GTI Resources to benefit from aggressive drilling campaign

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

GTI Resources Ltd (ASX:GTR) recently informed the market that it had received encouraging assay results from the recently completed second auger soil sampling program at the company’s Niagara Gold Project.

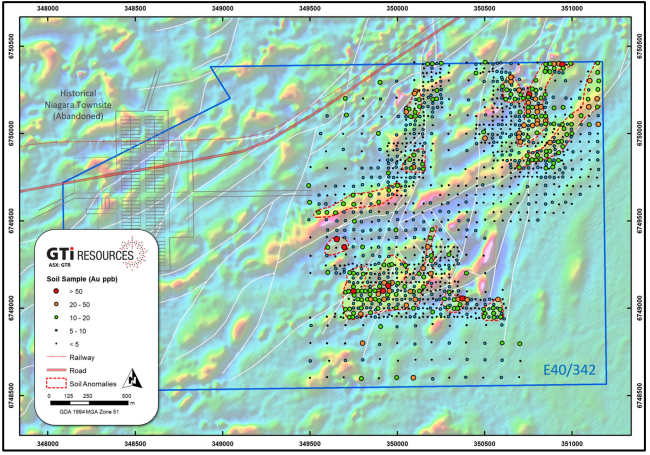

The follow-up soil sampling campaign identified five promising new gold in soil anomalies in addition to the previously defined three anomalies within exploration licence E40/342.

A total of 1,000 new soil samples and an additional 41 QAQC samples, were collected over the eastern part of exploration licence E40/342 on 50 x 50-metre and 25 x 25-metre grids.

The results confirmed several new gold anomalies that are coincident with the interpreted magnetic structures, including a 500-metre long by 100-metre wide anomaly above 10 parts per billion gold contour, up to a peak of 79 ppb, in the north-eastern corner of the licence that lies on a similar orientation to other known gold mineralisation within the Niagara-Kookynie district.

This program is the next step in GTR’s rapid evaluation of the potential for economic gold mineralisation across the newly consolidated and historically under-explored Niagara Trend in WA’s highly prospective eastern goldfields.

The project is located within the central part of the Norseman‐Wiluna greenstone belt and numerous historical workings occur within and to the north of the project area, with a number of major historical mines located in the immediate vicinity of Kookynie, including the Cosmopolitan Mine which produced approximately 360,000 ounces of gold at an average grade of 15 g/t gold from 1895 to 1922.

A fine time to accelerate exploration

It would be highly beneficial for GTR given the current Australian dollar gold price if this accelerated and extensive exploration campaign were to shape the way for a swift move to early-stage production.

While some corners of the investment community are focusing on gold’s retracement from about US$1950 per ounce to US$1860 per ounce over the last month, what appears to have gone unnoticed is the sharp depreciation of the Australian dollar against the US dollar that has occurred in the last week.

If we look at the last few weeks in isolation, the Australian dollar gold price was $2667 per ounce on 17 September when the price was US$1950 per ounce.

As we write, the gold price has rebounded in the last 24 hours to hit US$1890 per ounce, and with the Australian dollar sitting at US$0.707 the Australian dollar gold price is $2673 per ounce, implying a slight premium to the US dollar price that prevailed on 17 September.

The average operating production costs are in the vicinity of about $1350 per ounce, implying a hefty margin of about $1300 per ounce at current spot rates.

Consequently, GTR is very much a right place/right time story, particularly given the region’s history of yielding high-grade mineralisation that can significantly drive down the cost of production.

60-hole aircore drilling program

The current 60-hole program of aircore drilling is underway and is expected to be completed by early October.

Initial aircore drilling progress has been promising with 15 holes completed for a total of 2,500 metres.

The current round of drilling is on track to be completed by early October with assay results anticipated by late October.

An RC rig is scheduled to start testing bedrock targets during late October following receipt of results from the current round of aircore drilling.

Consequently, multiple potential share price catalysts are imminent, particularly in relation to results from deeper reverse circulation drilling that should be received in November.

The retracement in the company’s shares over the last month or so is arguably a function of broader share market volatility and a tapering in the gold price.

With the latter not representing an issue for Australian gold miners, this may be an ideal time to snap up GTR at an attractive price.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.