Telix a standout diagnostic and therapeutic radiopharmaceutical play

Published 19-MAY-2020 09:25 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Telix Pharmaceuticals (US) Inc, a subsidiary of Telix Pharmaceuticals Limited (ASX: TLX) announced on Friday that it has entered into a commercial distribution agreement with Boca Raton-based Pharmalogic Holdings Corp. (Pharmalogic) to provide nuclear pharmacy and logistics services to support Telix’s prostate cancer imaging product TLX591-CDx (68GaPSMA-11), a radiopharmaceutical for the imaging of metastatic prostate cancer.

This was an important development for Telix, and while its shares were up slightly during the day it could be argued that the significance of the agreement was missed by the broader market.

Under the agreement, Pharmalogic will prepare and deliver patient-specific unit-doses of TLX591-CDx, for the US market through its network of 27 nuclear medicine pharmacies.

Pharmalogic’s nuclear medicine pharmacy network services predominantly regional and rural areas in the Midwest and Northeast regions of the United States.

Pharmalogic president and chief executive Steven Chilinski is already looking towards commercialisation, and he said, “The collaborative partnership between Telix and Pharmalogic is being highlighted by the planned launch of this highly anticipated prostate imaging agent, ensuring that this important drug is available to our customers and patients, and furthering our mission to advance the development and commercialisation of new, game-changing diagnostic and therapeutic radiopharmaceuticals.”

Blue Ocean Equities highlights five near-term re-rating events

By way of background, TLX591-CDx (kit for the preparation of 68Ga-PSMA-11) is a proprietary formulation of PSMAHBED-CC (PSMA-11), a novel small molecule agent targeting prostate-specific membrane antigen (PSMA), originally developed by the Heidelberg group of the Deutsches Krebsforschungszentrum (German Cancer Research Center, DKFZ).

The ‘cold kit’ format of TLX591-CDx enables rapid radio-labelling at room temperature with high radio-chemical purity and production consistency, ideally suited for the radio-pharmacy setting.

TLX591-CDx (kit) is branded and trademarked in the US as illumet.

Currently, US TLX591-CDx is available for investigational use only as part of an FDA Investigational New Drug (IND) application, but it is already generating revenues for Telix while being used in this capacity.

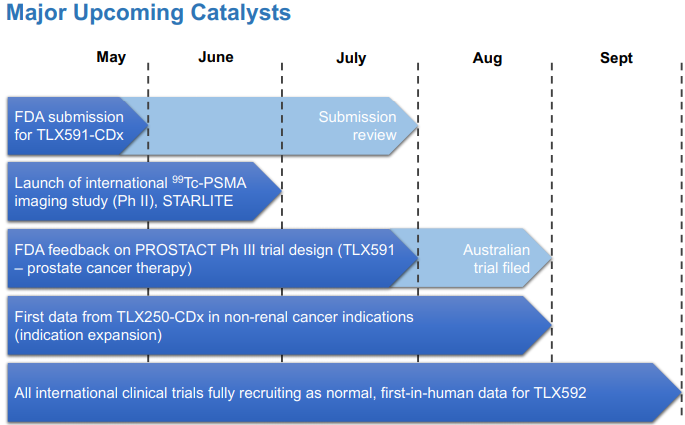

While TLX591-CDx is not presently an FDA approved agent, its approval is one of a number of value accretive near-term catalysts identified by Blue Ocean Equities analyst Michael Gerges who said last week, ‘’Near-term material re-rating events include: (1) US & EU marketing approval for TLX591-CDx (3Q/4Q20); (2) Commercial launch of illumet (1Q21); (2) FDA ‘green light’ on commencement of PROSTACT Ph3 trial for TLX591 (4Q20); (4) first patient dosing of PROSTACT Ph3 trial in Australia (4Q20); and (5) completion of enrolment for ZIRCON Ph3 trial (4Q20).’’

Gerges has just updated his price target from $1.70 to $2.10, implying share price upside of 50% relative to Monday’s closing price.

The broker highlighted that Telix was well funded with negligible debt and a cash balance of $34.5 million.

This along with a research and development credit of $11 million which should boost the coffers in the second half of 2020 will provide the company with ample funding to progress the initiatives that could lead to a very significant share price rerating.

The other factor working in Telix’s favour is that it is already generating revenues, and after nearly doubling to $6 million in 2020, Gerges expects income to increase more than six-fold in 2021 with forecast revenues of $37.6 million.

The broker is projecting Telix to deliver its maiden net profit of $21.6 million in fiscal 2022.

While operational milestones are likely to be the key catalysts over the next six months, investors who target the limited clutch of smaller players with material cash flows and medium-term earnings predictability are likely to focus on Telix as revenues accelerate in 2021 ahead of its maiden profit.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.