Vonex achieves strong growth - Nextel outperforming expectations

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As the first day of June marks the start of the last month of fiscal 2021, telecommunications innovator Vonex Limited (ASX:VN8) can be impressed with its achievements on the corporate front and from an operational perspective in the last 12 months.

A business update released on Tuesday morning indicates that the company continues to deliver strong organic growth, while gaining added momentum from acquisitions.

Importantly, management has taken a measured but active approach towards acquisitions, and its ability to successfully integrate the new businesses and capitalise on their operational strengths is evidenced in today’s update.

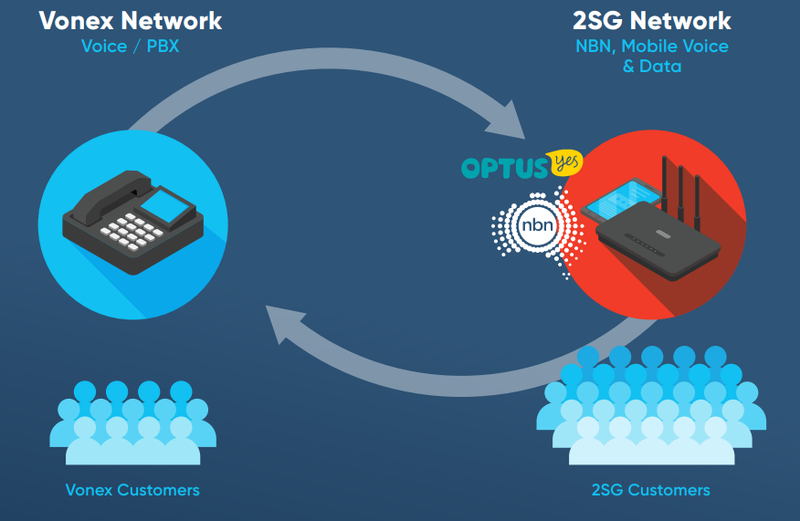

With regards to acquisitions, a significant income and recurring revenue driver in calendar year 2020 was the February acquisition of 2SG Wholesale.

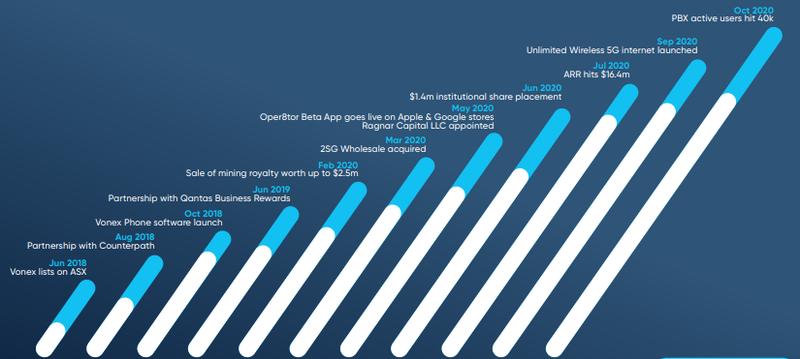

Vonex grew its base of annualised recurring revenue (ARR) by 89 per cent in fiscal 2020 to more than $16.4 million, supercharged by the strong operational and financial performance seen in the June quarter of fiscal 2020, the group’s best quarter since becoming a listed company.

Despite the economic effects of the COVID-19 pandemic, sales for the retail business overall remained strong, reflecting a healthy year-on-year increase of 65 per cent.

Nextel integration to maintain momentum

In December 2020, Vonex signed a binding term sheet with Nextel Pty Ltd, an industry leader in the design, installation and maintenance of voice, data and communications networks for business customers, to acquire its business and operations as a going concern.

On 3 February 2021, Vonex announced the completion of the acquisition of Nextel.

Since then, management has been working towards integrating Nextel with the company’s existing operations.

Having completed this process, Vonex will continue to explore further synergies between the Nextel business and the company’s existing operations to identify new opportunities to add value to the company’s business customers.

On this note, management is engaged in promoting Nextel with proactive marketing campaigns targeted at new build infrastructure construction projects after winning a $140,000 infrastructure job post completion of the Nextel acquisition.

As Nextel remains on target to perform ahead of the financial expectations set at the time of purchase, it would appear that this acquisition has kicked into gear smoothly as the 2SG integration was completed.

Vonex’s PBX business has expanded, now having more than 45,000 active users of its Private Branch Exchange (PBX) cloud-based phone service.

The company has recently upgraded its PBX platform to integrate it with the ZOHO customer relationship management (CRM) tool, which is expected to improve customer retention, pipeline conversion and user experience.

From a broader perspective management advised that Vonex had grown its number of small-to-medium (SME) enterprise clients by 27% over the year to 31 May 2021.

NBN Assure unlimited speed and data a key driver in FY22

Vonex has rolled out the NBN Assure service to partners following its release in the March quarter of fiscal 2021, and it is poised to have a significant impact in the coming 12 months, effectively maintaining the momentum provided by 2SG in the last 12 months.

NBN Assure is Vonex’s “always on” business NBN service with first to market unlimited speed and unlimited data via 4G backup, making the second connection as valuable as the first for business customers engaged in essential online work.

NBN Assure also provides business continuity assurance for all critical systems and applications with static IP and cyber-attack protection, features which are gaining a positive response from customers in both the wholesale and retail markets.

Vonex has successfully deployed newly integrated billing and provisioning platforms for 2SG Wholesale as well as Nextel.

The former has also deployed its new B2B NBN ordering platform for wholesale customers, enabling touchless provisioning and service management.

This is an essential feature as social distancing measures remain part of life in areas of Australia, enabling Vonex to offer the added benefit of reducing costs and overheads for both wholesale customers and the business unit.

On the back of these successful deployments, management has ramped up its efforts in cross-selling its voice offerings through this business unit.

2SG Wholesale continues to deliver strong growth across key sales metrics, highlighted by 61% growth in orders of mobile broadband, 95% growth in orders of NBN with 4G backup and 217% growth in orders of mobile voice services year-on-year in FY21 to date.

2SG Wholesale’s 5G services launch is imminent, and having been selected by Optus as a key 5G partner, 2SG has now completed preparations for the launch.

This includes the creation of a new Service Qualification and an automated ordering system for partners and customers.

Management expects this new product to contribute to revenue growth in the December half of fiscal 2022.

Acquisitions in negotiation and due diligence stages

Management plans to augment its strong organic growth through selective acquisition.

The company’s acquisition strategy remains a key focus and several late-stage opportunities are under review.

Vonex is being assisted in its acquisition search by TCA Partners (formerly known as Tor Corporate Advisory).

The company has a strong pipeline of acquisitions in negotiation and due diligence stages.

With a proven track record of making astute acquisitions that add shareholder value, the addition of new businesses could be a share price driver in fiscal 2022.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.