20 gold nuggets, the ingots of tomorrow

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Last week, Finfeed noted the strong run in the gold price as it surged past the US$1500 per ounce mark to hit a high of US$1522 per ounce, a level it hadn’t traded at for more than six years.

We also noted that the Australian dollar had slipped below the US$0.68 mark, implying an Australian dollar gold price of about $2250 per ounce.

These metrics have remained in place with the gold price trading in a tight range between US$1510 per ounce and US$1520 per ounce, and the US/Australian dollar exchange rate currently at US$0.68.

From a broader perspective, it was our view that the geopolitical environment would potentially support the gold price around current levels, or even provide a catalyst for further upside.

Consequently, this represents a good time to run the ruler across emerging gold plays, the little dynamos that could be the high flyers of tomorrow, particularly in the event of a sustained strength in the gold price.

Finfeed brings five gold stocks to you today, and over the next three days we will examine 15 other companies in the sector.

Classic Minerals delivers big grades and extends strike

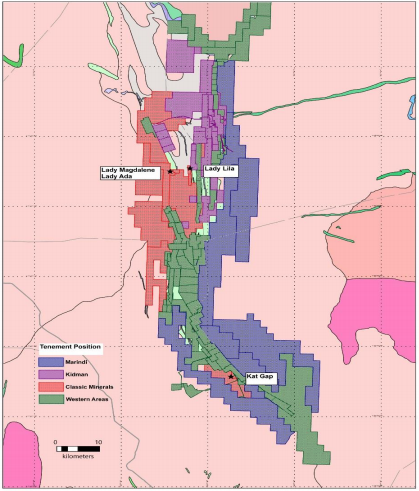

Gold exploration and development company Classic Minerals Ltd (ASX:CLZ) has released outstanding assay results from its 32 holes/2000 metre reverse circulation drilling campaign at the Kat Gap Project.

This project is strategically located approximately 70 kilometres from the company’s Forrestania Gold Project containing the Lady Magdalene and Lady Ada gold resources.

In what has turned out to be an absolute steal, Classic purchased the Kat Gap project from private company Sulphide Resources Pty Ltd for a total consideration of $250,000 plus a 2% royalty on production from E74/422 and E74/467.

Interestingly, Kat Gap already had a strong history of delivering high grade drilling results, including 15 metres at 15 g/t gold from 39 metres and 6 metres at 19 g/t gold from 17 metres.

However, previous drilling only tested a small section of the five kilometre geochemical gold anomaly, and Classic has now completed four separate drilling campaigns to depths of approximately 60 metres.

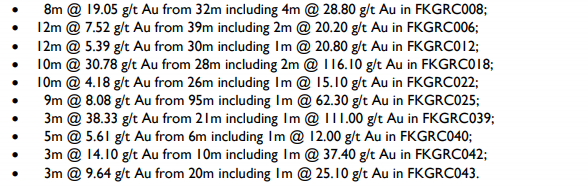

The following results demonstrate the success that the group is having by simply drilling relatively shallow holes.

Recent drilling at Kat Gap also showed that high-grade gold mineralisation projects very close to surface and continues down-dip with increasing width.

At this early stage, the high-grade and shallow nature of the gold mineralisation suggests there is the prospect of developing a low-cost open pit project.

However, on the other hand diamond drilling could well confirm the scenario that appears to be unfolding whereby high-grade mineralisation continues down dip with increasing widths.

One of the interesting holes in the above data set is FKGRC025, the deepest of the holes at 95 metres which featured 62.3 g/t gold.

Obviously, the presence of near surface bonanza grade gold of 116 g/t gold and 111 g/t gold in holes FKGRC018 and FKGRC039 respectively is extremely encouraging in terms of supporting an open pit operation.

Given that the system remains open in all directions, the upcoming drilling program which will include deep diamond holes to depths of up to 300 metres below existing drill coverage is much anticipated.

This could be the driver behind recent high volume buying which included one day where an all-time record of more than 150 million shares changed hands as the group’s share price doubled.

Imminent results suggest Dateline is a date claimer

Shares in Dateline Resources Ltd (ASX:DTR) doubled in July/August, and the current price represents an increase of 50% in just shy of four weeks.

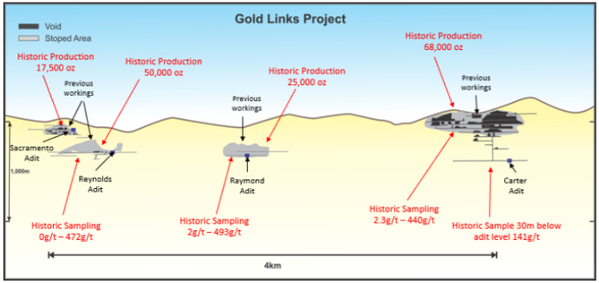

The company is focused on gold mining and exploration in Colorado where it owns 100% of the Gold Links Project.

Gold Links is comprised of several contiguous historic gold mines that have been consolidated by the company.

The deposit has produced up to 150,000 ounces of high-grade gold, and mineralisation can be traced on surface and underground for almost six kilometres from the northern to the southern sections of the project.

Well documented records indicate that there are large areas that remain untested at surface and little to no exploration has been done below the valley floor.

Dateline also owns the Lucky Strike and Mineral Hill permitted gold properties and it has recommissioned a gold processing plant located at the Lucky Strike Mine.

The Gold Links and the Lucky Strike tenements are located approximately 50 kilometres apart.

In the June quarter the company commenced an 8,000 metre drilling program at the northern section of the Gold Links Project.

The drilling program is intended to prove the down-dip extension of both the Sacramento and 2150 veins.

The drill program has so far been expanded from 41 to 45 holes as a result of testing further along the strike of the Sacramento vein.

In what appears to be an astute move given the presence of high-grade mineralisation at depth, management decided to acquire a multi-purpose drill rig capable of both reverse circulation (RC) and diamond core drilling, with the latter providing access to deeper sections of the orebody.

The company is awaiting the return of assay results for more than 60 samples which are expected back by mid-August, and at that stage they will be digitized and presented to the market.

Management expects to be able to establish a mineral resource estimate in the December quarter, and the upcoming drilling results will feed into the resource definition, suggesting the release of this data could be market moving.

Indiana produces promising results at West Mali

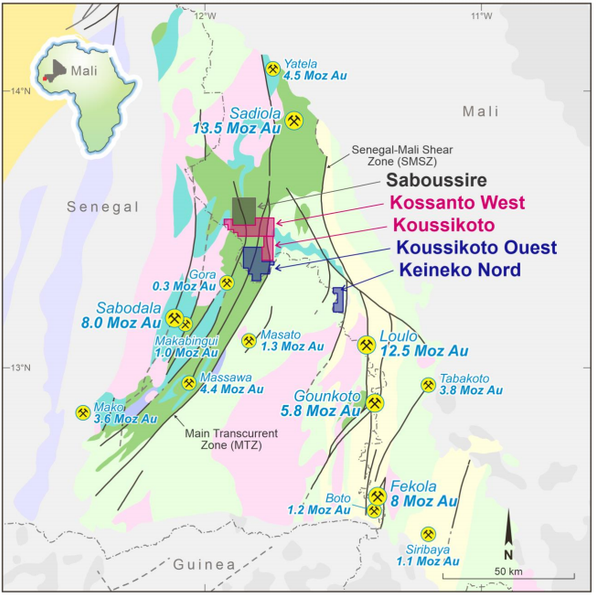

At the end of July, Indiana Resources Ltd (ASX:IDA) released promising results from infill and extensional soil geochemistry sampling at the Koussikoto Ouest Licence, part of group’s West Mali Gold Project.

Infill soil sampling was completed in several areas at the southern end of the project, focusing on east-west lines at a 200 metre by 50 metre spacing, covering a total area of 7.4 kilometres.

Assay results from 767 individual sites ranged from four samples at more than 100 ppb gold to 586 samples at less than 20 ppb gold.

Management is now of the view that there is significant gold anomalism across more than 20 kilometres of strike, and this recent program has identified significant extensions to existing anomalies.

Indeed, the company is in highly prospective territory, surrounded by sizeable deposits operated by some of the world’s largest gold companies.

Anomalies located by Indiana are consistent with mineralised structures that have tended to support large discoveries such as Barrick Gold’s 12.5 million ounce Loulou deposit and Teranga Gold’s 8 million ounce Sabodala deposit.

Management said that all persistent anomalies identified-to-date currently appear related to north-south and northwest-southeast trending structures within the Main Transcurrent Zone (MTZ) as indicated below.

Shree’s untested Golden Chimney West looks interesting

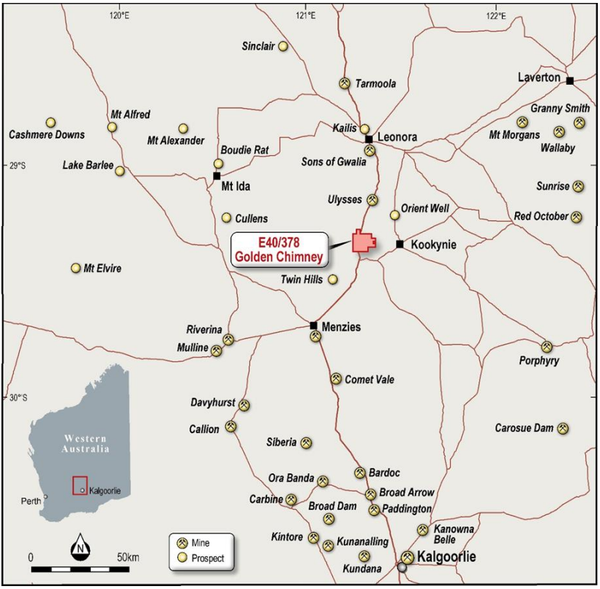

Following the completion of reconnaissance mapping, sampling and infill auger soil sampling at the company’s Golden Chimney Project in Western Australia, the management of Shree Minerals Ltd (ASX:SHH) said last week that it has an improved understanding of the project.

Fieldwork has enhanced the geochemical anomalies at both Golden Chimney West and Golden Chimney East.

Altered felsic volcanic rocks at Golden Chimney West may be the source of the gold and multi-element anomaly that stretches over two kilometres in length.

Old gold workings were found at the Golden Chimney East gold and arsenic anomaly.

Commenting on these developments, Shree executive director Sanjay Loyalka said, “The gold anomalies identified have a scale and continuity that may indicate the presence of significant gold mineralisation, and we are excited to progress towards drilling at Golden Chimney.’’

As indicated below, Golden Chimney is in the heart of gold territory, lying to the south of Leonora and surrounded by some of the largest gold mines in Western Australia.

The gold anomalies identified by the auger sampling have a scale and continuity that may indicate the presence of significant gold mineralisation.

Some gold anomalies are reinforced by multi-element signatures which may confirm the presence of gold mineralisation.

Also, new, previously untested areas, including Golden Chimney East, have multi-element anomalies that will be refined and possibly upgraded by the completed extensional auger sampling.

The Golden Chimney West Prospect is a significant, two kilometre long, gold and multi-element geochemical anomaly that is untested by drilling.

The auger anomaly has been confirmed and reinforced by historical soil sampling.

Infill sampling on a 100 metres x 15 metres spaced grid will upgrade the anomaly to drill ready status.

Assay results from the infill auger sampling are imminent, and these could be viewed as a guide to potential drilling results.

The target generation phase will be followed by the drilling phase of higher priority targets which will begin with reverse circulation (RC) drilling of up to 200 metre deep holes.

SER targets high grades at Saxby Gold Project

While Strategic Energy Resources Ltd (ASX:SER) offers diversification across a number of commodities including mineral sands, graphite, copper and iron ore, it could be argued that gold is where it has the most irons in the fire.

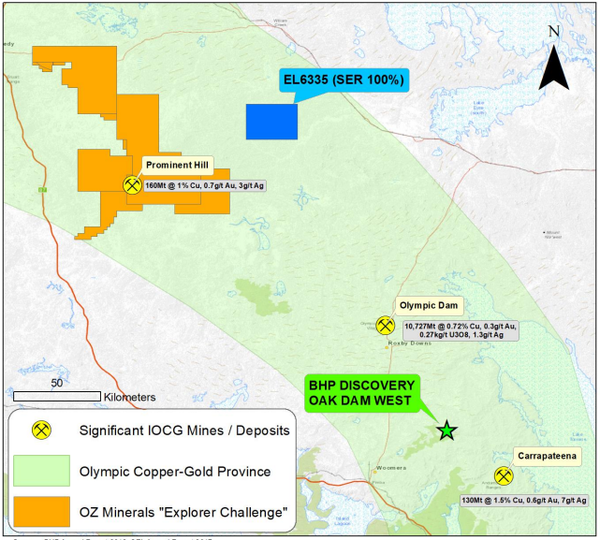

In April, SER won EL6335 (Billa Kalina) in a competitive process following BHP’s announcement of a significant IOCG (Iron Oxide Copper Gold) discovery at Oak Dam West.

A detailed ground gravity survey has been commissioned at Billa Kalina which is in close proximity to Oz Minerals’ (ASX:OZL) Prominent Hill Copper-Gold Project, a large long life, low cost mine.

EL6335 covers coincident and offset gravity and magnetic anomalies, and management recently highlighted that a major north-west/south-east trending crustal structure runs through the project area adjacent to the gravity anomaly.

In terms of examining one of SER’s more gold-focused assets, the group’s Saxby Gold Project in the Mount Isa province of Queensland is the most significant gold exploration prospect in that region.

Historic drilling includes high grade intersections of 17 metres at 6.75g/t gold and 15 metres at 9.09 g/t gold in two holes 190 metres apart.

Preparations for drilling are well advanced with management expecting to commence in the December quarter.

Several potential joint venture partners have conducted thorough due diligence on the Saxby project, but in the absence of a joint venture partner, SER will sole-fund the upcoming drilling program.

That's our five stocks for today, be sure to tune in tomorrow as we continue our analysis of gold stocks to watch.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.