Initial gold drill results in for Metminco

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Metminco Limited (ASX:MNC | AIM:MNC) has announced assay results for the first two diamond drill holes from its Tesorito gold prospect at its Quinchia Gold Portfolio in the Quinchia district of Colombia.

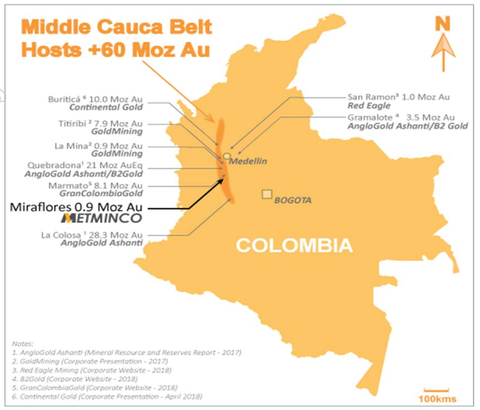

The Quinchia district is located in central Colombia within the prolific Middle Cauca Belt. This region is host to numerous large- scale projects including AngloGold’s 28Moz La Colosa and Gran Colombia’s 8Moz Marmato gold deposits.

The Tesorito prospect occurs 800m south east of the MNC’s Miraflores deposit (0.88Moz gold Resource) and approximately three kilometres south-east of its Dosquebradas deposit (0.92Moz gold NI 43-101 Resource).

It is also located approximately two kilometres north of the large undrilled Chuscal porphyry target. MNC’s current 1500m diamond drilling program is designed to confirm and expand the gold mineral system intersected in drilling by a previous operator.

Assay results from the first two drill holes at Tesorito are as follows:

Assays from hole TS_DH_04 include:

- 179.8m at 0.7g/t gold from surface including

Assays from TS_DH_05 include (partial results):

- 212.7m at 0.39 g/t gold from surface including

MNC expects to receive assays for the remainder of TS_DH_05, 06 and 07 in August.

What these results will show is yet to be determined, so investors should take all publicly available information into account and seek professional financial advice before making an investment decision.

This and previous drilling confirms the gold mineralisation (over 0.5 g/t Au) is extensive in area (400m x 180m) and is open laterally to the north-northeast, east-southeast and at depth.

This included hole TS_DH_02 which reported 384m at 1.1g/t gold from surface to end-of-hole. The program will also test a previously undrilled geophysical anomaly located approximately 300m to the northwest of TS_DH_02.

MNC Executive Chairman Kevin Wilson said, “The intensity of hydrothermal alteration seen at Tesorito together with prolific gold mineralisation already recognised in the Quinchia district and elsewhere in the Cauca belt suggests this to be major mineralising system which offers great potential for exploration success. In the classic porphyry model, the mineralisation seen at Tesorito could be the gold cap to base metal mineralisation at depth.”

MNC believes the mineralisation at Tesorito represents the gold-rich cap of a deeper base-metal rich porphyry system. This view is supported by the phyllic alteration and increasing base-metal content and igneous activity with depth seen in several holes.

The intensity of hydrothermal alteration seen at Tesorito together with prolific gold mineralisation already recognised in the Quinchia district and elsewhere in the Cauca belt suggests this to be major mineralising system which offers great potential for exploration success.

This latest news comes after a broker report from Stockdale Securities earlier this month when it initiated coverage with a “Buy” rating. At that time all assay results from MNC’s Tesorito gold prospect were pending, and Stockdale noted that it expected “a re-rating of MNC’s stock on the back of results, confirming extensive gold mineralisation”.

In addition to the assay results, the broker also notes that negotiations are on-going with AngloGold Ashanti for a formalised Joint Venture agreement allowing MNC to follow up on a significant gold-in-soil anomaly (>0.5g/t Au over a 500m x 250m area) at the nearby Chuscal prospect.

The broker concluded, “We expect MNC shares to perform well on the back the of continued exploration success while the Company progresses through the permitting and EIA stage at Miraflores.”

It should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.