Tempus completes drilling at Elizabeth, assays due in 2021

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

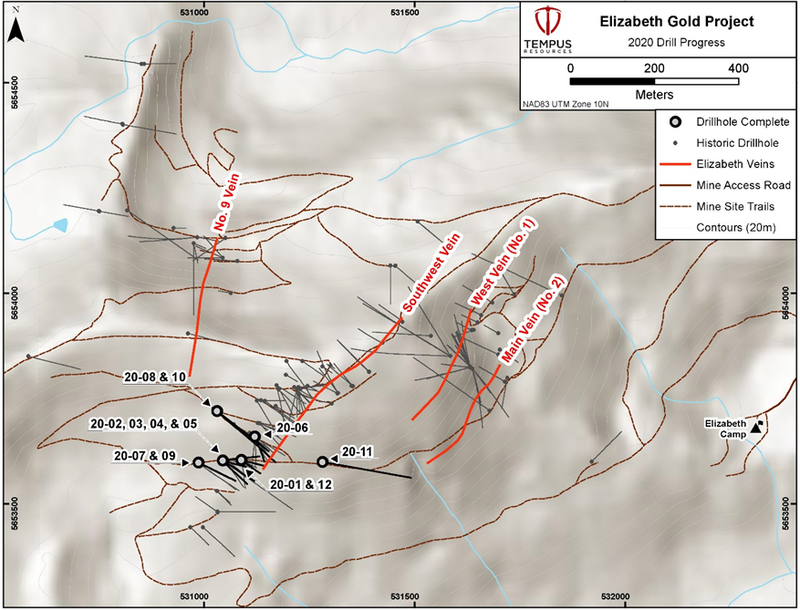

Tempus Resources Ltd (ASX:TMR) has provided an update on exploration activities at the Elizabeth sector of its Blackdome-Elizabeth Gold Project, located in British Columbia, Canada.

This is an interesting part of the resource as the South-west Vein particularly hosts the majority of the historical NI43-101 Mineral Resource, comprising 522,843 tonnes grading 12.26 g/t gold for 206,139 ounces of contained gold.

The company’s goal was to focus on verifying and expanding the historical high-grade Mineral Resource at the project by drilling extensions to existing mineralisation and other high priority targets within the 350 square kilometre licence area that remains relatively unexplored.

Given the presence of gold and silver mineralisation identified during previous exploration, this was shaping up as a highly anticipated drilling program, particularly at a time when the gold price was close to its record high and the silver price remained buoyant.

It is worth noting that these metals are both trading well above long-term averages, and with gold putting on 1.3% or US$24 per ounce last night to close at US$1856 per ounce companies exposed to the precious metal could finish the year on a strong note.

Diamond drilling at the high-grade Elizabeth sector of the project has now been completed for the 2020 field season.

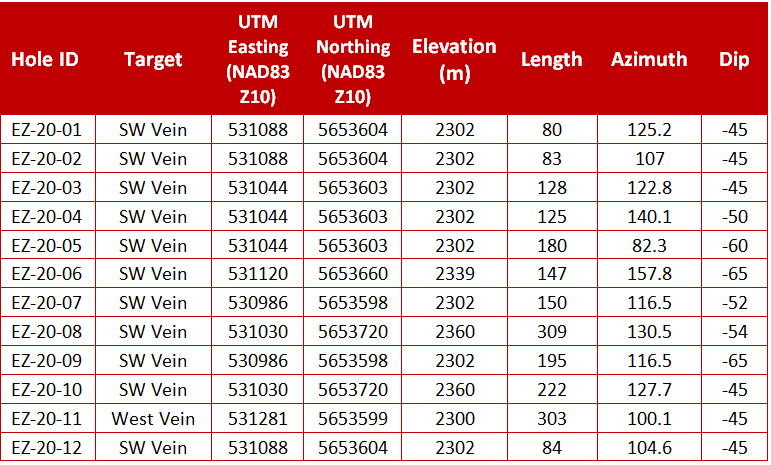

A total of 12 diamond drill holes as shown below were completed totalling 2,006 metres.

Visible gold observed from 116 metres

The remainder of the planned 6,000 metres of drilling will commence in the Canadian spring of 2021.

The first four drill holes are now undergoing analysis, and assay results are expected early in 2021.

In the interim, management has provided the following data.

The initial 12 holes as seen above were located in the southern portion of the SW Vein where infill and down-dip extension of the SW Vein was the primary focus.

Visually, the drilling has been very encouraging with management noting that infill hole EZ-20-06 intersected the SW Vein from 116.00 metres to 121.5 metres downhole with visible gold observed over approximately two metres of core length within the quartz vein interval.

Tempus has made significant ground since starting the drilling campaign in the second half of 2020.

In tandem with this, the group also raised $4 million and its shares gained considerable momentum as its plans unfolded.

Resource update in 2021 suggests this could be a useful entry point

While there has been a recent retracement in the group’s share price, this appears to be mainly related to a slight shift away from gold and a move back into equities markets as COVID concerns dissipated.

However, Tempus remains leveraged to a metal that is still very much in favour, and with a number of catalysts on the horizon in 2021 its current trading range may represent a useful entry point.

Assay results are a potential share price driver in 2021, but it could be the release of an updated resource estimate that should be to hand by March 2021 that triggers the most interest.

This will be a significant milestone for Tempus as it will allow peer comparisons to be made with other companies that have an established JORC 2012 resource.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.