Pac Partners sees 75% share price upside in Vonex

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A fortnight ago, telecommunications innovator Vonex Limited (ASX:VN8) provided a promising update on its retail business with the group achieving total contract value (TCV) of new customer sales of $3.7 million in the June half.

This represented year-on-year growth of 65%, illustrating its resilience during the height of the COVID-19 period.

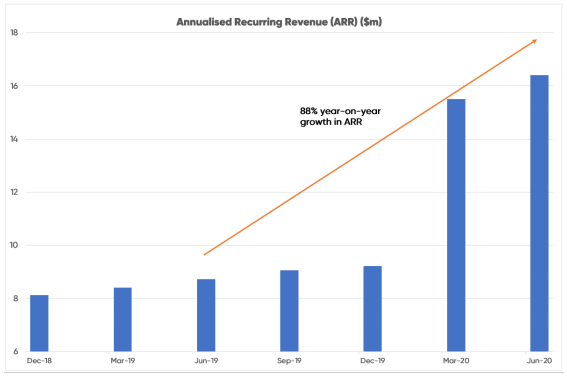

Of further encouragement was the exceptional growth in annualised recurring revenue which grew 89% to $16.4 million in fiscal 2020.

This news was well received with the company’s shares surging nearly 20% from just shy of 10 cents to 11.5 cents.

However, analysts at PAC Partners believe there is significantly more upside, and the broker has set its price target at 20 cents per share, representing a premium of 75% to the company’s current share price.

As well as citing the recent strong operational performance, the broker noted that the last capital raising has boosted the group’s cash to nearly $5 million, leaving it well-placed to fund growth initiatives in fiscal 2021.

Upcoming earnings catalysts

PAC Partners pointed to a number of factors that are likely to drive earnings growth in fiscal 2021.

The broker expects the number of registered users and customers on VN8’s PBX platform to expand through increasing channel partners and relationships like Qantas Business Rewards who have access to thousands of SMEs (small to medium enterprises).

PAC Partners is also anticipating average revenue per customer to increase through the sale of additional products and services saying, ‘’The hero product to date has been ONDESK a hosted cloud solution, while in time the company will layer on NBN fibre, business-grade fibre, and mobile services with 5G expected to come via the Optus relationships acquired through 2SG acquisition.’’

The 2SG acquisition was an important development for Vonex as it added an additional 100 wholesale customers, providing scale to the group’s wholesale business and numerous cross-selling opportunities.

PAC Partners also noted advantages in terms of improved margins as a result of being able to go direct for NBN as 2SG dispenses with payments to other wholesalers.

Commenting on the impact of NBN, PAC Partners said, ‘’While NBN is reaching the end of the build, there are many premises “ready for service” but not yet activated, so we see a positive industry backdrop for Vonex as these churn events create opportunities.

‘’We would also expect a big tail of activity just before the Core Access Network is turned off and SME’s are mandated to evaluate their telco services.’’

Vonex undervalued by any measure

Using the most relevant valuation metrics, Vonex represents outstanding value on all counts based on its current share price.

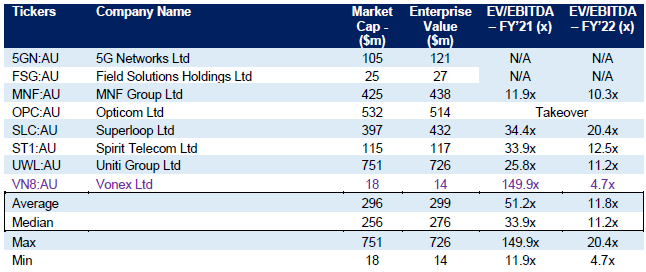

PAC Partners crunched the numbers and made peer comparisons on July 9 when Vonex’s share price was 10 cents and this is how the numbers stacked up.

The broker sees Spirit Telecom (ASX: ST1) as Vonex’s nearest peer, and it trades on an enterprise value/EBITDA fiscal 2021 forecast multiple of 12.5.

However, to adopt a more conservative approach, PAC Partners has used the group average multiple of 11.8 which translates into a share price of 20 cents.

One of the most compelling statements made by PAC Partners was its take on Vonex in the context of how it compares with early-stage players that had a similar business strategy/product offering in their infancy.

On this note, the broker said, ‘’We see VN8 through the same lens as MNF and TPM when they started their journeys through single products and layered more and more services and acquisitions to create the businesses of today.

‘’MNF started with hosted PABX, and TPM started with layering DSL over its own network and accessing the last mile via DSLAMs installed in the exchanges.’’

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.