Copper’s eight year high bodes well for copper-gold stocks

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

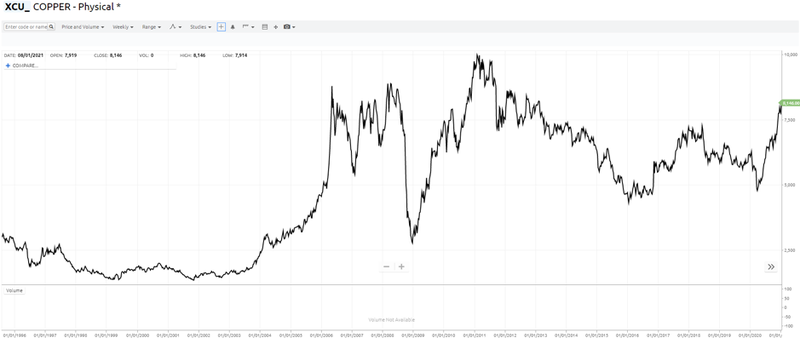

The copper price has soared since March last year when it slipped below US$5000 per tonne to trade at about US$4700 per tonne for the first time since 2016.

However, the recovery since then has been outstanding with the red metal closing out last week at US$8146 per tonne, representing a gain of more than 70% in just over nine months.

While the share prices of blue-chip players with strong exposure to the metal have experienced substantial gains, there are some smaller emerging players that could respond sharply to the buoyant environment in 2021.

On the blue-chip front, it is hard to go past Rio Tinto in terms of being significantly leveraged to a strong copper price, and its shares have increased more than 50% from less than $80.00 in March last year to recently hit an all-time high of $127.00 per share.

While the companies we will be discussing are at an early stage of pursuing much smaller projects than those operated by Rio Tinto, one factor they have in their favour is that they are targeting mineralisation that is also prospective for gold which continues to hover in the vicinity of US$1850 per ounce, implying healthy margins relative to production costs.

One of the key benefits experienced by copper-gold producers is the significant cost offset offered by the by-product, whether it be a predominantly copper mine with gold credits or a gold mine that benefits from the additional sale of copper.

The following chart shows that the copper price is sitting proximal to an eight year high, and is approximately 40% above the 25-year median price of about US$5700 per tonne.

Gold is trading at an even higher premium to the long-term median price, which on a 40 year basis is approximately US$1050 per ounce.

The current price isn’t far off the all-time record high of more than US$2000 per ounce set last year, and with significant volatility in the US and China, as well as the impost of the coronavirus on global economies it wouldn’t be surprising to see the precious metal revisit or exceed last year’s high.

We feature three companies that have dual exposure to copper and gold - Los Cerros Limited (ASX:LCL), Latin Resources Ltd (ASX:LRS) and Titan Minerals Ltd (ASX:TTM).

However, before delving into their operations we will provide a real-life snapshot of a copper-gold project, highlighting the significant cost reductions that can be achieved in comparison with a gold mine that doesn’t benefit from by-product credits.

How copper credits substantially drive down production costs

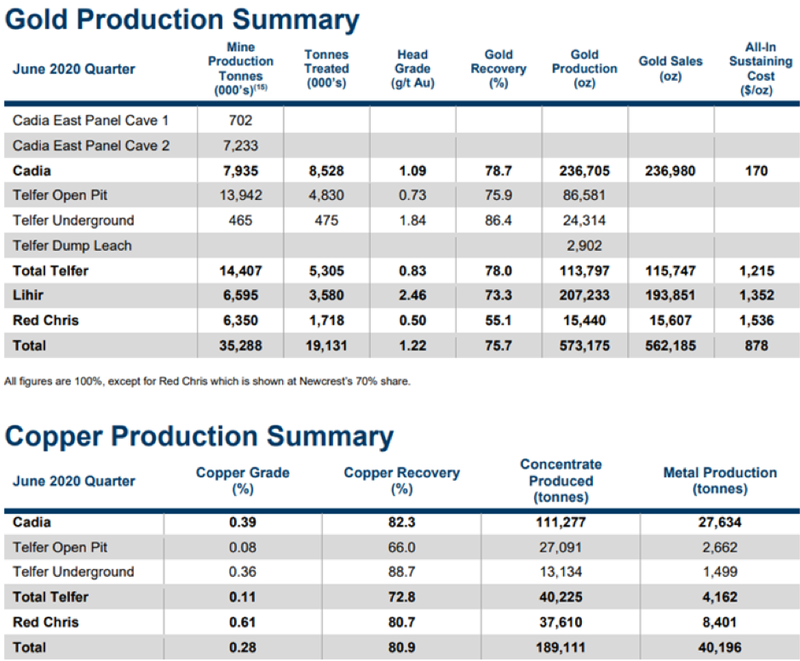

Our case study examines Australia’s largest gold mining group, Newcrest Mining (ASX: NCM).

In order to narrow the focus and simplify the means of comparison, we highlight a three month period of operation, being the June quarter of fiscal 2020.

Newcrest’s key producing assets in Australia are its gold-copper Cadia Project in New South Wales and the Telfer gold-copper-silver mine in Western Australia.

The company also generates substantial gold production from the Lihir mine in Papua and New Guinea, but this project doesn’t benefit from by-product credits.

As indicated below, Lihir’s gold production for the June quarter of 2020 was an impressive 207,233 ounces, but the All in Sustaining Costs (AISC) were $1352 per ounce.

By comparison, the Cadia Project produced 236,705 ounces in the June quarter at an extremely low cost of $170 per ounce.

Examining the second table you can see that Cadia produced more than 111,000 tonnes of copper concentrate and 27,634 tonnes of copper metal.

With the Australian dollar gold price currently hovering in the vicinity of $2400 per ounce, this implies a particularly healthy margin of $2230 per ounce.

Harking back to the benefits of copper and gold production, much of this substantial gap between the costs of production can be attributed to the credits Cadia received from its significant copper production.

Los Cerros targeting gold-copper porphyry targets at Chuscal

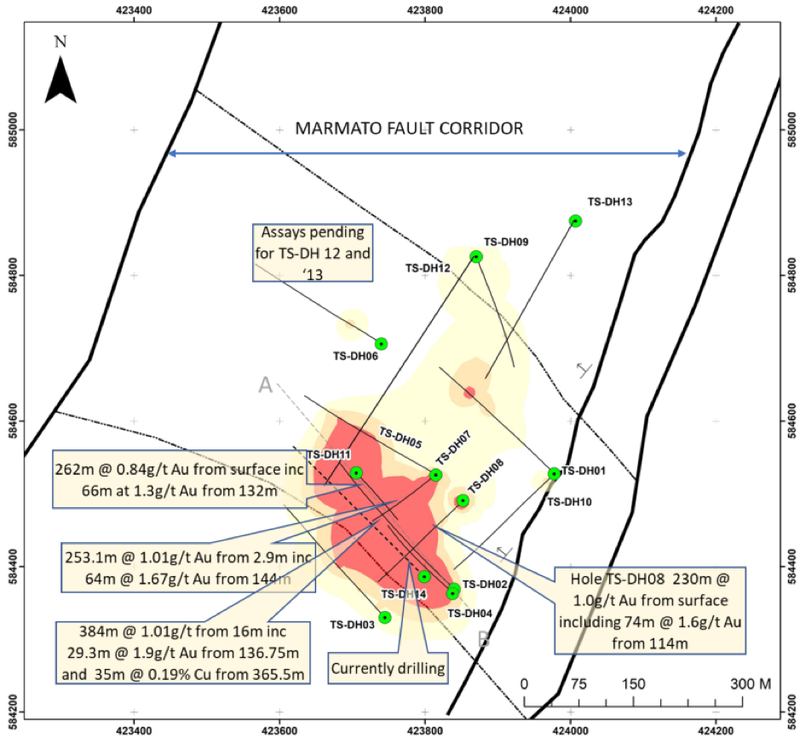

The first of our three emerging gold-copper plays that we examine is Los Cerros, a company that is about to embark on its largest year of exploration drilling to date in Colombia with a view to uncovering the true size potential of its Tesorito and Chuscal porphyry prospects.

The company has had considerable success at Tesorito, both in terms of drill results and understanding the geometry of the near surface, southern Tesorito gold/copper porphyry.

Management expects to announce assay results for holes TS-DH12 and TS-DH13, testing the northern anomaly, in January.

TS-DH14 was planned to test for depth and western extensions, and it is the first of a systematic program of holes expected to lead to a maiden JORC resource estimate for the Tesorito southern porphyry.

The following map shows TS-DH14, a step-in hole from TS-DH02 which delivered the longest intercept to date and ended in elevated copper.

The company’s recent drilling program at Chuscal has provided strong vectoring guidance for targeted porphyry drilling.

The much anticipated assay results for the last hole completed at Chuscal are imminent.

Drilling has now commenced on the eastern porphyry target which is interpreted to lie under historical workings and strong surface anomalism under very extensive downhole widths.

Los Cerros enters 2021 with cash of approximately $7 million which leaves the company well-funded in terms of undertaking its aggressive drilling program.

Investors appear to have moved ahead of the release of upcoming drilling results with the group’s shares having gained more than 30% in the last three weeks.

However, positive news could see further upside as Los Cerros looks to recapture its 2020 high of 23 cents.

Interestingly, the fundamentals that prevailed when the group’s shares increased three-fold in September are still in place, and given that the copper price has increased significantly over the same period it could be argued that the company’s investment appeal is comparatively even more compelling as things currently stand.

Latin Resources looks to exploit prolific Lachlan Fold region

Latin Resources Limited (ASX:LRS) is an Australian-based mineral exploration company with several projects in Latin America and Australia.

The Australian projects include the Yarara Gold Project in the NSW Lachlan Fold belt, Noombenberry Halloysite Project near Merredin, WA, and the Big Grey Project in the Paterson region, WA.

The company is also actively progressing its copper porphyry MT-03 project in the Ilo region with its joint venture partner First Quantum Minerals Ltd.

Highlighting the group’s diversification, management recently signed a JV agreement with the Argentinian company Integra Capital to fund the next phase of exploration on its lithium pegmatite projects in Catamarca, Argentina.

Shares in Latin Resources have doubled since November as investors target the stock ahead of a potential rerating in 2021 which could well be driven by exploration results.

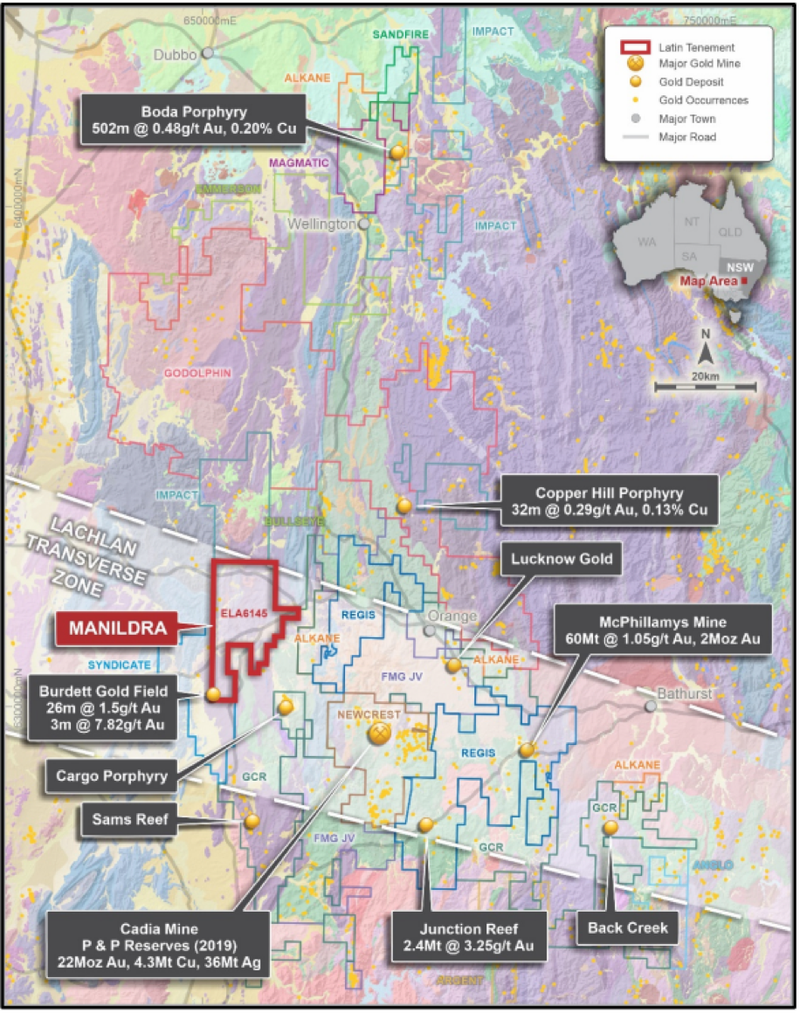

Complementing the Yarara Project is the securing of a major new project within the East Lachlan Fold Belt.

A new tenement application (ELA6145) was secured covering some 280 square kilometres of highly prospective territory in the Eastern Lachlan Fold Belt, straddling the regional scale Manildra Fault.

The project is located 30 kilometres to the west of Orange in NSW, 30 kilometres to the north-west of the Newcrest’s (ASX:NCM) world class Cadia Gold-Copper Mine (22 million ounces gold, 4.3 million tonnes copper) and 60 kilometres west of Regis Resources’ (ASX:RRL) McPhillamys Gold project (2 million ounces gold) which is hosted by similar geological trends, including being situated within the regional Lachlan Transverse Zone (LTZ).

Consequently, this is an excellent address with the potential to deliver outstanding exploration results in the relatively near term, while also perhaps heralding the commencement of a flagship copper-gold project for Latin Resources.

It is worth noting that these mines are traditionally low-cost, long-life projects with copper credits effectively driving down the costs of gold production.

Harking back to the Yarara Project, the securing of land access agreements has opened the door for the company to commence the on-ground reconnaissance mapping and prospecting work that is required to finalise drill target locations for ground-disturbing applications.

Latin Resources also has copper exploration interests in Peru, but on-ground activities on the company’s Joint Venture with First Quantum over the MT-03 Copper Project have been delayed due to the Covid-19 lockdown restrictions in that country.

A detailed ground magnetic survey is now planned over the MT-03 anomaly to assist in the targeting of planned maiden drill testing of the initial anomaly.

It is worth noting that the company’s assets are located in relatively close proximity to prolific copper-bearing regions of Peru.

The Western flanks of the Andes in southern Peru host a number of tier-1 porphyry copper deposits, including Cerro Verde (4 billion tonnes), Toquepala (3.4 billion tonnes) and Cuajone (2.4 billion tonnes) - together they account for over 40% of Peru’s copper production.

Titan Minerals to announce Dynasty assay results in January

Titan Minerals has two promising projects in Ecuador, being Dynasty and Copper Duke, and the company has been undertaking an extensive diamond drilling program in order to define a higher resolution geological model to support its established data.

Titan’s shares are up about three-fold from lows early in the year, but Reg Spencer, an experienced mining analyst at Canaccord Genuity sees further upside.

He has a price target of 25 cents per share on the stock, derived mainly from applying a peer average enterprise value/resource ounces multiple in relation to the established resource at Dynasty.

Discussing the group’s focus on Ecuador, Spencer said, ‘’The adoption of an investment-friendly Mining Code and fiscal framework in 2015 resulted in a significant increase in exploration and development activity, headlined by the recent discovery of the 10 million tonnes copper/23 million ounces gold Alpala deposit, and successful mine developments at the 300,000 ounce per annum Fruta de Norte gold mine and circa 100,000 tonne per annum copper Mirador copper mine.

‘’The improved standing of Ecuador and its mineral potential is further highlighted by numerous majors now being active in the country, including BHP, Fortescue, Anglo American, CODELCO and Newcrest.’’

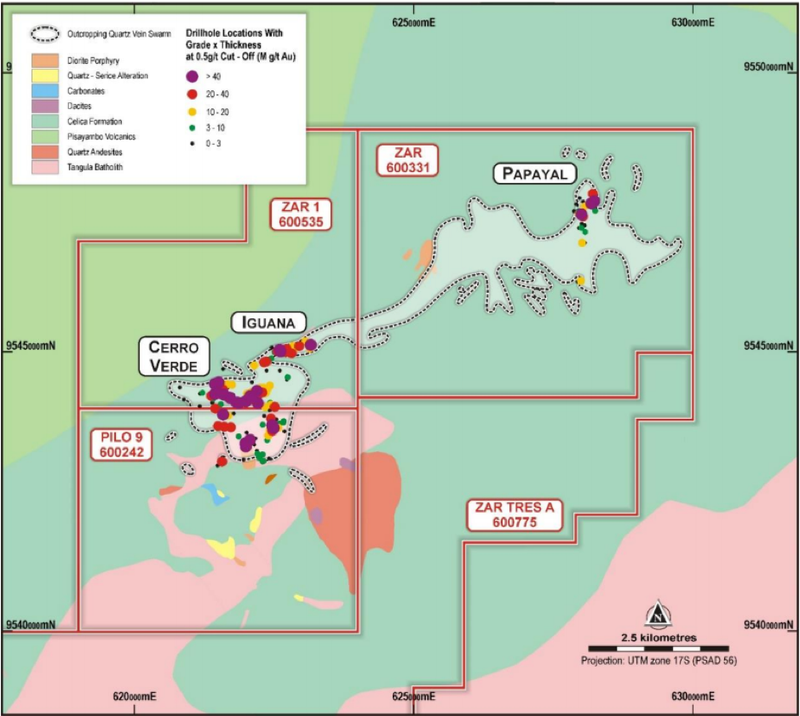

Titan’s drill programme has been increased from 6000 metres to 12,000 metres to accommodate for additional deeper drilling on mineralisation confirmed with depth in drilling results announced to date at Cerro Verde.

Additional drill holes are also being allocated for initial drill tests of multiple high-grade gold veins defined in previous trench results.

Titan continues to progress with its confirmatory drilling at the Dynasty Gold Project in southern Ecuador and substantial drilling at the Iguana and Papayal Prospects.

Discussing the Dynasty Project, Spencer said, ‘’We consider the Dynasty project area to be drastically under-drilled, with only circa 26,000 metres having been drilled on the property.

‘’Key exploration opportunities include depth and strike extensions (including 4 kilometres of undrilled strike in areas of known mineralisation identified in surface sampling), as well as testing for previously unidentified mineralisation under cover.

‘’The most advanced prospects include Cerro Verde, Iguana and Papayal.’’

All core samples for the Iguana Prospect from 21 holes totalling 4,560 metres drilled are now at the laboratory with results anticipated in late-January, a potential share price catalyst.

Drilling at Iguana consistently intersected multiple fault structures with quartz vein fill associated with favourable alteration and sulphide mineralisation.

At Dynasty, Titan believes the geophysical results will enhance the regional geological interpretation of the district by identifying multiple anomalies associated with major structural features in the 9 kilometre long corridor of outcropping vein-hosted mineralisation.

Copper Duke adds further flavour to the story with results expected to unlock its large-scale potential and identify areas of mineralisation.

Spencer is upbeat about Copper Duke’s prospects, saying, ‘’The project presents as a highly prospective yet mostly unexplored opportunity, with the potential for both porphyry copper-gold and high-grade epithermal gold mineralisation.

‘’Prospectivity is characterised by numerous large-scale gold and copper-gold anomalies over a 50 square kilometre area, with geophysics and initial drill-hole targeting planned for the coming months.’’

Additional data along with the refined geological interpretation will be used to rate and rank targets for maiden drill testing at Copper Duke in 2021.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.