More upside in gold following last year’s retracement

Published 28-FEB-2020 12:37 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

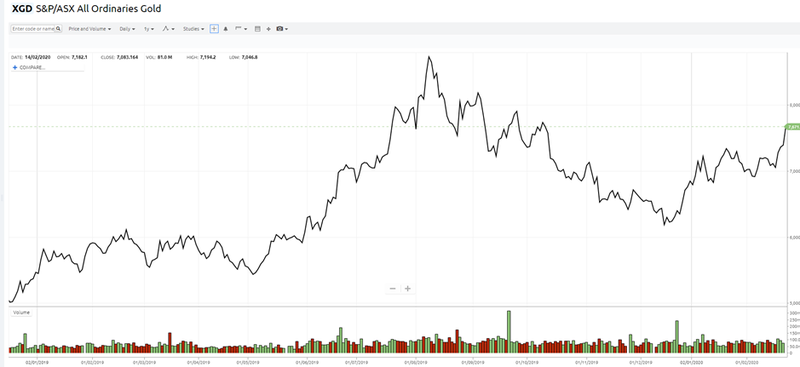

It was August 9, 2019 when the S&P/ASX All Ordinaries gold index hit an all-time record high of 8730 points, up from roughly 5500 points only three months earlier.

While one could argue that this was a bubble, the resilience of the gold price certainly indicates that the index should be well supported, particularly given recent gains.

Consequently, the retracement in the index to around 6200 points towards the end of December appeared to be an overreaction to what could only be considered as a slight softening in the price of the precious metal.

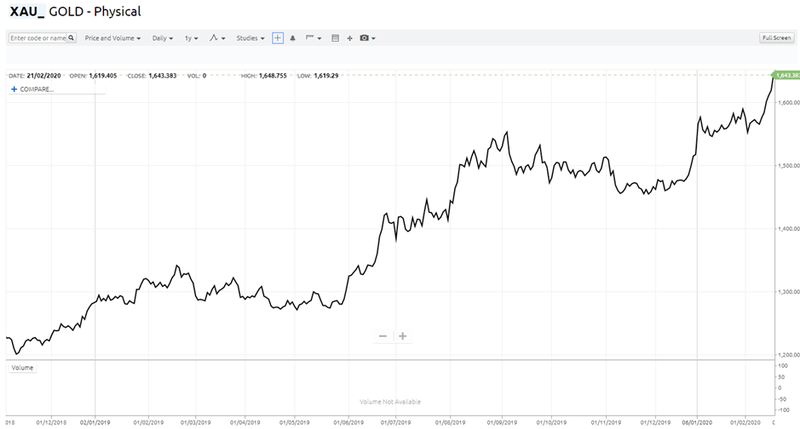

As a guide, the gold price hit US$1500 per ounce on August 9, and went on to eclipse the US$1550 per ounce mark before settling in a range between US$1450 per ounce and US$1550 per ounce between September 2019 and January 2020.

Given the minimal deviation from US$1500 per ounce supported the 8730 point of the XGD, the significant retracement in second half of 2019 appears unjustified.

But now another chapter has been written with the gold price surging past US$1600 per ounce in the last week as indicated below.

Bearing in mind that the all-time gold price high of about US$1920 per ounce which was struck in September 2011 occurred within a month of the precious metal hitting US$1650 per ounce.

All signs point north as gold hits seven-year high

While we are yet to see whether the XGD will eclipse last year’s record high, the sentiment towards gold stocks couldn’t be stronger.

With the US presidential election no longer looking like a one horse race following the surge in support for Bernie Sanders there will be significant uncertainty regarding the country’s political outlook, particularly given the polarising policies of Trump and Sanders.

Coronavirus is also having an impact.

According to Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets, “It’s difficult to imagine a scenario with a compelling ‘all clear’ on the COVID-19 virus in the near term, but things can/will get much worse before getting better. That asymmetry will govern trading conditions this week and makes it difficult to sustain any cheapening in safe-havens.”

Interestingly, disturbing economic data has also emerged from the US which indicates waning business confidence, and this along with global uncertainty has resulted in the volatility index increasing, as well as bond chart trends aligning with those that proved to be useful forward indicators ahead of previous recessions.

While the XGD has responded positively, up more than 4% as it hit a high of 7750 points on Monday, it could be argued that a new record may not be far away.

Indeed, it should be noted that even at current levels the index remains some 1000 points below last year’s high.

Another metric to throw into the mix is exchange rates.

The US$1500 per ounce gold price we referred to in August last year equated to an Australian dollar gold price of about $2200 per ounce based on the exchange rate of US$0.68.

The exchange rate has now fallen to approximately US$0.66, effectively enhancing the Australian dollar gold price which now sits at about $2510 per ounce.

Given that many of the companies that make up the XGD are Australian producers, one would expect their share prices should reflect the improved earnings that theoretically are likely to be generated courtesy of a $300 per ounce increase in the gold price.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.