GTI digging deep to follow historically defined mineralised trends

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

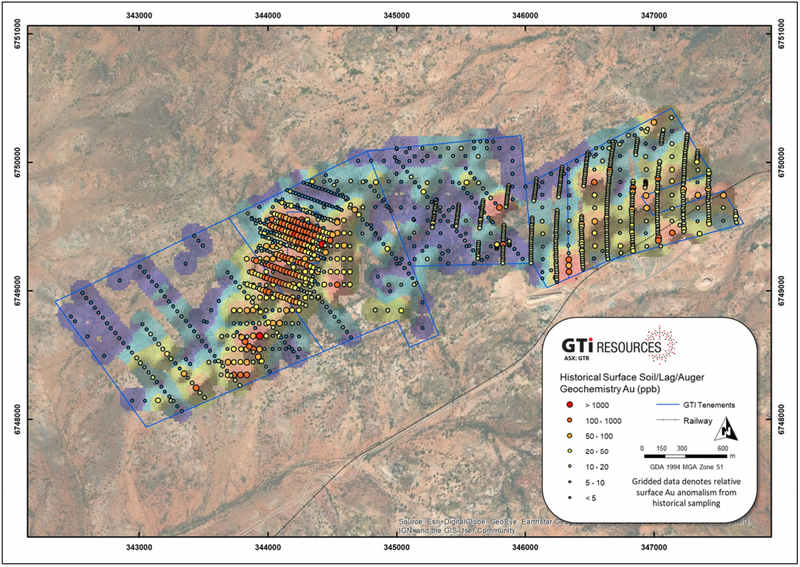

GTI Resources Ltd (ASX:GTR) has received an independent WAMEX compilation report, from CSA Global (CSA), assessing the historical gold production and exploration activity and potential prospectivity at the company’s newly granted prospecting licences, P40/1515, P40/1516, P40/1517 and P40/1506 and the recently acquired P40/1513 and P40/1518.

This contiguous land package over approximately five kilometres of mineralised trend now creates a significantly enlarged consolidated holding over extensive historic mine workings of the Niagara gold mining district.

The Niagara Project is located 6 kilometres south-west of Kookynie in the central goldfields of WA.

The project is within the central part of the Norseman-Wiluna Greenstone belt, and the geology of the area is characterised by large rafts of semi-continuous greenstone stratigraphy.

Numerous historical workings occur within and to the north of the project area, with a number of major historical mines located in the immediate vicinity of Kookynie, including the Cosmopolitan Propriety Ltd, which mined a total of around 630,000 tons of ore at an average grade of 15 g/t gold between 1897 and 1911 (Shire of Menzies, 2020), producing in excess of 300,000 ounces of gold.

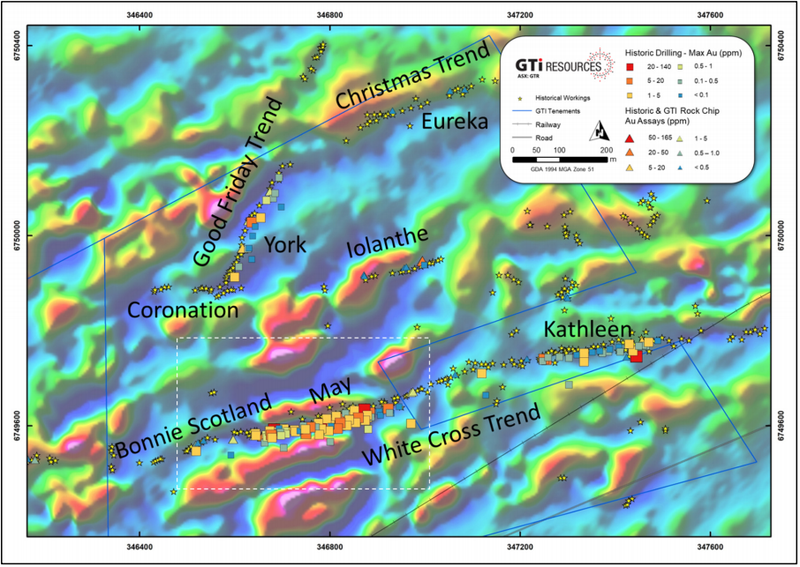

The tenements incorporate the historic White Cross and Perseverance mining areas and smaller historic working trends including the Christmas and Good Friday trends.

The Orion Trend extends east-north-east to the south of the tenements and hosts the historic Orion/Sapphire Mine.

The compilation report from CSA highlights the material past production and drilling which has occurred on the newly consolidated land package.

Commenting on these developments, Bruce Lane said, “The report from CSA has now pulled together all of the known historical information available for the newly consolidated land package and what the report reveals has exceeded our expectations in terms of the exciting gold potential of the ground.

"We are now evaluating our options to create shareholder value from the project as we prepare a plan and permits to properly test this historically heavily worked area using modern exploration techniques.”

Historic workings in the tenement package targeted high-grade quartz veins and were largely operated between 1898 and 1914 with reported production of 6800 tonnes at 25.8 g/t gold for 5100 ounces gold.

While most intersections were fairly narrow, some high grades were returned from shallow depths such as 2 metres at 70.5 g/t gold from 7 metres and 2 metres at 15.4 g/t gold from 10 metres.

Rock chip samples also featured high grades including 165 g/t gold from the White Cliffs area and 91.8 g/t gold from the Green Bullet area.

Management targeting mineralisation at depth and along strike

Extensive historic workings and reported high-grade production in the east of the project area represent an advanced exploration play.

More specifically, the project contains three high priority advanced exploration target areas, two secondary priority intermediate exploration target areas and three earlier stage third priority exploration target areas.

As historical drilling typically extended to a maximum depth of 50 metres, management intends to target deeper levels where known mineralisation exists, and along strike from established trends.

The mineralised trends that represent high‐priority, advanced exploration targets in the east of the project area are collectively up to 2.5 kilometres in length, including 1.6 kilometres of the White Cross trend from the May workings in the east to the Jarrahdale‐Spinaway workings in the west, 400 metres of the Good Friday trend, and 500 metres of the Christmas trend.

The central and western project areas represent earlier‐stage exploration targets with records of only limited but high‐grade historic production.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.