Latin Resources affiliate company to acquire Chile Copper Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

On Friday, Latin Resources Limited (ASX:LRS) announced its Canadian affiliate company Westminster Resources Limited (TSX-V: WMR) has entered into an agreement to acquire a copper project in Chile.

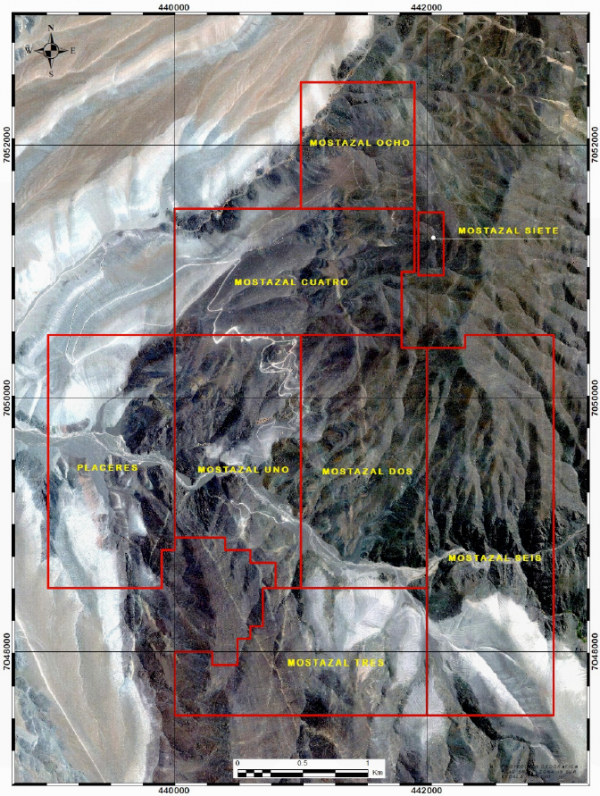

Westminster is to acquire from a private vendor a 100% interest in the 16-square kilometre Mostazal copper property located in the Atacama region of Chile, 80 kilometres northeast of Copiapo.

The Atacama Desert is among the richest copper regions on earth, hosting some of the world’s most significant porphyry copper deposits.

The Mostazal copper property is situated within the 500-kilometre long, north-south trending Domeyko Fault System, the major structural control for the majority of Chile’s largest copper mines including Escondida (BHP, Rio Tinto), Chuquicamata and the El Salvador mine (Codelco).

Along with this, known copper mineralization occurs in a series of stacked stratified lenses measuring 2.5km long by 2km wide and 300m deep.

Reported historical production of 120,000 tons processed with average grade of 1.8% Cu, and high quality geophysical targets support thesis that near-surface, copper mineralization may be a distal expression of a much larger porphyry deposit at depth.

Westminster President and CEO Jason Cubitt said: “We set out to secure an asset that was both transformative to the Company and complimentary to our current portfolio and I believe we’ve achieved this.”

“It’s rare to find a property in this jurisdiction with a technical feature set that so clearly describes a copper porphyry target – yet remains untested by drilling. And with the potential to resume and expand upon historic production this was indeed an opportunity we couldn’t turn down.”

Latin Resources Ltd is the largest Shareholder of TSX listed Company Westminster Resources Limited.

Latin Resources became the largest shareholder of Westminster after selling its Peruvian Copper assets in 2018.

The objective of the sale of the Projects was to secure material tangible value for Latin’s shareholders through Westminster’s expertise in South American copper. Latin currently owns 5,238,158 shares in Westminster or 27% of the issued Capital.

About Latin Resources

Latin Resources Limited is an Australian-based mineral exploration company with several mineral resource projects in Latin America and Australia. The Australian projects include the Yarara gold project in the NSW Lachlan Fold belt, Noombenberry Halloysite Project near Merredin, WA, and the Big Grey Project in the Paterson region, WA.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.