Latin Resources’ halloysite samples continue to shine

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Latin Resources Limited (ASX:LRS) has released a second batch of results from its 100% owned Noombenberry Project that has continued to show bright to ultra-bright kaolinite and high-grade halloysite with individual composite sample grades of up to 23% halloysite/87 ISO-B Brightness.

This builds on news released just a fortnight ago when the company advised the market that ‘’Exceptional results had been received from four grab/float samples collected as a part of a reconnaissance exercise in consultation with the landholder at the company’s 100% owned Noombenberry Halloysite Project in Western Australia.’’

It was noted at the time that results from the first 100 samples submitted by LRS for test work had confirmed that the project contained very high-grade halloysite with individual composite sample grades of up to 37% halloysite contained within the bright white (>75 ISO-B) to ultra-bright white (>84 IOS-B) kaolinite at Noombenberry.

Consequently, these latest results serve as further confirmation that the group could be in a position to significantly expand what is now shaping up as a highly promising resource.

On this note, Latin Resources executive director Chris Gale said, “We are extremely pleased to see our initial results mirrored in this next batch of results from our test work.

"We now have results for over 50 of our 197 holes drilled at Noombenberry, and we are seeing continuity and consistency of the high-grade halloysite and bright to ultra-bright white kaolinite.

"This is shaping up to be a very large and more importantly, a high-quality deposit that we expect will command strong attention from potential end-users."Work is well underway on building our geological wireframes, so that we can be ready to commence the resource estimate as soon as all of our test work results have been received.

"The team is focused on fast-tracking this process, as well as looking toward the next phase of drilling to extend our coverage to the north, where our initial results show the mineralisation remains open.”

Further drilling followed by resource estimate and potential offtake deals

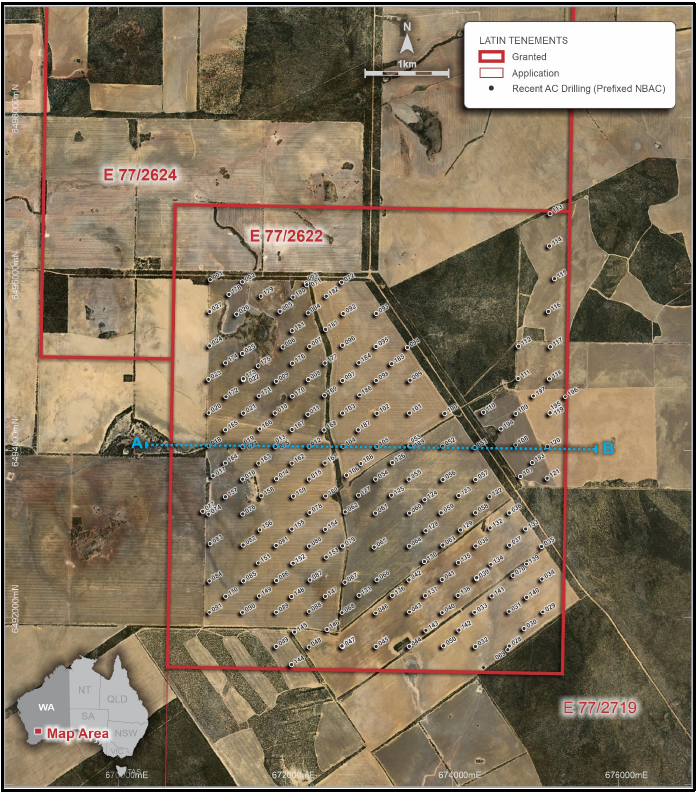

Management plans to re-commence drilling once all statutory approvals have been received to extend the current drill coverage into its adjacent 100% owned tenement E77/2624 (see below), where these initial results show the bright-white kaolin and high-grade halloysite mineralisation is open to the north.

Latin has formally engaged an independent consulting group to undertake a maiden JORC resource estimate for the Noombenberry Project mineralisation.

The company’s geological team is working closely with the consultant group with geological domaining and construction of the wireframe model underway.

This precursor work will enable the fast-tracking of the estimation process once all test work results have been received.

Management said that it is already receiving enquiries from potential offtake partners and the company will continue to progress these discussions as it gains a better appreciation of the scale and characteristics of the Halloysite project.

Shares in Latin Resources have surged in the last 12 months, more than doubling to yesterday’s closing price of 6.2 cents.

However, today’s positive news along with near-term catalysts such as further exploration results, the award of permitting agreements and developments regarding offtake agreements have the potential to provide substantial share price momentum.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.