Los Cerros responds positively to COVID-19 challenges

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Los Cerros Limited (ASX:LCL) has updated the market in relation to its recent capital raising, as well as explaining a Strategic Partnership Agreement currently under negotiation.

The company acknowledged the rapid and unexpected deterioration in global equity markets, due largely to the COVID-19 pandemic, and the resultant negative impact this has had on the Los Cerros share price.

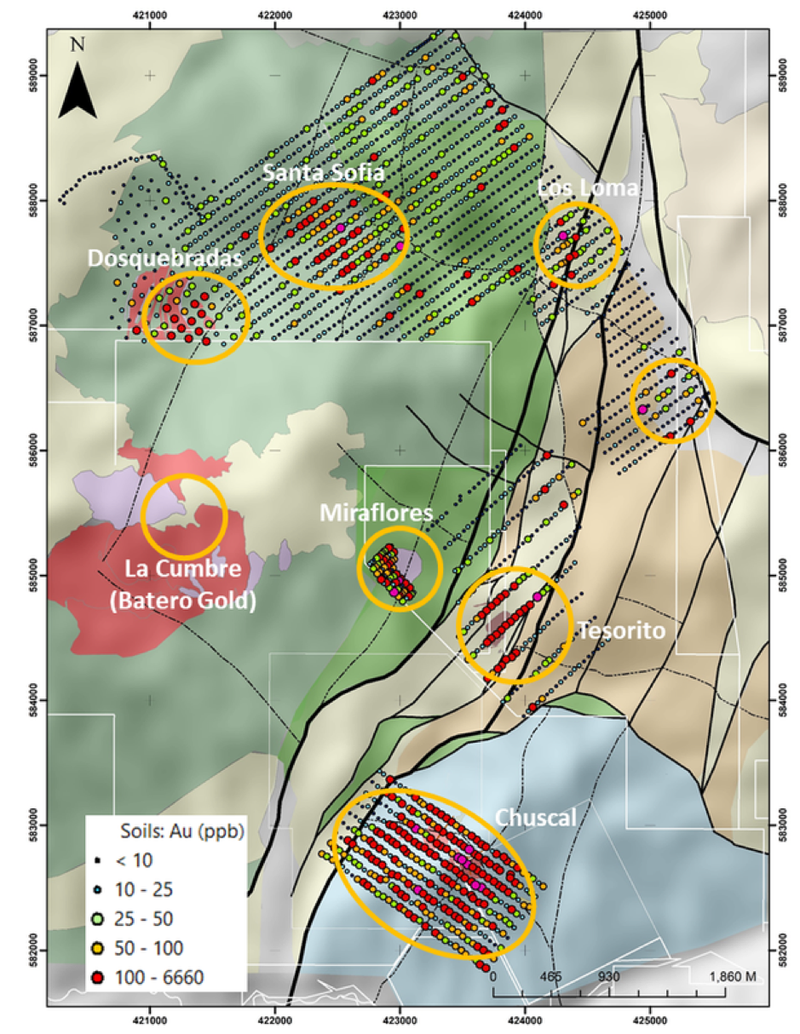

While there are obvious challenges ahead, Los Cerros started the year on a good note, as recently as late February announcing that the total JORC resource at its Dosquebradas gold deposit now stands at 1.3 million ounces gold, including a JORC Reserve of 457,000 ounces.

Dosquebradas is one of three gold porphyry systems within three kilometres from the established gold resource of 877,000 ounces at the company’s Miraflores deposit that forms part of the Los Cerros’ Quinchia Project in the prolific Mid-Cauca porphyry belt of Colombia.

The project could be enhanced if strategic partnership negotiations are successful.

Strategic Partnership Negotiations

In encouraging news, Los Cerros advised that it is in advanced stages of negotiating a Strategic Partnership Agreement (SPA) for the provision of IP survey services, drilling services, drilling equipment, personnel and consumables with Hong Kong Ausino Investment Limited.

Under the SPA, Ausino will provide equipment and services to the company.

Final terms are currently being negotiated, but investors are cautioned that there is no guarantee that terms will successfully be concluded.

Ausino is controlled by Dr Minlu Fu, who was a significant participant in Los Ceros’ recent capital raise. Ausino is heavily involved in the $69 million capped Tietto Minerals (ASX: TIE), a great and rapidly developing story in the Ivory Coast.

Upon completion of the Placement, Dr Fu is expected to be one of Los Cerros’ largest shareholders, with an interest of approximately 10.3%.

The key driver for seeking the SPA is to assist the company in driving down its in-country exploration costs, and to improve efficiencies.

In commenting on these recent developments managing director Jason Stribinskis said, “We thank our shareholders who have supported this placement and welcome new investors to our register, in particular our new cornerstone investor Dr Minlu Fu.

“Dr Fu’s geological and geophysical expertise will be invaluable to Los Cerros as we seek to improve our drill targeting to vector in on potentially large scale mineralised gold-copper systems at Chuscal and Tesorito.

‘’This is a great show of faith in the potential of our exploration prospects, and we look forward to building a long-term and mutually beneficial relationship with Dr Fu and his services company which is expected to help drive significant efficiencies in our future drilling programmes in Colombia.’’

Minlu Fu has experience with high profile copper-gold projects

Dr Fu is a highly accomplished geologist who received his PhD from La Trobe University in 1989.

From 1987 to 2000, Dr Fu worked for Western Mining Corporation in Australia and China as a research geologist, senior research geologist, and exploration manager.

He assisted in the discovery of the Tampakan copper gold deposit (Philippines), the Ernest Henry copper‐gold deposit (Queensland) and the West Musgrave nickel deposit (South Australia).

Notably, Ernest Henry is one of Australia’s largest, long-life, low-cost copper-gold projects.

In recent years Dr Fu has also been instrumental in the discovery of the Jinxi‐Yelmand epithermal gold deposit, the Huangtupo VSM copper, zinc, gold and silver deposit, the Jinhe copper‐gold deposit, the South copper‐gold deposit and the Huangtan volcanogenic gold deposit, all of which are based in Xinjiang -PRC.

More details of the placement

On 5 February, 2020, Los Cerros announced a capital raising via a placement at 4 cents per share, and in executing this, a Share Purchase Plan (SPP) was completed on 7 February.

Both the placement and the SPP included the issue of one option for every two shares subscribed exercisable at 10 cents.

The Placement will raise up to $2.125 million in aggregate before costs.

Tranche 1 has already completed and raised approximately $997,500 before costs.

Los Cerros has received binding commitments to raise $1.127 million under Tranche 2, including $125,000 from directors of the company.

To date over $600,000 in funds under Tranche 2 have been received, a strong response given challenging market conditions.

The balance of the Tranche 2 Placement is expected to conclude shortly.

Additional unquoted options issued to placement participants

To assist in the completion of the Tranche 2 placement, the Board has resolved to issue additional unquoted options to all Placement participants for every two shares subscribed in the Placement.

The issue of up to 26,562,500 options will have an exercise price of $0.02 each and expiry date of [two years from the date of issue] (Additional Placement Options) providing the Company with $531,250 if all the Additional Placement Options are exercised.

The issue of up to 25,000,000 of additional placement options will be issued from the company’s ASX Listing Rule 7.1 capacity, and these will be issued to participants in both Tranche 1 and Tranche 2 of the placement as a sign of goodwill from the company and a measure of gratitude to investors for providing the capital during very difficult times in the market.

The funds raised will allow the company to continue to move forward with its plans.

Los Cerros also raised $352,000 from the SPP that closed on 27 February on the same terms as the Placement.

Management is investigating how to extend a similar benefit provided to the Placement participants to the SPP participants.

Reduction in Corporate Overheads & COVID-19 Response

The uncertain economic climate arising from the spread of COVID-19 has led Los Cerros to implement a series of measures aimed at protecting the health and safety of its people, contractors and the communities in which it operates.

Whilst ensuring operational and financial integrity, these measures have included eliminating non-essential travel (international and domestic), encouraging personnel to work remotely where possible, and reducing discretionary expenditure.

Management noted that Los Cerros is fortunate to have recently completed its significant drilling and other field activities, which has meant the impact on its business to date has been modest.

While fieldwork is on hold, Los Cerros’ geological team remain active in planning the next phases of exploration at the Chuscal, Tesorito and Miraflores project areas.

Drilling is due to commence early in the second half of 2020, subject to the progress of the COVID-19 pandemic.

Management has undertaken a review of all expenditure and, where possible, taken immediate action to reduce overheads to preserve cash, and ensure the company is well placed to continue with its activities once confidence is restored in global financial markets.

On this note, Stirbinskis said, “These are extremely challenging times.

‘’The company has recently raised funds which de-risks our immediate future and, in addition, I would like to thank our major suppliers and the entire LCL team for making and finding savings to significantly reduce our monthly expenditure and to focus on immediate, essential and value adding activity.

‘’The company’s primary concern is to ensure the health and safety of its people, and we will continue to monitor the COVID-19 situation carefully.’’

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.