Latin Resources receives exploration rights for 70,000 hectares

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Latin Resources (ASX:LRS) were up more than 10% at one stage today after the company announced that the mining authority of Catamarca in Argentina had granted the company exploration rights in relation to 7 mining tenements totalling more than 70,000 hectares.

Management highlighted that these tenements are prospective for lithium pegmatites and that the granting of exploration rights will allow the group to commence drilling on the approval of an Environmental Impact Report (EIR).

There could be further good news to follow given that LRS applied for additional exploration tenements totalling more than 7000 hectares, and the outcome of this application is expected in coming weeks.

It should be noted that LRS is an early stage play and anything can happen, so seek professional financial advice if considering this stock for your portfolio.

A drilling program has been approved by the board with the expectation that it will commence in December and be completed by January. Having recently raised $3.4 million, LRS is well funded to commence this program.

Lithium bearing pegmatites previously identified

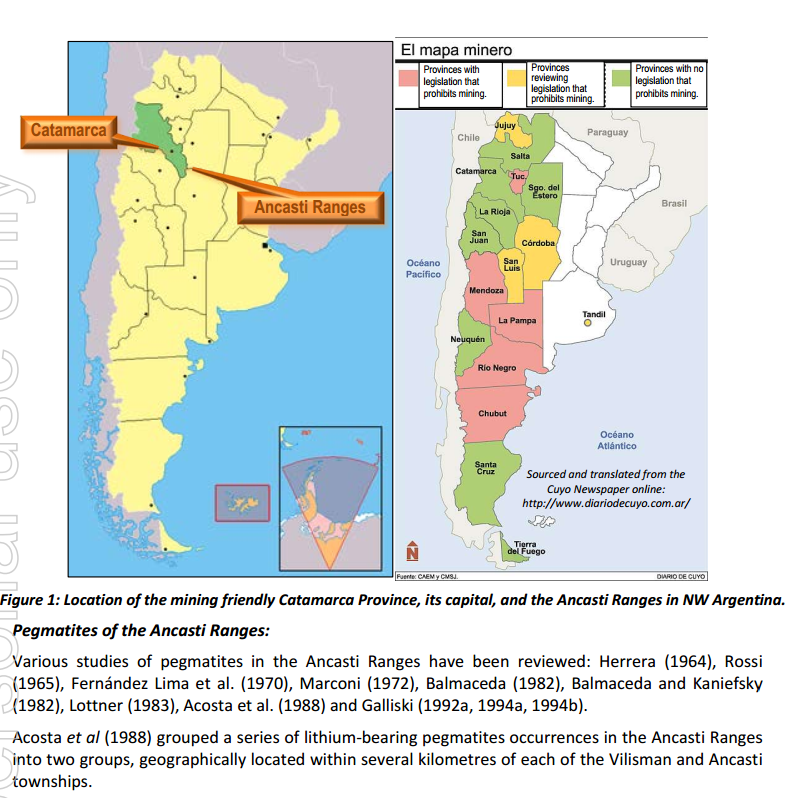

Management highlighted that two claim applications cover the Vilisman and Ancasti pegmatite groups which host a number of well documented lithium bearing pegmatites, each located on the eastern slopes of the Ancasti Ranges, approximately 40 kilometres from the Provincial Capital, San Fernando del Valle de Catamarca.

The following map shows the locations of these lithium bearing pegmatites with commentary regarding historical studies in adjacent areas.

Management confident of proving up a resource

The Vlisman Group hosts at least eight pegmatite deposits that have evidence of past mining activity. Six of these are individual dykes emplaced along structures in banded mica schists, while two are formed as multiple dykes.

Management highlighted that most of the dykes outcrop over at least 100 metres of strike length with thicknesses of between 1 metre and 5 metres.

In discussing today’s developments, Managing Director Chris Gale said, “We are funded for the drilling campaign, we have an excellent exploration team together with compelling drill targets in a lithium pegmatite district of Argentina”.

This has given Gale confidence that the group is in a position to prove up a lithium resource in the very near future. LRS’s shares have rallied approximately 70% since early September, suggesting investors share Gale’s sentiments.

The following highlights the company’s achievements to date.

It should be noted that past trading performances may not be replicated and prospective exploration results are unpredictable, and as such investors should seek independent financial advice before investing in this early stage mining stock.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.