Vonex outlines impressive growth opportunities off the back of acquisition success

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Today, telecommunications group Vonex Ltd (ASX:VN8) published its 2020 Annual General Meeting, which highlights their strong operational and financial performance and future growth schemes.

As the company develops, delivers and licences its advanced communication technologies, generation of recurring revenue continues to drive strong growth.

Vonex possesses a three pillar growth strategy of Retail, Wholesale and Acquisition, with the latter encompassing many key drivers and achievements for all pillars and the company as a whole.

At the forefront of Vonex’s achievements of fiscal 2020 is its March acquisition of 2SG Wholesale.

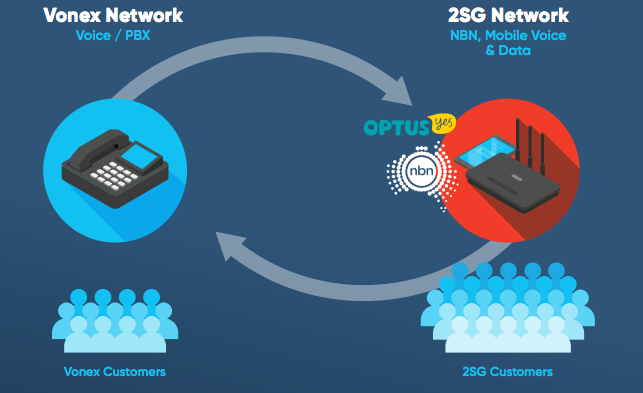

As an established wholesale provider of hardware and connectivity solutions, the acquisition has delivered a new dimension to Vonex’s business, bringing 150+ new wholesale customers and expanding SME (small to medium enterprise) product offerings.

Through 2SG, Vonex has been able to provide fast, secure, business-grade wireless broadband, meeting strong customer demand amid the rise of COVID-19 induced working from home – a trend that is set to continue.

Consumer demand will assist in utilising immediate cross selling opportunities; selling 2SG internet products to Vonex customers and Vonex voice services to 2SG customers.

Vonex will continue to pursue both organic and acquisition-led opportunities to grow its Wholesale business in FY21.

The 2SG acquisition also helps improve margins by providing wholesale services to the retail division of Vonex; supplying customers with an expanded product range of mobile voice products, NBN, mobile broadband and 5G.

Vonex’s annualised recurring revenue has steadily increased since its ASX listing in 2018, with the 2SG acquisition largely contributing to the 89% increase in FY20.

From a shareholder perspective, Vonex has seen an 160% rise in share price since January 2020, currently trading at $0.26 AUD.

The AGM outlined Vonex’s FY21 outlook, which presents enormous opportunities to address unmet needs among SME’s for an optimal telco service in the new ‘work from home’ paradigm.

A proactive approach to ongoing strategic acquisitions will be central to the company’s FY21 growth.

M&A advisors are aiming to find multiple transaction opportunities, specifically searching for profitable private Telco businesses with annual revenue up to ~$10m.

Targeting such revenues affords Vonex some relatively uncontested space in the Telco sector, increasing their chances of becoming the next consolidation success story.

Vonex having successfully integrated 2SG Wholesale positions the company well to execute this strategy and quickly scale.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.