Vonex delivers strong operational result ahead of product launch

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

After the market closed on Friday, diversified telecommunications services provider Vonex Ltd (ASX:VN8) released an impressive interim result for the six months to 31 December, 2019.

During the period, the company grew revenues by 30%, as well as making strong advances in terms of expanding the business through acquisitions, product development and building on its proven established product areas.

While Vonex’s shares were up about 7.5% in early morning trading, it could be argued that there may be more upside to come, and perhaps a more significant rerating would have occurred if not for depressed market conditions.

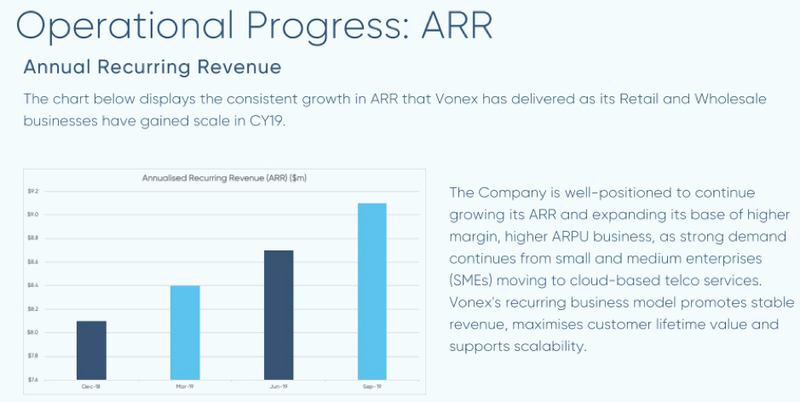

As well as achieving strong revenue growth, it is important to note that Vonex is accelerating its recurring revenue streams as the company develops, delivers and licenses its own advanced communications technology, a factor that provides investors with earnings predictability.

The following chart highlights the significant increase in annual recurring revenues during the 12 months to 30 September, 2019.

2SG acquisition provides substantial revenue boost

It is worth noting that management confirmed the completion of the acquisition of the 2SG wholesale business on Monday morning, another positive development for the group.

2SG Wholesale is a telecommunications and data wholesaler based in Brisbane, Queensland which provides Australian Managed Service Providers, ISPs and System Integrators with access to the latest in hardware and connectivity solutions from leading brands.

In fiscal 2019, 2SG Wholesale achieved revenue of circa $7 million, with income from mobile broadband a key growth driver.

To highlight the financial significance of the acquisition, Vonex generated revenues of $5.6 million in the December half, equating to annualised revenues of $11.2 million.

Consequently, 2SG provides a revenue boost of some 60% on a base case scenario, but bear in mind the group’s current income generating capacity could be higher.

One needs to also take into account the synergies between the two businesses.

2SG Wholesale brings a highly capable and experienced team that is well positioned to drive further growth from immediate cross selling opportunities, and a dedicated technical support team.

2SG Wholesale’s mobile broadband capability provides Australian ISPs with the opportunity to sell a wireless broadband solution via the Optus 4G Network.

Integration with Australia’s premier carriers facilitates the delivery of the latest fixed line, mobile connectivity and hardware solutions country-wide.

Retail revenues up by more than 15%

Running the ruler across the operational achievements in the December half, Vonex continued to develop and grow its established cloud hosted PBX system and retail customer base with revenues increasing by 15.7%.

The retail division under the Vonex Telecom brand has continued to grow its sales revenues base achieved via the sale of IP hardware, full suite of telecommunication services, including the provision of data, internet, voice (including IP voice) and billing services within Australia.

The Sign On Glass technology, developed internally, has continued to aid the retail divisions new customer sign-up through automation and efficiency.

As well as generating a 15% increase in sales revenues, the retail division has delivered a 14% net increase in customer accounts across the 12-month period ending 31 December 2019.

This compares favourably with the prior year growth 10%, and the continued strong performance can be attributed to greater brand exposure and recognition achieved through a range of marketing and partnership initiatives.

Wholesale achieves 22% increase in direct sales

The wholesale division has also continued to grow its sales revenues achieved via the offering of wholesale “white-label” hosted PBX services under license to Internet Service Providers (ISPs), telcos and cloud vendors within Australia and internationally.

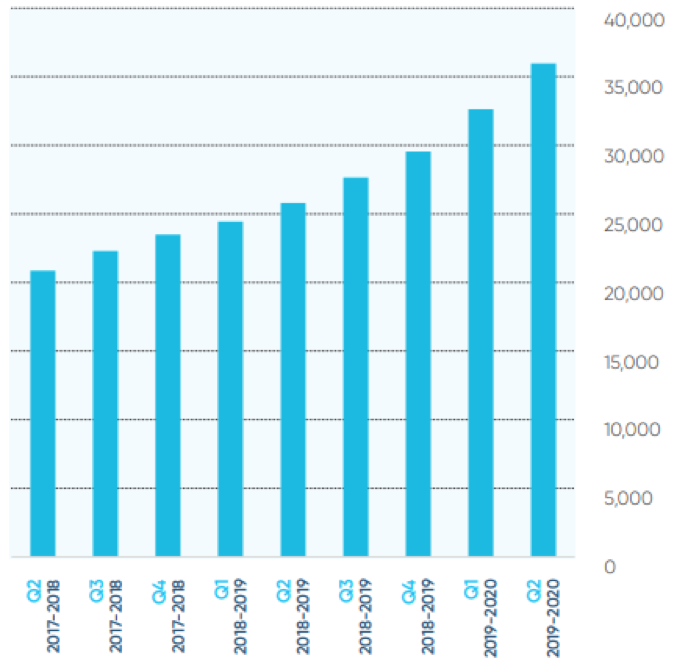

The reporting period has seen the wholesale division achieve a 22% increase in its direct sales revenue, along with a 39% increase in the user numbers hosted with Vonex across the 12-month period ending 31 December 2019.

Private Branch Exchange (PBX) users have passed the 35,000 mark, up by about 10,000 on a year-on-year basis.

Registered users of these PBX connections are a key indicator of business development progress as Vonex penetrates the multi-billion dollar Australian market for telco services to Small to Medium Enterprises (SMEs).

Achieving this milestone reflects the company’s strong first half of fiscal 2020, signing Total Contract Value (TCV) of new customer sales worth more than $3 million, an increase of 63% compared to the December half sales in fiscal 2019.

TCV of provisioned customers is calculated using the minimum monthly commitment multiplied by the contract length and is typically realised over a period of between two and three years.

In the last 12 months Vonex has grown its PBX user base by approximately 22% to more than 36,000 users as at January 2020.

The following graph shows the consistent growth achieved by the company over the past two years.

Product development – Oper8tor

While the rollout of the group’s in-house developed Oper8tor communications platform has taken longer than originally expected, management has adopted the right approach in taking the extra time to make sure it is state-of-the-art and fully compatible.

To this end, the company has completed a rebuild of the Skype connector, while also including SMS capability on a single thread.

During this period, internal testing has seen the Vonex successfully release 216 beta test builds of Oper8tor to Apple’s mobile app testing service, TestFlight, and Google Play’s mobile app testing service.

The company expects to move Oper8tor’s development into a phase of polishing and ensuring stability at scale in the current quarter with a closed user group to verify third party testing results.

Once this phase commences, Vonex intends to release Oper8tor Version 1 to a wider community and plans to invite investors to participate in the company’s controlled launch.

On release, Version 1 of Oper8tor will provide a voice and messaging app with connections between two social media messaging platforms, SMS integration and voice call blast functionality to mobile and landline numbers.

Future releases will target the inclusion of additional social media voice and messaging connections.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.