Investors flock to Tempus on release of drilling data

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Tempus Resources Ltd (ASX:TMR) surged more than 60% on Monday morning after the company released historical drilling data from its Mineral Creek Property, located in British Columbia, Canada.

These included a wide bonanza grade return of 7.2 metres at 159 g/t gold from 64 metres, including 4.5 metres at 253.6 g/t gold.

Strong grades were also delineated at depth, including 1 metre at 74.5 g/t gold from 82 metres and 5.3 metres at 13.1 g/t gold from 92 metres.

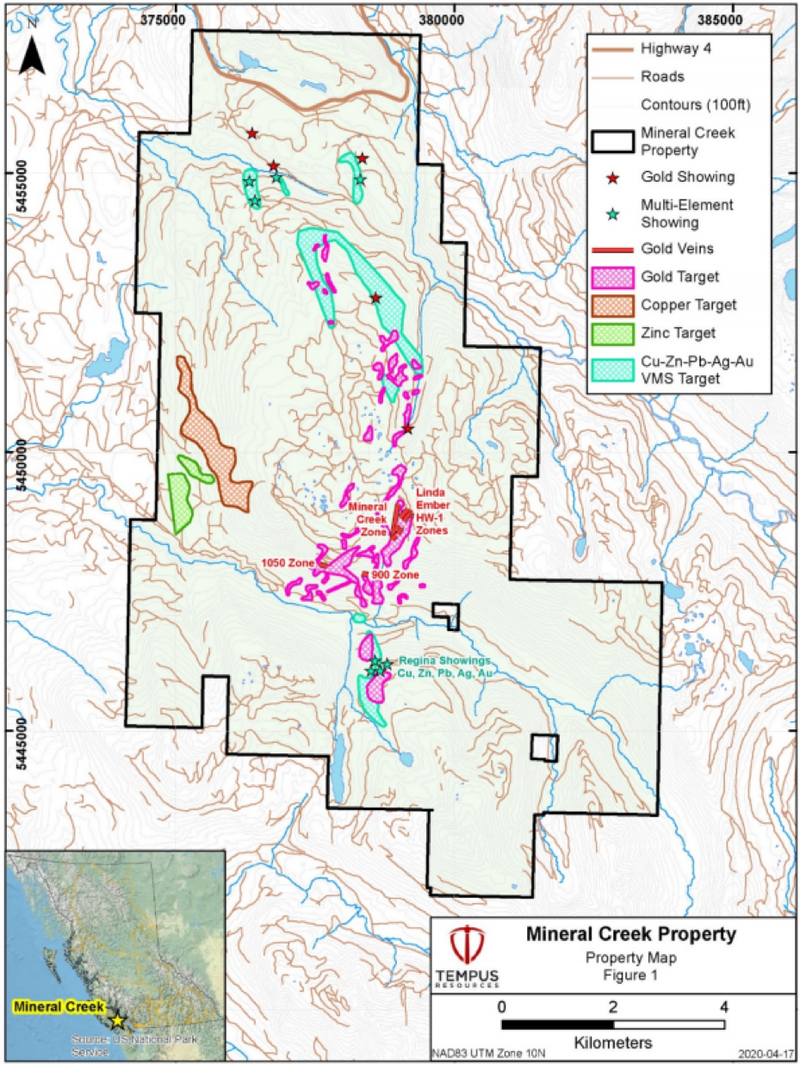

As shown below, the Mineral Creek Gold Property is located on Vancouver Island, British Columbia, approximately 10 kilometres east of the town of Port Alberni. Tempus recently announced it would accelerate its exploration program here.

The property was acquired by Tempus together with the Blackdome-Elizabeth Gold Project last year, and it consists of 42 contiguous mineral claims totalling nearly 9900 hectares.

All 42 mineral claims are owned 100% by Tempus subsidiary Sona Resources, and have no underlying royalties.

The property is readily accessible by an extensive network of all-season logging roads.

Mineral Creek has a long history of gold mining, dating back to the late 1800’s where placer gold was mined from Mineral Creek and China Creek, and from several adits along the Mineral Creek Fault Zone, where gold was mined from high grade gold-quartz veins.

In the 1980s approximately 50,000 metres of diamond drilling was completed on the property, and while this data has been compiled it hasn’t been reported given lower reliability and the subsequent need for further field validation.

Six zones of high-grade gold

Drilling in the 1980s focused on the volcanogenic massive sulphide (VMS) and gold mineralisation potential.

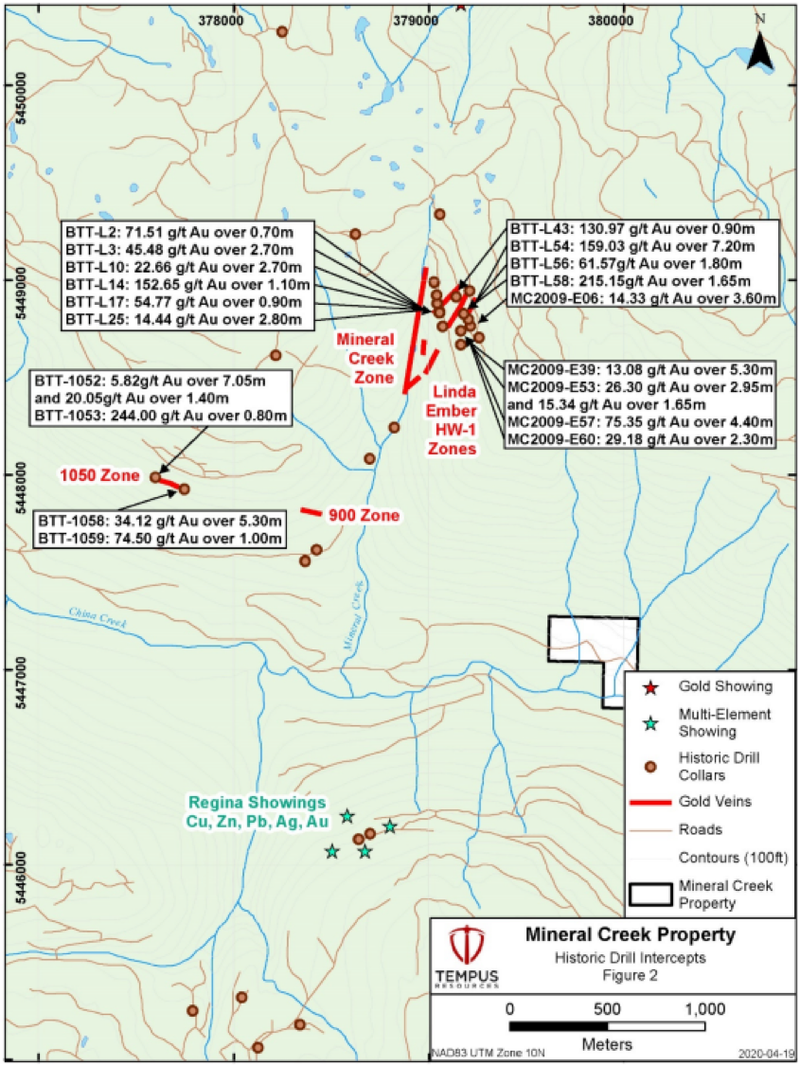

The second physical exploration phase came in the 2000s when a total of 216 diamond drillholes for 37,500 metres was completed on the property, identifying 6 gold zones (Linda, Ember, 1050, 900, Gap and Big Southeaster).

As indicated below, these included the bonanza grade results we referred to earlier, which more specifically was returned from the Linda zone (up to 7.2 metres at 159 g/t gold).

Gold grading up to 75.25 g/t was delineated in a 4.4 metre intersection at Ember.

Drilling at 1050 identified a 0.8 metre zone grading 244.00 g/t.

The Mineral Creek Property’s predominant geological structure is the north-south trending Mineral Creek Fault Zone that hosts the Mineral Creek Gold Zone.

Within this zone, there are several narrow quartz vein splays off the Mineral Creek Fault that have been known to return bonanza-grade gold assay values.

Many of these splays remain underexplored with significant strike potential.

Further field assessment and sampling programs at Mineral Creek are being planned as part of the upcoming field season, set to commence in the coming weeks at Blackdome-Elizabeth.

Management’s primary focus in British Columbia is its larger, more advanced and also high-grade Blackdome-Elizabeth Gold Project.

However, given the outcomes of this review, Tempus plans to allocate further resources to advancing the Mineral Creek Property.

Compilation of a consolidated database is in progress, which will be used to generate mineralisation models to assist in the planning of new drilling programs.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.