LYN hits nickel copper sulphides - What’s next?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 2,631,250 LYN shares and 300,000 LYN options at the time of publishing this article. The Company has been engaged by LYN to share our commentary on the progress of our Investment in LYN over time.

Looks like it's “fertile”.

Earlier in the week, our micro cap exploration Investment Lycaon Resources (ASX:LYN) hit nickel-copper sulphides with its first ever drillhole at its Bow River project in WA.

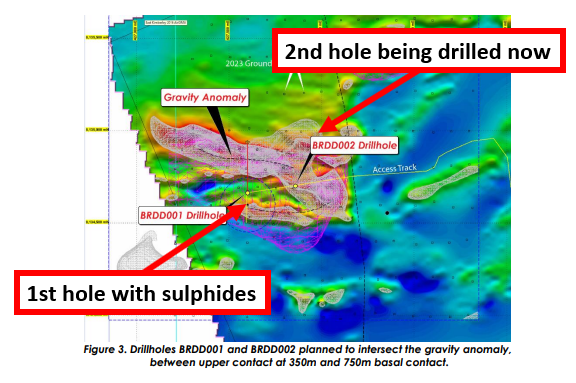

LYN is now drilling a second hole into its large (over 1km) gravity anomaly a few hundred metres underground.

Nickel-copper sulphide deposits are hard to find and consequently can be extremely valuable.

LYN’s first diamond drill hole hit ~13m of disseminated nickel copper sulphides.

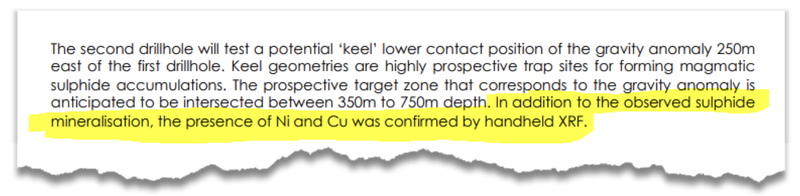

The presence of nickel and copper was confirmed by a handheld XRF. We will need to wait for assay results to get a firmer idea of exactly what was found though, as on site XRF readings aren't always accurate.

In any case, this is a promising start.

(Source)

Now LYN is in the midst of drilling a second hole, 250m away to test the ‘keel’ position of the gravity anomaly it is targeting.

The second drill hole should be completed by ‘mid-late September’ - which is soon.

Down hole EM surveys are also planned in the coming weeks, which have the potential to light up any ‘off hole’ conductors.

LYN is currently capped at $9.4M, has $3.9M cash in the bank following the recent placement, which equates to an enterprise value of $5.5M.

Hitting sulphides is important because it indicates that an explorer is looking in the right place - sulphides are typically the host rock for high grade nickel-copper mineralisation.

Most of the world's nickel-copper is produced from sulphide-hosted orebodies.

Sulphides are also the same type of rocks that host Panoramic Resources Savannah North discovery which sent that companies share price to ~$1BN market cap at its peak.

They are also the same type of rocks that host one of Australia’s biggest ever nickel discoveries - the Nova Nickel discovery which was eventually sold for $1.8BN.

At this stage, LYN’s first hole hit disseminated sulphides which is a good start - it is still early days though and the company will need to back the result up with more of the same in future drillholes.

After this week’s news, we know that LYN is drilling in and around the right places...

Going into this drill program, LYN had a gravity anomaly >1km long, gossans at surface (the type of rocks typically found above sulphides) and copper rock chips grading up to 28% - what we didn't know exactly was what was producing that gravity anomaly underground...

Now we know that LYN has the right type of rocks underground to potentially host a nickel-copper orebody.

Here’s what we will be looking out for in the coming weeks:

- Second hole being drilled now - LYN is drilling a second hole 250m to the east of this week's hit. Any material visuals / drilling updates will be something to look out for.

- Assay results from drillhole 1 - Assay results from the 13m intercept are now pending.

- Downhole EM after both holes are done - LYN is planning downhole EM surveys to work out whether or not the EM structures extend out underground and whether or not there are other targets nearby (offhole conductors).

(Source)

How do this week’s results stack up against our expectations for the drill program so far?

Going into this maiden round of deep drilling, we set up our expectations for the drill program as follows:

- Bull Case = intercepts with nickel/copper grades >0.5%.

- Base Case = Sulphides intercepted worthy of follow-up drilling.

- Bear Case = No valuable metals are intersected.

After today’s announcement, LYN has already hit our “Base Case” expectation - with pending assay results (from both holes) to determine if our Bull Case gets hit.

If assays come back above 0.5% nickel-copper then we think LYN will be in a position where it has a project that is definitely worth following up with additional drilling to see if a large discovery can be declared.

(Source)

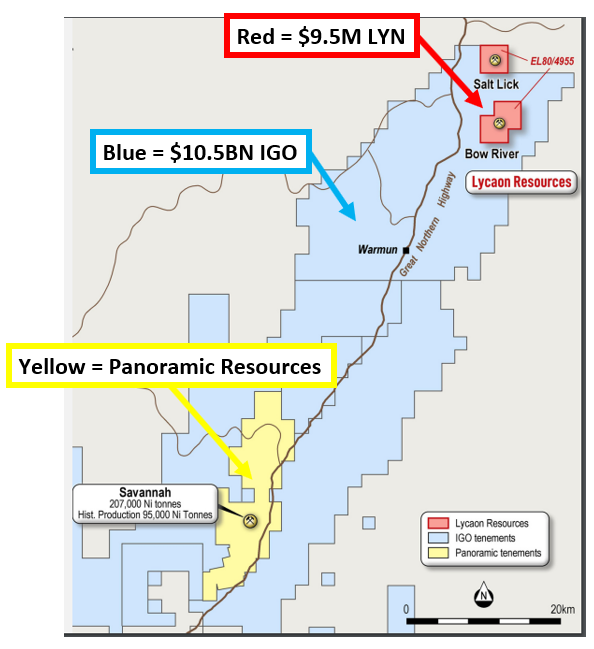

LYN’s target - surrounded by IGO, and inspired by Panoramic

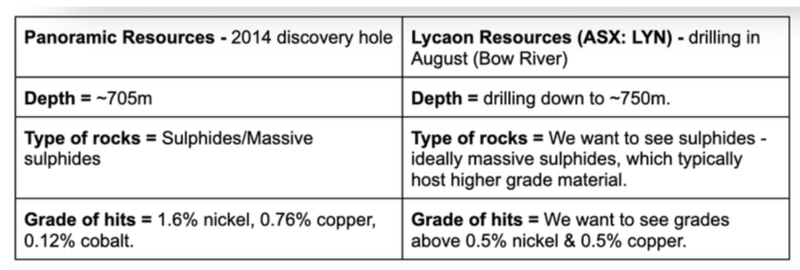

At Bow River, LYN is testing a target similar to Panoramic Resources which sits ~60km to the south.

Back in 2014, Panoramic tested a deeper target next to its Savannah mine and made the Savannah North discovery - in the years after that discovery Panoramic’s market cap hit ~$1BN.

The deeper Savannah North discovery was ~ 4 x bigger than the original Savannah mine and hadn't been picked up on EM surveys (similar to LYN’s target).

Interestingly, IGO tried to takeover Panoramic in a deal worth ~$319M back in 2019 AND they hold all the ground surrounding both LYN and Panoramic.

Clearly IGO are watching the region and any exploration activity in the region closely.

Ultimately, LYN is chasing a similar style discovery to the one Panoramic made back in 2014.

Here is a side by side comparison with the Panoramic discovery hole at Savannah North and what we want to see from LYN.

As we noted above, LYN is currently capped at $9.4M and has $3.9M cash in the bank following the recent placement, which equates to an enterprise value of $5.5M.

If the company can deliver high grade nickel-copper results from its assay results and can repeat it with the second drillhole we think the low enterprise value and shares on issue means the company could re-rate higher.

However, this is no guarantee of course - this is high risk exploration, whilst it can be high reward, there is also a low chance of success.

Exploration success forms the basis for our LYN Big Bet which is as follows:

Our LYN ‘Big Bet’:

“LYN’s share price re-rates by over 1,000% off the back of a new discovery and the definition of a deposit significant enough to move into development studies”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our LYN Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor the progress LYN has made since we first Invested, we maintain this LYN “Progress Tracker”:

The latest from LYN’s West Arunta (WA1 country) projects:

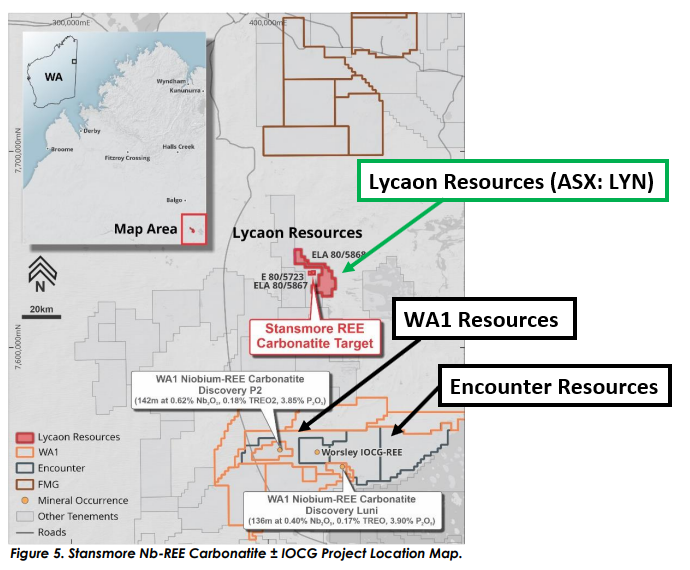

A big part of our Investment in LYN is the company’s projects in the West Arunta in the same region as the $146M Encounter Resources & $329M WA1 Resources.

LYN now holds ~173km^2 of ground in the region and has ~six targets it could drill - the most advanced of which is the Stansmore prospect.

The region became hot property late last year when WA1 Resources made its rare earths/niobium discovery and went from a share price of 13.5c to a high of $7.05.

Now WA1 Resources trades at a share price of $5.80 and is capped at $329M.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Here is where LYN’s ground sits relative to its much bigger neighbours in the West Arunta:

(Source)

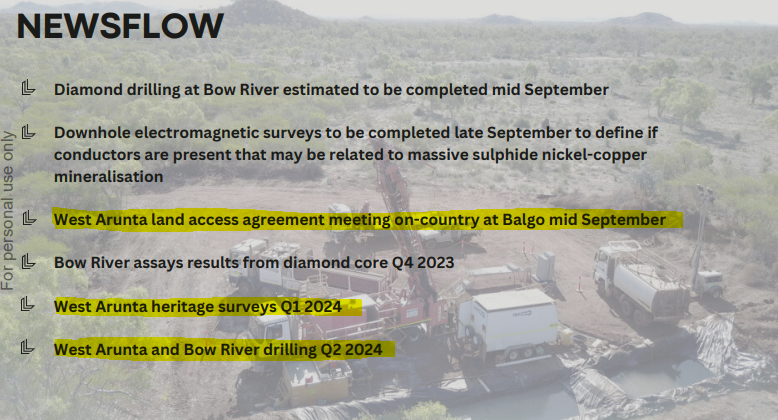

Next at West Arunta, LYN is planning on country meetings with indigenous groups in mid September, heritage surveys in Q1 2024 and drilling in Q2 2024.

Assuming everything goes well for LYN, the company should be drilling its West Arunta targets in Q2 of 2024.

(Source)

We covered the latest from LYN’s West Arunta projects in our last LYN note here: LYN granted more ground near WA1 Resources

What’s next for LYN?

🔄 Drilling at Bow River Nickel-copper-cobalt/PGE project:

We want to see LYN hit more sulphides with its second drillhole & want to see assay results show high nickel-copper grades in the sulphides.

Any grades above 0.5% nickel or copper would pass our bull case for LYN’s first pass drill program.

🔄 Permitting and approvals for rare earths/niobium project:

LYN is currently running through the land access & permitting process for the ground.

At the same time, LYN still needs to settle the acquisition of its project, which includes getting shareholder approvals for the deal.

What are the risks?

In the short term, with drilling now underway, the key risk for LYN is “exploration risk”.

As always with junior explorers, there is always a chance the company finds nothing and its projects are deemed stranded.

Check out the key risks to our LYN Investment Thesis in our Investment Memo here:

Our LYN Investment Memo

Below is our LYN Investment Memo, where you can find the following:

- Key objectives for LYN for the coming year

- Why we are Invested in LYN

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.