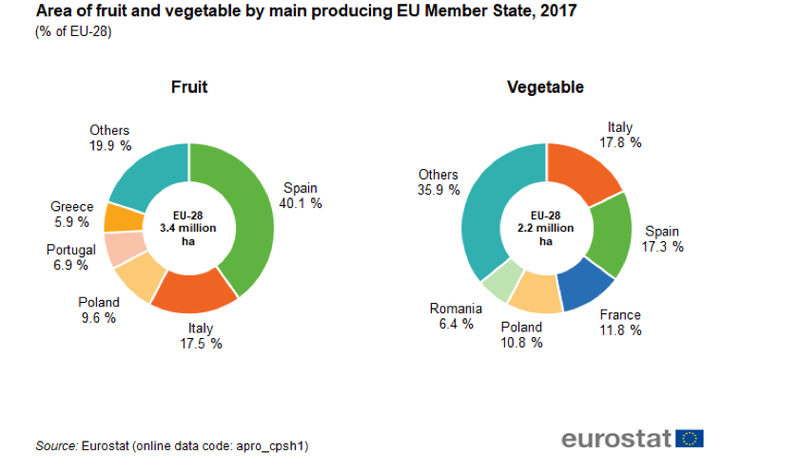

According to The Italian National Institute of Statistics (Istat), Italy is in the top three European countries for agricultural production, with fruit and vegetables, viticulture and olive crops the main sectors of Italian agriculture.

Italy is Europe’s main supplier of vegetables, slightly ahead of Spain.

This, like Roots’ recent focus on cannabis, is a highly strategic move intended to boost sales and expand its global footprint.

Should the agreement hit all its targets, Roots would become an ag-tech force in Europe and could capture the attention of other agricultural players across the continent.

With that in mind, let’s take a closer look at the latest news.

A quick catch up with ...

Share price: $3.6 cents

Market capitalisation: $4.43 million

Here’s why I like ROO...

Roots: Making an impact in Italian agriculture

Roots Sustainable Agricultural Technologies Limited (ASX:ROO) continues to build on its international partnerships, but one partnership in particular is shaping up to be quite lucrative for the company.

Its partnership with leading Italian ag-tech producer and nursery Cairo & Doutcher began in October 2019, when Roots signed a 12-month Letter of Intent (LOI) with Cairo & Doutcher to install a commercial demonstration utilising Roots’ patented RZTO technology, while also exploring distribution opportunities.

Under the LOI, Roots installed its hybrid ground source heat exchange system combined with a heat pump to improve crop quality and increase yields for herbs and flowers at Cairo & Doutcher’s growing facilities in Southern Italy.

The Italian producer is an early adopter of agricultural technology, utilising innovative cultivation techniques to improve the quality of its pomegranate, mango, avocado, herb and flower crops.

Its commercial nursery facility also supplies its seedlings, graftings and cutting varieties to wholesale growers.

With that in mind, it is no surprise Cairo & Doutcher found a need for Roots RZTO technology to help grow its crops.

Cairo & Doutcher has since stated its satisfaction with the effects of the RZTO system and even attracted the attention of the Italian minister of Agriculture.

Up to three additional demo installations for other crops are now on the cards.

A further benefit of this collaboration is an exclusive multi-year purchase and distribution agreement in Italy – the subject of today’s news.

The latest agreement with Cairo & Doutcher

ROOTS has signed an exclusive binding agreement with Italian distributor Cairo & Doutcher for RZTO systems that could net it €2 million, or A$3.2 million a year in 2023.

Cairo & Doutcher has been around since 1996, when it conquered the Italian market by becoming a leader for the production of Gypsophila (commonly called "mist") with a variety of the plant named Million Stars.

The company is famous for combining traditional knowledge with technological development and has carefully followed technological innovations in the agricultural and nursery sector.

Thus Roots provides the perfect alliance.

To maintain exclusivity in relation to selling the RZTO system Cairo & Doutcher must build up sales of the RZTO system over a three year period, with incremental growth expected each year.

This year, Cairo & Doutcher will be expected to sell five RZTO systems. In the subsequent three years, the company must sell €500,000 worth of product in 2021, €1 million in 2022 and €2 million during 2023.

Dr. Sharon Devir, Roots co-founder and director said, "This binding distribution agreement is a testimony to the viability of RZTO technology and the interest it generates around the world. Italy is an important agricultural producer for the EU and it’s a versatile market with great potential for roots RZTO’s technology.”

Roots is confident it can “produce significant sales” and expand its footprint in this territory.

Why Italy?

Italy is the third-largest economy in the euro-zone, with a GDP estimated at €2.3 trillion and a per capita GDP of €38,200.

Agriculture is one of Italy's key economic sectors.

In 2017, Italy’s agricultural industry was penalised by unfavourable weather trends, however in 2018 Italian agriculture regained a positive role in contributing to the national economy.

That role has continued to rise. In fact, as stated earlier, Italy is in the top three European countries for agricultural production with fruit and vegetables, viticulture and olive crops the main sectors of Italian agriculture.

In the last year, Italy produced 10 million tonnes of fruit and around 7 million tonnes of vegetables and exports one third of its production.

Italy is the main supplier of vegetables to the broader European community, which makes this region and Roots’ relationship with Cairo & Doutcher vitally important.

Not only could it bring in important revenues, it could open doors to the broader European agricultural market.

The final word

While Roots has a big focus on the cannabis sector, it shouldn’t be forgotten that its RZTO technology could have a significant impact across the entire agricultural industry.

You can read about Roots latest innovations in the cannabis sector in our previous article: Roots Makes 2020 The Year of The Cannabis Deal.

Grand View Research suggests the legal cannabis market will reach US$66.3 billion (A$98.6B) by the end of 2025.

Roots has important partners in the cannabis space, which is important considering how fast the industry is growing.

However, traditional agriculture is another beast altogether.

Roots is already making waves in this sector and as its relationship with Cairo & Doutcher strengthens, we could see this Australian listed ag-tech junior step into the limelight to become a prime player in Europe’s production of all things fruit and vegetable.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.