Latin Resources granted final two exploration tenements

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Furthermore, there was the potential for further upside should the company be successful in its application for additional exploration tenements totalling more than 7000 hectares, the outcome of which was expected in a matter of weeks.

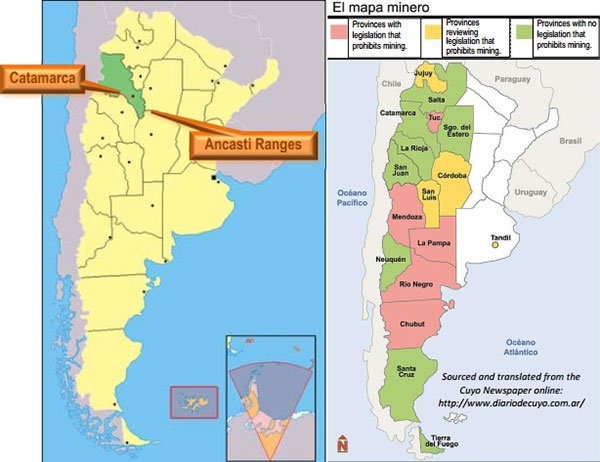

News released by the company yesterday indicating that the final two exploration tenements had been granted for exploration rights by the Mining Authority of the Catamarca province in Argentina was well received.

As highlighted by management this now brings the total area of exploration concessions granted to 76,700 hectares. Investors were quick to pick up on the good news as the company’s shares rallied 17% from 1.2 cents on the previous day to close at 1.4 cents.

It should be noted that this is an early stage play and share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

The two exploration tenements just granted cover the Vilisman and Ancasti project areas. Importantly, each has a history of lithium mining activity, together hosting more than 20 lithium bearing pegmatite deposits documented by various authors in publications made over the last 50 years.

Previous exploration yielded positive results

Management noted that combined estimates of spodumene content within 15 metres of surface of 12 of the deposits within the final two tenements now granted are in excess of 120,000 tonnes (Acosta et al 1988, Balmaceda & Kaniefsy 1982 and other non-JORC foreign publications).

Because the data being relied upon to form the above estimates is historical in nature and not reported in accordance with the JORC code it is uncertain that following evaluation and/or further exploration work that the estimates will be able to be reported in accordance with a JORC code.

Upcoming catalysts as exploration commences

Consequently, that is one of the tasks now facing LRS, and the necessary drilling and exploration work should commence once the company has received its Environmental Impact Report (EIR).

On reflection though, some of the data has been extremely impressive with analysis of three samples collected by Latin geologists from old mine workings into pegmatite deposits within the final two tenements now granted reporting grades of 7.1%, 6.3% and 4.9% lithium dioxide.

Summing up these developments and the current state of play, LRS’s Managing Director Chris Gale said, “The granting of the final two concessions allows Latin Resources to commence drilling once the approval of the permit occurs with the added bonus of not only having lithium rich pegmatites in our concession package, but existing historical lithium mines to drill, an incredibly encouraging position for our exploration team”.

With the EIR and drill permits expected to be approved in coming weeks, management has flagged December as a likely commencement date for drilling.

This suggests 2017 will be an exciting year for the company as exploration results come to hand and mineral resource estimates are prepared.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.