LCL grabs all land surrounding 45.8% “nickel boulder”

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 9,755,814 LCL shares and staff own 14,285 LCL shares at the time of publishing this article. The Company has been engaged by LCL to share our commentary on the progress of our Investment in LCL over time.

It’s all coming together...

Nine months ago our Investment LCL Resources (ASX:LCL) first acquired its projects in Papua New Guinea.

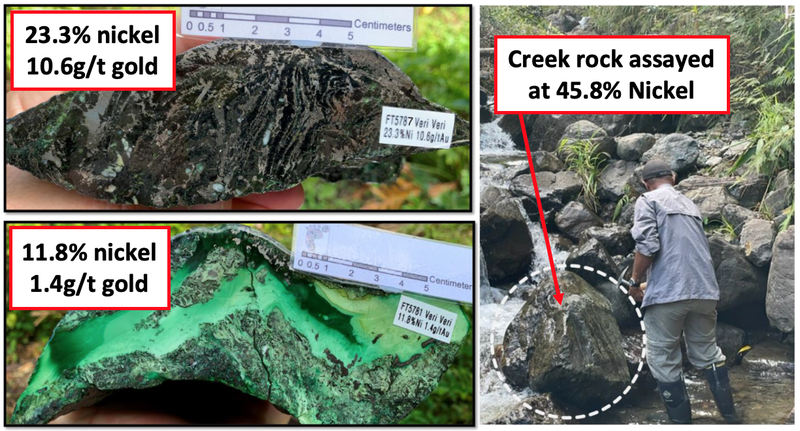

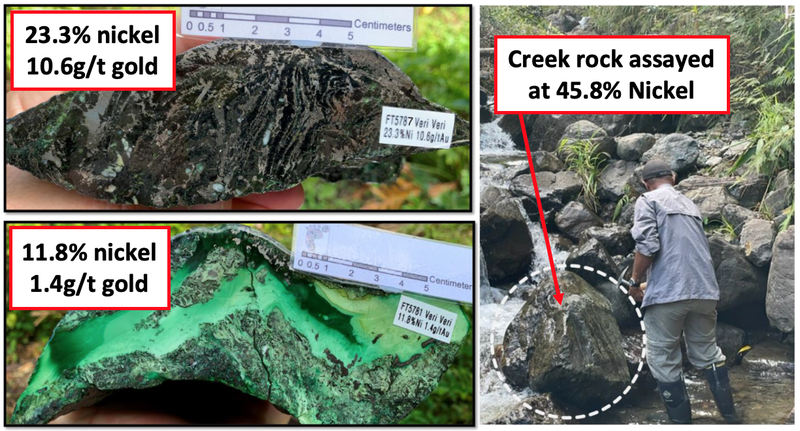

At the time the company had “nickel boulders” grading up to 45.8% nickel but didn’t know where the source was...

Then in July this year, LCL picked up more of these nickel boulders finding what it believes could be the source of the nickel - in situ outcropping nickel sulphides grading as high as 13.4%.

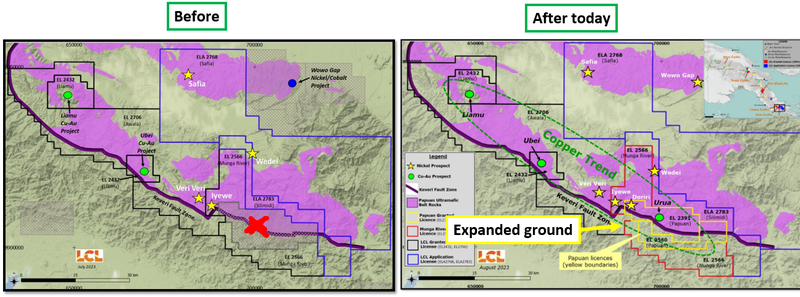

In the background, LCL went on a rampaging land consolidation spree acquiring all of the ground around these new nickel targets.

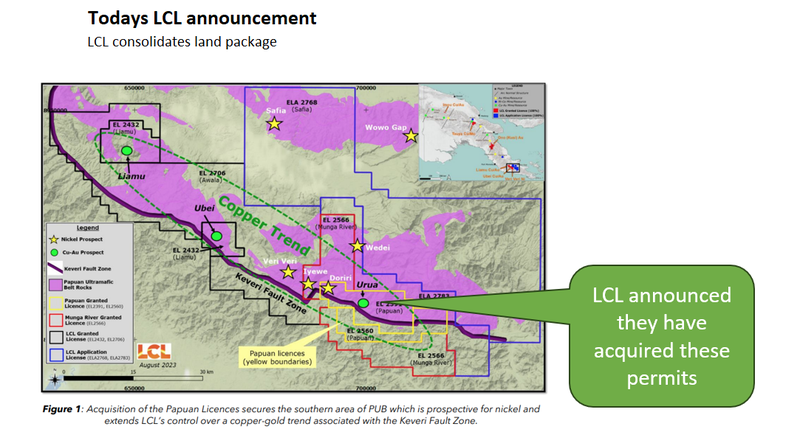

Today LCL acquired the last uncontrolled parcel of land surrounding its nickel project.

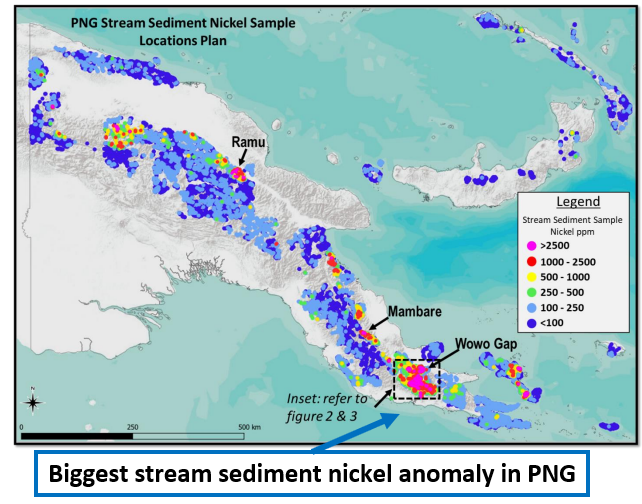

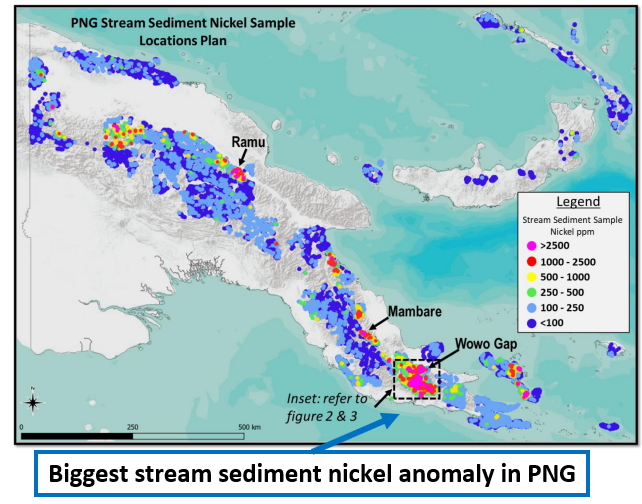

Now LCL holds ~3,400km^2 of ground around the biggest ‘stream sediment nickel anomaly’ in PNG.

And it hasn't even been drilled yet...

LCL seems to have sniffed out strong exploration targets and has quietly been acquiring and consolidating all the surrounding land...

LCL now has 100% control of 3,400 continuous square kms in the Papua Ultramafic Belt (the PUB).

LCL now holds the biggest stream sediment nickel anomaly in PNG.

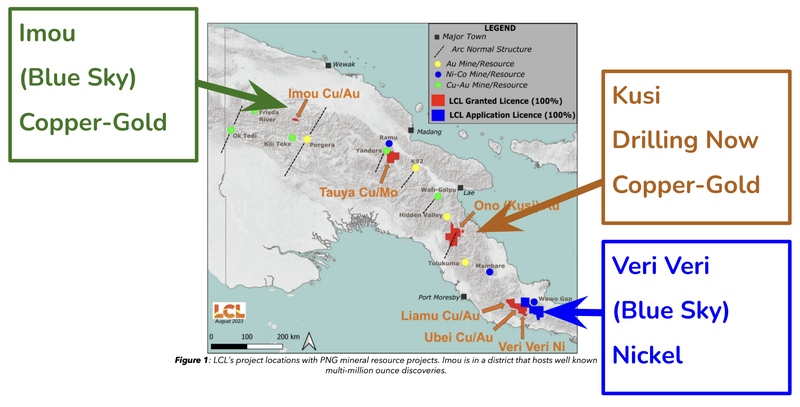

LCL is putting together a portfolio of PNG exploration prospects that are true “swing for the fence” style drill targets.

We like Investing in micro cap companies with drill exploration targets that have the potential to deliver company-making discoveries like the ones LCL is working on.

Micro cap Investing is high risk, and so when making Investments we are always looking for companies that have the potential to deliver outsized returns.

Explorers with that type potential need a good balance of blue sky exploration prospects and established well defined discoveries that give the company a fundamental value which limits risk to the downside.

We think LCL is one of those companies with the right balance of company making exploration targets and well-established gold projects with existing JORC resources.

LCL is capped at $24.6M, and had $5.8M in cash in the bank at 30 June 2023, which equates to an enterprise value of $18.8M.

Right now, LCL has over 2.6 million ounces of gold resources in Colombia.

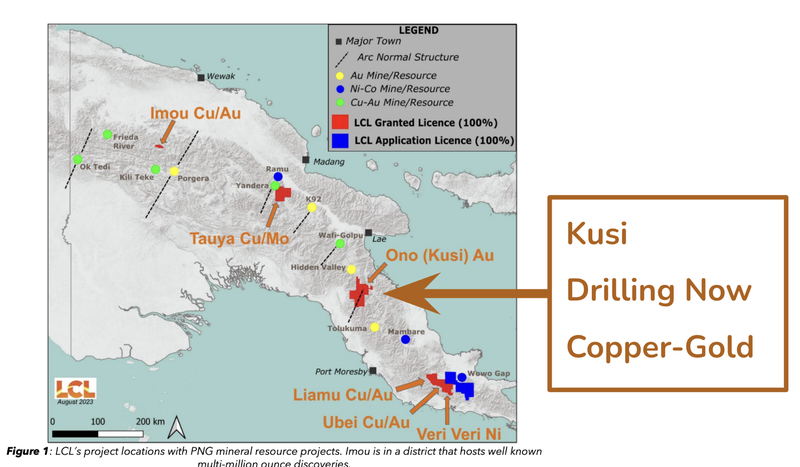

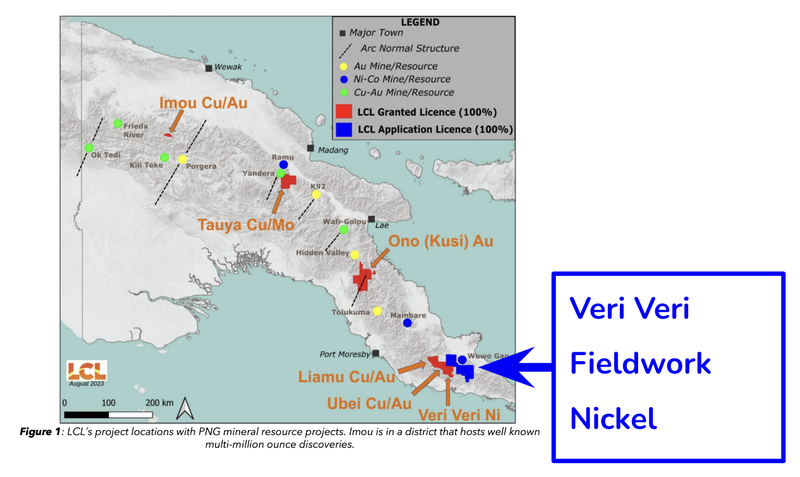

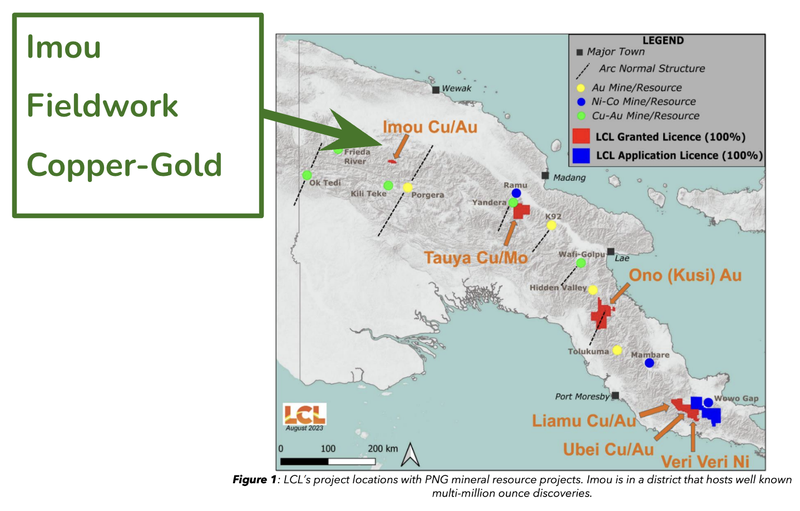

In Papua New Guinea, LCL has an existing gold-copper project it is drilling right now, and multiple blue-sky nickel-copper-gold exploration targets.

Over the last ~9 months, since acquiring its PNG projects, LCL has:

1) Drilled its Kusi gold-copper project - LCL is seven holes into an 18-hole drill program at Kusi. Here LCL is hoping to define a multi million ounce gold-copper JORC resource.

2) Defined the biggest stream sediment nickel anomaly in PNG - LCL found the source rock to the nickel sulphide boulders at its Veri Veri project. Immediately after, LCL consolidated all the neighbouring prospective ground in that region. After today, LCL holds all the ground covering the target.

3) Defined multiple “company making” copper-gold porphyry targets - Earlier this week, LCL made progress at one of those targets (Imou), which sits in the same neighbourhood as one of the world’s biggest undeveloped open-pit copper-gold projects - Frieda River.

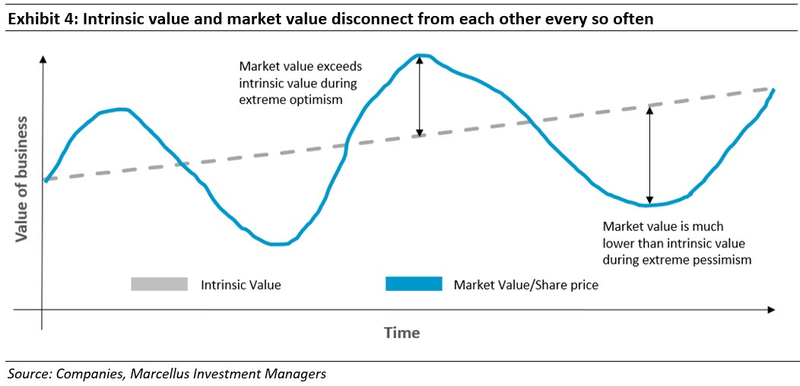

Why we like LCL’s approach to operating in a rough market

We have been Investing in micro cap companies for decades and every time a rough market rolls around, company shares get sold down.

Unlike the bigger companies on the ASX, which see buying from index funds and algorithms, small cap stocks are more prone to the laws of supply and demand.

When there are more sellers than buyers, liquidity disappears and any attempts to sell even the smallest positions lead to large falls in share prices.

Almost always, periods of low liquidity lead to small cap valuations getting to levels that sometimes go below the value of a company’s existing projects.

We think LCL fits this bill right now.

LCL’s Colombian projects have existing gold JORC resources of 2.6 million ounces.

In PNG, LCL has its Kusi gold-copper project which keeps delivering strong gold-copper hits.

AND on top of all of that, LCL holds exploration targets that investors would want to see get drilled in a bull market.

We think that ultimately, market sentiment will improve (we don't exactly know when though - no one does) and especially in the copper-nickel-gold space:

- Copper because it's one of the most underappreciated metals for the electrification revolution and one of the metals predicted to be in shortage later this decade.

- Nickel again because of its use in electric vehicle batteries and a lack of discoveries leading to supply shortages.

- Gold because it's one of the most out of favour sectors in the market right now despite near all time high gold prices.

With LCL holding giant nickel-copper-gold exploration targets and existing discoveries, we think the company is positioning itself as a good exposure to all three commodities when sentiment improves.

Instead of going slow and doing nothing in a rough market, LCL is putting together high priority exploration targets AND drilling out its Kusi gold-copper project.

Blue sky exploration, backed by existing projects:

Here’s a snapshot of LCL’s main projects right now:

LCL also has a couple of other copper-gold projects in the area including Liamu and Ubei, which could emerge as potential projects to develop at a later stage.

While high risk exploration may be out of favour right now, when discoveries are made, share prices are rewarded by significant re-rates.

Eventually, we think the market will turn, and companies with blue sky exploration potential chasing discoveries will get re-rated IF they are able to deliver discoveries.

When that time comes, we think companies like LCL will be the ones to outperform in our Portfolio.

Exploration success forms the basis for our LCL Big Bet, which is as follows:

Our LCL Big Bet

“LCL to deliver a 1,000% return off exploration success on its PNG gold, copper, nickel projects OR from developing its advanced gold project in Colombia”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our LCL Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor the progress LCL has made since it acquired its PNG assets and how the company is doing relative to our “Big Bet”, we maintain the following LCL “Progress Tracker”:

LCL’s PNG nickel target

After today’s news, LCL holds the biggest undrilled stream sediment nickel anomaly inside PNG.

The project now covers ~3,400 km^2 of ground.

(Source)

Veri Veri was always of interest because of the infamous “nickel boulder” that had nickel grades as high as ~45.8%.

A few months back, LCL found what it believes could be the source area for the nickel boulders picking up “in-situ” outcropping nickel sulphides grading as high as 13.4%.

We covered that news in a previous LCL which you can read here: Has LCL found the source rock of its nickel boulders at surface?

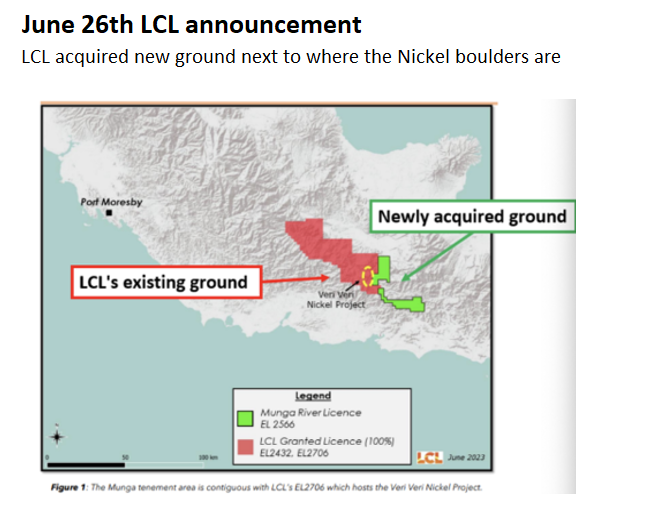

All the while, LCL was busy picking up all of the ground in and around Veri Veri in the background.

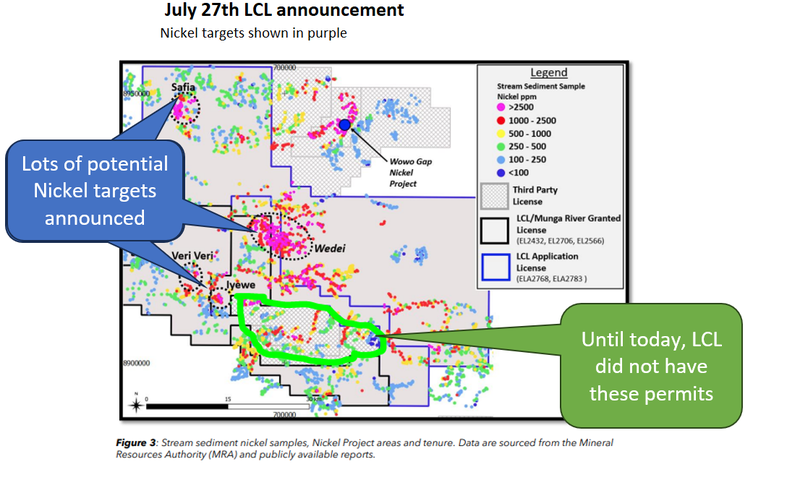

In July, LCL picked up a big landholding to the east of Veri Veri.

Today LCL consolidated all of that ground to the east by picking up the only areas left that weren't controlled by the company.

Here is a before and after of the area LCL acquired today:

Why we think the consolidation matters:

Whenever a company goes on a rampaging consolidation spree PRE-DRILLING it's usually a sign the management team believes there is genuine potential in a project.

As the field programs are run and the data keeps improving the management team has every reason to start picking up all of the ground that they think is prospective.

Ultimately, the management team will look to take full control of the area around them so that if a discovery is made, the company holds all of the ground around the project.

LCL has been doing just that and now holds almost all of the ground in and around its four main nickel prospects.

What did LCL pay for the new ground?

- 9.6 million LCL shares - based on yesterday’s closing price of 3.1c per share, that equates to circa $300k.

- 2% net smelter royalty (NSR), with the right for LCL to buy back both royalties for $5M in the future.

Overall we think it is a small price to pay especially with the option to buy back the royalty should a large, economic discovery be made.

Another positive is that LCL isn't paying any cash for the deal which leaves more precious funds for LCL to spend on exploration (as opposed to land acquisition).

More on LCL’s copper-gold porphyry targets

Earlier in the week, LCL also progressed one of its copper-gold targets in PNG.

LCL put out results from fieldwork at its Imou copper-gold project in PNG.

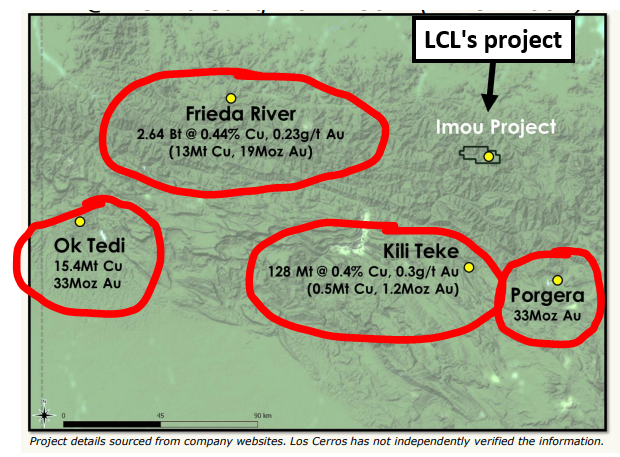

LCL’s Imou project sits in the same region as some of PNG’s biggest copper-gold projects, including:

Frieda River copper-gold project

Frieda River is described as one of the largest undeveloped open-pit copper-gold projects in the world.

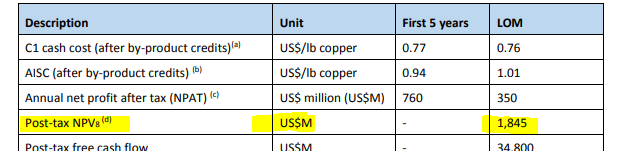

In a 2018 feasibility study, Frieda River showed a post-tax net present value of ~US$1.8BN.

The feasibility study used a copper price of US$3.30/lb and US$1,390 per ounce for gold

Prices for both gold and copper are higher now - US$3.70/lb copper and US$1,922 per ounce gold.

Ok Tedi copper-gold project

The longest running open-pit copper, gold and silver mine in PNG, which was built for over US$2.3BN.

To get a sense of the size/scale of the projects surrounding LCL’s, the four projects in the neighbourhood have resources of over 30.9mt of copper and 86 million ounces of gold.

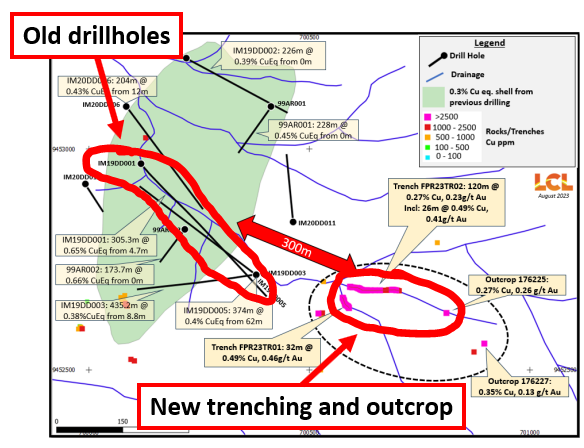

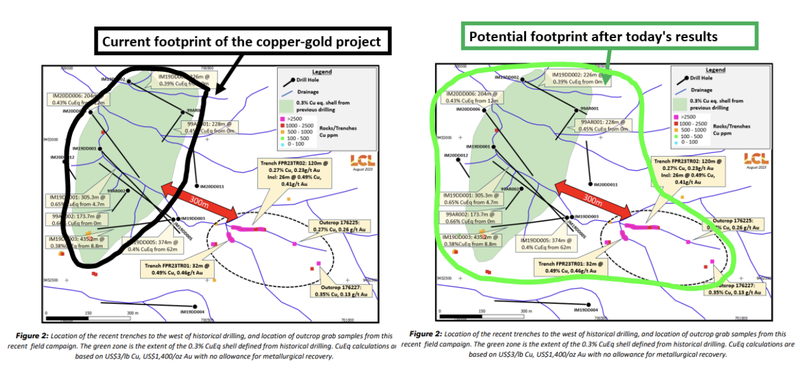

LCL’s results from its field program returned grades up to 0.49% copper and 0.46g/t gold across surface trenches measuring between 32m and 120m in length.

To put those grades into perspective, the giant Frieda River project has grades of ~0.45% copper and 0.42g/t gold almost identical to the ones LCL released today.

Of course, its early days for LCL in its exploration, with only trenching conducted to date, and some historical drill holes to go off. LCL has a heap of work to do ahead of any drilling or resource definition.

Another key takeaway from the recent announcement was that LCL picked up these grades in trenches dug right next to old drillholes which have confirmed copper-gold mineralisation in the area.

The most notable drillhole was a 305.3m hit with copper grades of 0.37% copper and 0.37g/t gold (0.65% copper equivalent).

Now, LCL has managed to extend the footprint of the project by over ~300m to the east.

Ultimately, we want to see LCL drill in that area to the east to see if the copper-gold mineralisation extends out into the newly sampled areas.

Here is LCL’s principal geologist, John Dobe, discussing the Imou project:

LCL also has a bunch of other copper-gold targets across its portfolio, which we think could become of interest in the future.

Of particular interest to us is the ~60km channel between its Liamou and Ubei targets.

Across those targets, LCL has undrilled EM and IP geophysical anomalies which it believes could be indicative of copper-gold porphyry systems.

We are looking forward to LCL drilling these at some stage in the future.

What’s next for LCL?

Drilling at the Kusi gold/copper target 🔄

LCL is seven holes into a ~18 hole drill program.

The next stage of the drill program will focus on step out holes and drilling around the Leah’s Lode target <1km NE from the current drillholes.

Fieldwork and airborne EM across Nickel Project 🔄

Airborne electromagnetic (EM) geophysical surveys and get on ground for some sampling/mapping - these will help work out the best places LCL should focus its future drill programs.

Joint Venture discussions 🔄

Potential farm-out/Joint ventures across LCL’s project portfolio both in PNG and Colombia.

Our LCL Investment Memo:

Click here for our latest LCL Investment Memo, where you can find a short, high level summary of our reasons for Investing, including the following:

- Key objectives for LCL

- Why we are Invested in LCL

- The key risks to our Investment thesis

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.