Matador motors ahead at Cape Ray

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Matador Mining Limited (ASX:MZZ) has provided an update regarding the continued progress of the Environmental Assessment process for the Cape Ray Gold Project in Newfoundland.

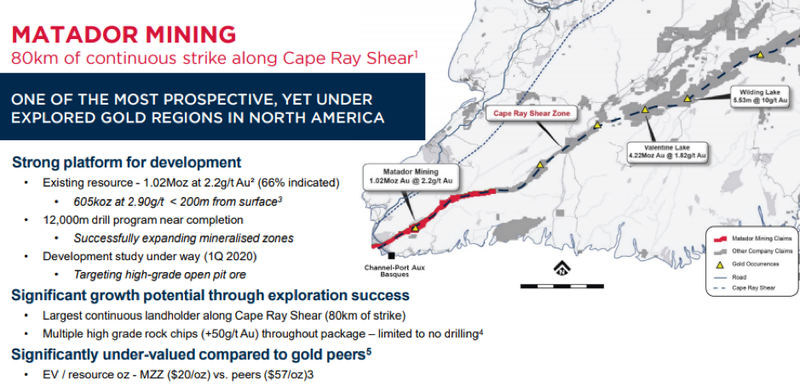

The company’s tenure covers 80 kilometres of continuous strike along the highly prospective, yet largely underexplored Cape Ray Shear in Newfoundland, Canada.

Within the package is a 14 kilometre zone of drilled strike which hosts a JORC resource of 14.2 million tonnes at 2.2 g/t gold for just over 1 million ounces of gold.

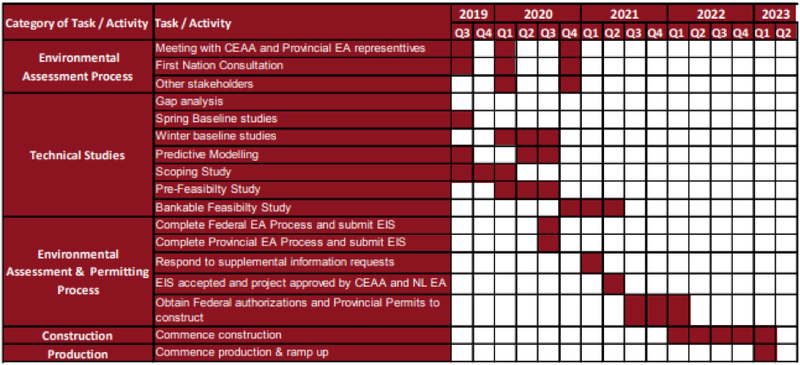

The environmental assessment process for the project made significant progress in the second half of 2019, specifically in the areas of First Nation and Stakeholder Consultation, public participation, regulatory agency consultation, advancement of grid power connection studies and continuation of environmental baseline studies to support the preparation of the Environmental Impact Statement for the project, which will be submitted in September quarter of 2020.

Matador next major gold producing mine in Newfoundland

Matador has been encouraged by the level of support for the project, and on this note technical director Keith Bowes said, “The pace at which we have been able to move ahead with our Environmental Assessment for the Cape Ray Gold Project has been very encouraging and initial discussions with elected officials in Newfoundland have garnered significant project support with the permitting process expected to be completed in a relatively short time frame.”

“In parallel with our assessment work we are also pursuing options for grid power connections for a future operation.

‘’Newfoundland has an abundance of hydroelectric power through the new Maritime link which will benefit the project as grid connections are in close proximity to the site and power authorities have already expressed a willingness to support the project.”

“Given the current status of the Environmental Assessment, the progress made with the exploration program and our initial assessment work, Matador is on track to potentially become the next major gold producing mine in Newfoundland.”

A busy 12 months ahead

With a number of key operational and environmental studies targeted for completion in 2020, the next 12 months is shaping up as a very full year for Matador.

We have already touched on the issue of environmental assessments, but from an operational viewpoint, 2020 is a watershed year for the group.

As indicated below, the scoping study is due for completion in the March quarter and the prefeasibility study should be prepared by the September quarter, with the latter being an important indicator of the economic viability of the project.

A favourable PFS can be a market moving event given that it provides an indication of the financial returns that can be expected based on a range of operational assumptions, costings and commodity prices.

Consequently, this is a much anticipated period for the company, particularly given these major developments will be punctuated by results from the group’s extensive 12,000 metre drilling program.

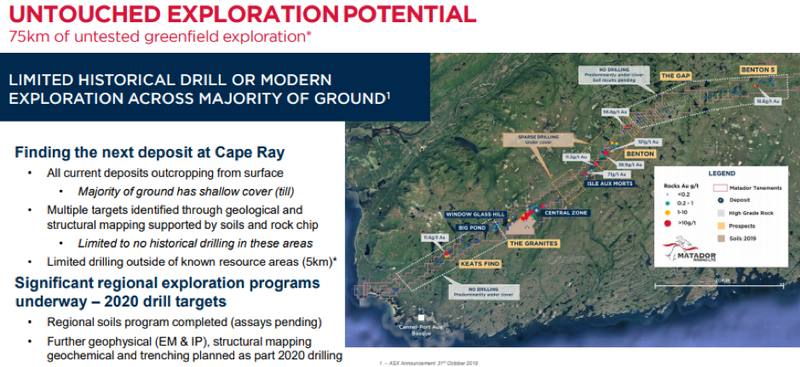

As indicated below, there are extensive areas which haven’t undergone drilling in the past, and given the company’s early success at delineating high-grade mineralisation, exploration results could also be a share price catalyst.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.