Nelson commissions second drill rig to test Tropicana territory

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Nelson Resources Limited (ASX:NES) has provided a drilling update for its Woodline Project in the Fraser Range, Western Australia.

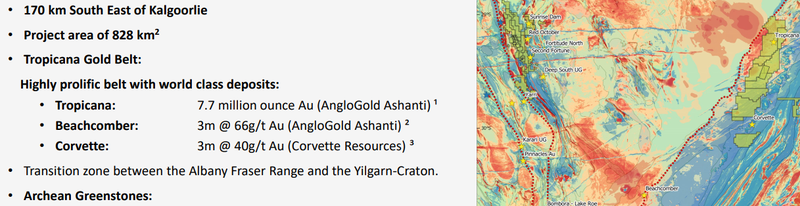

The project lies on the boundary of the Albany Fraser Oregon and the Norseman - Wiluna Greenstone belt in Western Australia.

The area encompasses 45 kilometres of the Cundeelee Shear Zone which already consists of a known +20 kilometre gold geochemical and bedrock anomaly, hosted in the same geological structural setting as the 7.7 million ounce Tropicana Gold mine.

Nelson’s significant and unique holding is within the confluence of the Keith-Kilkenny Fault / the Claypan Shear Zone and the Cundeelee Shear Zone.

These three shears have hosted many of the largest gold projects in Western Australia.

Consequently, there is much anticipation regarding the group’s upcoming drilling program, and since Nelson announced that it had raised $2 million to advance’s exploration projects in January, the company’s shares have increased by about 25%, striking a 12 month high of 12.5 cents in early February.

Diamond drilling to follow up reverse circulation program

Management has commissioned its second drilling rig (RC) to complement its currently operating diamond drilling rig.

The current 68-hole 6068 metre RC program is designed to test the interpreted dip and strike of potential gold-bearing structures identified in the course of historical RC drilling by Sipa/Newmont.

These structures are currently being tested by the company with a 1000 metre to 1500 metre diamond drilling program.

Initial diamond drilling and RC samples are planned to be with SGS laboratory late next week.

Nelson is benefiting from having its own drilling capabilities as this not only reduces exploration costs, but it also expedites the drilling program.

Given that diamond drilling and RC samples will be undergoing analysis in about a week’s time, it won’t be long before assay results are released, an event that could provide share price momentum.

In the following video NES CEO Adam Schofield speaks with Proactive Investor on site at Woodline about the drilling program:

The combined diamond and RC program is designed to further test the gold potential of the company’s Socrates, West Socrates, East Socrates, Grindall and Redmill projects.

The Grindall and Redmill projects sit within a 20 kilometre gold geochemical anomaly that is positioned in the hanging wall of the Albany Fraser Oregon.

Importantly, the Tropicana Gold mine is in the same structural geological setting.

Commenting on the start of this RC drilling program and highlighting the benefits of the group’s internal drilling capabilities, Nelson’s chief executive, Adam Schofield said, "Nelson’s start to this RC Drilling program is a significant progression for the company.

"The 6000 metre RC program is an effective way for us to test the dip and strike of potential gold-bearing structures identified in historic RC drilling.

"I am extremely proud of the concerted three-month effort the Nelson team has made in getting our drilling division fully operational.

"Having this internal drilling capability affords us significant flexibility and cost savings in the future. ‘

"We look forward to delivering multiple RC and diamond drilling programs in the next 12 months, ongoing news flow and value to our shareholders.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.