Los Cerros lays out sustained drilling program for 2021

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Los Cerros (ASX:LCL) has laid out its biggest drilling plan to date, that should see it hit several milestones in 2021.

The company will be hard at work next year as it looks to uncover the true size potential of Tesorito and Chuscal porphyry prospects, as well as test for extensions to the advanced Miraflores Resource at the Quinchia Gold Project in Colombia.

The Quinchia Project hosts the Miraflores Gold Deposit with a Resource of 877,000 Au ounces at 2.80g/t Au and Reserve of 457,000 Au ounces at 3.29g/t Au.

Quinchia is located in the mid-Cauca porphyry belt of Colombia, the same structural trend that hosts several multi-million ounce gold discoveries.

LCL’s 12-month plan includes continuous, multi-rig drilling program focused on:

- Drilling at Tesorito leading into a maiden JORC Resource calculation in 2021;

- Exploration drilling testing the gold-copper porphyry targets identified at Chuscal; and

- Drilling for extensions to the existing Miraflores Resource (877,000 ounces) and Reserve (457,000 ounces)

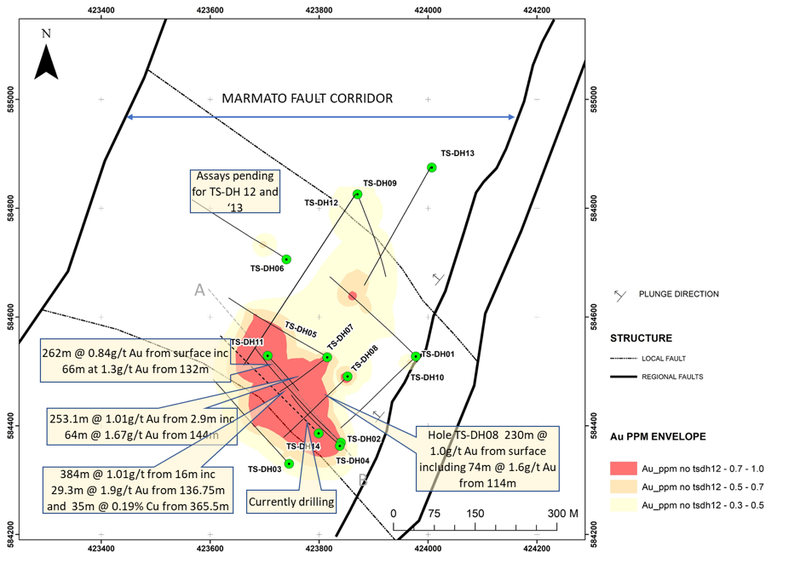

Looking at Tesorito first, it has been highly successful in terms of drill results and understanding the geometry of the near surface, southern Tesorito gold +/- copper porphyry.

Results now include three holes of greater than 1g/t Au over 230m from near surface and include:

- 384m @ 1.01g/t Au from 16m including 29.3m @ 1.9g/t Au from 136.75m in TS-DH02;

- 253.1m @ 1.01g/t Au from 2.9m including 64m @ 1.67g/t Au from 144m in TS-DH07;

- 230m @ 1.0g/t Au from surface including 74m @ 1.6g/t Au from 114m in TS-DH08; as well as

- 262m @ 0.84g/t Au from surface including 32m @ 1.7g/t Au from 144m within 66m at 1.3g/t Au from 132m in TS-DH11.

Drilling to date has provided confidence in the southern and eastern potential limits of the mineralised zone of interest, with the body remaining open to the west, north and at depth.

Assay results from Tesorito for holes TS-DH12 and TS-DH13, testing the northern anomaly, are due in January.

TS-DH14 is currently testing for depth and western extensions and is the first of a systematic program of holes expected to lead into a maiden JORC resource estimate for the Tesorito southern porphyry.

Other highlights to look out for next year will include assay results for the last hole completed at Chuscal (CHDDH009). Results are due in January, with drilling already underway on the eastern porphyry target.

Further to this, early in 2021, LCL intends to allocate a rig to test for near surface extensions to the established Miraflores Resource. LCL has committed to finalising remaining submissions for approvals for a potential mining development based on the Miraflores Reserve and DFS to retain the optionality of fast tracking production.

Finally, LCL plans to concentrate on surface work and ground geophysics at key epithermal and porphyry targets at its Andes Project.

Los Cerros Managing Director Jason Stirbinskis said of the plans, “The Company has managed to navigate the challenges of the global pandemic to deliver its 2020 plan with great results. With significant funding secured to support a multi-rig, multi-target program combined with our additional strategic plans, 2021 is going to be another exciting year for the Company. I would like to acknowledge the efforts of our dedicated team and the ongoing support of our shareholders and wish all a safe and healthy 2021.”

Minlu Fu appointed as technical consultant

To help it fulfil its ambitious 2021 targets, LCL has appointed Dr Minlu Fu as a Technical Consultant. Dr Fu will join Dr Steve Garwin (Solgold) and Dr Roric Smith (Sandfire, Saracen) on the technical team. Dr Fu is LCL’s largest shareholder and also founder of Hongkong Ausino though which Los Cerros has purchased its Atlas Copco drill rig and other exploration equipment/services.

Dr Fu’s geological and geophysical expertise and track record with realising large scale mineralised gold-copper systems will be invaluable to Los Cerros as it develops its understanding of the Quinchia and Andes Projects.

Dr Fu isn’t the only appointment made, LCL has also appointed a senior ESG (Environmental, Social and Governance) manager to the existing ESG team, to focus on contributions to local communities around Quinchia.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.