Dateline confirms extension of high-grade Sacramento vein

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It was just this morning in our gold feature that we flagged Dateline Resources Ltd’s (ASX: DTR) imminent drilling results as a potential share price catalyst.

The following is an excerpt from our overview of Dateline’s operations and prospects:

The company is awaiting the return of assay results for more than 60 samples which are expected back by mid-August, and at that stage they will be digitized and presented to the market.

Management expects to be able to establish a mineral resource estimate in the December quarter, and the upcoming drilling results will feed into the resource definition, suggesting the release of this data could be market moving.

Dateline has delivered in spades, providing a promising update on the maiden surface drilling program which commenced on June 3, 2019 at the northern section of the Gold Links project in Colorado.

The company’s success was reflected when the market opened on Tuesday morning as investors flocked to the stock.

Dateline’s shares traded more than 30% higher, reaching levels that imply a 100% gain in less than a month.

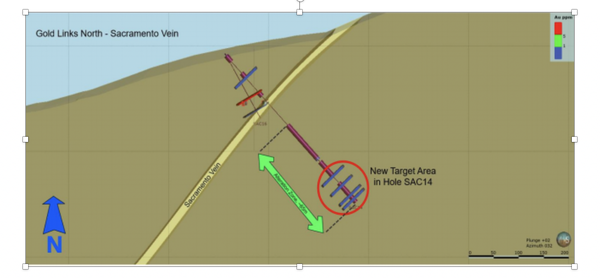

New targets identified at Sacramento

Not only has the company identified high grade mineralisation characteristic of previous mining at the site, but it has intersected a new mineralised structure east of the Sacramento vein.

A previously unmapped and unknown area to the east of the Sacramento vein was intersected in the course of reverse circulation drilling.

The altered zone is 65 metres wide and had several distinct zones of quartz veining, four of which contained anomalous gold values.

Follow up drilling as indicated below will be made to test the area adjacent to this intercept.

Mineralisation was intercepted over 225 metres of strike and 60 metres down dip.

Providing further promise is the fact that mineralisation remains open in all directions.

One of the key takeaways was from a deeper hole which had the widest intersection and the highest gold and silver grades, boosting management’s confidence that other veins at Gold Links are likely to have similar high-grade deeper extensions.

High-grade intercepts included 1.7 metres at 24.9 g/t gold and 153 g/t silver, representing 26.6 g/t gold equivalent.

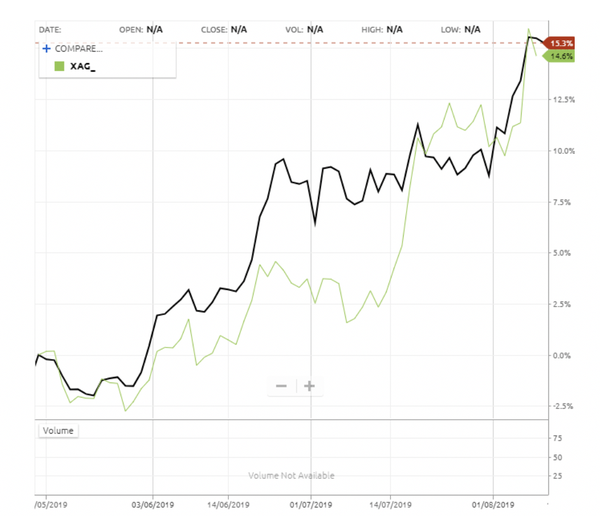

There were numerous other high-grade gold and silver hits, and the presence of high grade silver should resonate with the market given that the precious metal has been going stride for stride with gold over the last three months.

As can be seen below, both metals have gained approximately 15% since May.

Further catalysts on the horizon

With results from drilling the 2150 veins located in that Gold Links North imminent and deeper extension drilling planned at Sacramento, there are numerous catalysts which should assist in maintaining share price momentum.

The company is also in good shape financially as it has nearly $5 million in cash to fund further drilling.

This suggests that the company’s market capitalisation of just over $20 million doesn’t capture the value of the group’s assets or the exploration upside.

Given Gold Links has produced in excess of 125,000 ounces of high-grade gold there is a valid argument to suggest that some material value should be attributed to the project.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.