VN8’s “Hunt for Growth” Strategy Now Delivering

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 3,273,182 VN8 shares at the time of publication. S3 Consortium Pty Ltd has been engaged by VN8 to share our commentary and opinion on the progress of our investment in VN8 over time.

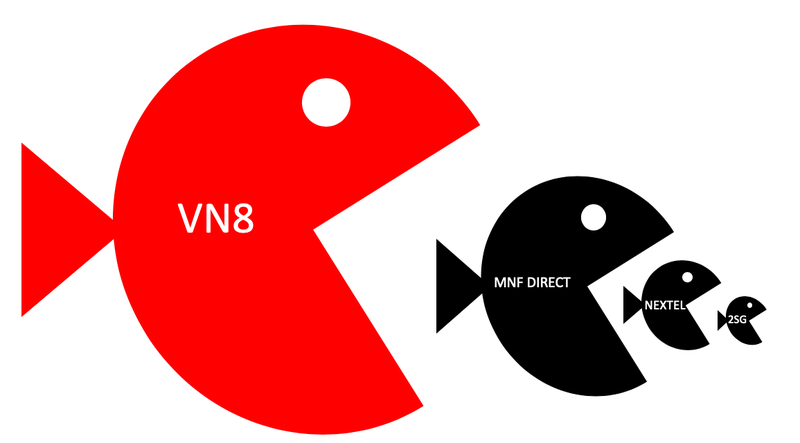

Our small cap telco investment Vonex (ASX:VN8) has been on an acquisition shopping spree, gobbling up 3 other telcos over the past 18 months.

These acquisitions have helped lead VN8 to its best ever quarterly earnings result announced last month.

VN8’s acquisition strategy is a simple one that can be very effective in capturing market share and accelerating growth.

VN8 provides telecommunication (telco) solutions primarily for Australian small and medium enterprises (SME).

With the pandemic transforming how SMEs across the board operate, the importance of having trusted and reliable business interconnectivity has never been more important.

We first invested in VN8 at 14c in September last year and increased our position last quarter at 11c- and continue to hold as VN8 executes its growth by acquisition strategy. Our average entry is ~12.5c, which is about where the company is trading today.

Our strategy here is to hold the majority of our stake as management executes its vision and grows the business, with the expectation of dividend returns down the road. We’ve assumed that once VN8 strings together consecutive years of positive earnings, it could begin to pay dividends. Of course, VN8 is a long way from that, and even then, success is no guarantee here.

Enterprises that pay dividend streams tend to be viewed as less risky, and attract more interest from institutional investors, self managed super funds and income investors.

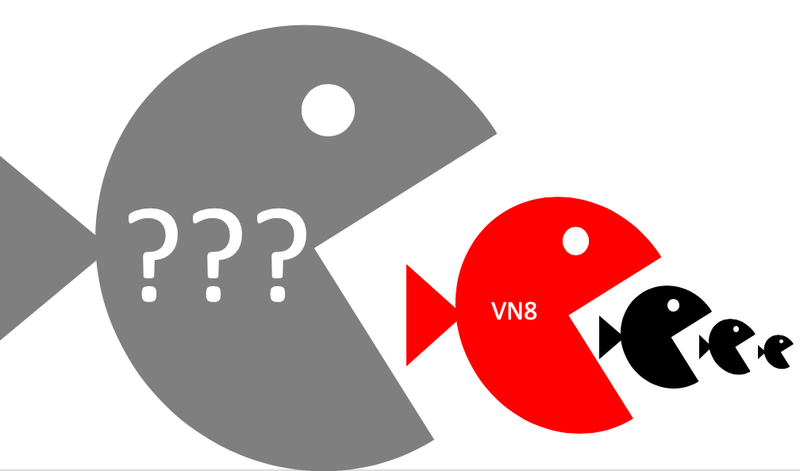

For this to happen though, it assumes that VN8 doesn’t get swallowed up by a bigger telco in the interim. Given the history of the telco sector, this may be a tough ask though - we will touch more on this later.

Note also that small cap investments, even if generating revenue, are inherently risky - only invest what you can afford to lose at this end of the market.

We like that VN8’s ‘hunt-for-growth’ strategy is already paying off on its top line, and think that this spreads to the bottom line shortly as well. We suspect that VN8 delivers its first full year, cashflow and earnings (EBITDA) positive results this FY, with a shot of being cashflow positive as early as the current calendar year (given that they’ve already delivered a cashflow positive 1H CY21).

Many of our other portfolio investments have delivered strong gains to date, yet VN8 remains one of a handful of our investments yet to garner market traction.

VN8 started the year strongly on the back of its second acquisition, hitting a 52-week high of 32.5 cents in early February 2021. However, since then it has trended downwards, to be trading around 12 cents recently .

The downturn in VN8’s share price coincides with a trend that much of the broader communication services sector is suffering too, with poor market sentiment for listed telcos being fairly widespread at present.

We also presume that the market wants to see how VN8’s latest acquisitions are digested, and if these lead to stronger earnings and customer growth over the coming quarters.

Yet while we would obviously smile at a higher market valuation, we are mindful that this is out of management's control to a large extent.

What we like to see from management - and that we believe VN8 is doing - is to grow the business, both organically and via acquisitions. The key metrics we track on these fronts are:

- Annual Recurring Revenue - the amount of recurrent revenue we expect based on regular retainers and/or subscriptions payments.

- PBX customers - PBX stands for Private Branch Exchange, which is a private telephone network used within a SME. e.g you might call the same number to order pizza from a national pizza chain with hundreds of franchises, and it channels you to the nearest one (rather than having a unique number for each franchise to call directly). Every PBX user pays a regular monthly fee that contributes to the bottom line. The more PBX users, the more fees collected, and so we can project revenues going forward.

- EBITDA - earnings before interest, taxes, depreciation, and amortisation, is a simple measure of core profitability.

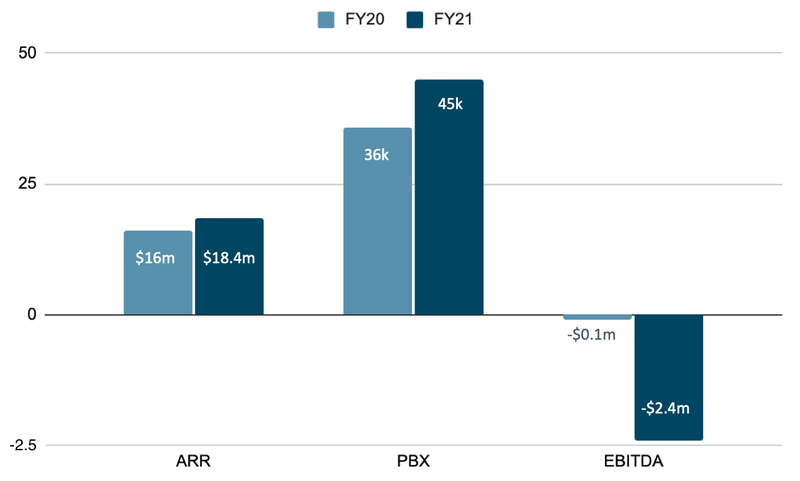

Over the last two financial years, this is how VN8 fared across these metrics.

As you can see, there is good improvement on ARR and PBX figures, yet EBITDA is yet to cross into positive territory (though underlying EBITDA - which strips off many non-recurring expenses - last year was positive at $593,126, signalling to us that VN8 isn’t far from reaching positive EBITDA).

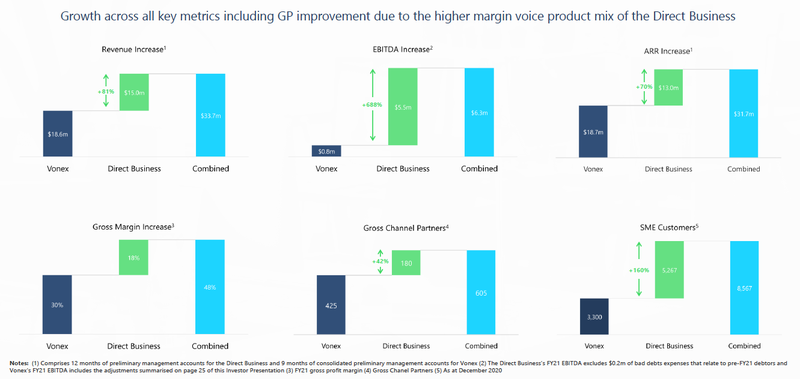

What we are very encouraged by - and the reason we increased our holdings last quarter - is that the latest acquisition of the Direct Business division from larger telco MNF Group, has led to a profound impact across several key metrics.

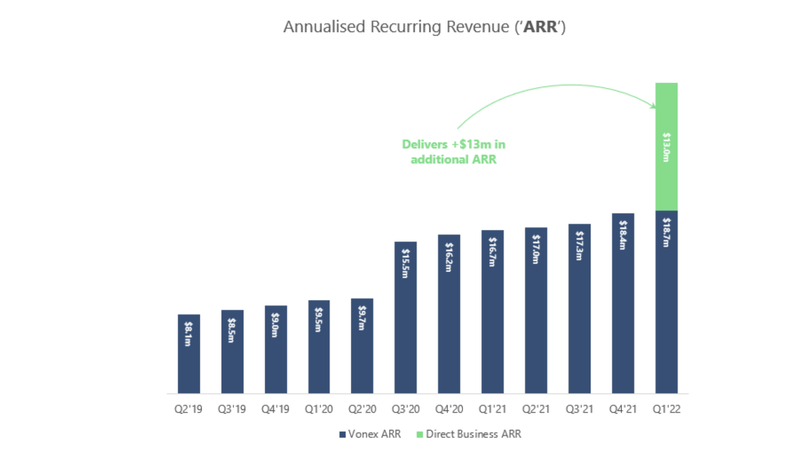

This slide shows the anticipated growth in ARR, with the last column (i.e. the highest) integrating the latest acquisition.

The complete integration will take closer to 9 months, but we are already seeing good headway.

After only a few weeks in the VN8 stable, this new division has substantially grown VN8’s customer base and channel partner network, leading to an increase in monthly retail/SME customer billings by more than 185% from a year ago.

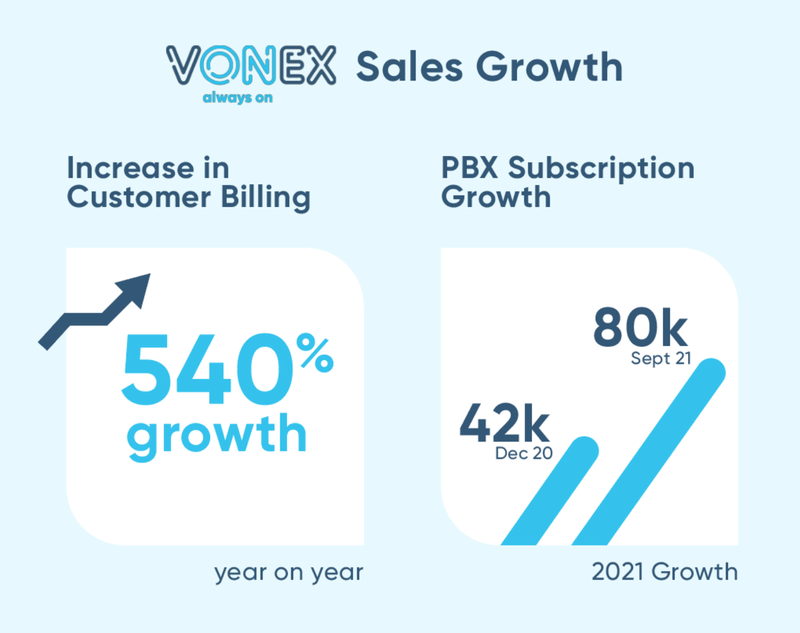

Last quarter, VN8 delivered its best ever sales revenue result, up 47% year-on-year to $6.54M for the 3 months to 30 September.

Annual recurring revenue is now $32M, and PBX users (a proxy for revenue) is up 90% year-on year to over 80,000 (a quantum growth leap in user numbers enabled by the Direct Business acquisition.

So, we like the progress VN8 is making, and expect to see stronger earnings growth as the latest acquisition is integrated in the following two quarters.

Telcos - home of the predators and the prey

Telstra, Optus, Vodafone... household names that seem to have been around forever in the world of telecommunications.

It may come as a surprise to many readers that these reside in the land of mergers and acquisitions (M&A) - indeed Optus was snatched up by Singtel of Singapore back in 2001 - in turn, Optus has been swallowing up smaller companies for years, the latest being junior telco Amaysim last year.

Vodafone Australia merged with TPG last year, and Telstra has been swallowing up smaller telco businesses for years too (most recently, a $2.1BN deal for one of the Pacific region's largest telecommunication companies, Digicel).

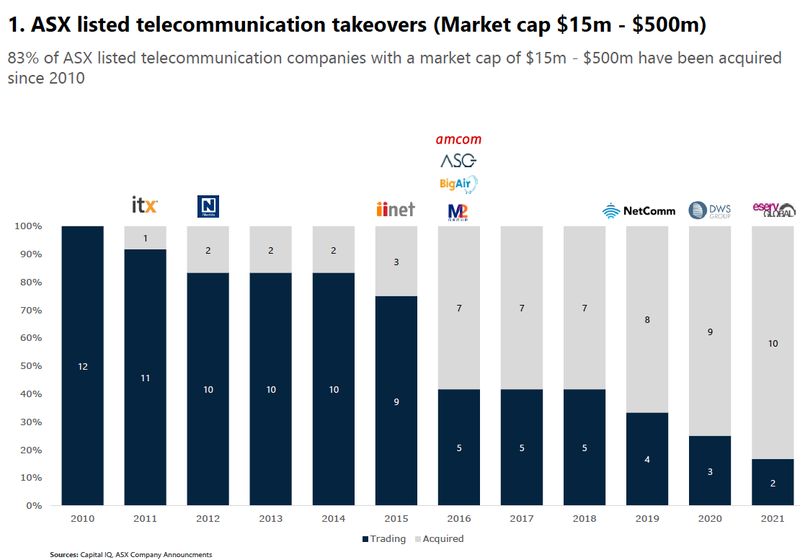

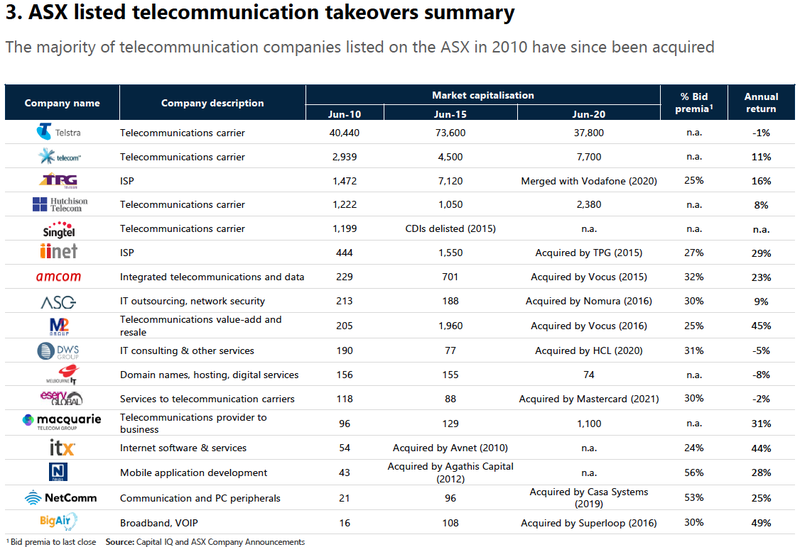

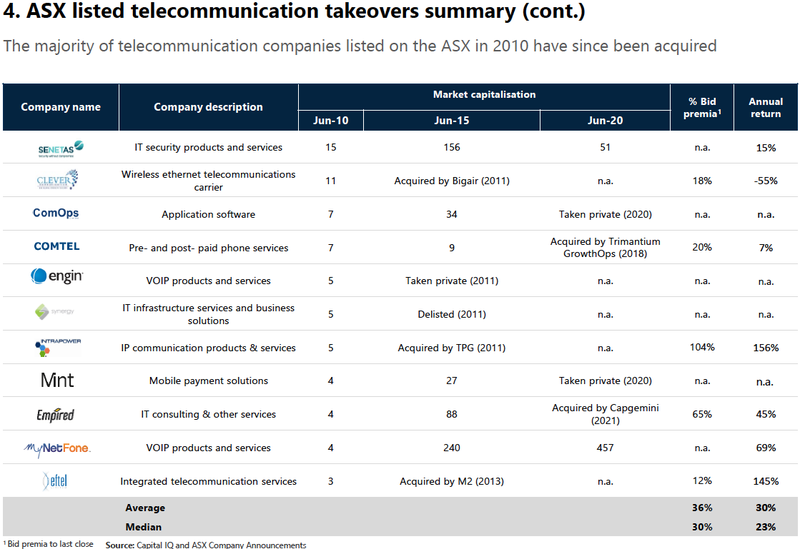

The table below shows that if you’re a telco on the ASX, whether nanocap to smallcap in size, you’re likely to be part of M&A activity, whether swallowing up smaller companies, or until a bigger group takes a look at you on their menu.

Over 83% of ASX listed telcos with a market cap of between $15M to $500M have been acquired since 2010.

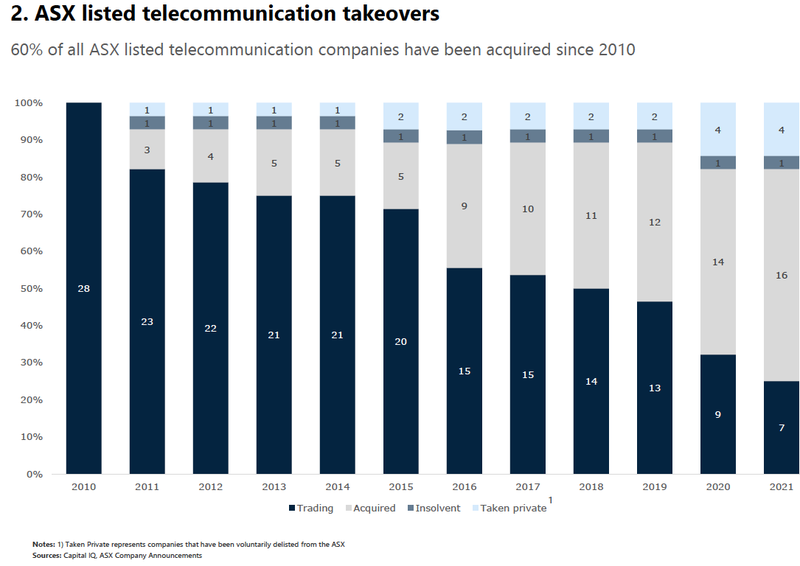

If we remove the market cap restriction, since 2010, 60% of all ASX-listed telecommunications companies end up being acquired.

The tables below show several of the M&A transactions since 2010. As you can see, M&A activity has been fairly commonplace each year.

Based on history, M&A activity is set to continue on in the years ahead - the nature of the beast is that it is typically more efficient and quicker to enter a new market and/ or build market share through acquiring other companies, than to grow the customer base organically.

In 2021, already we’ve seen Aussie Broadband confirm a $342m approach for Over The Wire, Capgemini’s $186m takeover of IT services group Empired; Superloop’s $110m acquisition of

internet service provider Exetel, Twiggy-backed Swoop gobbling up Countrytell Holdings, and Aware Super/ Macquarie’s $4.6Bn takeover of Vocus.

The main takeaway is that VN8's 'hunt for growth’ strategy is very much part of the territory of residing in the ASX-listed telco space, and not at all particular to VN8.

That VN8 is reaping the rewards of this strategy is being seen in strong revenue growth and increased market share.

We suspect that VN8 isn’t done with its acquisition spree - the question is will it be swallowed up by a bigger player before the company begins delivering positive EBITDA returns, and ultimately, paying dividends?

Vonex Company Milestones

✅ Acquisition 1: Incorporation Complete (2SG)

✅ Portfolio Initiation

✅ 2SG Wholesale 5G services selected by Optus as a key 5G partner

🟥 Oper8r app discontinued

✅ Acquisition 2: Acquisition Complete (Nextel)

✅ Wholesale Agreement with Orange

✅ Acquisition 2: Incorporation Complete (Nextel)

✅ Acquisition 3: Acquisition Announced (MNF Group Direct Business)

✅ $14M Cap Raise @11c ($12M Insto, $2M SPP)

✅ Acquisition 3: Acquisition Complete (MNF Group Direct Business)

✅ Acquisition 3: Incorporation into Business (MNF Group Direct Business)

🔲 Acquisition 4 - Announced

🔲 Acquisition 4 - Complete Transaction

🔲 Acquisition 4 - Incorporate into business

🔲 Acquisition 4 - Revenue Growth

✅ 50,000 PBX Customers

✅ 75,000 PBX Customers

🔲 100,000 PBX Customers

🔲 150,000 PBX Customers

✅ Annual recurring revenue hits $25M

🔲 Annual recurring revenue hits $50M

🔲 Positive EBITDA FY22

✅ Cashflow positive for half year|

🔲 Cashflow positive for full year

🔲 Unexpected Announcement 1

🔲 Unexpected Announcement 2

🔲 Unexpected Announcement 3

🔲 Vonex acquired by larger telco company

Here is our VN8 investment strategy

✅ Initial Investment: @14c

✅ Increase Investment: @11c

🔲 Increase Investment

🔲 Price increases 500% from initial entry

🔲 Price increases 1000% from initial entry

🔲 Price increases 2000% from initial entry

✅ 12 Month Capital Gain Discount

🔲 Free Carry

🔲 Take Profit

🔲 Hold remaining Position for next 2+ years

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 3,273,182 VN8 shares at the time of publication. S3 Consortium Pty Ltd has been engaged by VN8 to share our commentary and opinion on the progress of our investment in VN8 over time.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.