Drilling ahead at 88E's expanded Alaskan North Slope oil portfolio

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

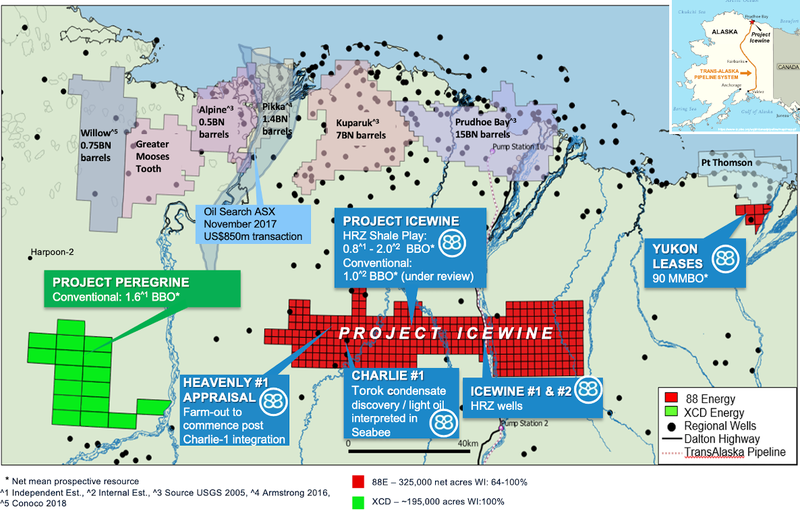

Oil exploration junior, 88 Energy Ltd (AIM:88E | ASX:88E) has expanded its position on the Alaskan North Slope, acquiring XCD Energy and its 135,000 acre Project Peregrine.

88 Energy now has net half a billion acres of exploration ground across multiple world class assets with multi-billion barrel discovery potential on the North Slope, with Peregrine joining Project Icewine and the Yukon Leases in 88 energy’s portfolio.

Alaska’s North Slope basin has a long history of successful oil discoveries — recent discoveries have included the two largest conventional oil discoveries onshore North America in over 40 years.

It is the location of North America's largest current oil field, Prudhoe Bay, which originally contained over 25 billion barrels of oil. Furthermore, the basin is surrounded by several other large oilfields, having together produced over 17 billion barrels of oil since 1977 through the Trans Alaska Pipeline System.

88E acquires Project Peregrine

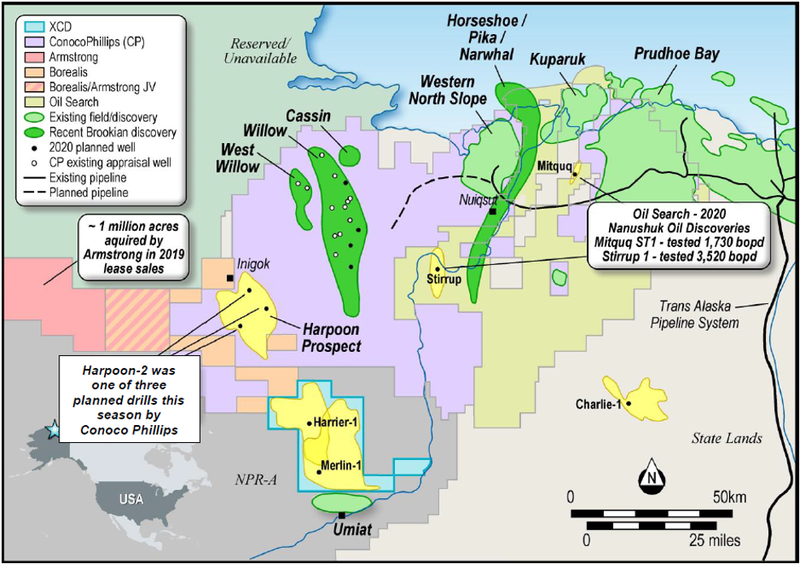

Project Peregrine comes with three onshore prospects already identified at the project — Merlin (Nanushuk), Harrier (Nanushuk), Harrier Deep (Torok).

Combined, these prospects have a mean unrisked recoverable prospective resource of 1.6 billion barrels of oil, as per an independent report generated by ERC Equipoise.

To the north and south of Project Peregrine sit major oil discoveries.

Willow, to the north, is a 0.75 billion barrel discovery made by ConocoPhillips (NYSE: COP), a $44 billion goliath on the North Slope.

A recent well drilled by ConocoPhillips, just 15 kilometres from Project Peregrine, encountered hydrocarbons at its Harpoon prospect, which is interpreted to be directly on trend and analogous to the Harrier prospect at Peregrine.

The Peregrine Project also lies directly to the north of the Umiat oil accumulation that’s estimated to have greater than 1.0 billion barrels of oil in place.

2021 Drilling Planned

88 Energy intends to drill two, low cost wells to explore Project Peregrine in early 2021.

These wells will test the resource potential of Peregrine, with the aim of unlocking the next major oil discovery on the North Slope.

As 88 Energy currently holds 100% of the project, it intends to do a farm out deal with other partners that want exposure to near term upside.

The company will be undertaking low cost options for well drilling, estimating that the two wells will to cost ~US$15 million.

88 Energy has identified two primary prospects — Merlin and Harrier that total over 1 billion barrels, that it is intent on drilling in early 2021. Both prospects are located on trend to existing recent discoveries, with Harrier recently being de-risked by evidence of hydrocarbons at Conoco’s Harpoon-2 well.

Charlie-1 well at Project Icewine

In addition to the newly acquired Project Peregrine, there remains significant opportunity and value at the company’s Project Icewine.

Despite a negative market overreaction to early results from the Charlie-1 well at Project Icewine earlier this year further investigations have been promising These results were released amid ‘peak fear’ from the COVID-19 pandemic and faced a record low oil price environment that saw oil futures contract fall into negative territory.

However, 88 Energy believes that sell off to be an overreaction. The company has now released sidewall core analysis using two different techniques. Both demonstrate that the primary targets — the Seabee and Torok Formations — are in fact, full of oil.

Reservoir modelling of stimulation of the formations is now underway to understand flow potential.

More lab data and news is to come from Charlie-1 and 88 Energy has identified a new preferred well location to test the conventional targets at Project Icewine — a location with better reservoir quality.

Major upcoming activity for 88 Energy includes the farm-out of Project Peregrine in the lead up to the drilling of two wells in early 2021, plus the integration of new results from the Charlie-1 well, and reinvigoration of the farm-out process for Project Icewine.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.