Alexium primed for success: doubles revenue, lifts margins

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Alexium international Group Ltd (ASX:AJX) is at the forefront of global flame retardant technology.

Alexium utilises phase change materials in developing proprietary products for advanced thermoregulation. The group’s chemical treatments are currently marketed as Alexicool® and Alexiflam®, while applications under development include textiles, packaging, electronics, and building materials.

Over the past 18 months, Alexium with a renewed management team, has made tangible progress in repositioning the business for future growth. Actions taken by the current management team across the business in that time are driving a strong and continued improvement in profitability.

The company’s progress was reflected in its half yearly report and presentation announced this morning.

The group made meaningful progress across all key financial indicators over the half year to December 31. Highlights include:

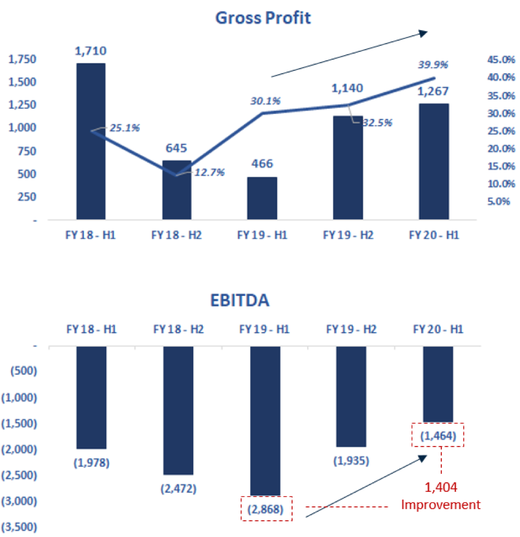

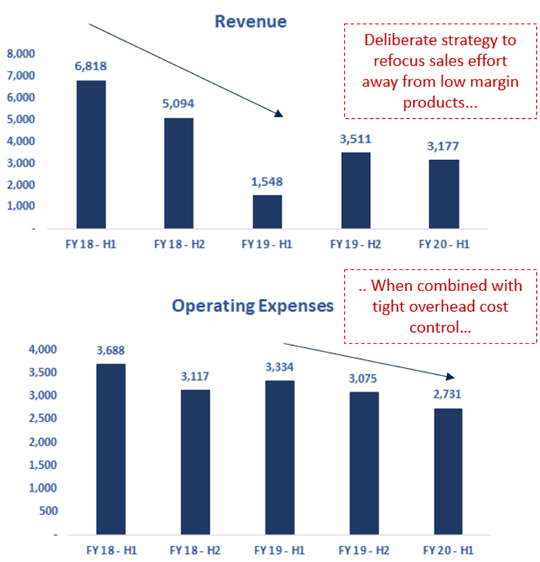

- Revenues more than doubled from US$1.548 million (AU$2.2M) in the six months to December 31 2018 to US$3.177 million for the corresponding six-month period a year later (H1 2020).

- Improved gross margins by 9.8% through pricing and manufacturing controls and processes from 30.1% in H1 2019 to 39.9% in H1 2020.

- The group had a tight control of overheads with operating overhead reduced by 18% from US$3.3 million to US$2.7 million from fiscal stewardship and increased efficiencies.

- The total operating loss (EBITDA) improved by US$1.4 million versus same 6-month period last year.

While incremental growth has continued, Alexium has leveraged its broad product portfolio and analytical tools to develop total mattress cooling systems (TCMS) where a suite of textile and foam-based Alexicool® products are used.

This increases revenue per unit, strengthens the reliance on Alexium IP, and promotes the utilisation of the company’s analytical tools.

These opportunities provide a step change in revenue growth and are the basis for achieving cash flow positive.

Capital position

Alexium successfully raised US$15.1 million in December 2019 / January 2020 with proceeds used to retire GPB debt.

The capital raising process reduced debt by US$5.5 and annual interest costs by circa US$1.0 million.

The group’s US$6.9m of cash on hand (post tranche 2 of placement) provides sufficient funding to realise the significant opportunities ahead.

The financing saw well regarded institutional investor, Colinton Capital Partners become a cornerstone investor in Alexium, investing a total of A$9.2 million in Alexium shares and convertible note.

Colinton is now working with the Board and management to realise the near-term potential of Alexium. Additionally, Simon Moore, Senior Partner of Colinton Capital Partners joined the Alexium Board in February 2020.

Highlights for the product lines

Alexicool®

Alexium’s Alexicool® products are expanding in the US bedding market.

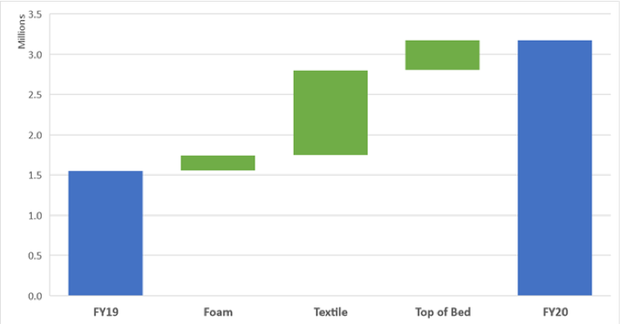

The group recorded revenue growth in the half year from new customers of Alexicool® products in the three categories of Foam, Top of Bed and Textile, along with increased revenue from existing customers.

The graph below shows first half revenue growth FY19 v FY20 comparison (blue) and the business lines and their contribution to that growth (green):

While incremental growth has continued, Alexium has leveraged its broad product portfolio and analytical tools to develop total mattress cooling systems (TCMS) where a suite of textile- and foam-based Alexicool® products are used.

This increases revenue per unit, strengthens the reliance on Alexium IP, and promotes the utilisation of the Company’s analytical tools.

These opportunities provide a step change in revenue growth and are the basis for achieving cash flow positive.

Alexiflam®

In the first half, the group’s product ‘Alexiflam® NF-treated Cotton Socks for Protection of Foam Mattresses’ had its product design validated in laboratory-scale testing, cost and supply chain models established, and commercial production efforts commenced.

Based on H1 FY2020 achievements, production scale work has now commenced in preparation for and to support a full mattress scale burn test.

In parallel, Alexium will continue to meet with customers to introduce the product. Initial customer interest is positive given hazards of the incumbent products.

Given addressable market, strong value proposition and established customer relationships, commercialisation is a 12-month priority here.

Over the six-month period, a framework was established with ICL (a global leader in flame retardants) for the commercialisation of Alexiflam® NF with ICL customers in target markets.

Over the coming year, Alemium will finalise the Alexiflam® NF commercial agreement with ICL, and support ICL commercial efforts with research, product development and manufacturing resources. The Alexium commercial team will continue to work on established FR opportunities.

Alexiflam® FR NyCo

Minor adjustments have been made to Alexiflam® flame retardant NyCo (nylon/cotton) fabrics for military applications to suit the Pine Belt manufacturing process and promote even chemical application.

Alexium will support Pine Belt in finalising and optimising production scale processes, complete technical production testing on lowest weight add-on with FR NyCo process, deliver FR NyCo fabrics to USMC for testing and evaluation (T&E), and support Pine Belt and USMC efforts.

The company will host a conference call and live audio webcast at 9:00am AEST on Friday, 28 February 2020. CEO Bob Brookins and CFO Jason Lewis will review Alexium’s progress over this period as well as provide updates on major initiatives. You can join the meeting by clicking HERE.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.