Prepare for a fossil fuel recovery in 2021

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

With the Dow having rallied approximately 200 points on the last day of the calendar year and the ASX 200 up by about 1.5% on the first day of trading for 2021, it seems that investors are whetting their appetite for some strong gains in equities as the new year unfolds.

The Dow actually notched up its 2020 high of 30,637 points on Friday, while the NASDAQ finished less than 100 points shy of its all-time high of 12,973 points.

While these bullish numbers speak for themselves, it could be one of the beaten-down sectors of 2020 that outperforms in 2021.

The S&P/ASX 200 Energy Index (ASX:XEJ) fell from about 12,000 points at the start of 2020 to a low of 5000 points in March as COVID concerns gripped the market.

While the index finished the year some 60% above this mark, another 50% rally throughout 2021 wouldn’t surprise, and this would see it return to pre-COVID levels.

Disconnect between index and key commodities due for correction

It is worth noting that the Brent Crude Oil Continuous Contract is hovering in the vicinity of US$52 per barrel, having recently passed the tipping point which saw it fall from about US$50 per barrel to US$28 per barrel in the space of three weeks, courtesy of COVID.

While Brent is approximately 20% shy of its January 2020 high, a kick of about 40% is required to bring the XEJ back into kilter, highlighting the potential share price upside that lies in our energy stocks.

There is another facet to this scenario which may prove to be useful in terms of cherry-picking the sector in the coming 12 months, and it revolves around a resurgence in LNG prices - on the last day of 2020, the spot Asian LNG price, the Japan-Korea Marker benchmark, surged above $US15 per million British thermal units for the first time since April 2014.

Global LNG Hub highlighted the significance of notching up a six-year high in the following commentary:

‘’North Asian spot LNG prices rose to a six-year high on December 28, while the market continued to focus on bare naked inventory levels in Japan. The S&P Global Platts JKM for February was assessed at 70.3 cents/ MMBtu higher day on day at $12.514/MMBtu.’’

Will LNG continue to shine in 2021

On December 31, Bloomberg energy markets specialist Anna Shiryaevskaya along with other colleagues reported in theedgemarkets.com that liquefied natural gas traders were anticipating a swift demand recovery in 2021 after a year in which the coronavirus pandemic prompted dramatic price swings.

In part, the report said, ‘’Colder weather in key importing nations, outages at major production hubs and congestion along global shipping routes already have combined to push spot prices in Asia to the highest level since 2014.

‘’That's a more than six-fold jump from a record low in April, making Asian LNG the best performer among major commodities in 2020.

‘’Demand for the fuel used in heating and power generation is growing faster than for any other fossil fuel as nations look for a cheap, reliable and cleaner alternative to coal.

‘’The pandemic derailed that growth for 2020, but China and India are emerging as major sources of demand.’’

Importantly, the demand drivers referred to largely relate to non-discretionary spending.

Consequently, while negative sentiment towards the commodity was based on a downturn in demand due to factors such as decreased manufacturing, LNG prices are now being driven to a significant extent by consumer and household consumption.

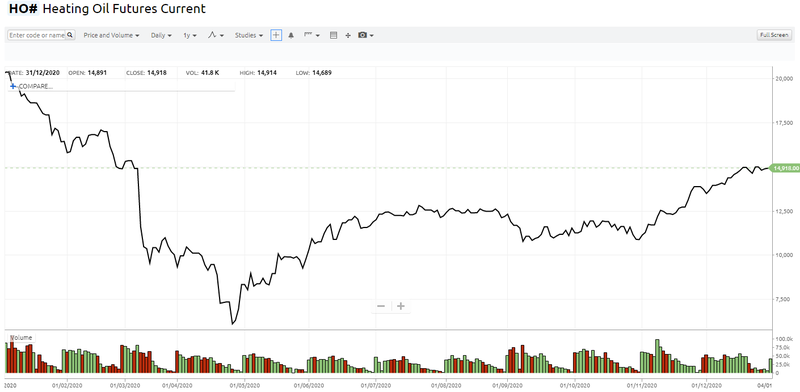

The demand for domestic purposes such as countering cold weather conditions, particularly in northern hemisphere countries at this time of year is demonstrated below with the surge in heating oil futures since November equating to an increase of nearly 40%.

Moreover, the price has more than doubled since the long-term COVID-related low that was set in March.

Supply problems could see China sourcing LNG from regional markets

Like any commodity, prices will be impacted by both supply and demand, and on this note, LNG is looking even stronger as supply constraints continue to mount.

Edgemarkets reported, ‘’Unplanned maintenance at LNG export facilities from Australia to Qatar to Malaysia has led to a tighter than expected market in the second half of the year.

‘’And delays in navigating the Panama Canal curbed supplies to Asia.

‘’If these disruptions persist well into the year, then prices could remain elevated well above current levels.’’

With China being the fastest growing LNG importer and little in the way of long-term supply deals between China and the US, producers and advanced exploration groups proximal to China are likely to come under the microscope with the prospect of commercially lucrative offtake agreements being negotiated and a strong likelihood of corporate activity.

China likely to be eyeing off activity in Mongolia

In terms of accessing new supply, China could look to Mongolia given its close proximity and abundant energy resources.

One player that we have been monitoring closely is Elixir Energy (ASX:EXR), a company that had a highly successful year on the exploration front in 2020.

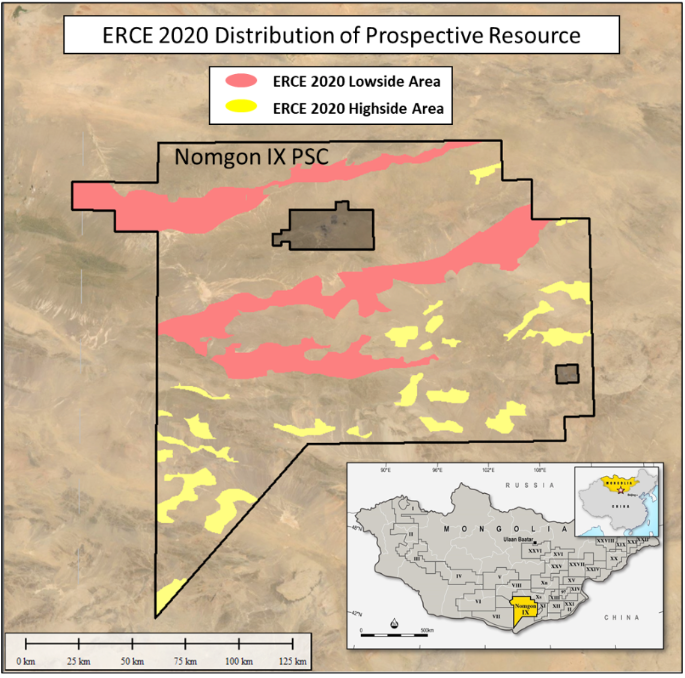

Analysts at K1 Capital ran the ruler across Elixir Energy Limited (ASX:EXR) after the company recently released an updated prospective resource for its 100% owned Nomgon IX CBM PSC project.

The PSC as shown below covers approximately 30,000 square kilometres adjacent to the border with China, and with leaders openly stating that they are aiming to reduce emissions, the country could be a source of demand with Elixir’s sizeable acreage being a key attraction.

The independent reserve auditor ERCE Equipoise (ERCE) appraised the project following Elixir’s successful 2020 drilling campaign where seven CBM exploration and appraisal wells were drilled spanning a distance of 62 kilometres. Notably, all of the wells intersected coal.

An initial contingent resource estimate for the Nomgon sub-basin discovery area will be prepared and issued once all of the data from the appraisal drilling program has been compiled, modelled and analysed.

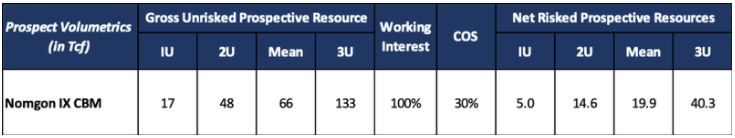

In the interim, a summary of the prospective resource range is outlined below.

K1 Capital analyst John Young was impressed with the updated prospective resource, increasing his valuation from 27 cents per share to 29 cents per share, implying upside of 15 cents per share or approximately 100% to the company’s current share price.

In part, Young said, ‘’The increase recognises greater gas in place and higher geological chance of success (30% vs. 19% previously), based on recent drilling.

"Results from the two core holes indicate high gas content (8.6-8.9 m3/t DAF) and fully saturated coals, indicating good CBM potential.

"With cash at bank and in-the-money options due by end December, Elixir is funded to continue exploration and appraisal in 2021.’’

An initial contingent/discovered resource estimate for the Nomgon sub-basin should be established in 2021 following further analysis of drilling data, and this could well be a significant share price catalyst.

Young sees the prospect of extensional drilling and an expansion of exploration drilling to other sub-basins as potential share price catalysts in the next 12 months.

Highflying Invictus to take off in 2021

Invictus Energy Limited (ASX:IVZ) is another emerging player to watch closely in the next 12 months.

While not linked to the China factors we have discussed, the Cabora Bassa Project in Zimbabwe could bridge a sizeable supply gap across African markets.

Consequently, there is the potential for strong news flow from high impact drilling planned for 2021, with the company having completed field operations and reconnaissance in 2020.

The Cabora Bassa Project encompasses the Mzarabani Prospect, a multi-TCF and liquids-rich conventional gas-condensate target, which is potentially the largest, undrilled seismically defined structure onshore Africa.

A key development in late-December was the receipt of a non-binding offer for farm-in to the Cabora Bassa Project.

The proposed transaction is subject to completion of further technical, legal and commercial due diligence by both parties, as well as approvals and agreements by requisite government authorities and execution of binding Farm-Out Agreement(s).

Further details of the proposed transaction will be made public upon completion of a binding FOA(s) and satisfaction (or waiver) of conditions.

The prospect is defined by a robust dataset acquired by Mobil in the early 1990s that includes seismic, gravity, aeromagnetic and geochemical data.

Additional detailed traversing and mapping across the area have been completed and identified the optimal acquisition routes.

The company is making significant progress on executing the first seismic acquisition program in the country for 30 years and is working closely with the seismic contractors on a planned acquisition campaign in 2021 to commence once the rainy season has concluded.

The progress that has been made in 2020 has been value-accretive for the group with the company’s shares increasing more than five-fold since March.

The reconnaissance program also identified additional locations for further geochemical sampling and analysis.

In the interim, the Production Sharing Agreements with the Republic of Zimbabwe continue to progress and are now in the approval process.

Updates to the market regarding progress in finalising the PSA and any associated government approvals could provide further share price momentum.

Pantheon Resources could pave the way for 88E rerating

Another company that is poised to deliver further upside in 2021 is 88 Energy Ltd (ASX:88E; AIM:88E) given its highly prospective assets on the North Slope of Alaska.

As the group made significant progress in the latter months of 2020 with updated resource estimates, a $10 million capital raising and the negotiation of a farmout agreement in relation to Project Peregrine, the company’s shares rallied 60%, continuing to trade close to the eight-month high struck in December.

Having executed the contract to drill the Merlin-1 and Harrier-1 wells for Project Peregrine on the North Slope of Alaska, the spud date is February, suggesting there could be important news flow in the March/June quarters.

From a broader perspective, 88 Energy has executed a rig contract with All American Oilfield, LLC for the use of Rig 111 to drill the Merlin-1 and Harrier-1 wells at its Project Peregrine in the NPR-A region of the North Slope of Alaska.

Both wells are planned for drilling to a Total Depth of approximately 6000 feet in order to intersect the prospective Nanushuk topset horizons that are located on trend to existing discoveries to the north of the project area.

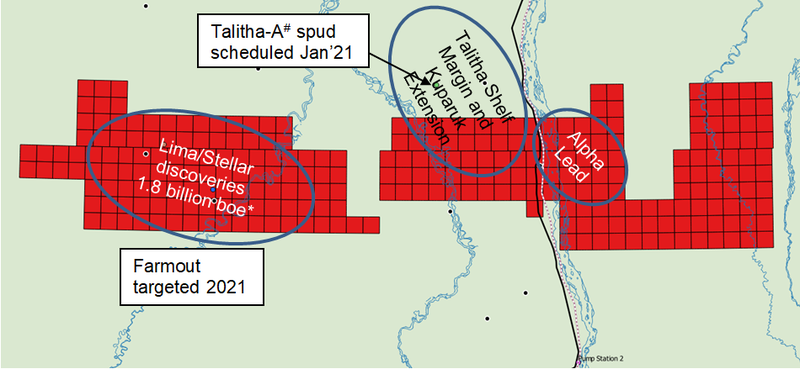

In a recent development, the $380 million Pantheon Resources (AIM:PANR) has announced that its Talitha-A well, located close to the northern border of the 88E central acreage position, is scheduled to spud in January ’21.

Several of the prospective horizons in Talitha-A are interpreted to extend into 88E acreage as indicated below.

With drilling of the Talitha-A well occurring ahead of the Merlin-1 spud, 88 Energy’s share price could receive some support even before drilling results start to filter through if Pantheon has success.

As Pantheon recently highlighted, Alaska North Slope is home to the US’s largest two oil fields and it hosts some of the world’s largest discoveries over recent years, featuring both onshore and conventional (not shale) with enormous potential.

With excellent infrastructure and low royalty rates, it is a good place to do business.

Harking back to 88 Energy’s prospects, managing director Dave Wall said, "Drilling at Project Peregrine is moving ahead as planned and we are only about two months away from spud on what will be a potentially company-making prospect for our shareholders.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.