Vonex rallies 15% following strong September quarter growth

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Telecommunications innovator Vonex Limited (ASX:VN8) has recorded an outstanding quarter on quarter increase in user growth, as well as achieving promising levels of satisfaction in its retail business.

This news prompted significant interest in the company on Thursday morning with its shares up 15.8% to 11 cents in the first hour of trading.

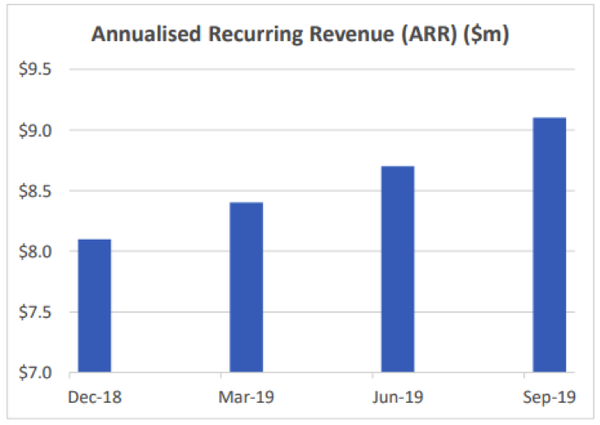

Vonex has employed a new system of disclosure which shows a success metric that indicates the levels of annualised recurring revenue (ARR).

ARR excludes one-off sales revenue and does not factor in net churn as the business continues to deliver positive net growth in active users.

The chart below displays the consistent growth in ARR that Vonex has delivered as its retail and wholesale businesses have gained scale in in calendar year 2019.

Growth driven by SMEs moving to cloud based services

Discussing Vonex prospects of sustaining these high levels of growth, managing director Matthew Fahey said, ‘’The company is well-positioned to continue growing its ARR and expanding its base of higher margin, higher average revenue per user (ARPU) business, as strong demand continues from small and medium enterprises (SMEs) moving to cloud-based telco services.

‘’Vonex's recurring business model promotes stable revenue, maximises customer lifetime value and supports scalability.’’

The continued strong performance of the company’s Private Branch Exchange (PBX) business augurs well for the future.

Registered users of these Private Branch Exchange (PBX) connections are a key indicator of business development progress as Vonex penetrates the multi-billion dollar Australian market for telco services to SMEs.

The company has passed the 35,000 active PBX users milestone, having achieved significant growth in signed contracts.

Achieving this milestone reflects the company's strong start to the December quarter of fiscal 2020, signing Total Contract Value (TCV) of new customer sales worth more than $500,000 in October 2019, an increase of 65% compared to October 2018.

TCV of provisioned customers is calculated using the minimum monthly commitment multiplied by the contract length and is typically realised over a period of between two and three years.

Vonex plans to deliver continued growth in TCV in fiscal 2020 as a mix of upfront and recurring revenue as it meets healthy demand from SME customers.

Customer satisfaction important in transitioning to NBN

Management is buoyed by the high levels of customer satisfaction being achieved with Fahey saying, ‘’Enhancing the customer experience is increasingly critical as the migration of customers to services delivered over the National Broadband Network (NBN) reaches its peak.’’

The Telecommunications Industry Ombudsman (TIO) recently reported a total of 32,801 complaints relating to the provision of Australian phone and internet services in September quarter of fiscal 2020, an increase of more than 6% compared to September quarter of 2019.

Management noted that Vonex received zero TIO complaints from customers in September quarter of fiscal 2020.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.