NASDAQ surges, strength in metals, but ASX set to open lower

Published 15-SEP-2020 09:08 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

After last week’s rollercoaster ride, there was a real sense of confidence that was maintained throughout the day with the S&P/ASX 200 index (XJO) closing at 5900 points on the back of a strong finish in the last hour.

This represented a gain of 41 points or 0.5%, and with a robust lead coming out of the US last night, this positive momentum could continue.

Tech stocks led the way with Apple Inc being one of the strongest performers.

US trends, along with strength in key commodities such as iron ore, gold, and base metals suggests we could be in for another positive day, but the ASX SPI200 suggests otherwise, down 13 points to 5893 points.

There was also positive news on the vaccine front with AstraZeneca resuming trials and the new kid on the block Vaxart (NASDAQ:VXRT) surging approximately 50% after it received clearance from the FDA to start human trials of its vaccine.

NASDAQ back in favour

These developments had the most impact on the NASDAQ with the index spiking 203 points or 1.9% to close at 11,056 points.

The S&P 500 gained 42 points, closing at 3383 points, while the Dow closed in on 28,000 points with a gain of 1.2% or 327 points.

It was a different story in Europe where markets traded very indifferently.

After a solid start, the FTSE 100 gave up 50 points throughout the day to finish at 6026 points, a decline of 0.1%.

It was a similar story in Germany with the DAX up about 140 points when the market opened before flat-lining during afternoon trading, eventually finishing down nine points at 13,193 points.

The Brent Crude Oil Continuous Contract pushed above US$40 per barrel early in the session, but it faded later in the day to close at US$39.61 per barrel.

Iron ore rallied 1.4% to edge above the US$130 per tonne mark.

Gold stocks could be back in favour today with the precious metal having hit US$1972 per ounce overnight, and it continues to hover just below that mark.

There were also some strong gains across base metals, suggesting it could be our miners that lead the way today.

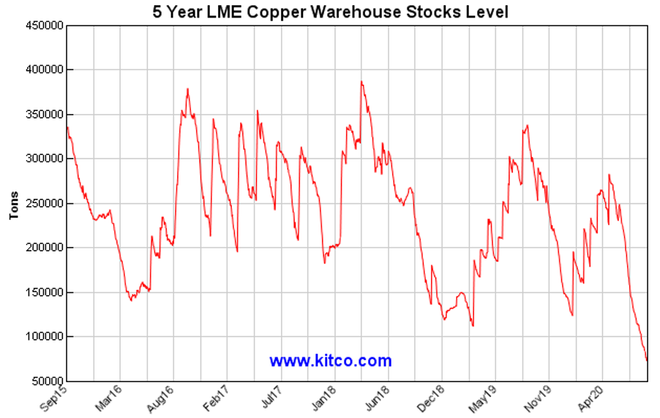

Copper was the standout performer, hitting US$3.09 per pound, a level it hasn’t traded at since mid-2018, and only about 5% shy of a long-term high.

With five-year London Metals Exchange copper warehouse stock levels at record lows it wouldn’t be surprising to see the red metal test its long-term high.

There was also strong support for nickel, another key ingredient in stainless steel, as it hit US$6.85 per pound.

Zinc and lead also made solid gains, but they are clawing their way back from some steep declines in the last fortnight.

The Australian dollar strengthened slightly last night, pushing just above the US$0.73 mark, and it continues to hover in that vicinity.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.