TMR announces new Canadian lithium projects

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 9,398,000 TMR shares and 4,716,000 TMR options at the time of publishing this article. The Company has been engaged by TMR to share our commentary on the progress of our Investment in TMR over time.

$7.5M capped Tempus Resources (ASX:TMR) has just announced new lithium exploration projects in Canada.

The market is currently rewarding material progress on lithium exploration and positive lithium drill results.

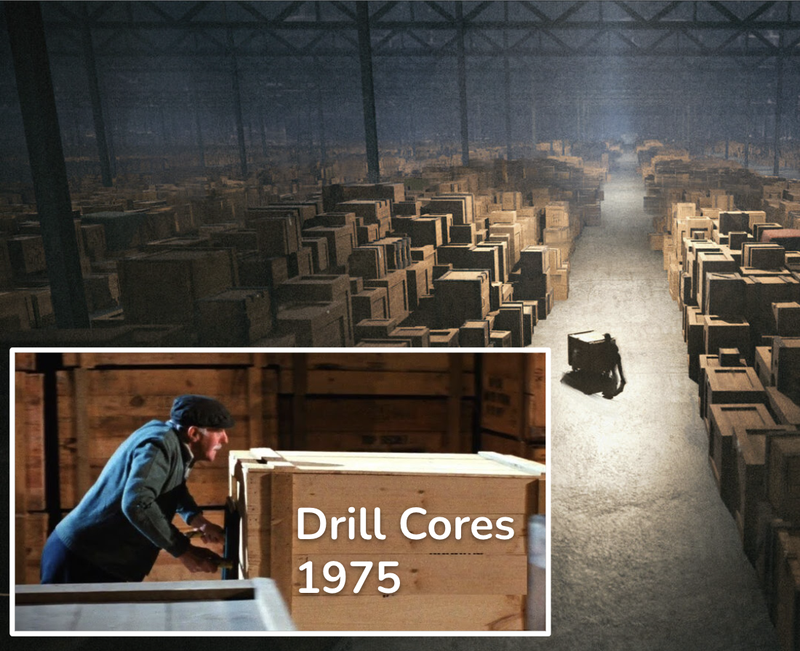

One of its new lithium projects was previously drilled for base metals (NOT lithium) back around 1975, but instead hit pegmatites with thickness up to ~33m.

In the 70’s, 80’s and 90’s, the battery boom hadn’t happened yet, so no one cared about pegmatites, spodumene or lithium.

Back then, the original goal was to find base metals, so these pegmatite intercepts were a “disappointment” and were never assayed for “boring” lithium.

These pegmatite cores were subsequently ignored, filed away and forgotten in a Canadian government warehouse like the Ark of the Covenant was at the end of Indiana Jones.

Things have certainly changed since the great lithium boom that started in 2020.

Pegmatites, spodumene and lithium are what every small cap explorer and investor is praying for in their drill results.

A bit of recent digging through historical drill records uncovered these once “worthless” pegmatite hits, and TMR has now acquired an option on the ground they are from.

Some of the biggest lithium deposits have recently been found by reviewing old drill cores, including:

- Red Dirt Metals (now $436M Delta Lithium) - Delta acquired the Mount Ida gold project. After resampling old drillholes, and drilling some new holes itself, the project became one of WA’s hottest lithium projects.

- Kidman Resources (sold to Wesfarmers for $776M in 2019) - Kidman acquired the Mount Holland gold project back in December 2015. After resampling old drillholes and drilling under its gold resource, the company declared a new lithium discovery. Only four years later in 2019, that project was sold to Wesfarmers for $776M.

Both of the above examples were at a time when lithium was less popular and so stumbling over new lithium discoveries was more likely.

Now lithium discoveries are in high demand and its harder to find these type opportunities and so there is no guarantee TMR’s projects produce a similar outcome.

TMR’s plan now is to send some of these historic pegmatite drillcores to the assay lab to see how much lithium these past explorers actually found (and ignored) before lithium became the world’s hottest commodity.

These assay results will provide a very interesting potential share price catalyst for TMR IF the drillcores end up having lithium in them.

Also using this historical drill data, TMR will be planning some lithium exploration drilling of their own on the project.

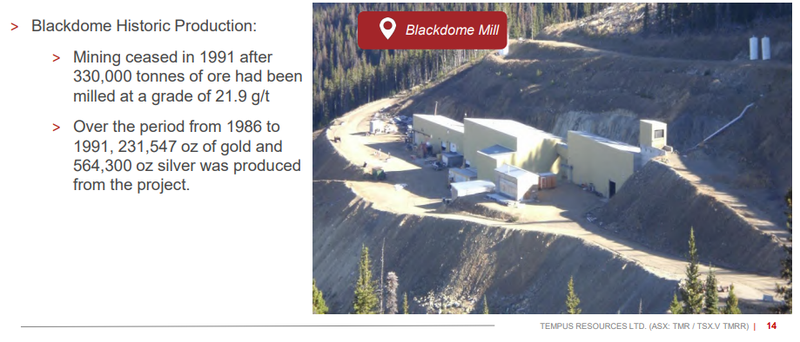

We originally Invested in TMR back in February 2020 because of TMR’s Canadian gold project, which historically produced ~230,000 ounces of gold through a previously operating gold mill that can be brought back into production.

The market has been uninterested in gold, and the sustained gold run we were hoping for hasn’t happened (...yet).

In anticipation of a spike in gold price being “just around the corner”, over the last 3 years we increased our Investment in TMR at 20c, 34c, 14.5c, 17.86c, 5c and most recently 4c...

The gold run hasn’t happened yet, and we have not sold a single TMR share since we first Invested, certainly not a great Investment for us so far.

Our volume weighted average entry price is ~9.4c. TMR is currently trading at ~2.4c so we remain very underwater on this Investment for the time being, but we are still holding.

We think adding a lithium exploration project while still progressing the original gold project should improve market interest in the story (and hopefully the TMR share price).

And it will keep things interesting while we wait for the gold price run that will hopefully generate a wider market appreciation of TMR’s gold project.

We also like that the new lithium project is in Canada, so TMR can utilise its Canadian based team of geologists (who are also working on the gold project).

Tempus Resources

ASX:TMR

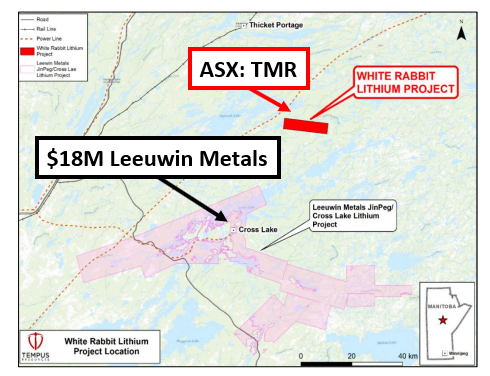

TMR’s new lithium projects sit in the province of Manitoba - not James Bay.

Manitoba is prospective for lithium but is not as well known amongst investors as being a lithium hot spot like James Bay... yet.

We like TMR exploring in a different part of Canada to most other explorers, as it means there is blue sky potential for TMR to be the first to make a region defining discovery - however it is early days of course.

Another company ~40km away has taken a similar exploration approach to TMR and is capped at almost double TMR’s current market cap.

That company managed to show lithium grades as high as 1.75% in its historic drillholes and thicknesses up to ~22m.

Anything remotely similar to those numbers for TMR could get the market interested in TMR’s lithium projects.

We should note that TMR had $1.47M in the bank at June 30. In order to conduct material exploration and drilling, it will need to attract new capital, hopefully at a higher share price than today.

It’s also worth noting that the claims TMR now has an option over are still under application with the Manitoba Mines, this may take several months to process.

More on TMR’s new lithium projects

TMR has an option to acquire its new lithium projects until the 30th of October 2023.

The option is over two different projects:

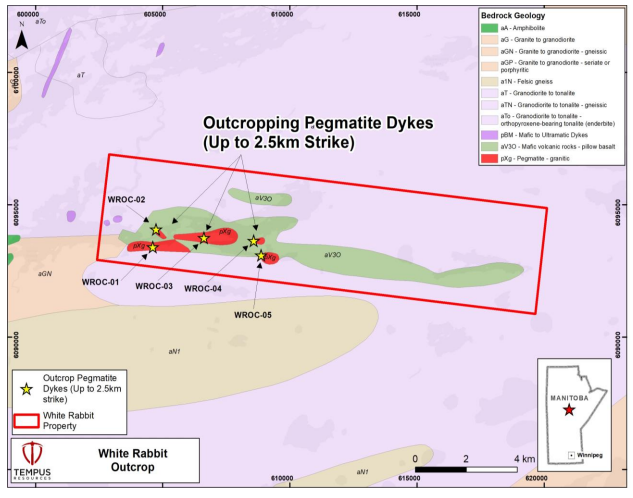

White Rabbit project

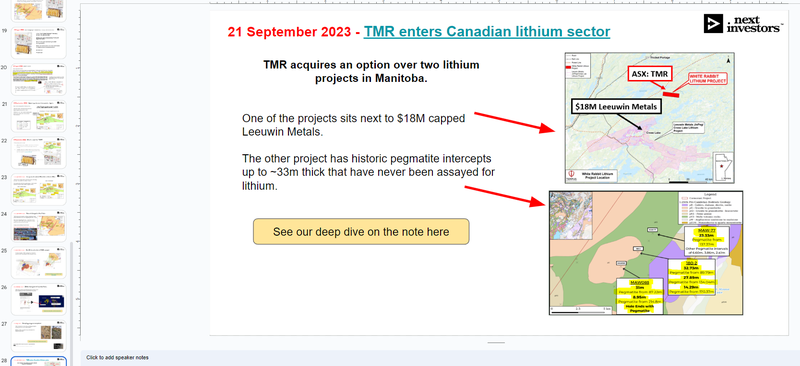

Here TMR will have ~70km^2 of ground near ASX listed Leeuwin Metals’ Cross Lake lithium project.

Leeuwin has already put out a set of assay results from the project showing intercepts up to ~21m wide with lithium grades as high as 1.75%.

Leeuwin’s market cap is ~$17M compared to TMR’s market cap of $7.5M.

TMR’s White Rabbit Lithium Project to date has only been surface mapped showing five different outcropping pegmatites with strike lengths up to 2.5km and widths of ~500m.

All TMR has to do is drill into the outcrop to see if it can make an economic discovery.

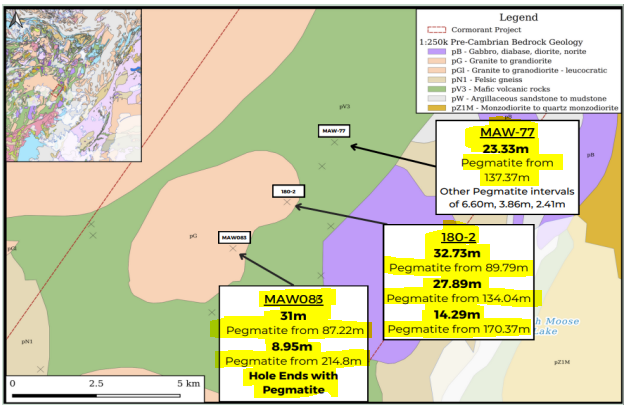

Cormorant Lithium Project

Here TMR will have ~187km2 of ground that has never been explored for lithium.

But as we noted above, the project was drilled back in 1975 with a focus on base metals.

Six of the drillholes completed back then hit pegmatites with thickness up to ~33m - so the project has the right type of rocks for a hard rock lithium deposit.

TMR just needs to get those logs assayed for lithium.

A big positive here is that TMR won't need to spend much money to get this done.

Instead TMR just needs to get access to the drillcores and see if those pegmatites contain any economic lithium grades.

As we mentioned earlier, both of the projects are being acquired in the Manitoba region in Canada.

Up until now, the Canadian lithium industry has mostly been focused in James Bay but Manitoba is encouraging companies to start building out a lithium industry in the region.

(Source)

TMR is almost like a first mover into a region that is largely untouched for lithium exploration.

Being a first mover is always higher risk, because the market has no comparisons to make and no comparable major discovery in the region BUT it also means there is potential to deliver higher rewards for shareholders if a discovery is made.

What is TMR paying for the lithium projects?

TMR is paying an option fee of $25k which gives TMR until 30th October 2023 to choose to acquire the projects.

Once the option is exercised TMR will need to pay:

- Upfront - 37.5 million TMR shares (half escrowed for 6 months) + 22.5 million options exercisable at 7.5c expiring September 2025.

- Milestone payment 1 - 22.5 million performance shares which convert into TMR shares if 5 rock chips return lithium grades above 1%.

- Milestone payment 2 - 22.5 million performance shares which convert into TMR shares if 3 drillholes/surface trenches return 10m+ thickness with lithium grades over 1%.

- Royalty - 2% on gross revenue with an option to buy back 1% of it for $1M.

Our take on the deal terms

We like that a large part of the acquisition costs are based on milestones.

We also like that there are minimal cash payments being made to the vendors which typically signals the vendors are confident the project will do well for the acquirer’s share price.

If both milestones are triggered then TMR would be issuing a total of ~82.5 million TMR shares which at current market prices would be worth ~$2M.

IF TMR delivers the two milestones then we would hope TMR’s share price would re-rate by multiples of the amount being paid to the vendors.

We also note that TMR has until the 30th of October to make a call on whether to proceed with the acquisition so the company has time to do some more work on the projects before going ahead with the deal.

What are the short term risks for TMR?

Like any microcap stock that doesn’t generate revenue, there are risks involved in an investment.

In the short term, we see three key risks for TMR.

Funding risk - TMR had ~$1.47M in cash at 30 June 2023 which will mean TMR might need to raise capital soon - particularly if it wants to aggressively explore.

Deal risk - at the moment TMR has an option over the project. To complete the acquisition TMR needs to exercise the option before the 30th of October to take control of the projects.

Permitting risk - the two projects TMR is acquiring are still at the application stage. While this is generally more of a formality, there is always a risk that the permits get rejected.

We are hoping TMR addresses all three of these risks between now and the acquisition being completed.

TMR’s maiden gold JORC resource - any week now?

The main reason we are Invested in TMR is still for its Canadian gold project.

TMR’s project has in the past produced ~230,000 ounces of gold at grades of ~22g/t.

TMR now has:

1) Existing processing infrastructure - TMR owns the existing Blackdome Mill which was responsible for ~230,000 ounces of gold production in the past. The plant can be refurbished to be ready for operations if TMR defines a large enough gold resource across its project.

(Source)

2) Maiden JORC resource on the way - At the moment TMR’s project has a historic resource totaling ~300,000 ounces of gold. In July TMR advised that its maiden JORC resource should be released by September.

3) Exploration upside - TMR has plenty of undrilled targets it can explore for more gold.

TMR’s strategy had always been to try to make enough new discoveries to warrant getting its project back into production.

The first step in that process is to get a maiden JORC resource for the project which will form the base for any restart of its mill.

TMR getting back into production forms the basis for our Big Bet which is as follows:

Our TMR ‘Big Bet’

“TMR becomes a gold producer following the discovery of enough new gold sources to justify the restart of its onsite gold mill.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done and many risks involved - some of which we list in our TMR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor TMR’s progress since we first Invested and to track how the company is doing relative to our “Big Bet”, we maintain the following TMR “Progress Tracker”:

Tempus Resources

ASX:TMR

What’s next for TMR?

Maiden JORC resource at Canadian gold project 🔄

According to a July announcement, TMR’s JORC gold resource should be out this month, and so we expect to see news from the gold project in the coming weeks.

TMR’s maiden resource estimate is one of the key remaining objectives of our current TMR Investment Memo and the key piece of news we have been waiting for since the company completed its 2022 drill program.

We did a deep dive on what we want to see from the resource in our last TMR note which you can read here: Looking ahead to the maiden JORC resource estimate.

Our expectations for the resource are as follows:

- Bull case = >300k oz of gold

- Base case = 100-300k oz of gold

- Bear case = <100k oz of gold

Deal completion for new lithium projects 🔄

TMR has until the 30th of October 2023 to make a call on whether to proceed with the acquisition.

In the short term this will be the next bit of newsflow we are waiting for on the lithium front.

Our 2022 TMR Investment Memo

Click here for our TMR Investment Memo, where you can find the following:

- Key objectives we want to see TMR achieve

- Why we are Invested in TMR

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.