We Just Doubled Our Holdings in 88 Energy ASX - Find Out Why

Investing in undervalued and under the radar stocks, not yet recognised by the broader market, is possibly the best way to achieve outsized returns.

Once a share price has surged and the whole market is talking about a stock, it’s often too late to make serious gains.

Our investment strategy is to unearth undervalued micro-cap stocks that are on the cusp of value accretive newsflow, the kind of news that can see them rapidly gain 100% or more.

We don’t always get it right. No one can, especially at the speculative end of the market, but we have had some recent successes by backing unloved stocks.

We took a risk on a little unloved coal seam gas explorer Elixir Energy (ASX: EXR) back in May 2020 when it was trading at 2.4¢ – doubling our holdings at that time.

It’s since risen to 18¢ — that’s a gain of 650%. Not bad for just a few months:

We don’t make many investments in oil and gas stocks, but we are glad we backed EXR over the long term.

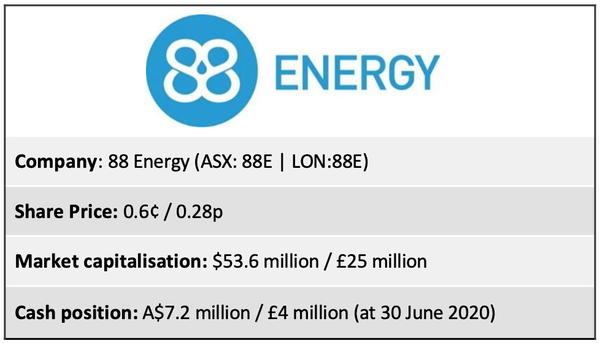

Another stock we have a large position in is 88 Energy (ASX | LON : 88E), and we are looking for similar sized returns in the coming months here.

88 Energy (ASX | LON: 88E) hunts for monster oil deposits.

This kind of exploration can have binary outcomes – providing outsized rewards on success.

Like we did with EXR, we have just doubled our holding in 88E Energy (ASX | LON: 88E) - while sentiment is low.

The calibre of 88E’s assets are high, and the company is set to embark on a number of game changing drilling events, to unfold over the coming 6-12 months.

88E has not had the greatest of years, with unfortunate timing on a number of fronts. The stock was oversold on news back when ‘peak fear’ around COVID-19 was gripping global markets and the oil price was at all time lows.

Despite the sentiment, 88E’s asset portfolio has only grown in stature in recent months, with the company having quietly accumulated additional assets holding potential for billion barrel plus oil discoveries.

At its Project Icewine, the company has just upgraded the Net Pay to 398’ from its Charlie-1 well.

This appraisal well made oil discoveries that the market has completely missed to date.

The increase in Net Pay comes despite higher cut offs for both porosity and water saturation.

Shortly, 88E will be integrating all the data, which will ultimately yield updated volumetrics for the resources.

Armed with a slew of new and valuable data from Charlie-1, the company will soon be opening a dataroom, inviting potential farm in partners to join them on the follow up well.

This second well, in a preferred location, is targeting the Seabee and Torok Formations that are looking highly promising.

The new well location is in a more oily location, with better reservoir quality.

88E has no major expenditure items planed for 2020 and drilling in 2021 will be funded via a farm out.

Despite all of this progress, the company is trading at close to all time lows, and like all cyclical markets, the oil market is due to return to favour soon...

We think right now is the best time to invest in 88E.

We are long term backers of this company and its high calibre management team.

88E has shown time and time again it can get farm out deals done, deliver to operational milestones and reward shareholders.

In early 2016, 88E’s share price ran up 10x on one drilling event alone.

We have seen it before and will see it again — 88E tends to surge upwards and trade on large volumes ahead of high impact drilling events.

Investing in stocks unrecognised by the market is the way to get significant gains.

Take Vulcan Energy Resources as another example:

We took a position in Vulcan Energy Resources (ASX: VUL) in February at around 18¢ per share. The company, which is developing a zero carbon lithium project in Germany, took a hit amid the COVID-19 crisis with its shares declining through April. But since then it undergone an impressive recovery.

VUL hit a milestone $1 per share yesterday for a ~455% return:

Los Cerros (ASX: LCL) was one that doubled down on our position on earlier this year when it was first recovering from the market lows.

After an exceptional session yesterday in which LCL closed up 127%, it has returned a total of 400% for our readers:

We think 88E has all the potential to go on similar style runs as EXR, VUL and LCL over the coming six to 12 months.

This article will cover all the reasons why we recently doubled our holdings in 88E, and remain long term investors.

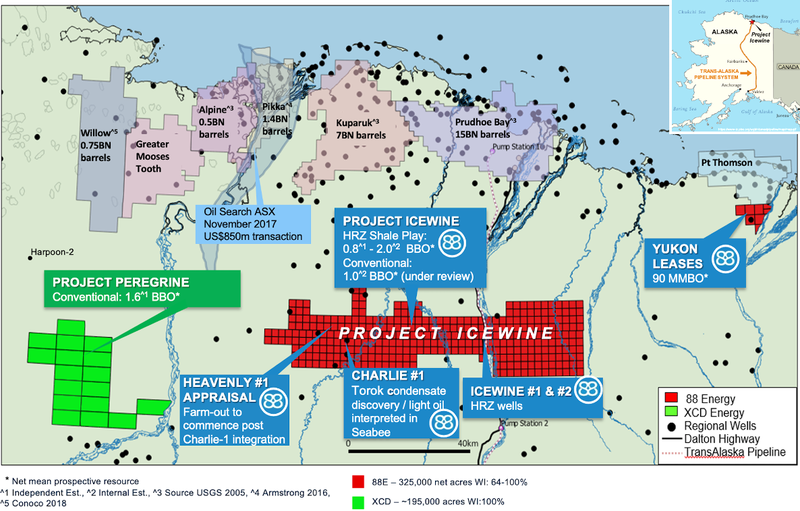

88E has multiple world class oil assets on the oiliest place on earth – the Alaskan North Slope

88 Energy controls multiple world class exploration/appraisal projects across ~520,000 net acres on the Alaska Central North Slope.

This includes Project Icewine, Project Peregrine and the Yukon leases, with 88E maintaining very high ownership positions across all.

Here’s 88E managing director Dave Wall discussing the expanded asset portfolio in late July, and also what investors can look forward to over the coming months:

Charlie-1 appraisal well – a significant oil discovery the market missed

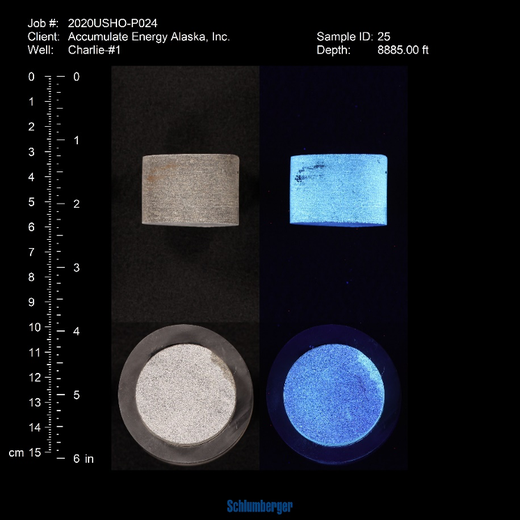

Back in April at Project Icewine, 88E confirmed that the Charlie-1 appraisal well had proved the presence of mobile hydrocarbons, in the form of condensate gas, in the Torok Formation in both the Middle Stellar and Lower Stellar targets.

Importantly, the company also indicated that the Seabee was full of oil but had not been tested.

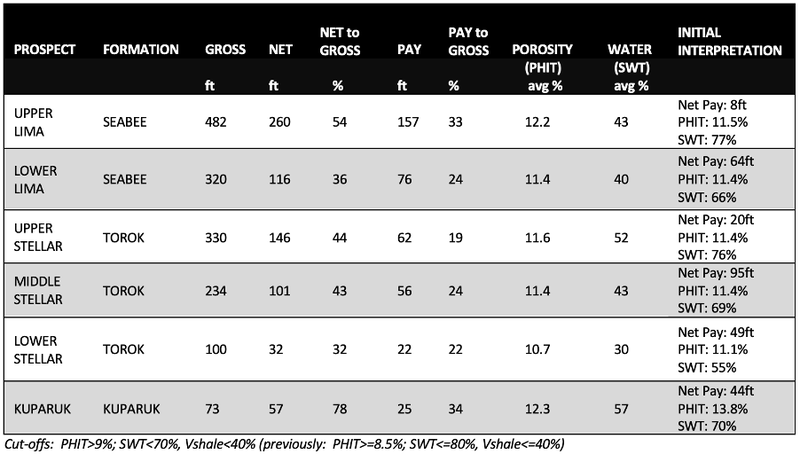

Final third party petrophysical interpretation from the recently drilled Charlie-1 well have now been received.

This petrophysical interpretation, using sophisticated Laminated Sand Analysis, substantially upgrades net hydrocarbon pay in the Charlie-1 well to 398 feet from 280 feet.

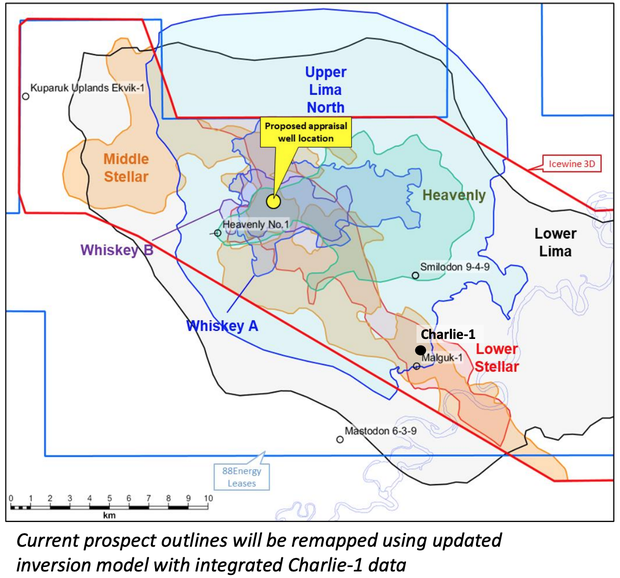

The largest contribution comes from the Lima discoveries in the Seabee Formation. Both Upper and Lower Lima (in the Seabee formation) are confirmed as large oil discoveries by this interpretation and the lab results.

Seabee hydrocarbons are proven in the historical Malguk-1 well by oil observed over the shakers at surface and in cores from Heavenly-1 and now Charlie-1.

The reservoir quality is clearly evident to be higher away from the Charlie-1 location, both updip and downdip.

The results are particularly significant as these targets are the most extensive of the Icewine conventional horizons as well as being relatively shallow, by comparison to the Torok Formation.

Dave Wall, said, "The results from the Seabee, despite Charlie-1 not being optimally located, are outstanding.

“Whilst these may appear as a serendipitous by-product of the well, internal analysis prior to drilling had already significantly high graded this formation; however, it was too late to change the objectives/location of the well, meaning that work remained largely on the drawing board.

“This final interpretation is a strong vindication of that internal effort. We are now looking forward to the conclusion of the evaluation of the Seabee oil discoveries as we integrate the petrophysics into the seismic inversion and subsequent mapping, which will ultimately yield updated volumetrics for our resources that will feed into the Icewine farm-out process.”

Over the coming weeks, the extent of the accumulations will be estimated as these final petrophysical numbers are integrated into the updated seismic inversion product.

The Stellar targets in the Torok Formation are also confirmed as hydrocarbon discoveries with good liquid hydrocarbon content.

There remains some uncertainty about the gas to oil ratio as the liquid hydrocarbon saturations measured from the Charlie-1 cores in the lab imply much lower gas to oil ratio than that observed during the downhole tests, which recovered gas condensate.

It is possible that these liquids may be unlocked by stimulation of the reservoir.

The Kuparuk also remains a prospective target, with anomalously good reservoir quality for its depth, however, no mapping has been done for this horizon and it is considered more gas prone than the Torok Formation.

Armed with more data, 88E has identified a new preferred well location to test the conventional targets at Project Icewine — an ‘oilier’ location with better reservoir quality.

The company will be shopping the project around to farm in partners once again and have another crack at striking flowing hydrocarbons.

Oil explorers are risky investments, but with multiple billion barrel oil discoveries made on the North Slope to date, 88E is intent on finding the next one.

The upside on that could be enormous for investors entering the stock at its current levels.

88E’s Project Peregrine – 1.6 billion barrels of net mean prospective resource

The company earlier this year completed the acquisition of XCD Energy in an off market takeover. This included the acquisition of XCD’s Project Peregrine that is now 100% owned by 88E.

The combined entity now has extensive technical knowledge of the regionally successful Brookian oil plays in which 88 Energy retains significant upside exposure via its highly prospective portfolio of exploration/appraisal projects.

Project Peregrine spans 195,000 acres of prime exploration ground in the National Petroleum Reserve-Alaska (NPRA) region of the North Slope of Alaska.

Three onshore prospects are already identified — Merlin (Nanushuk), Harrier (Nanushuk), Harrier Deep (Torok).

Combined, these prospects have a mean unrisked recoverable prospective resource of 1.6 billion barrels of oil located on trend to recent discoveries.

Conoco Phillips’ 0.75 billion barrel Willow discovery to the north, and Umiat, a recent Brookian oil discovery with over a billion barrels of oil, to the south show that Project Peregrine is situated in the right place.

In fact, the Willow oil discovery is considered a direct analogy to the Project Peregrine’s Merlin prospect.

Conoco’s Harpoon Prospect is also near that of 88E’s — Harpoon is just 15 kilometres from Peregrine and interpreted to be directly on trend and analogous to the project’s Harrier prospect. Conoco this year confirmed that it encountered hydrocarbons at Harpoon.

88E is intent on drilling Peregrine in early 2021 and has identified two primary prospects — Merlin and Harrier that total over 1 billion barrels.

Permitting commenced and farm-out discussions underway for drilling of the two wells in the first half of 2021.

88E will be undertaking low cost options for well drilling, estimating that two wells are expected to cost US$15M.

The prospects are both in the Nanushuk formation so the wells will only require drilling to about 5,000 feet to fully test.

The third prospect in the Peregrine block, Harrier Deep, has a Torok objective at about 10,000 feet.

Dave Wall reports that “good progress continues to be made at the newly acquired Project Peregrine on both the farm-out and permitting/planning fronts. Additional news related to that will be provided to the market in a separate announcement in the near term.”

88E will seek a farm in partner looking for exposure to near term discovery potential to fund the drilling. This could be a very compelling opportunity on the 1 billion barrel plus opportunity presented at Peregrine.

In my last article on 88E — More Shots on Goal Ahead: 88E Reveals Next Multi-Billion Barrel Oil Opportunity — I provided some examples of recent ASX deals in which companies were prepared to invest similar amounts of cash for much less upside.

It might only be a matter of time before a deal is struck and 88E starts drilling preparations here.

88E’s Unconventional HRZ shale play – derisked by three wells

Further upside potential remains from the 0.8-2.0 billion barrel prospective HRZ shale resources at Project Icewine.

Three exploration wells have been drilled that have de-risked and improved understanding of the large shale potential here. This is consistent with early stage results from other successful plays.

The confirmation of the ideal thermal maturity for the HRZ shale at Charlie-1 is encouraging and will form the basis of further work to continue to unlock its large potential.

The results from Charlie-1 analysis of HRZ liquids rich resource play expected to facilitate farm-out process.

Shale plays are complicated, and there will be further analysis, however a farm out deal could still be on the cards for this unconventional play.

Looking ahead

The time to ‘get set’ in stocks such as 88E is when the broader market is not looking, at the bottom of the cycle, when attention is elsewhere.

This was the case when we invested in EXR. It was the case when we invested in VUL.

And now, this looks to be the case with 88E, and is why we have decided to double our holding in the stock.

There are significant catalysts on the horizon for 88E in the lead up to 2021 planned drilling, and that will start by securing farm out partners looking for near term oil discovery upside.

As a large holding in our long term investment portfolio, we’ll be following developments closely in the months ahead.

88E has been shown before that it can quickly gain traction in the market. Coming off its current low base, we expect that it could soon return into focus in the small end of the oil and gas space.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.