TWO major share price catalysts… in the coming weeks

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 7,710,000 NTI shares at the time of publishing this article. The Company has been engaged by NTI to share our commentary on the progress of our Investment in NTI over time.

Two separate clinical trial results are expected in the coming weeks.

Each with the potential to significantly re-rate the stock...IF successful.

We are Invested in Neurotech International (ASX:NTI) - a clinical stage biotech company.

NTI is advancing clinical trials targeting rare and severe neurological disorders predominantly in children.

Clinical trials are major catalysts for early stage biotechs like NTI.

NTI has TWO clinical trial results to come in ‘Q1 or early Q2’.

That means the results should be announced at any point over the coming weeks.

Generally, if clinical trial results show a newly developed treatment is effective and safe for patients, an early stage biotech's share price will likely re-rate upwards.

If the trials fail, then the share price will likely go down.

Either way the next few weeks should be very interesting for NTI.

Clinical trials take a long time and so trial results announcements are rare for early stage biotechs.

The two clinical trial results we are expecting from NTI are on a potential new treatment for Rett Syndrome and a potential new treatment for Autism.

Rett Syndrome is a rare genetic neurological and developmental disorder that affects the way the brain develops in very young women.

Rett Syndrome symptoms are horrible and permanently life altering for both the patient and caregivers.

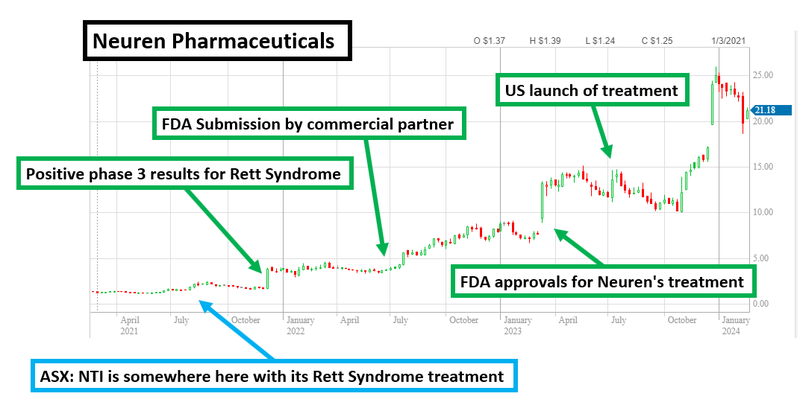

One of the main reasons we have Invested in NTI is because we like the company’s strategy of following the success of $2.7BN Neuren Pharmaceuticals.

Neuren rose from a ~$100M market cap to its current ~$2.7BN market cap in three or so years on its own treatment for Rett Syndrome.

This re-rate to a multi-billion dollar stock came from FDA approval, and subsequent commercialisation under the orphan drug regime for its Rett Syndrome treatment.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

$2.7BN Neuren has recently been under pressure from a short report questioning the safety of its Rett Syndrome treatment.

Safety (and efficacy) results on NTI’s Rett Syndrome treatment are expected any week now...

... so we will soon find out if $82M market capped NTI Rett treatment is safe(r) and can potentially capture some of Neuren’s market share with a product that also hopefully works better.

Last week we found out that all 14 patients in NTI’s Rett Syndrome trial are voluntarily staying on the treatment for a further 52 weeks.

This is an excellent sign ahead of the trial results read out - 100% of patients and families chose to keep taking NTI’s treatment after the trial finished...

We would not expect patients and families to continue with the treatment if patients were experiencing serious adverse effects from NTI’s treatment... which means we could infer NTI has no significant safety issues.

Of course - this is still speculation on our part, and we will need to wait for the official trial results in the coming weeks.

We are ALSO expecting clinical trial results for NTI’s new treatment for autism symptoms in children.

Australia's National Disability Insurance Scheme - the NDIS - provides an average annual payment of $33,800 per patient to scheme participants with autism.

This $33,800 per year is to cover ongoing support services such as speech pathologists, psychologists, neurologists, occupational therapists and carers.

NTI's clinical trial results for its Autism treatment are also due in the coming weeks.

If successful in this trial, NTI could have a treatment that:

- provides a cheaper and more effective way to significantly improve the wellbeing of children with autism (and their parents, carers)

AND

- reduces the need for so many expensive support services.

Again, NTI has already reported positive results on Autism in a Phase I/II trial, so we're hoping the latest results match up.

So two material clinical trial results for NTI in the coming weeks, which we will be watching closely.

To hear the NTI story direct from the company - NTI Managing Director Dr Tom Duthy will be presenting at the NWR Virtual Healthcare Conference tomorrow (Thursday 21st March) at 9:40AM AEST.

Anyone can attend a live video stream of this presentation for free by registering here.

So what would success look like for NTI?

To get ourselves ready for the clinical trial results, as Investors we have thought about what we want to see when the announcements come out.

Below is a summary of our bull, base and bear cases.

Plus, keep scrolling further down and you can see more detailed technical information on what we are looking out for.

🔄 Rett Syndrome Phase I/II trial - results due in “results in Q1/Early Q2 2024”

- Bull case: NTI’s Rett Syndrome results demonstrate efficacy better than Neuren’s results, with no safety issues.

- Base case: NTI’s Rett Syndrome results demonstrate efficacy to around the same standard as Neuren’s results, with no safety issues.

- Bear case: NTI’s Rett Syndrome results don’t demonstrate efficacy to the standard of Neuren’s results, and/or there are safety issues.

🔄 Autism Spectrum Disorder (ASD) Phase II/III trial - results due in “coming weeks”

- Bull case: NTI’s Phase II/III ASD results are broadly in line with its Phase I/II ASD results.

- Bear case: NTI’s Phase II/III ASD results are worse than its Phase I/II ASD results.

Rett Syndrome - Phase I/II trial results due soon - is NTI’s treatment better than $2.7BN Neuren’s Rett treatment?

NTI is currently running a Phase I/II clinical trial for Rett Syndrome.

Results are due within the coming weeks.

Phase I/II trial results will reveal if NTI’s treatment is safe/effective.

Rett Syndrome is a rare genetic neurological and developmental disorder that affects the way the brain develops in very young women.

Rett Syndrome symptoms are horrible and permanently life altering for both the patient and caregivers.

Children with Rett Syndrome can experience:

- delayed development milestones,

- loss of motor skills,

- seizures,

- intellectual disabilities,

- sleep disturbance,

- behavioural problems,

- social anxiety,

- poor coordination,

- and vision problems.

Sadly, right now there is no cure for Rett Syndrome.

And as a result, Rett Syndrome is considered an Orphan Disease considering there is only one FDA approved treatment that aims to reduce its impact and severity.

That FDA approved treatment belongs to ASX listed Neuren Pharmaceuticals - the drug is called ‘Daybue’.

In 2018 Neuren closed a licensing deal for Daybue with a NASDAQ listed company called Acadia Pharmaceuticals ($6.3BN market cap).

Between 2020 and 2023, FDA approvals and commercialisation took Neuren’s market cap from ~$100M to a peak of $3.3BN.

Neuren is currently capped at $2.7BN.

A few weeks back, the company that did a deal with Neuren - Acadia Pharmaceuticals - was subject to a short seller report...

The short report primarily questioned their treatment's safety.

You can access the full short report on Acadia Pharmaceuticals here.

Meanwhile NTI is just weeks away from releasing its own, competing Rett Syndrome treatment’s safety results...

If successful, NTI could one day eat into the analyst estimates of Acadia’s ~US$800M peak revenues per year for treating Rett Syndrome.

NTI is capped at $82M.

We are Invested in NTI because we think its market cap could go much higher - getting much closer to Neuren’s - IF its Rett Syndrome treatment shows safety/efficacy AND is eventually commercialised.

(We'll know more about safety and efficacy in the coming weeks)

Here is our full write up on how the Nueren short report could be positive for NTI if their trial results are successful.

Autism - NTI’s Phase II/III trial results due in the next few weeks

Big cost blowouts.

The looming threat of a funding cut.

While providing important support for Australians with disabilities, Australia’s National Disability Insurance Scheme (NDIS) is in a precarious position right now.

The number one disability amongst NDIS participants?

Autism.

Autism costs now make up $6.7BN per year of the NDIS budget.

Late last year, NDIS cost blowouts relating to Autism treatment started showing up in the mainstream media:

And the NDIS remains in the headlines, with its future clouded.

The NDIS provides an average annual payment of $33,800 per patient to NDIS participants with autism.

This $33,800 per year is to cover ongoing support services such as speech pathologists, psychologists, neurologists, occupational therapists and carers.

(and this is JUST in Australia alone)

But there could be a cheaper and more effective way to significantly improve the wellbeing of children with autism (and their parents, carers) AND reduce the need for so many expensive support services.

It has the potential to save the NDIS billions of dollars in costs.

NTI’s oral drug treatment is being clinically trialled with children suffering from some of the negative effects of autism, with results due in the coming weeks.

NTI’s treatment has the potential to significantly improve socialisation, communication, and adaptive behaviours for children with autism.

NTI’s Phase II/III clinical trial aims to further establish its efficacy and safety as a treatment for some of the negative aspects of autism.

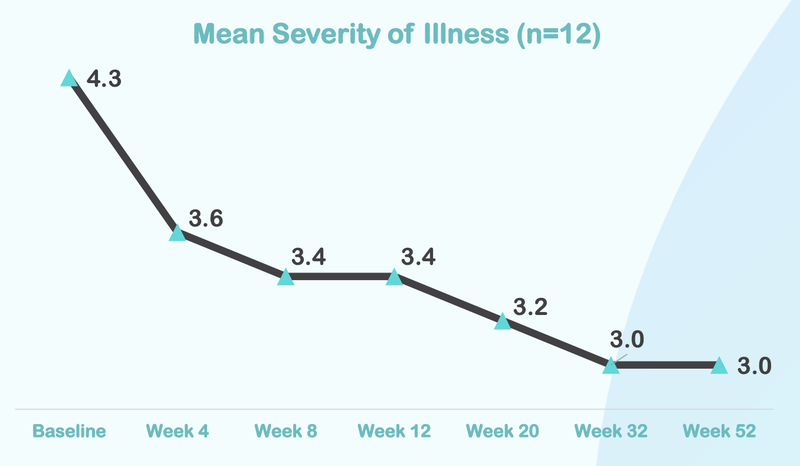

NTI already completed a Phase I/II trial which showed material reduction on a “severity of illness” scale over 52 weeks - so much so that ALL the parents of kids participating in the trial opted to voluntarily continue using the treatment AFTER the trial finished.

If NTI can advance its autism treatment to the commercialisation stage, we would expect it to be highly cost effective compared to the current $33,800 per year that the NDIS pays.

As you are surely well aware by now - NTI is due to report results from its Phase II/III Autism Spectrum Disorder (ASD) trial in the coming weeks...

Here is our full write up of NTI’s Autism trial:

Deeper dive - What disorders is NTI aiming to treat? And what’s the market for treatments?

As a whole company strategy, NTI is investigating the use of its biopharmaceutical NTI164 for a range of disorders linked to inflammation of the brain and nervous system.

Here’s a quick summary of the main disorders NTI is focussing on for now.

Rett Syndrome

Description: a genetic neurological disorder which primarily impacts females between the ages of 6-18 months, and causes severe cognitive and physical impairments.

Initial symptoms usually include loss of purposeful hand skills, reduced social engagement and slow growth of limbs. As the syndrome progresses, symptoms can include seizures, repetitive hand movements and intellectual disability.

Market opportunity: An annual drug therapy market of ~US$2BN.

Rare disorder - potential orphan drug designation could make NTI’s treatments lucrative. NTI is copying the success of $2.7BN Neuren Pharmaceuticals.

Neuren rose from a ~$100M market cap to its current ~$2.7BN market cap in three or so years on FDA approval, and subsequent commercialisation under the orphan drug regime for its Rett Syndrome treatment.

Autism Spectrum Disorder (ASD)

Description: A developmental disorder which affects social interaction, communication and behaviour. Symptoms appear in early childhood and range in intensity.

Market opportunity: An annual drug therapy market of ~US$2BN.

Autism Spectrum Disorder (ASD) is estimated to affect around 1 in 100 children around the world.

In Australia, 35% of the ~610,000 National Disability Insurance Scheme (NDIS) participants have ASD, and 78% are under 18 years old.

If NTI’s treatment is proven safe and effective for ASD, we think it could become an important part of the overall care for ASD sufferers, ease the burden on both carers and government programs, and as a result, make NTI’s treatment commercially attractive.

We see NTI’s ASD trial results as potentially opening up a large Total Addressable Market (TAM) commercialisation opportunity in Australia - with the rest of the world, in particular the lucrative US healthcare market to follow subsequently

PANDAS/PANS

Description: PANDAS is thought to be triggered by strep infections in children. Whereas, PANS can be set off by various infections, toxins, and other triggers.

Both disorders are autoimmune in nature, where the child’s own cells mistakenly attack healthy brain cells.

Symptoms include a sudden onset of OCD, tics, anxiety, emotional lability and some motor abnormalities. Symptoms may worsen acutely.

Market opportunity: An annual drug therapy market of ~US$1.4BN.

No FDA/EMA approved drug. Rare disorder - potential orphan drug designation could make NTI’s treatments lucrative.

[New] Cerebral Palsy

Description: A group of permanent movement neurological disorders, appearing in early childhood.

It impacts muscle coordination and motor-neuron skills, but can often impact other body parts too. No two people experience CP in the same way.

Market opportunity: An annual drug therapy market of US$4.3BN.

Rare disorder - potential orphan drug designation could make NTI’s treatments lucrative.

At the moment there are only two FDA approved drugs available.

Today, however, we are focussed on the two catalysts which are due in the coming weeks (Rett + ASD)...

So far, early signals are looking solid for NTI regarding the safety and efficacy of its treatment...

As we noted above, just last week, we learned that NTI’s Phase I/II Rett Syndrome trial was extended...

All 14 patients in the trial will remain on NTI’s biopharmaceutical NTI164 for an additional 52 weeks, which we interpret as a potential leading signal of the treatment's efficacy and safety.

The reasoning here is straightforward, parents caring for children with the rare paediatric neurological condition (Rett Syndrome) may have seen positive results from the treatment, and felt comfortable with their children’s toleration of the treatment.

Of course, however, we must wait for the clinical trial results to get a clearer picture on the safety and efficacy of NTI’s treatment for Rett Syndrome, which are just around the corner.

NTI has now had the following trials extended:

✅Rett Syndrome Phase I/II trial - results due in (results in Q1/Early Q2 2024)

✅Autism Spectrum Disorder (ASD) Phase II/III trial - results due in “coming weeks”

✅Autism Spectrum Disorder (ASD) Phase I/II trial - now going for 90 weeks

✅PANDAS/PANS Phase I/II trial - strong data at 24 weeks

That’s a very good pattern for NTI to establish.

We have high hopes that NTI may be able to improve upon the safety profile of Neuren Pharmaceuticals Rett Syndrome treatment - something we covered in our latest NTI note.

The results shape as a major catalyst for NTI, we see a lot of momentum in NTI’s clinical trial program, especially after NTI announced that it intends to start a Phase I/II trial for Cerebral Palsy in the first half of this year as well.

Bottom line for us: NTI has kicked a lot of goals in a short period of time, and we think the company has plenty more “shots on goal” to come.

We are Invested in NTI to see it get regulatory approvals and then commercialise one of its treatments - this forms the basis for our NTI Big Bet...

Our NTI Big Bet -

“NTI re-rates to a +$500M market cap by successfully advancing one or more of its clinical trial programs through to regulatory approval, partnership/licensing and/or is acquired by a large pharmaceutical company”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our NTI Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What we’re looking for in NTI’s Rett Syndrome results...

One of the main reasons we have Invested in NTI is because we like the company’s strategy of copying the success of $2.7BN Neuren Pharmaceuticals.

Neuren rose from a ~$100M market cap to its current ~$2.7BN market cap in three or so years on FDA approval, and subsequent commercialisation under the orphan drug regime for its Rett Syndrome treatment.

Reminder - Rett Syndrome is a rare genetic neurological disorder that occurs almost exclusively in girls, more rarely in boys, and leads to severe impairments, affecting nearly every aspect of the child’s life.

NTI’s biopharmaceutical has already shown promising signs in terms of both safety and efficacy in an Autism Spectrum Disorder (ASD) Phase I/II trial and a Phase I/II on a rare paediatric neuroinflammatory disorder called PANDAS/PANS - so we are hoping those results carry over to the Rett Syndrome trial.

If NTI is successful, the rewards could be great for us as long term NTI Investors - and it is perhaps one of the biggest catalysts of the year in our Portfolio.

First a bit of context though...

We all want safe and effective medicines and therapies.

Clinical trials determine efficacy and safety through endpoints.

An endpoint is “a targeted outcome of a clinical trial that is statistically analysed to help determine the efficacy and safety of the therapy being studied”. (Source)

There are both primary endpoints and secondary endpoints:

“Primary endpoint(s) are typically efficacy measures that address the main research question. Secondary endpoints are generally not sufficient to influence decision-making alone, but may support the claim of efficacy by demonstrating additional effects or by supporting a causal mechanism.” (Source)

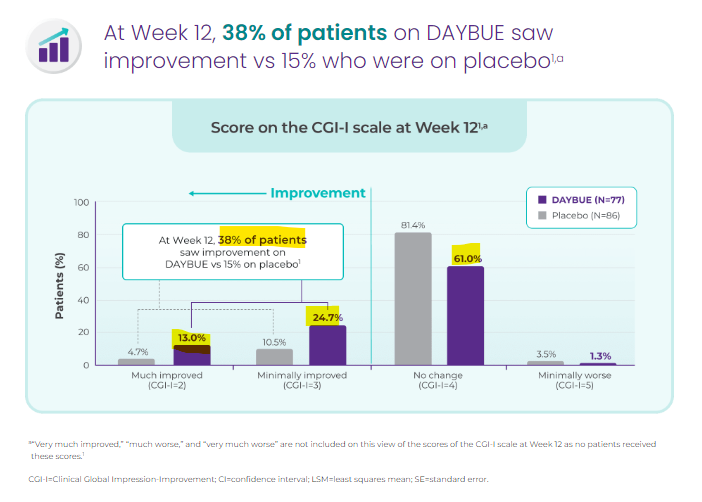

As a result, in the case of the NTI - we are most interested in the primary endpoint of the Rett Syndrome results which is called Clinical Global Impression – Improvement (CGI-I).

CGI-I “provide[s] a brief, stand-alone assessment of the clinician's view of the patient's global functioning prior to and after initiating a study medication.” (Source)

Think of it as a standardised barometer of how a clinician views the effectiveness of NTI’s medication in improving the neuropsychiatric symptoms of Rett Syndrome.

Now, if NTI can get a good CGI-I endpoint score - then we think NTI’s treatment could be well received in the market.

Particularly considering, the current standard of care for Rett Syndrome is Neuren Pharmaceuticals' Daybue treatment - which helped Neuren re-rate more than 2000%, despite a recent short report which questioned the safety of the treatment.

(Read our note on this short report).

So what would a good CGI-I score look like for NTI?

We think the best reference point is Daybue’s metrics - which received FDA approval.

Daybue was the first and so far, only FDA approved treatment for Rett Syndrome.

Now looking at Daybue’s CGI-I scores:

(Source)

As we can see, 38% of patients saw improvement, and 61% of patients saw no change on the Daybue treatment from Neuren Pharmaceuticals.

We feel like that is a relatively low bar for NTI to step over with its treatment - however we need to see the clinical trial results on the primary endpoint of NTI’s study for Rett Syndrome.

We’ve already seen that NTI’s treatment is generally well tolerated in terms of safety across multiple trials for different disorders already, so we don’t think safety will be a major concern (noting that things can still go wrong).

With that said, here are our bull, bear and base cases for the NTI Rett Syndrome results - which again - should be out in the coming weeks.

- Bull case: NTI’s Rett Syndrome results demonstrate efficacy better than Neuren’s results, with no safety issues.

- Base case: NTI’s Rett Syndrome results demonstrate efficacy to around the same standard as Neuren’s results, with no safety issues.

- Bear case: NTI’s Rett Syndrome results don’t demonstrate efficacy to the standard of Neuren’s results, and/or there are safety issues.

Importantly, we note that the base case for NTI’s upcoming results, would still be a remarkable achievement.

And potentially the basis for an FDA approval - given potential concerns around Daybue’s safety and the need for a better tolerated treatment.

The bull case would be an exceptional result for us and potentially a major catalyst for NTI on the charts.

What we’re looking for in NTI’s ASD results...

NTI is currently also running a world-first Phase II/III clinical trial for Autism Spectrum Disorder (ASD).

Results from the Phase II/III ASD clinical trial are due in “Q1/early Q2-2024.”

Meaning results could come before or after the Rett Syndrome results - at this point we simply don’t know what comes first.

For context...

Leading up to the extended clinical trial, NTI had run a Phase I/II clinical trial - the primary objective for that was to show the safety and efficacy of NTI’s drug following ~30 days of use.

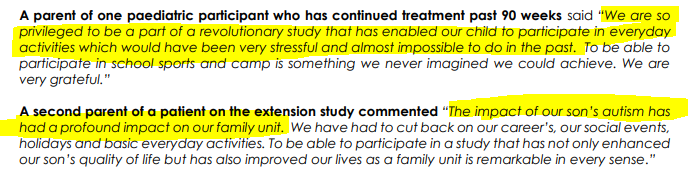

Previously, NTI announced that 11 of the patients who had participated in the Phase I/II clinical trial had just passed the 90 week mark of using NTI164.

This was a major milestone.

Our key takeaways from that announcement were as follows:

1. 11 of the patients enrolled in NTI’s initial Phase I/II clinical trial have now passed the 90-week mark using NTI’s drug.

The fact that patients have continued using the drug beyond the intended Phase I/II clinical trial period tells us that the drug is having a positive impact on their lives.

Some of the feedback from the patient’s parents seems to back that up as well:

2. Safety and tolerability profile for all patients is looking good even at the 90 week mark.

NTI also confirmed that all of the patients that are continuing to use NTI164 are showing stable blood chemistries as well as normal liver and kidney function.

NTI also mentioned that “caregiver and clinician reports remain positive with symptomatic improvement maintained at 90 weeks” another datapoint that backs up the impact NTI164 is having on the patients using it.

3. NTI’s study is now the longest ever examining the safety of a cannabinoid drug treatment for ASD.

Hitting the 90 week mark makes it the longest ever safety study for a cannabinoid-based drug in treating ASD.

The significance of this is that NTI can use all of the longer term data when it builds a case to present to regulators.

At the end of the day regulators like the FDA look at data in a holistic manner - the more positive data points the stronger a case is for a drug to be approved for a specific use.

Things like long term safety data can be a major positive when a biotech is looking to go through all of the regulatory approval hurdles.

Now, how do we judge NTI’s results?

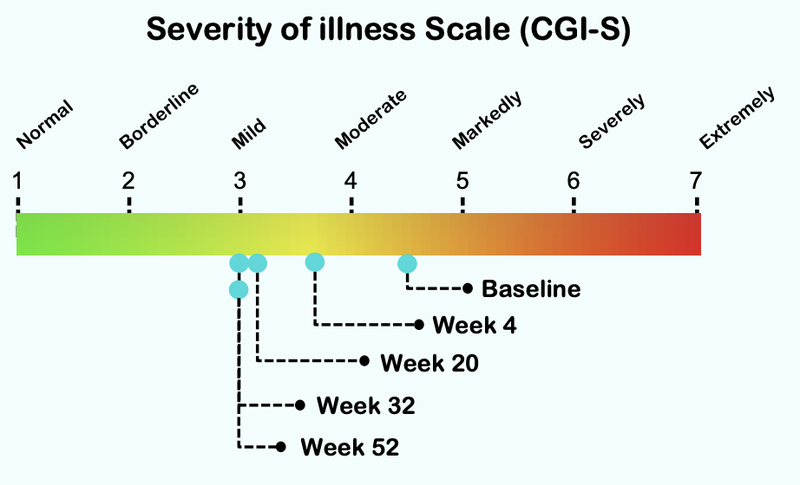

Well, in this case the primary endpoint for NTI is CGI-Severity (CGI-S) which rates illness severity.

We’ve already seen positive CGI-S results in the previous Phase I/II ASD trial from NTI.

Below is the data from NTI’s first ASD trial...

From this chart you can see that the severity of illness for children with Autism moved from “Markedly” to “Mild”:

Here is how the treatment reduces over time, with significant improvement after just four weeks of taking the treatment:

Autism Spectrum Disorder (ASD) is estimated to affect around 1 in 100 children around the world, and in Australia, 35% of the ~610,000 National Disability Insurance Scheme (NDIS) participants have ASD, and 78% are under 18 years old.

If NTI’s treatment is proven safe and effective for ASD, we think it could become an important part of the overall care for ASD sufferers, ease the burden on both carers and government programs, and as a result, make NTI’s treatment commercially attractive.

We see NTI’s ASD trial results as potentially opening up a large Total Addressable Market (TAM) commercialisation opportunity in Australia - with the rest of the world, in particular the lucrative US healthcare market to follow subsequently.

Given the 90 weeks that the initial Phase I/II trial has extended to, we are largely confident in the safety of the treatment and are mostly looking for the Phase I/II results to be replicated in the Phase II/III results.

So here’s what we are looking for in the Phase II/III ASD trial results:

Bull case: NTI’s Phase II/III ASD results are broadly in line with its Phase I/II ASD results.

Bear case: NTI’s Phase II/III ASD results are worse than its Phase I/II ASD results.

What’s next for NTI?

🔄Phase I/II Rett Syndrome clinical trial

We are hoping NTI can show that its treatment is safer and has similiar (we hope better) efficacy to $2.7BN capped Neuren’s Daybue treatment.

🔄Phase II/III trial for Autism Spectrum Disorder results due in “coming weeks”

After promising Phase I/II trial results, we see this trial as important from a commercialisation perspective.

Risks

The two key risks to our NTI Investment Thesis are “Clinical trial risk” and “Funding/Dilution risk”.

NTI has clinical trial results due for two target disorders in the coming weeks.

It is important to be aware that clinical trials can be unsuccessful, and investing in early stage biotechs is risky.

It’s possible that the drug/treatment is not considered safe for humans or is ineffective at treating the particular disease.

One or more of NTI’s clinical trials could fail to meet their primary or secondary endpoints, meaning the treatments fail to satisfy the criteria of the studies.

Any clinical trial results, if negative, could hurt the NTI share price.

Clinical trials are also relatively expensive to run, so any failed clinical trials could mean NTI is left with a lower share price and cash balance following the results.

In that scenario NTI would need to raise capital to fund future trials at a discount to already depressed market prices.

However it's also worth noting that NTI had cash and cash equivalents of $4.5M at December 31st 2023 - which the company has stated is sufficient to complete all active clinical trials as previously indicated to the market.

Our NTI Investment Memo

In our NTI Investment Memo you’ll find:

- Key objectives for NTI

- Our long term NTI Big Bet

- Why we are Invested in NTI

- What the key risks to our Investment

Read all about NTI - our past coverage:

Articles & Quick Takes:

Introducing our new Portfolio Addition: Neurotech International (ASX: NTI)

NTI completes Rett Syndrome Recruitment

NTI’s clinical trial meets primary endpoints for neurological disease

NTI get HREC approval to extend Phase II/III ASD Trial to adults

NTI completes autism trial recruitment

NTI ASD patients still being treated after 90 weeks

NTI update on PANDAS/PANS clinical trial

Good sign: NTI’s Rett Syndrome Trial Gets Extended

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.