Introducing our new Portfolio Addition: Neurotech International (ASX: NTI)

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 8,400,000 NTI shares at the time of publishing this article. The Company has been engaged by NTI to share our commentary on the progress of our Investment in NTI over time.

Today we are adding a new Investment to our Portfolio.

We Invested in this company because it has three major share price catalysts coming in the next 6 to 12 months.

Its backers and management have delivered success for us in the past.

And it has spent the last few years building the groundwork to emulate the strategy of a similar company that delivered a 1,300% price rise over the last three years.

(Note: this success is NOT an indication that today’s company will perform the same way)

We have been following this company for a quite a while now, and with years of preparation now completed and three key catalysts coming, today we are adding them to our Portfolio.

Each catalyst on its own has the potential to deliver a significant re-rate in the company’s share price... if successful.

Our latest Investment is Neurotech International (ASX:NTI).

Neurotech International

ASX:NTI

Today we will outline why we have Invested in NTI, and what we are looking out for the company to achieve over the 12 months, and also the potential risks we have identified and accepted in this Investment.

NTI is an early stage biotech focused on developing treatments for rare neurological disorders in children, including:

- Autism Spectrum Disorder

- Rett Syndrome

- PANDAS/PANS

- Cerebral Palsy

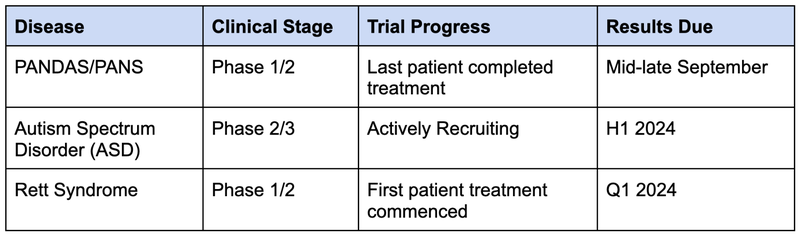

NTI expects to deliver the results of three different clinical trials in the next 6-12 months.

...including one set of trial results potentially in the coming weeks.

In terms of the impact on a share price, biotech clinical trial results are the equivalent of oil & gas drilling results - big catalysts.

The clinical trial process is long, expensive and risky, but the prize is enormous on successful trial results and commercialisation.

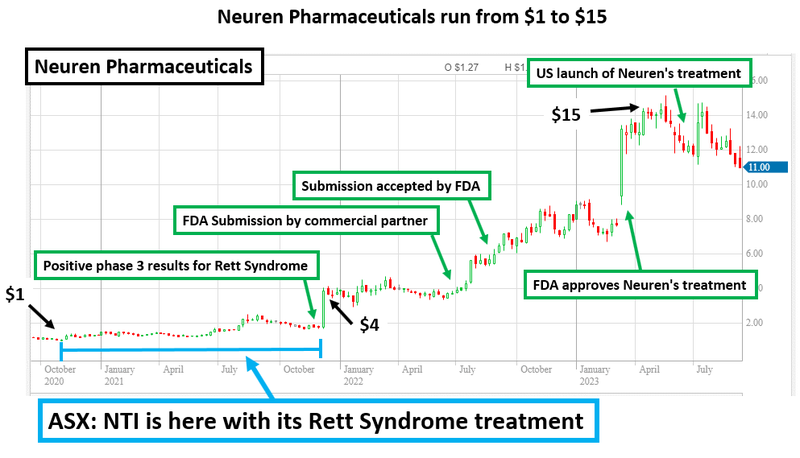

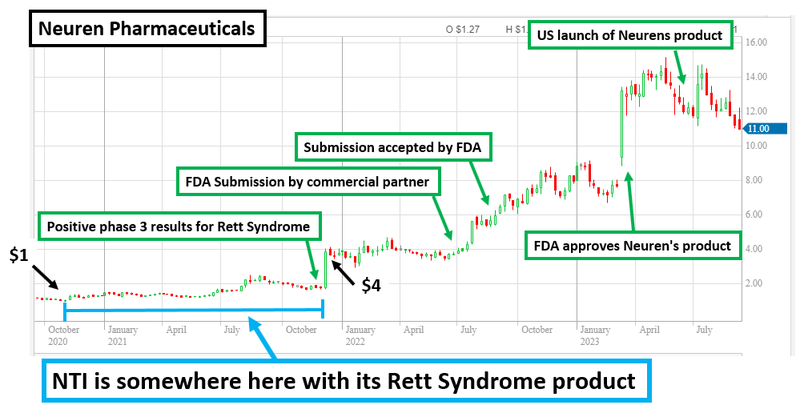

An example of a biotech that delivered successful clinical trial results is Neuren Pharmaceuticals, which rose 1,300% over three years (it now has a $1.4BN market cap).

This rise was on the back of a successful phase III trial and commercialisation of a treatment for Rett Syndrome (yes, the same disorder NTI is currently running a trial on).

NTI is currently capped at $55M - we Invested because we think NTI can follow a similar pathway to success as $1.4BN Neuren.

(Assuming of course that NTI can deliver success on one or more of its three trials over the next 6-12 months - this is what will start the share price re-rate.)

NTI has specifically created a strategy to replicate Neuren’s success.

It is targeting several different neurological disorders in children with a key focus on rare disorders that are highly valuable to treat and have fast tracked approvals to market.

NTI has set up the foundation to become the next Neuren... now NTI just needs to deliver the all-important successful trial results, and here is where the risk comes in.

But how did Neuren do it?

FDA approval and subsequent commercialisation of a treatment for orphan disease Rett Syndrome helped Neuren Pharmaceuticals’ share price to re-rate by more than 1,300% in the space of three years (~$100M market cap to $1.4BN market cap).

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Just like Neuren, NTI is targeting Rett Syndrome - and early indications from its clinical trial program targeting a different condition is that its treatment is safe.

The next step is for NTI to prove the treatment’s safety and efficacy for treating Retts in a Phase II trial, which has already started, results are due in Q1 2024.

Retts is just one of three disorders NTI is aiming to treat

Retts is just one of three clinical trials for three different disorders that NTI is currently running.

NTI is also running a Phase I/II trial for PANDAS/PANS and a Phase II/III trial for Autism.

This means NTI has three independent near term catalysts due imminently - with the potential to re-rate the share price with positive results from any of the three trials.

Having three concurrent trials for three different disorders is rare in early stage biotechs, and is a big part of the reason we Invested in NTI.

With three material trial results expected over the next 12 months it promises to be an exciting journey for NTI Investors (keeping in mind that pre-revenue biotech stocks are risky and trial results can be failures.)

If we go back to the oil & gas drilling analogy, it’s like if an exploration company (like IVZ) was drilling THREE separate high-impact drill targets over a 12 month period.

Results for the PANDAS/PANS clinical trial are due imminently, with results for the other two clinical trials expected in the first half of next year.

It takes years to prepare and undertake clinical trials, and as investors in early stage biotech companies, the results of these trials are the ‘proof points’ that underpin the value of the company.

Because of the broader market weakness over the last 12 months, NTI’s share price has come off from highs of 13c to around 6c - NTI’s last cap raise was done at 10c back in October 2022.

Another reason we Invested in NTI is because of Dr Tom Duthy, who is the chairman of one of our other biotech Investments Arovella Therapeutics, which has doubled since we Invested.

We like to back management that has delivered for us in the past.

Merchant Group (we like to follow their biotech Investments too given their successful track record) is also a substantial holder in NTI - they became substantial with 5.01% back in November 2022 when the NTI share price was ~9c.

Some of Merchant’s previous big wins include:

- Polynovo: $0.04 to a high of $4.05

- BARD1 Life Sciences (Now Inoviq): $0.50 - a high of $5.60

- Race Oncology: $0.14 to a high of $4.20

- BCL Diagnostics: $0.029 to a high of $0.27

- Prescient Therapeutics: $0.05 to a high of $0.28

- AND one that we were also Invested in Arovella Therapeutics (ASX: ALA) which has gone from our Initial Entry Price of 3.8c to a high of ~10.5c.

In summary, we have Invested in NTI because:

- We like their strategy to copy the success of $1.4BN Neuren,

- We have had past success with NTI’s management and backers, but most importantly;

- There are three key trial results over the next 6 to 12 months which will make things very interesting.

...and of course what's not to like about being involved in helping to discover treatments for disorders in children.

In this note we will share our initial Investment memo for NTI where we will share:

- Key objectives for NTI

- Why we are Invested in NTI

- The key risks to our Investment thesis

- Our Investment plan

We will give a quick explanation and summary of the disorders that NTI is targeting including the known causes, prevalence, symptoms and existing treatments.

We will also provide a deeper dive into the reasons we Invested in NTI.

First, here is our NTI Investment Memo:

Investment Memo for Neurotech International (ASX:NTI)

Shares Held: 8,400,000

Memo Opened: 18 September 2023

What does this company do?

Neurotech International (ASX:NTI) is a clinical stage biotech company.

NTI is advancing clinical trials targeting rare and severe neurological disorders predominantly in children tied to neuroinflammation.

NTI’s primary treatment is a cannabinoid derived biopharmaceutical called NTI164.

NTI is seeking to prove it is a both safe and effective treatment for disorders such as Autism Spectrum Disorder, Rett Syndrome, PANDAS/PANS and Cerebral Palsy.

What is the macro theme?

Paediatric neurological disorders are not getting as much attention from biotech companies as they should, but luckily there are government incentives for companies developing treatments for these disorders.

The impact to families who have children with these disorders is significant and society more generally bears a large cost in supporting these families. Moreover, some treatments can have bad side effect profiles or suboptimal efficacy.

NTI’s clinical trials are for disorders of the brain and spinal cord, mostly in children, across potential orphan drug indications for rare conditions, such as Rett Syndrome as well as disorders that have larger total addressable markets such as Autism Spectrum Disorder (ASD). Both avenues to market for NTI164 could prove lucrative, assuming the trials are successful.

As is often the case, biotechs that successfully complete clinical trials can generate sustained re-rates as positive data comes out, regulatory approvals are granted and commercialisation agreements are made.

We think that companies that can improve on existing standards of care across both safety and efficacy will attract capital in the market due to their ability to improve both quality of life and health economics.

Our Big Bet for NTI

NTI re-rates to a +$500M market cap by successfully advancing one or more of its clinical trial programs through to regulatory approval, partnership/licensing and/or is acquired by a large pharmaceutical company.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our NTI Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Why did we Invest in NTI?

- NTI has significant material newsflow in the next 6-12 months across 3 trials - Clinical trial results are massive share price catalysts for biotechs. NTI has three different trials completing over the next 12 months. One of them is expected in the next couple of weeks.

- NTI is targeting “orphan” diseases - treatments that are highly valuable - NTI is currently targeting PANDAS/PANS and Rett Syndrome, which are potentially eligible for orphan drug designation. The average price for an orphan drug is US$32,000 per year per patient and government approvals to market are fast tracked.

- NTI is following the same strategy as the $1.4BN capped Neuren - Neuren Pharmaceuticals’ share price re-rated by more than 1,300% (~$100M market cap to $1.4BN market cap). Neuren developed a successful treatment for Rett Syndrome and is working on other orphan diseases. NTI is unashamedly trying to replicate Neuren’s path to success. We like this approach.

- Strong safety profile, is NTI’s treatment better than $1.4BN Neuren? - If NTI’s upcoming Rett Syndrome trial shows its treatment is SAFER than $1.4BN Neuren’s “claim to fame” Rett Syndrome treatment, we think NTI can take a big chunk of the market (and hopefully get to a similar $1.4BN market cap).

- Promising efficacy data at treating Autism, large addressable market - If NTI’s treatment is proven safe and effective for Autism Spectrum Disorder (ASD), we think it could become an important part of the overall care for ASD sufferers, which is 1 in 100 children.

- NTI Management track record - NTI’s Executive Director is Dr Tom Duthy, who is also Chairman of Arovella Therapeutics, another one of our Portfolio Companies, which grew from a low of 2 cents to a high of 10.5 cents between January and April 2023. We like to follow management that has delivered for us in the past.

- Successful fund, Merchant Group has a substantial position in NTI - Merchant Group became a substantial shareholder of NTI with a 5.01% stake when NTI was trading at ~9 cents. We have followed Merchant Group’s investments closely and think the fund has a keen eye for high potential biotechs given its past history of success.

What do we expect the company to deliver?

Objective #1: Rett Syndrome clinical trials

NTI is currently undertaking a Phase I/II trial that will test the safety and efficacy of NTI’s treatment for a rare genetic neurological and developmental disorder called Rett Syndrome.

This is the same disease that Neuren Pharmaceuticals commercialised a treatment for which helped take Neuren to a ~$1.4BN market cap.

NTI’s trial is aiming to improve on Neuren’s results across safety and efficacy, after dosing the first patient in this trial in August 2023.

Milestones

🔲 Last patient dosed for Phase I/II

🔲 Results (anticipated Q1 CY2024)

Objective #2: Autism Spectrum Disorder (ASD) clinical trials

After a successful Phase I/II trial demonstrated the safety of NTI’s treatment in 2023, and showed promising signs on its efficacy, NTI launched a larger Phase II/III trial for ASD.

We expect NTI to complete recruitment for this trial before the end of 2023.

Milestones

🔲 Completion of patient recruitment (H2 CY2023)

🔲 Last patient dosed

🔲 Results (Q1 CY2024)

Objective #3: PANDAS/PANS clinical trial

This Phase I/II clinical trial is testing the safety and efficacy of NTI’s treatment for a rare paediatric neurological disorder sometimes associated with Streptococcal infections called PANDAS/PANS.

Milestones

🔲 Results (mid-late September CY2023)

Objective #4: Cerebral Palsy clinical trials

NTI intends to launch a Phase I/II clinical trial for Cerebral Palsy in 2H CY2023. We see this as a source of additional upside for NTI over the long term.

Milestones

🔲 HREC Approval and TGA clearance

🔲 First patient recruited

🔲 Completion of patient recruitment

🔲 Last patient dosed

🔲 Results

Objective #5: Advance commercialisation through licensing/partnerships

We want to see NTI advance commercialisation initiatives at this early stage, and ideally accelerate these initiatives pending clinical trial results. This could be a source of additional capital for the business.

Milestones

🔲 Sign a licensing/partnership agreement with another larger company

What could go wrong?

Clinical trial risk

It is important to be aware that clinical trials can be unsuccessful.

In particular, there are some standard risks that are associated with biotechs that are undertaking clinical research:

- Patient recruitment is delayed or fails

- Ethics approval is delayed or fails

- Clinical trial cost blowouts

- The drug/treatment is not considered safe for human consumption (usually established in Phase I)

- The drug or treatment is ineffective at treating the particular disease (usually determined by clinical trial results in Phase II and Phase III)

- The design of the trial is such that the regulatory body does not approve the drug/treatment

There is a chance that one or more of NTI’s clinical trials fail to meet their primary or secondary endpoints, meaning the treatments fail to satisfy the criteria of the studies. Any clinical trial results, if negative, could hurt the NTI share price.

Competition risk

NTI will need to move quickly to establish its presence in the market. If progress is slow, alternative treatments could emerge hurting NTI’s prospects.

Funding risk

Pre revenue biotech companies regularly need to raise capital to fund their growth ambitions. Capital raises can cause dilution to existing shareholders.

NTI will likely need to raise capital at some stage in the future, potentially at a discount to market prices to secure funds. This will be contingent on clinical trial results and broader market sentiment (see next risk).

Market risk

Broader market sentiment for small pre-revenue biotechs could get worse and the sector as a whole trades lower, taking NTI’s share price with it. Alternatively, the entire market could sell down as well.

What is our Investment Plan?

Our Investment Plan for NTI is to hold on to a majority of our position to see the company execute on its business strategy over the next two to three years.

If the company’s share price materially re-rates in the medium term due to the results of any of the clinical trial results, a macro triggering event or any other unknown reason, we may look to sell up to ~20% of our holding. See our general disclosure policy for more details.

Understanding the Target Disorders NTI is finding treatments for

Autism Spectrum Disorder (ASD)

Autism Spectrum Disorder (ASD) is a developmental disorder which affects social interaction, communication and behaviour. Symptoms appear in early childhood and range in intensity.

- Causes: The exact cause of ASD is unknown, but generally believed to be a combination of genetic and environmental factors.

- Symptoms: Social difficulties, communication challenges, repetitive/restricted behaviours.

- Prevalence: ASD is a common disorder, affecting approximately 1 in 100 children around the world. Prevalence of Autism has been rising in recent times, but the cause is unclear.

- Treatments: There is no current cure for ASD, but early-stage intervention therapy like Applied Behavior Analysis (ABA) and speech therapy can improve outcomes. Medications can also be used for associated symptoms such as anxiety or aggression.

Rett Syndrome

Rett Syndrome is a genetic neurological disorder which primarily impacts females between the ages of 6-18 months, and causes severe cognitive and physical impairments.

- Causes: Rett Syndrome is the result of mutations in the MECP2 gene (located in the X chromosome - hence more prevalent in females). The gene mutation is often sporadic, meaning it is not usually inherited from parents.

- Symptoms: Initial symptoms usually include loss of purposeful hand skills, reduced social engagement and slow growth of limbs. As the syndrome progresses, symptoms can include seizures, repetitive hand movements and intellectual disability.

- Prevalence: Rett syndrome is rare, usually impacting 1 in 10,000 live female births.

- Treatments: There is no cure for Rett Syndrome, but the core focus is to manage symptoms. Symptom management can include medications for anxiety, physical therapy and sometimes devices like limb braces. The recent drug pioneered by Neuren (NEU) targets treatment of Rett Syndrome.

PANDAS - PANS

PANDAS (Paediatric Autoimmune Neuropsychiatric Disorders Associated with Streptococcal Infections) and PANS (Paediatric Acute-onset Neuropsychiatric Syndrome) are conditions that affect children, resulting in sudden changes in behaviour and mood. PANDAS is specifically linked to strep infections, however PANS can be caused by various infections.

- Causes: PANDAS is thought to be triggered by strep infections in children. Whereas, PANS can be set off by various infections, toxins, and other triggers. Both disorders are autoimmune in nature, where the child’s own cells mistakenly attack healthy brain cells.

- Symptoms: Sudden onset of OCD, tics, anxiety, emotional lability and some motor abnormalities. Symptoms may worsen acutely.

- Prevalence: Research suggests that PANDAS impacts 1 in every 200 children, however prevalence of PANS is less clear.

- Treatments: There is no simple treatment for PANDAS/PANS. Treatment usually involves antibiotics, anti-inflammatories and immunotherapy.

Cerebral Palsy

Cerebral Palsy (CP) is a group of permanent movement neurological disorders, appearing in early childhood. It impacts muscle coordination and motor-neuron skills, but can often impact other body parts too. No two people experience CP in the same way.

- Causes of CP: Cerebral Palsy can be caused by a breadth of reasons, such as brain damage during or shortly after birth. Some risks include premature birth, infections during pregnancy, and complications during labour.

- Symptoms: poor coordination, stiff and weak muscles and tremors. The intensity and severity vary significantly, and these symptoms can often affect multiple limbs.

- Prevalence: It is estimated that 1 in every 323 children are identified to have some form of CP (in the US).

- Treatments: There is no specific treatment for CP. However, CP symptoms are managed by physical therapy, medications (muscle relaxants) and sometimes surgical interventions.

🎓 To learn more about orphan drugs and conditions read: Orphan Drugs Explained

Deep Dive: The 7 Reasons We Invested in NTI

1. Significant material newsflow in next 6-12 months across 3 trials

Clinical trials take years to develop, run and finally arrive at a binary outcome. The long time to wait for results can put impatient investors off biotechs.

There won't be much waiting around for NTI - the company has flagged that it should report results for all three clinical trials in the next 6-12 months.

It is uncommon for small cap biotech companies to have so many clinical trial results due in a short period of time.

Each NTI trial result could be a share price catalyst in their own right.

The programs and the timeframes that NTI expects newsflow from are:

- Phase I/II PANDAS/PANS clinical trial (results mid-late September this year )

- Phase I/II Rett Syndrome clinical trial (results in Q1 next year)

- Phase II/III trial for Autism Spectrum Disorder (patient recruitment complete before Christmas this year. We think results could be reported in the first half of next year)

We see these clinical trials as delivering multiple “shots on goal” and chances for NTI to re-rate in the near to medium term.

2. NTI is targeting “orphan” diseases - treatments that are highly valuable

Two of the four diseases NTI is currently targeting are potentially eligible for orphan drug designation - PANDAS/PANS and Rett Syndrome.

Governments have created incentives to encourage the development of these drugs. These incentives are important as they open up the opportunity for biotech companies to pursue potentially lucrative markets that otherwise wouldn’t exist.

The average price for an orphan drug is US$32,000 per year per patient (according to a 2021 study published in the Rare Diseases & Journal of Orphan Drugs).

Another disease NTI is targeting, Cerebral Palsy, is also quite rare and particularly debilitating - which means NTI’s treatment for this disease may also be eligible for certain government incentives.

3. NTI is following the same strategy as the $1.4BN capped Neuren

Neuren Pharmaceuticals grew from small cap biotech stock to a $1.4BN success story off the back of its treatment for orphan disease Rett Syndrome.

In the space of three years, the company completed its Phase 3 clinical study and secured FDA approval to commercialise the treatment.

As a result the company’s share price grew 1,300% (from ~$100M market cap to $1.4BN market cap) making it one of the biggest biotech success stories on the ASX.

NTI is looking to replicate this success.

NTI is also working on a Rett Syndrome treatment - with good early results on safety for its treatment shown in another clinical trial for Autism (more on that below).

If NTI can produce a treatment with efficacy similar to Neuren’s product, with potentially improved safety, we think this could form the basis for an NTI re-rate, as it would be well received by the market after Neuren’s success.

4. Strong safety profile, is NTI’s treatment better than $1.4BN Neuren?

NTI’s Phase I/II ASD (Autism) trial showed no serious adverse events across 52 weeks.

This is consistent with what we know about cannabinoid derived medications such as CBD oils - they are well tolerated.

The safety profile that NTI has established with its treatment in the ASD trial is particularly important because it suggests that this safety profile should extend to NTI’s other trials, including its Rett Syndrome trial.

While Neuren’s Rett Syndrome trial was successful from an efficacy standpoint, enough to see the company receive FDA approval for the treatment (brand name DAYBUE), there were some indications that the safety profile of the treatment was suboptimal.

For example, in both a “12-week study and in long-term studies, 85% of patients treated with DAYBUE experienced diarrhoea. In those treated with DAYBUE, 49% either had persistent diarrhoea or recurrence after resolution despite dose interruptions, reductions, or concomitant antidiarrheal therapy.”

As a result, we think that NTI has an opportunity to improve on the Neuren Pharmaceuticals treatment’s safety profile.

This is something which we think would be well received by the market, clinicians and potential commercial partners if the treatment is demonstrated to be effective in NTI’s imminent Rett Syndrome trials.

5. Treatment shows promising efficacy data for Autism, large potential market

There has already been promising safety and efficacy data from NTI’s Phase I/II clinical trial on Autism (ASD).

So much so, that the trial has been extended - which we think implies that those carers with children on the trial have seen a marked improvement in their children’s symptoms and are comfortable with the safety of NTI’s treatment.

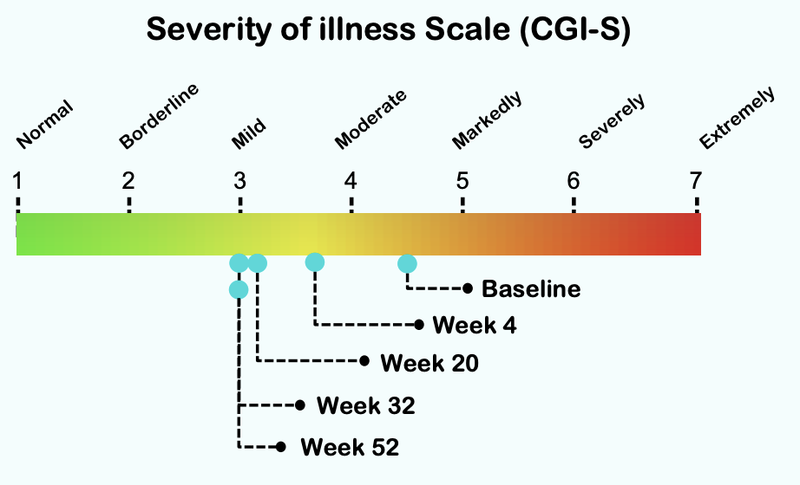

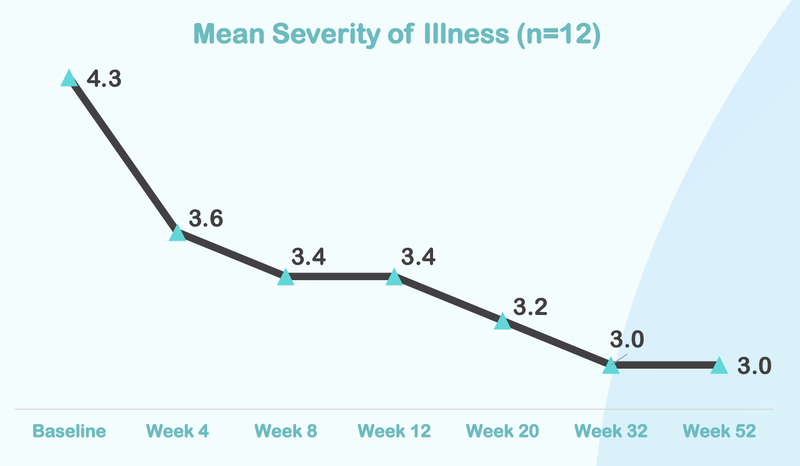

From this chart you can see that the severity of illness for children with Autism moved from “Markedly” to “Mild”.

Here is how the treatment reduces over time, with significant improvement after just four weeks of taking the treatment:

In reality, this change from markedly ill to mildly ill is significant.

It appears that it can be the difference between being able to function and integrate into society or not.

Although this initial data is clinically significant, NTI will need to prove this treatment is effective in a larger scale Phase II/III clinical trial which is currently underway.

Recruitment for the trial is expected to be completed by Christmas this year, with results due in the first half of next year.

If clinical trials continue to be successful, there is a large potential market that could be available to NTI here.

ASD makes up roughly $6.1BN of the NDIS total $35.5BN expenditure in 2022 and equates to an implied per year expenditure of $32K per NDIS participant that has ASD.

Autism Spectrum Disorder (ASD) is estimated to affect around 1 in 100 children around the world, and in Australia, 34% of the 550,000 National Disability Insurance Scheme (NDIS) participants have ASD, and 40% are 14 years old or younger.

If NTI’s treatment is proven safe and effective for ASD, we think it could become an important part of the overall care for ASD sufferers, ease the burden on both carers and government programs, and as a result, make NTI’s treatment commercially attractive.

6. NTI Management track record

NTI’s Executive Director is Dr Tom Duthy who is well known and respected in Australian biotech circles and is also Chairman of Arovella Therapeutics, another one of our Portfolio Companies.

On top of Duthy’s significant biotech experience, Arovella has previously run from a low of 2 cents to a high of 10.5 cents between January and April 2023.

As a result, we think Duthy is well equipped to deliver value for shareholders, ourselves included.

7. Successful biotech fund, Merchant Group has a substantial position in NTI

On 4 November 2022, we note that Merchant Group became a substantial shareholder of NTI with a 5.01% stake when NTI was trading at ~9 cents.

Last week, Merchant was announced as NTI’s corporate advisor, and will only be remunerated in options that require exercising at 6c.

We have followed Merchant Group’s investments closely and think the fund has a keen eye for high potential biotechs given its past history of success including:

- Polynovo: $0.04 to a high of $4.05

- BARD1 Life Sciences (Now Inoviq): $0.50 - a high of $5.60

- Race Oncology: $0.14 to a high of $4.20

- BCL Diagnostics: $0.029 to a high of $0.27

- Prescient Therapeutics: $0.05 to a high of $0.28

- AND one that we were also Invested in Arovella Therapeutics (ASX: ALA) which has gone from our Initial Entry Price of 3.8c to a high of ~10.5c.

Merchant also has a presence on the register of our other two biotech Investments in our Portfolio.

Merchant’s continued presence on the register and accumulation of shares at a higher valuation, reassures us that we have made a good Investment in NTI.

To learn more about orphan drugs and conditions read:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.