NHE’s rig has arrived in Tanzania - on track to drill this month

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,980,926 NHE shares and 2,437,037 options, and the Company’s staff own 54,339 NHE shares and 2,000 NHE options at the time of publishing this article. The Company has been engaged by NHE to share our commentary on the progress of our Investment in NHE over time.

After 28 days of tracking the rig’s every move it has finally arrived.

Our helium Investment Noble Helium (ASX:NHE) just got its rig to the Dar es Salaam port in Tanzania, and it's now unloading and entering customs.

NHE is now just a few weeks away from drilling its first ever well at a project that has a prospective resource large enough to shore up global helium supply for the next 30 years.

NHE will soon be drilling into a Basin Margin Fault Closure (BMFC) within the East African Rift System (EARS).

There is a 100% success rate for EARS oil and gas wells that are BMFC plays.

NHE wants to continue this unbroken record.

The key difference with other wells is that NHE’s geological evidence points to helium gas, rather than petroleum gas, within the geological traps.

After 28 days at sea, here’s the good ship MV Bohwa Tsingtao - containing NHE’s drill rig safe and sound at the Tanzanian port, ready for unloading:

NHE plans to be drilling this month

NHE’s first two wells in the coming weeks will be drill testing an unrisked mean helium prospective resource of 15.7 billion cubic feet (BCF).

This is only 10% of NHE’s entire independently certified prospective resource which sits at 176 bcf.

A second well, drilled immediately after the first, means that NHE can immediately appraise a discovery on the first exploration well.

A successful discovery would be a company-making event for NHE.

For context, NHE has previously said that a 6bcf discovery would be a “company maker” and has the potential to generate ~US$382M in revenues from its first full year of production.

Of course, it's early days and we are pre-drill, so any future potential revenues from production are highly speculative, with no guarantees to ever eventuate. This is high risk / high reward exploration, and anything can happen.

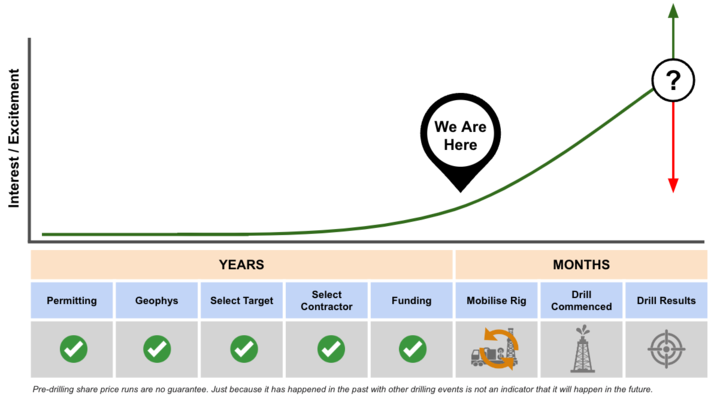

With drilling starting in the coming weeks we think NHE is getting very close to the period where high impact oil and gas drilling events become the talk of the markets.

Big drilling events always attract a lot of market attention as the company approaches its drilling catalyst.

We like to Invest early, well before the drilling event and patiently wait a few years for the drill event to approach.

As the drilling event approaches, we have observed a company’s share price will usually run as excitement and speculation on a positive result enters the market.

In mid-August NHE closed out what looks like the last capital raise before the company drills later this month - raising $12M at 20 cents per share.

With a big capital raise done, the chance to buy a meaningful position off-market is gone.

Now, NHE is fast approaching a position where:

- It kicks off its drill program (increasing excitement/interest) - potentially generating a high level of excitement and speculation from investors starting to price in blue sky success scenarios.

- Funding pre-drill all done (decreasing supply/selling pressure) - no new shares coming to market from an off-market capital raise.

If NHE can deliver a meaningful discovery, we think there is a scenario where supply of shares (sellers) is far less than demand (buyers) - pushing the share price up on a successful result.

However, if no discovery is made then it is likely that the share price will fall.

Exploration drilling often results in a binary outcome.

Here is where NHE is currently sitting on the pre-drilling excitement chart we made:

Note - Pre-drilling share price runs are no guarantee. Just because it has happened in the past with other drilling events is not an indicator that it will happen in the future.

🎓If you would like to learn more about our investment strategy for major catalyst events read: What is a share price catalyst?

NHE is securing all of the ground around its project

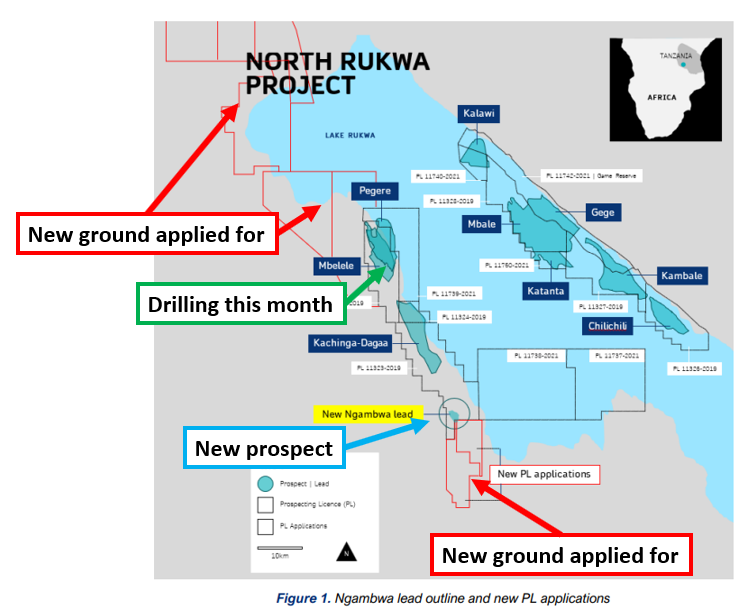

Earlier this week NHE added another prospect to its portfolio of drill targets.

At the moment NHE’s total unrisked prospective helium resource sits at ~176 billion cubic (BCF).

This week NHE identified the Ngambwa target which it estimated has an unrisked 2.8bcf prospective helium resource.

The new target sits ~40km south of where NHE will be drilling its first well.

We also noticed that NHE has started increasing its landholding across the basin with applications for new ground to the north and south of its existing project area.

A 100% strike rate on the EARS - why we like NHE’s chances of making a discovery

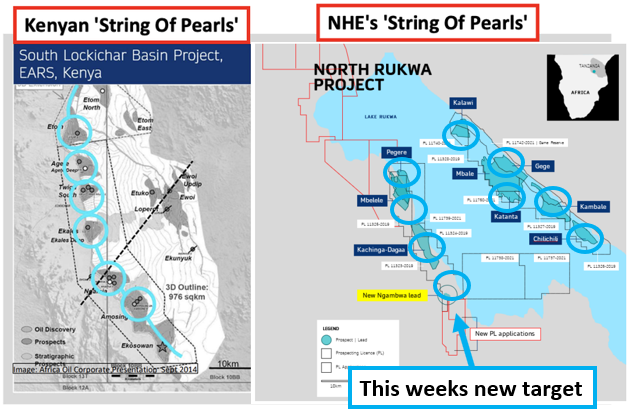

Those who have been following our NHE coverage since the very beginning will know of the East Africa Rift System (EARS) & ‘String Of Pearls’ story.

The EARS starts in the north next to the Dead Sea and ends in the southern part of East Africa.

Some of Africa’s biggest oil and gas discoveries have been made across these basins.

Nearly 40 exploration wells proved more than 4 billion barrels of oil and gas in two EARS basins - the Albertine Graben in Uganda and South Lokichar Basin in Kenya.

Of the 40 wells drilled ~14 were drilled across Basin Margin targets with a 100% discovery rate - the 14 wells were part of a “string of pearls” system which resulted in a string of discoveries.

NHE is drilling into the first of its Basin Margin targets, inside the EARS.

The string of pearls analogy is a concept in oil and gas exploration where one discovery on a target (a “pearl”) in the “string” implies a high chance of success on all other targets in the “string”.

By adding a new prospect to its portfolio this week, NHE just added another pearl to its own string of pearls.

The imminent drilling of NHE’s maiden well in the coming weeks will aim to confirm the discovery of the first pearl...

By securing all of the potential “pearls” around the project area, NHE is protecting its asset from external parties, and securing in the upside IF a discovery is made.

This isn't the first time NHE’s CEO Justyn Wood has drilled a “string of pearls” target.

Back in 2006, Justyn was a geophysicist at Hardman Resources where he designed the first seismic survey over Hardman’s East African Rift System project area in Uganda.

Hardman was one of the early 2000s small cap success stories going from 2 cents per share to a share price of $2 and eventually being bought out by its 50% JV partner Tullow Oil for $1.5BN in 2007.

All of that happened after the company made its first oil discovery in the EARS.

Now in 2023, Justyn is looking to do the same with NHE only this time he is taking a slightly different approach.

Back when Hardman made its first discovery the company had a small landholding across the basin it made its discovery in.

Instead of having full control of the “string of pearls” play, Hardman held a postage stamp across the entire structure.

A postage stamp is exploration speak for a small isolated landholding.

Off the back of its discovery majors started rushing in and taking up all of the ground in the area where the same success could be repeated.

Hardman had potentially left billions of dollars on the table by NOT securing all the best, geologically similar ground BEFORE testing (and proving) their EARS “string of pearls” hypothesis.

In addition, after his experience at Hardman, NHE Jusytn Wood is holding 19.51% of NHE shares - which means he has significant skin in the game, and personal exposure to NHE’s success.

That's where the news this week comes into play.

NHE added 36km^2 to its project to the north and south.

We think NHE is looking to make sure it holds as much of the prospective land across Tanzania’s North Rukwa Basin BEFORE drilling starts.

In the event NHE makes a globally significant helium discovery it will be in the driver’s seat should a major come in and look for exposure to the project - just like Tullow did with Hardman back in 2007.

We have written about all of this in a previous NHE note which you can read here: NHE targets String of Pearls in East African Rift System.

With drilling happening this month, we won't have to wait long to see if NHE can make a discovery and justify all of the work to lock up the region.

A discovery forms the basis for our NHE big Bet which is as follows:

Our ‘Big Bet’

“NHE discovers the world’s largest helium reserve held by a single company and is strategically acquired by a major company OR a state owned enterprise to secure supply (USA, China, Qatar).”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done and many risks involved - some of which we list in our NHE Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor NHE’s progress since we first Invested and to track how the company is doing relative to our “Big Bet”, we maintain the following NHE “Progress Tracker”:

What’s next for NHE?

⚠️The Big One: Drilling ⚠️ 🔄

With the rig at the port in Tanzania, it is being unloaded, and is passing through customs, to then make its way to the drill site.

NHE expects its rig to be on site and drilling this month.

We will release our bull/bear/base case expectations for the drill program closer to the spud date.

Our NHE Investment Memo:

Click here for our NHE Investment Memo where you can find a short, high level summary of our reasons for Investing.

In our NHE Investment Memo, you’ll find:

- Key objectives for NHE

- Why we are Invested in NHE

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.