Capital raising paves the way for Tempus Resources to progress gold exploration

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Tempus Resources Ltd (ASX:TMR) has successfully completed a bookbuild for the issue of approximately 26,169,868 million new shares to raise approximately $4 million at an average issue price of 15.3 cents per share.

The placement was to sophisticated and institutional investors, including Sprott Capital Partners, a prominent investor in the mining industry and an Asia-based specialist natural resources investment fund.

Underlining the importance of the capital raising in terms of exploration funding and raising the group’s overseas profile, managing director Brendan Borg said, “This capital raising ensures Tempus is well funded for the exciting period ahead, as we commence our physical exploration programs in Canada in the coming weeks. We are very pleased to welcome some significant new investors to Tempus as part of this placement, as we continue to build our profile internationally and in Australia.”

The placement comprises two tranches, consisting of about 7.7 million shares at a price of 13 cents per share to raise approximately $1 million.

Tranche 2, subject to shareholder approval, consists of 18,430,025 shares at an average price of 16.0c per share, to raise approximately $3,000,000.

The volume-weighted average issue price of shares to be issued under the Placement is 15.3c per share, which represents an 4.37% discount to the volume-weighted average share price for the 15 trading days prior to the Placement.

Proceeds from the Tranche 1 placement will be applied to the company’s exploration projects in Ecuador and for general working capital, whilst the larger Tranche 2 component will be used to fund exploration at the company’s Blackdome-Elizabeth Gold Project in British Columbia.

Tranche 2 includes three sub-tranches of: 2,307,700 shares priced at 13.0c per share, 5,649,217 shares priced at 13.5c per share (the standard Canadian flow-through sub-tranche); and 10,473,108 shares priced at 18.5c per share (the charity flow-through sub-tranche). .

Tempus positioned to progress exploration

By way of background, Tempus has two key projects, one being the the Blackdome-Elizabeth Project which includes a historical Mineral Resource declared under Canadian NI43-101.

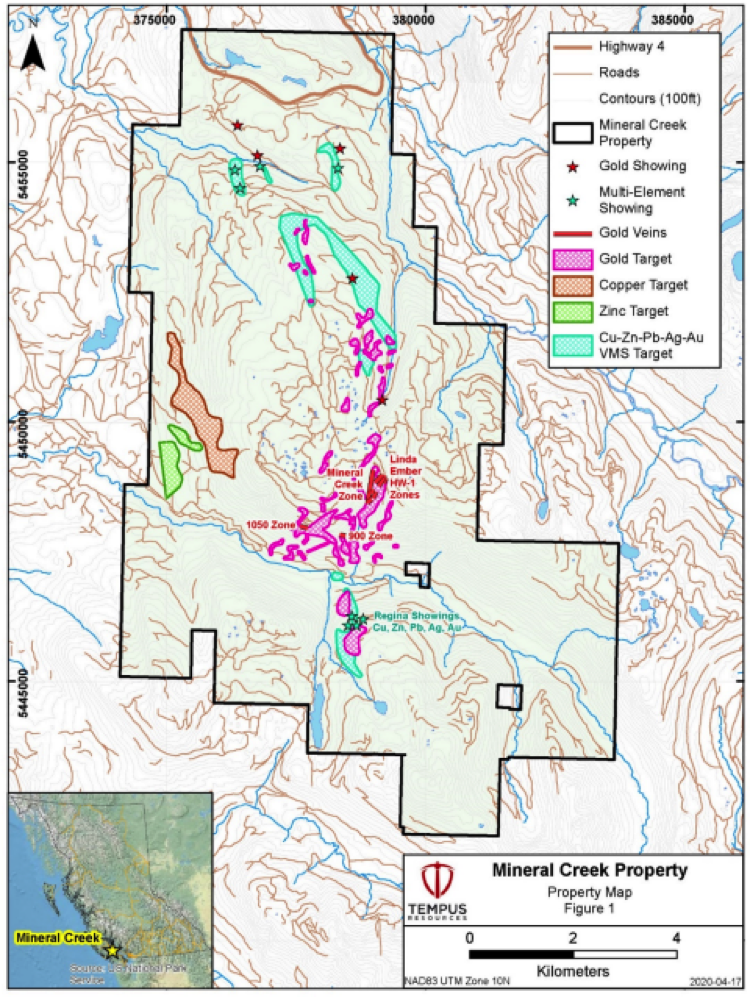

Some important historical data on one of the company’s other assets, the Mineral Creek Gold Property located on Vancouver Island British Columbia was released last week.

The presence of bonanza gold grades excited investors as the company’s shares soared 50% from 12.5 cents to 19 cents on the day the information was released.

Most of these gains were retained despite subsequent market volatility, and given the capital raising will assist the group in progressing these projects Tempus should continue to receive strong support.

The company’s primary focus is on the Blackdome-Elizabeth Gold Project.

However, given the outcomes of recent reviews, management plans to allocate further resources to advancing the Mineral Creek Project.

Compilation of a consolidated database is in progress, which will be used to generate mineralisation models to assist in planning of new drilling programs.

Further field assessment and sampling programs at Mineral Creek are being planned as part of the upcoming field season, set to commence in the coming weeks at Blackdome-Elizabeth.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.