NHE’s Probable Free Gas Cap 6x Bigger Than Expected? This Upcoming Drill Will Find Out…

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,494,333 NHE shares and 2,437,037 NHE options and the Company’s staff own 25,000 NHE shares at the time of publishing this article. The Company has been engaged by NHE to share our commentary on the progress of our Investment in NHE over time.

Noble Helium (ASX:NHE) has announced a “Probable free gas cap at Mbelele 6x larger than originally mapped.”

A “Free gas” helium discovery is what the market has always wanted to see.

and now NHE is one step closer to delivering it.

The next step is an upcoming appraisal well...

(using a much lower drill cost rig)

Where NHE can hopefully confirm this “6x bigger than expected free gas cap”

AND

deliver a commercial helium flow rate from it.

This will hopefully deliver the moment long-time NHE holders have been waiting for...

Setting the foundation for NHE’s potential $138M revenue per year early monetisation plan.

We are still holding our entire pre-drill result position in NHE, and we increased in the 13c placement in December.

So why has the NHE share price been trading so low?

In December last year NHE announced it had hit helium in its first and second wells in Tanzania.

A potential “prolific new helium province”.

The market initially loved the news...

...but later that day the share price fell as the market realised that NHE had found mostly helium mixed with water.

(which is still good, the helium can be extracted from the water)

BUT

The market was expecting helium as a “free gas”.

“Free gas” reservoirs are better understood by the industry and are easier to produce from.

(because the gas flows freely to surface without having to extract helium from water)

And most importantly it flows to the surface without stimulation.

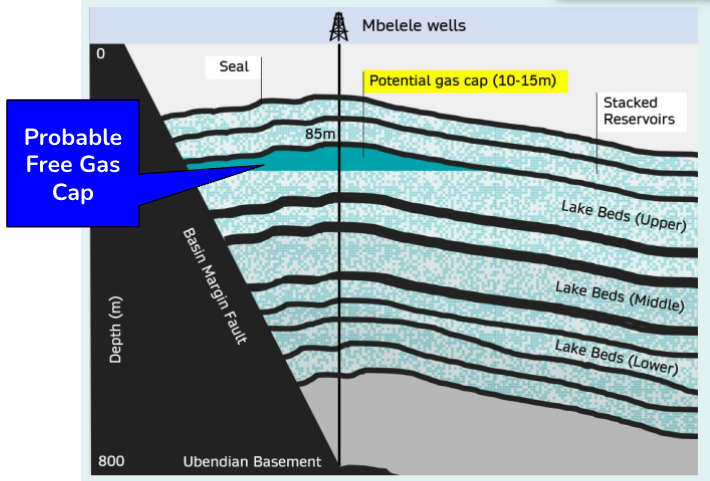

NHE did actually find a free gas column in its first well...

but wasn’t able to declare a discovery on it because it was not able to sample that specific reservoir due to the drilling mud weights it used.

And NHE has subsequently found that the free gas gap could be 6x bigger than what NHE had originally mapped.

The free gas cap is important because it could underpin NHE’s fast track monetisation strategy which is to define a 2bcf reserve, lease processing infrastructure and start producing ~0.2bcf per annum.

NHE is currently negotiating a lease on that processing infrastructure so they are confident in declaring a discovery in a “free gas” cap.

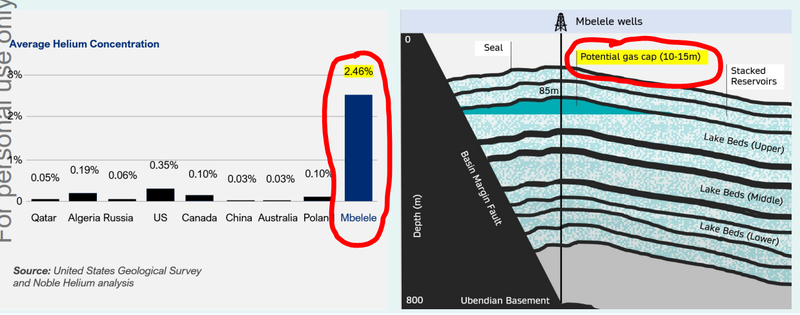

So far, NHE has got helium grades up to 2.46% (well above the average across producing countries which is often <0.5%) and hydrogen grades ~1,500x background levels.

Despite all of the progress NHE has made, its share price has come off quite a bit.

However, we are still holding our entire pre-drill position in NHE, because it wasn’t clear exactly what NHE had found yet.

(NHE’s often confusingly worded announcements and clarifications haven’t helped in the market, although it looks like recent couple of announcements have significantly improved.)

While waiting for the lab results, we participated in the 13c NHE placement (post drilling) back in December.

What we want to see next from NHE:

We are hoping the NHE share price can start coming off its lows in the near term as we wait for:

- Confirmation that a less expensive drill rig has been secured: Shallow holes can be done cheaper, which requires fewer dilutive capital raisings for existing shareholders. NHE had a high cost of drilling its first two shallow wells using the “Rolls Royce” of drill rigs and large crews. We think the market will reward NHE if they prove drill costs can be materially reduced.

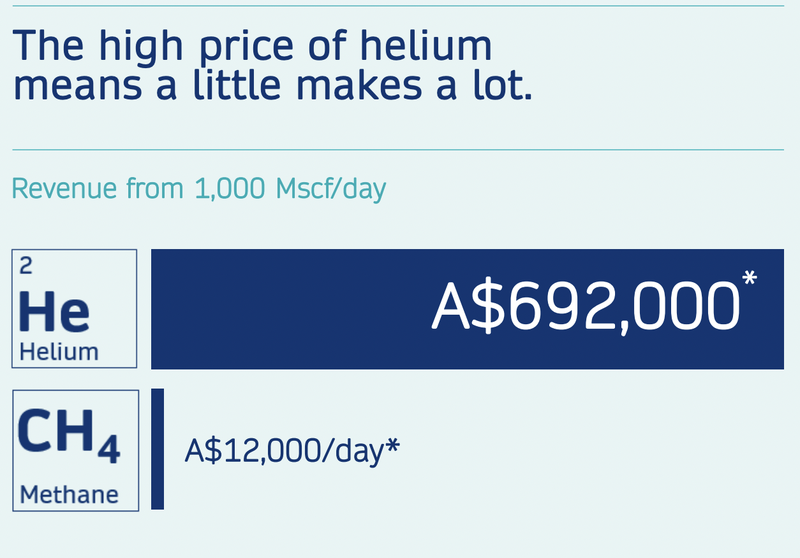

- Drill an Appraisal well: This is the big one - prove the 6x bigger gas cap and deliver a commercial flow rate with decent % helium content - if the gas cap is confirmed and free gas flows at a commercial rate then we think its GAME ON for NHE. 0.2bcf per annum of production at the A$692,000 price in NHE’s presentation (for 1,000Mscf/day) would mean NHE could generate up to ~$138M in revenues per year.

- Updates on early monetisation strategy - NHE has publicly stated that at all it needs is ~2bcf in helium reserves to justify an initial 0.2bcf per annum 10-year operating asset.

So plenty of potential re-rating catalysts to come, especially coming off what feels like pretty low NHE sentiment and a low base for NHE’s share price.

NHE’s neighbour's share price went up 18x in two months

While we wait for updates on well timings from NHE, we have been watching with interest what's happening to NHE’s regional neighbour and fellow micro cap helium explorer, Helium One.

Helium One put out drill results from its latest well in January.

Helium One sampled three different parts of its well and returned fluid samples with helium grades up to 4.7% and hydrogen grades up to 2.2%.

Off the back of those results Helium One’s share price went from £0.002 to £0.035.

An ~18x move.

Now Helium One’s market cap sits at £80M (A$156M).

(NHE currently sits at ~$45M)

We think NHE’s two wells last year at Mbelele delivered similar results to Helium One:

- Multiple fluid enriched helium zones: 148m net reservoir in its first well and 271m in its second well.

- Helium and hydrogen in samples: Helium grades up to 2.46% and hydrogen grades ~1,500x background levels.

- AND a probable free gas cap: This is a key differentiator between NHE and its neighbour... NHE hit a potential free gas cap which means the helium could flow to surface without the need for any stimulation.

So NHE hit results that we think are at least on par with Helium One’s if not better.

BUT, right now NHE trades with a market cap of $45M, just less than a third of its regional neighbour Helium One.

New information from the lab analysis

Over the last few months, NHE has put out lab results from its first two wells.

We now know:

- Net Reservoir thickness’ - 148m at Mbelele-1 and 271m at Mbelele-2.

- Helium grades - up to 2.46% in Mbelele-1.

- NHE has a probable free gas cap 6x bigger than originally mapped - potential for NHE to declare a conventional helium discovery when it samples the free gas cap.

- NHE has multiple fluid enriched helium reservoirs - Similar to the results Helium One got from its well which re-rated its market cap to ~$180M.

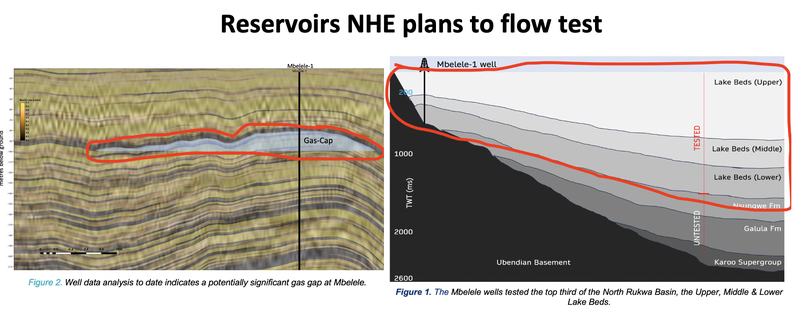

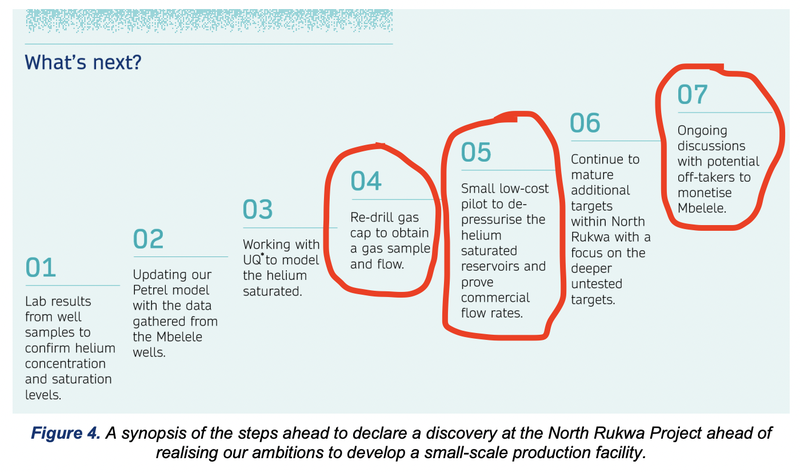

Next for NHE it's all about flow testing its two wells and proving to the market it can fast track its “early monetisation strategy”.

The flow tests will be focused on the potential gas cap at Mbelele-1 and the Lake Bed reservoirs in both Mbelele-1 and Mbelele-2.

At the same time NHE is trying to lease a processing plant and sign an offtake agreement to get the project into production post flow test.

What we think could be major catalysts for NHE

From a market perspective we think it comes down to two major catalysts:

- Appraisal well - the flow test results

- Early monetization strategy

The flow test results

A flow test is a make or break moment for almost every oil/gas/helium project.

If the wells aren't able to flow helium to surface at commercially viable rates then they won't justify any development CAPEX.

If NHE can produce strong flow rates we think the market will start to price in what development cases look like for the company.

The early monetisation strategy

NHE said in its December quarterly that all it needs is ~2bcf in helium reserves to justify an initial 0.2bcf per annum 10-year operating asset.

0.2bcf per annum of production at the A$692,000 price in NHE’s presentation (for 1,000Mscf/day) would mean NHE could generate up to ~$138M in revenues per year.

However all of these future production calculations mean nothing unless NHE can flow test the wells and prove commercially viable flow rates first though.

This is also a part of the reason NHE’s market cap is where it is.

So we think the next major share price catalyst for NHE will be the flow test results.

We think the flow test will be a very important catalyst for NHE to achieve our Big Bet for the company which is as follows:

Our NHE “Big Bet”

“NHE discovers the world’s largest helium reserve held by a single company and is strategically acquired by a major company OR a state owned enterprise to secure supply (USA, China, Qatar)”

(NOTE: This is what we hope the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done by the company to get to this outcome and obvious risks to which need to be considered, some of which we list in our NHE Investment memo).

What are the risks?

The key risk for NHE is still “Exploration Risk”.

NHE hasn’t yet officially declared a discovery at its project and there is always a chance NHE is NOT able to declare one.

In that scenario we think NHE’s share price could re-rate lower.

We are hoping the flow test results are storing enough to warrant discoveries being declared and commercialising NHE’s project.

We have listed many other risks to our NHE Investment Thesis - to see all of those risks, check out our NHE Investment Memo here.

Is there a plan B? Unlocking the unconventional helium reservoirs

NHE has helium enriched fluids across both its Mbelele wells.

In order to declare a discovery across those reservoirs, it is currently working with the University of Queensland to meet the discovery requirements.

We consider the helium enriched fluids unconventional because NHE will need to work out how to extract the helium from waters and produce a saleable product.

The best analogy is oil and gas that requires fracking stimulation or coal bed methane gas that needs similar technology to produce saleable gas from.

Interestingly, NHE’s chairman Shaun Scott is the “father of coal seam gas” in Queensland.

Shaun helped pioneer the Queensland coal seam gas industry from “novelty” status to a $20 billion per year export industry.

He was the CEO of Arrow Energy Ltd and led the growth of that business from a $20M coal seam gas explorer through to its $3.5BN acquisition by Shell and Petro-China.

So if anyone is going to find a way to unlock NHE’s unconventional helium it is Shaun.

Our NHE Investment Memo

In our NHE Investment Memo, you can find the following:

- Our NHE Big Bet

- Why we are Invested in NHE

- Key objectives we want to see NHE achieve

- The key risks to our Investment thesis

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.