LCL expands nickel project in the PNG

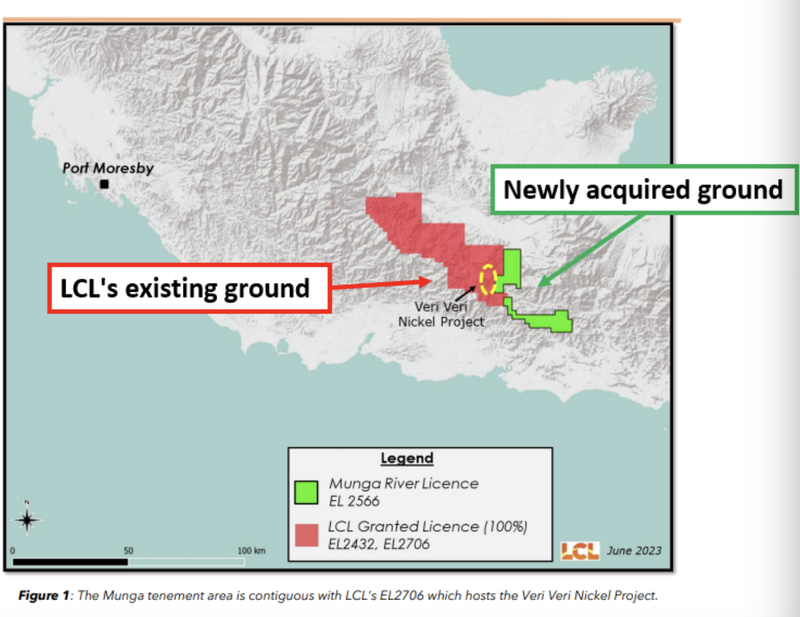

LCL Resources (ASX: LCL) just picked up some more ground right next to its nickel project in Papua New Guinea.

While our current focus is on LCL’s drill program at its gold/copper project the acquisition looks interesting ahead of a maiden drill program at the nickel project.

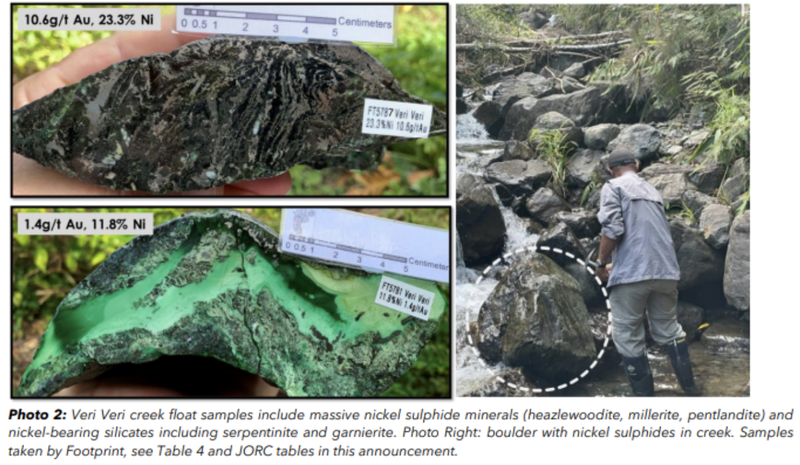

For some context, the Veri Veri nickel project is where historic samples taken from the creek near this project have returned grades as high as ~45.8% nickel.

LCL also recently completed a field mapping program at the project so it makes sense to us that the acquisition today may have been done off the back of the data gathered during that field trip.

Interestingly, the ground acquired would also be where the project extends (if a discovery is made and it trends east).

LCL’s target at Veri Veri is nickel sulphide mineralisation - the type of nickel mineralisation that makes up for much of the nickel production around the world.

What is LCL paying for the new ground?

- LCL will be issuing 6,700,617 shares to the vendors.

- 2% net smelter royalty. LCL will have the right to buy this back for $5M at any time.

- $25k cash and 1,340,123 in transaction fees.

All in all, at today’s share price the deal will end up costing LCL $25k in cash and ~$280k in LCL shares.

To see what’s next for LCL, check out our last note here: