Drilling set to commence at Los Cerros’ Quinchia gold project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Los Cerros Limited (ASX:LCL) has today confirmed that its highly anticipated September quarter drilling campaign is on schedule to commence on 31 July.

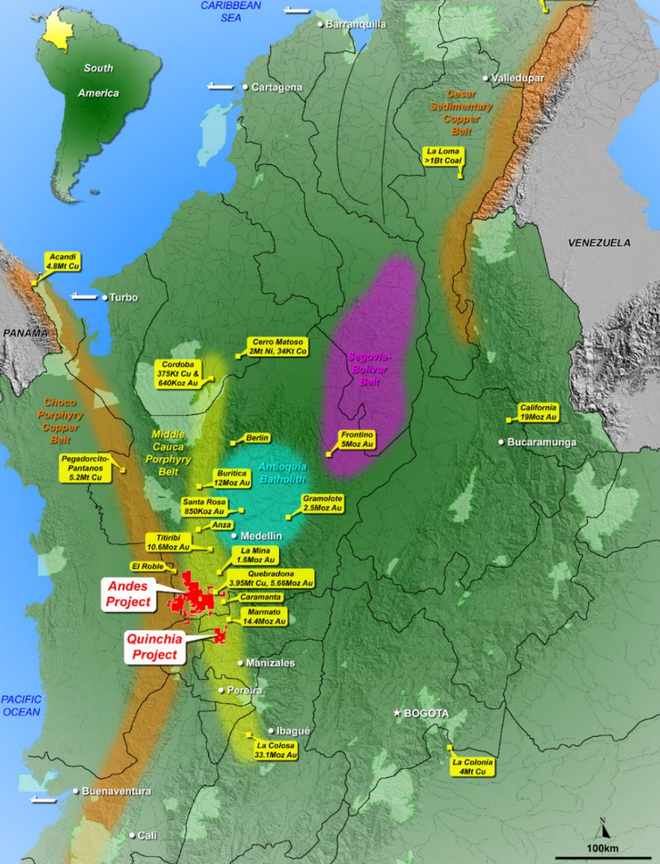

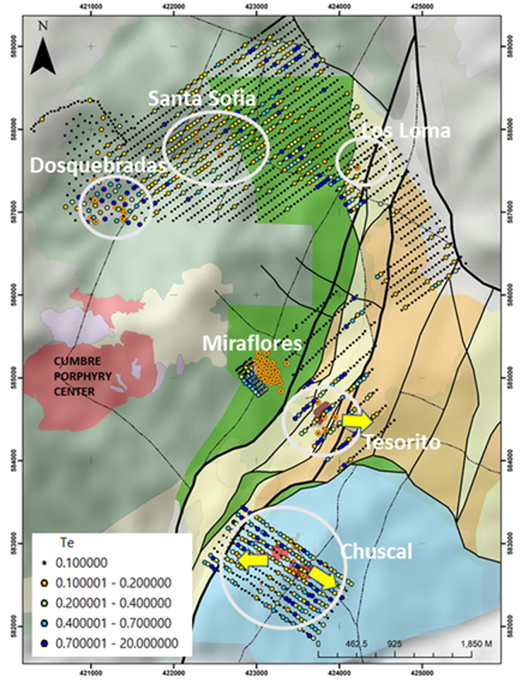

The diamond drilling program at the company’s Quinchia Gold Project in Colombia’s Mid-Cauca porphyry belt will span ~2500 metres and commence at the Tesorito porphyry, before moving to targets at Chuscal and Miraflores.

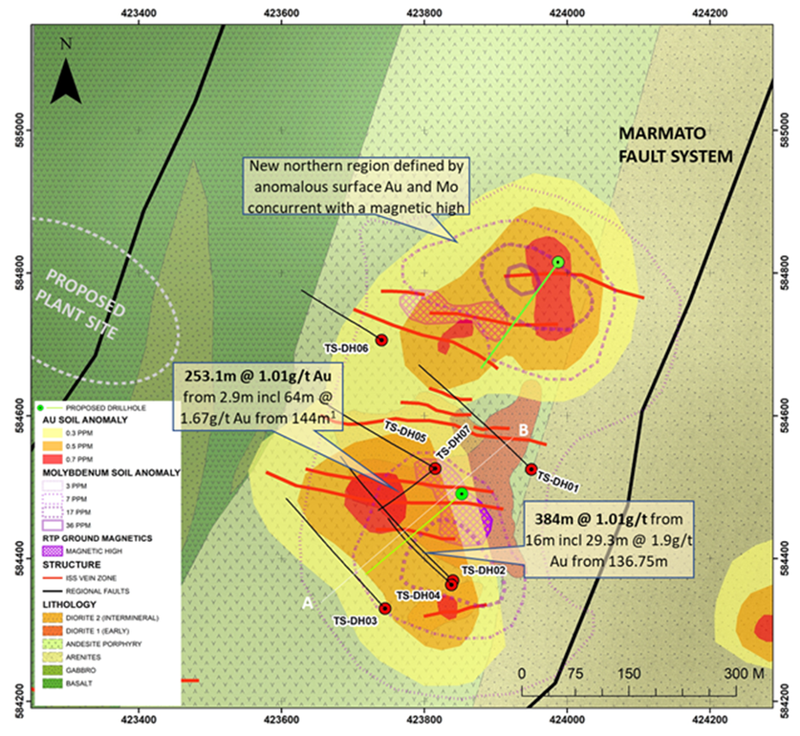

The first hole of the upcoming drill program is at Tesorito — an at surface gold mineralised porphyry system — and will further explore the southern anomalous zone that has already delivered impressive results.

Los Cerros is also developing its drilling strategy for the northern anomalous zone defined here by gold and strong molybdenum assays in soil over a magnetic high.

Previous drilling delineated broad widths of mineralisation

Tesorito was last drilled in late 2018 with all of the seven holes drilled to date intersecting porphyry-style gold mineralisation including impressive intercepts.

These included 253 metres at 1 g/t gold from 2.9 metres (TS-DH-07) and 384 metres at 1 g/t gold from 16 metres (TS-DH-02).

All drill holes tested the southern highest grade 250 metre x 250 metre region of an 800 metre long x 350 metre wide north north-east trending gold-molybdenum soil anomaly.

Recent infill soil sampling shows that the anomaly comprises two separate higher grade regions, with the northern region untested by drilling.

Both cores are broadly similar in size, with each corresponding to a magnetic high, overprinting east-west trending epithermal veining and porphyry-style alteration.

The northern core is poorly exposed but higher in gold and molybdenum values than the southern core.

The drill program will commence with testing the continuity of wide higher grade intersections in holes TS-DH-02 and TS-DH-07 (referenced above), and following that the company will test the newly defined northern gold-molybdenum soil geochemistry anomaly as outlined below.

Strategic agreement tempers exploration costs

Los Cerros struck a strategic agreement with Hong Kong-based Ausino to assist in funding its drilling campaign.

In April, the company executed a Strategic Partnership Agreement for the provision of IP survey services, drilling services, drilling equipment, personnel and consumables with Hong Kong Ausino Investment Limited.

The key driver for seeking the SPA is to assist Los Cerros in driving down its in-country exploration costs, maintain cash, improve efficiencies and facilitate significant drilling and IP programs.

Under the terms of the agreement, Ausino will provide a new, fit for purpose, diamond core drill rig, drill rods, consumables and extended after sale support in the form of expert senior drillers on site to build the company's internal capabilities.

Ausino will also provide two sets of specialist Induced Polarisation (IP) equipment and a specialist geophysics team to conduct IP surveys over targets within the company’s portfolio.

Forging the strategic partnership and bringing more exploration capability in-house will give Los Cerros a significant long term advantage.

On this note, managing director Jason Stribinskis said, “With full support from Ausino, the company has decided to commence drilling via a Colombian drilling services provider while we wait for our own equipment to arrive.

‘’The intention is to drill at least two circa 350 metre length diamond holes at Tesorito first and then, once we have our own rig and the efficiencies that should bring, we will tackle more targets across the Quinchia Gold Project.

‘’The encouraging work of our Colombian geologists and international consulting experts has generated a good number of exciting targets to be drill tested.

‘’The first two holes will provide additional geological data to fine tune several deeper porphyry targets”.

Tesorito just part of a bigger story

The Chuscal and Tesorito prospects are part of the larger Quinchia Gold Project which also comprises Miraflores, Dosquebradas and other established targets and untested areas of interest within a 7500 hectare parcel, as illustrated below.

The Miraflores Gold Deposit has an existing Resource of 877,000 ounces gold at 2.80 g/t gold and a Reserve of 457,000 ounces gold at 3.29 g/t gold.

In February, the company established a JORC Resource at the project’s Dosquebradas gold deposit of 1.3 million ounces gold including reserves of 457,000 ounces.

With further exploration success elsewhere within the Quinchia Gold Project, leveraging existing mine planning, plant design and approval status of Miraflores (Mining Authority approval of PTO (construction and operation plan), the ability to fast track towards gold production becomes a compelling opportunity.

Los Cerros lays strong platform in first half

It has been an impressive first half for Los Cerros with the company having received final tranche of assays from the 2019 Chuscal drilling program in February.

This consisted of four diamond holes, the first drilling to occur at the prospect.

The final hole of the drilling program intercepted regions of vein gold at depths predicted in the regional structural model, adding weight to the validity of the model for the distribution of epithermal vein related gold and silver.

Results included 8.0 metres at 1.65 g/t gold, just 8.0 metres below surface.

Such is the support for the company, and representing an acknowledgement of the quality of its assets, that global mining group AngloGold Ashanti (JSE:ANG | ASX:AGG) entered into a binding terms sheet, exchanging its Chuscal joint-venture interest for Los Cerros securities, effectively making it a 4.3% shareholder in the group.

Under the terms of the agreement, AngloGold Ashanti will have the right to increase its interest to 10%.

The agreement brought Los Cerros’ ownership of Chuscal to 100% and resulted in the company holding 100% of the entire Quinchia Project, of which Chuscal is a part.

Highlighting AngloGold Ashanti’s view of the broader region, the company now has exposure to the larger Quinchia Project and the enormous greenfield potential of the Andes Project, 70 kilometres to the north.

This represents a high profile endorsement given AngloGold Ashanti’s prolific record, having notched up more than 100 million ounces of gold resource discoveries.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.